Updated July 27, 2023

Current Yield of Bond Formula (Table of Contents)

What is Current Yield of a Bond Formula?

The term “current yield of a bond” refers to the rate of return expected from the bond based on its annual coupon payment and current market price. As such, it is the rate of return expected from the bond in the next year.

The formula for current yield is very simple and can be derived by dividing the annual coupon payment expected in the next year by the current market price of the bond, which is then expressed in percentage. Mathematically, it is represented as,

Examples of Current Yield of Bond Formula (With Excel Template)

Let’s take an example to understand the calculation of the Current Yield of bonds in a better manner.

Current Yield Formula – Example #1

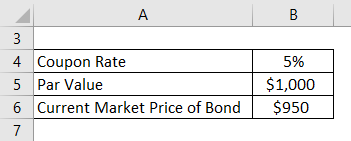

Let us take the example of a bond that pays a coupon rate of 5% and is currently trading at a discount price of $950. Calculate the current yield of the bond.

Solution:

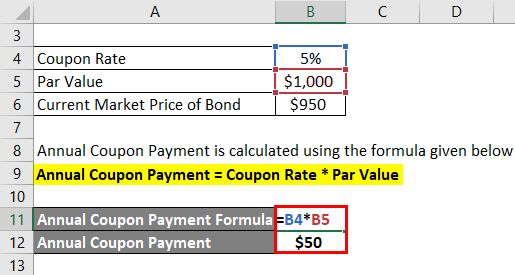

The formula to calculate Annual Coupon Payment is as below:

Annual Coupon Payment = Coupon Rate * Par Value

- Annual Coupon Payment = 5% * $1,000

- Annual Coupon Payment = $50

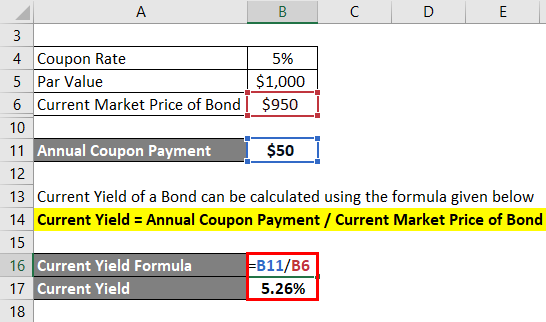

The formula to calculate Current Yield of a Bond is as below:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

- Current Yield = $50 / $950

- Current Yield = 5.26%

Therefore, the current yield of the bond is 5.26%.

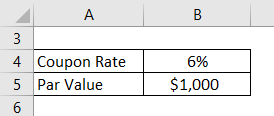

Current Yield Formula – Example #2

Let us take the example of a 10-year coupon paying a bond that pays a coupon rate of 5%. Calculate the current yield of the bond in the following three cases:

- Bond is trading at a discounted price of $990.

- Bond is trading at par.

- Bond is trading at a premium price of $1,010.

Solution:

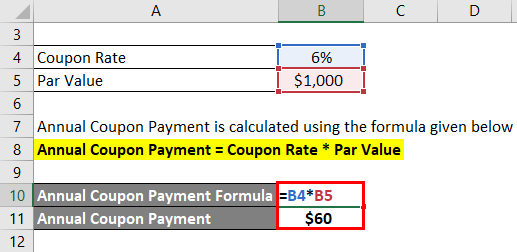

The formula to calculate Annual Coupon Payment is as below:

Annual Coupon Payment = Coupon Rate * Par Value

- Annual Coupon Payment = 6% * $1,000

- Annual Coupon Payment = $60

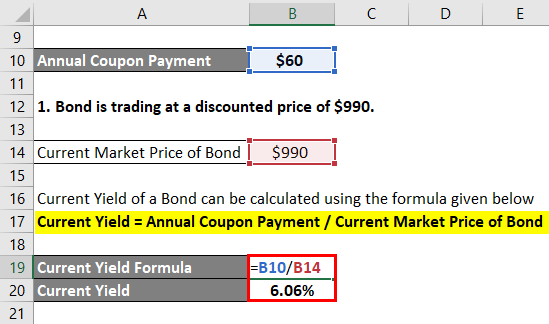

1. Bond is trading at a discounted price of $990.

The formula to calculate Current Yield of a Bond is as below:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

- Current Yield = $60 / $990

- Current Yield = 6.06%

Therefore, the current yield of the bond is 6.06%.

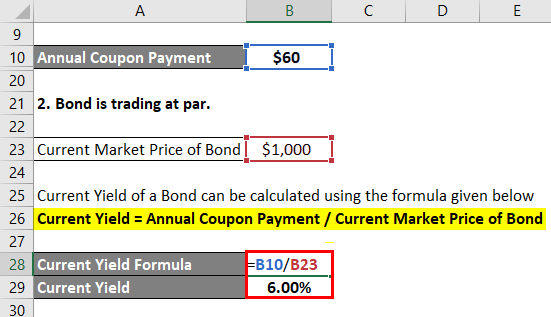

2. Bond is trading at par.

The for,mula to calculate Current Yield of a Bond is as below:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

- Current Yield = $60 / $1,000

- Current Yield = 6.00%

Therefore, the current yield of the bond is 6.00%.

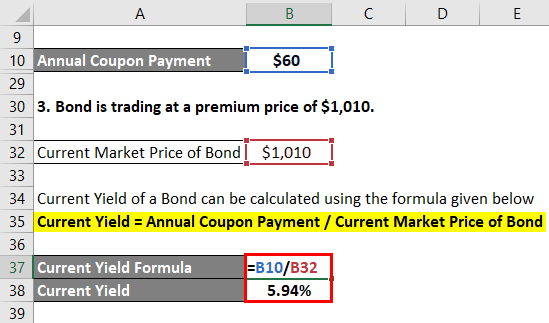

3. Bond is trading at a premium price of $1,010.

The formula to calculate Current Yield of a Bond is as below:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

- Current Yield = $60 / $1,010

- Current Yield = 5.94%

Therefore, the current yield of the bond is 5.94%.

Current Yield Formula – Example #3

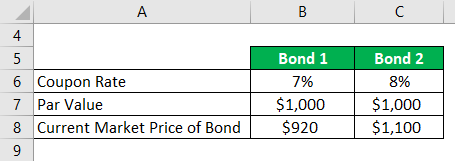

Let us take the example of Stuart, who is considering investing in one of the two bonds. Bond 1 pays a coupon rate of 7% and is currently trading at $920, while Bond 2 pays a coupon rate of 8% and is currently trading at $1,100. Help Stuart in deciding which is a better investment option.

Solution:

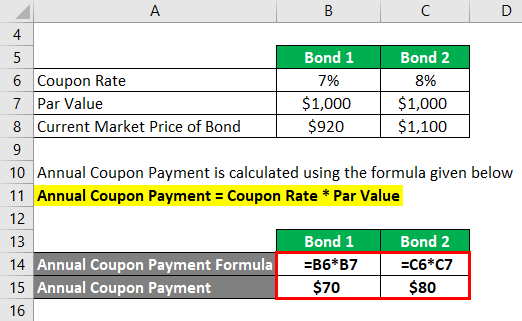

The formula to calculate Annual Coupon Payment is as below:

Annual Coupon Payment = Coupon Rate * Par Value

For Bond 1

- Annual Coupon Payment = 7% * $1,000

- Annual Coupon Payment = $70

For Bond 2

- Annual Coupon Payment = 8% * $1,000

- Annual Coupon Payment = $80

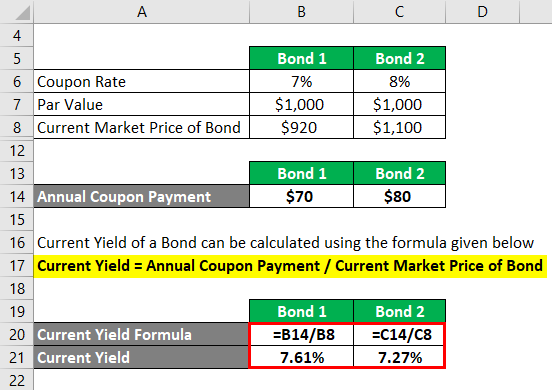

The formula to calculate Current Yield of a Bond is as below:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

For Bond 1

- Current Yield = $70 / $920

- Current Yield = 7.61%

For Bond 2

- Current Yield = $80 / $1000

- Current Yield = 7.27%

Bond 1 seems to be a better investment option for the next year, given its relatively better current yield.

Explanation

The formula for the current yield of a bond can be derived by using the following steps:

Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment.

Step 2: Next, determine the bond’s current market price based on its coupon rate vis-à-vis the ongoing yield offered by other bonds in the market. Based on the fact that whether its coupon rate is higher, equal, or lower than the prevailing market yield, the bond will be traded at premium, par, or discount, respectively.

Step 3: Finally, the formula for the bond’s current yield can be derived by dividing the expected annual coupon payment (step 1) by its current market price (step 2) and expressed in percentage, as shown below.

Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100%

Relevance and Use of Current Yield of Bond Formula

From the perspective of a bond investor, it is important to understand the concept of current yield because it helps assess the expected rate of return from a bond currently. Typically, the stated coupon rate of a bond remains the same until its maturity. However, the expected rate of return of the investors fluctuates during the period based on the ongoing market trend. As such, bond investors set the bond prices higher or lower until its current yield is equal to that of other bonds with a similar level of risk.

Current Yield Formula Calculator

You can use the following Current Yield Calculator

| Annual Coupon Payment | |

| Current Market Price of Bond | |

| Current Yield | |

| Current Yield | = |

|

|

Recommended Articles

This has been a guide to Current Yield Formula. Here we discuss How to Calculate the Current Yield of a bond, along with practical examples. We also provide a Current Yield Calculator with a downloadable Excel template. You may also look at the following articles to learn more –