Updated July 25, 2023

Accounting Rate of Return Formula (Table of Contents)

What is the Accounting Rate of Return Formula?

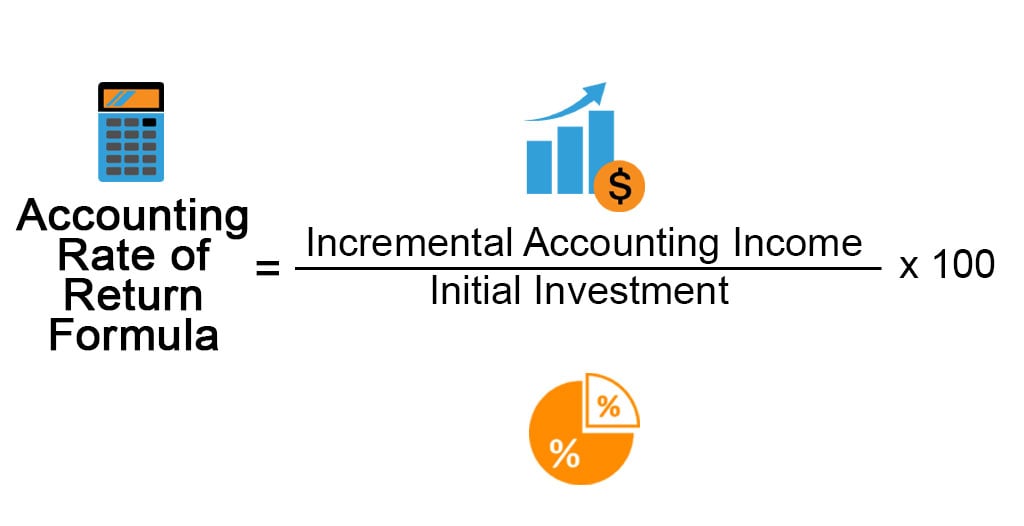

The term “accounting rate of return” refers to the percentage rate of return that is expected on an investment or an asset as against the initial investment that helps in management decision making.

In other words, it helps in deciding whether or not to go ahead with a new investment based on its expected profitability. The formula for the accounting rate of return can be derived by dividing the incremental accounting income by the initial investment on the asset and then express it in terms of percentage. Mathematically, it is represented as,

Examples of Accounting Rate of Return Formula (With Excel Template)

Let’s take an example to understand the calculation of the Accounting Rate of Return in a better manner.

Accounting Rate of Return Formula – Example #1

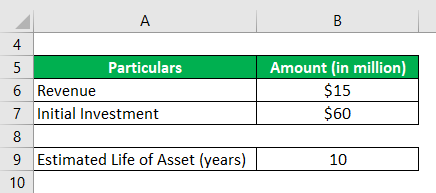

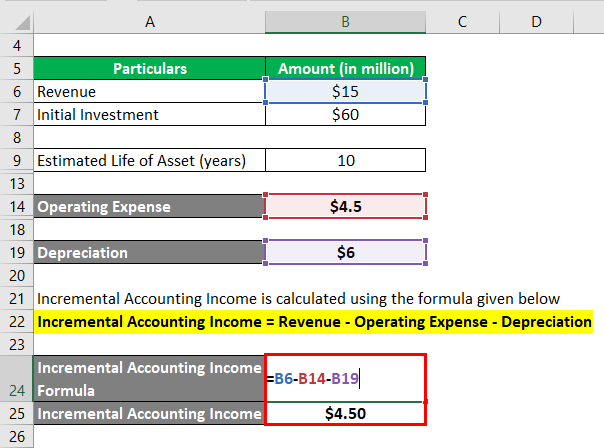

Let us take the example of a company that has recently invested $60 million in setting up a new plant. The company expects to generate revenue of $15 million in the first year while operating expense is likely to be 30% of the revenue. The asset is expected to be scrapped after 10 years of estimated life with zero salvage value. Calculate the accounting rate of return for the investment based on the given information.

Solution:

Operating Expense is calculated as

Operating Expense = 30% * Revenue

- Operating Expense = 30% * $15 million

- Operating Expense = $4.5 million

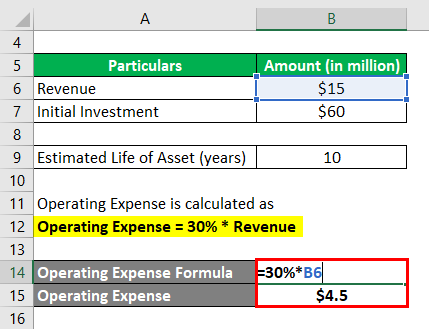

Depreciation is calculated using the formula given below

Depreciation = (Initial Investment – Salvage Value) / Estimated Life

- Depreciation = ($60 million – $0) / 10 years

- Depreciation = $6 million

Incremental Accounting Income is calculated using the formula given below

Incremental Accounting Income = Revenue – Operating Expense – Depreciation

- Incremental Accounting Income = $15 million – $4.5 million – $6 million

- Incremental Accounting Income = $4.50 million

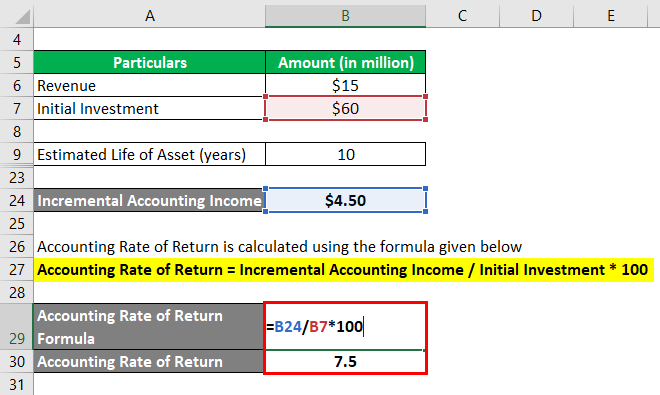

Accounting Rate of Return is calculated using the formula given below

Accounting Rate of Return = Incremental Accounting Income / Initial Investment * 100

- Accounting Rate of Return = $4.5 million / $60 million * 100

- Accounting Rate of Return = 7.5%

Therefore, the accounting rate of return of the new plant is 7.5%.

Accounting Rate of Return Formula – Example #2

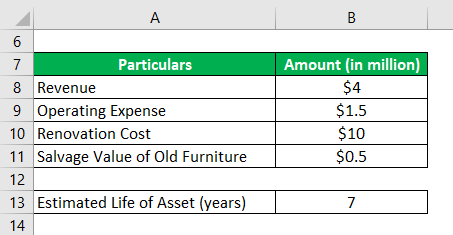

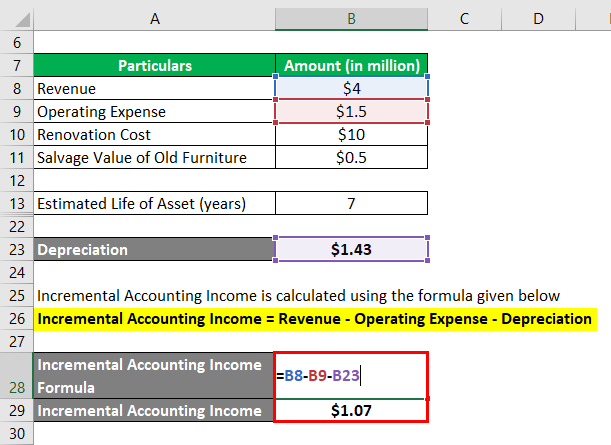

Let us take an example of a company SDF Ltd which is a food store chain in Chicago, IL. The company has renovated its store in Wheeling which is another village in the state of Illinois. The promoter is expecting strong revenue from this store given the lack of too many branded stores in the locality. The store renovation has cost around $10 million and is expected to generate annual revenue of $4 million with an operating expense of $1.5 million. The renovation has been capitalized and will be depreciated over the next 7 years. Further, the store had some old furniture and fixture which have been sold for $0.5 million. Calculate the accounting rate of return for the investment based on the given information.

Solution:

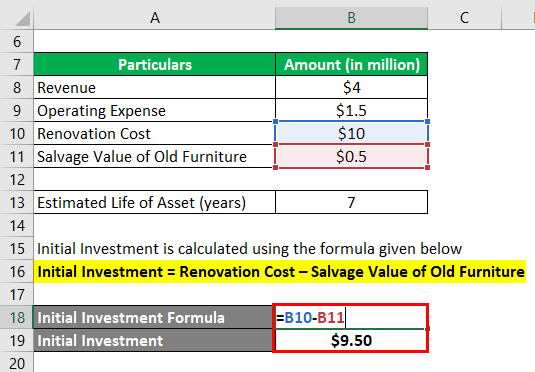

Initial Investment is calculated using the formula given below

Initial Investment = Renovation Cost – Salvage Value of Old Furniture

- Initial Investment = $10.00 million – $0.50 million

- Initial Investment = $9.50 million

Depreciation is calculated using the formula given below

Depreciation = Renovation Cost / Estimated Life

- Depreciation = $10.00 million / 7 years

- Depreciation = $1.43 million

Incremental Accounting Income is calculated using the formula given below

Incremental Accounting Income = Revenue – Operating Expense – Depreciation

- Incremental Accounting Income = $4.00 million – $1.50 million – $1.43 million

- Incremental Accounting Income = $1.07 million

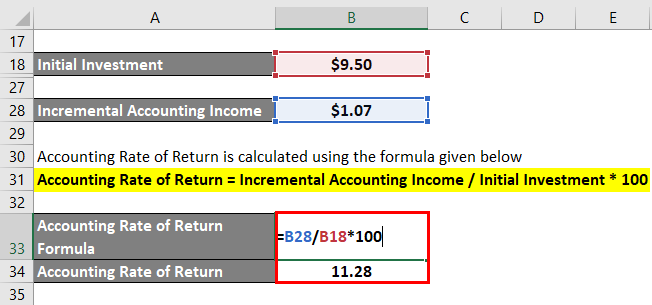

Accounting Rate of Return is calculated using the formula given below

Accounting Rate of Return = Incremental Accounting Income / Initial Investment * 100

- Accounting Rate of Return = $1.07 million / $9.50 million * 100

- Accounting Rate of Return = 11.28%

Therefore, the accounting rate of return of the renovated store is 11.28%.

Explanation

The formula for the accounting rate of return can be derived by using the following steps:

Step 1: Firstly, determine the incremental accounting income from the investment, which can be calculated by assessing its potential revenue minus the operating expenses and the amortization/ depreciation charged on the investment or asset based on its operating life.

Incremental Accounting Income = Revenue – Operating Expense – Depreciation

Step 2: Next, determine the value of the initial investment made on the asset. The initial investment may be a replacement in which the salvage value of the previous asset should be deducted from the new investment.

Initial Investment = New Investment – Salvage Value of the Previous Asset

Step 3: Finally, the formula for the accounting rate of return can be derived by dividing the incremental accounting income (step 1) by the initial investment made on the asset (step 2) and expressed in terms of percentage as shown below.

Accounting Rate of Return = Incremental Accounting Income / Initial Investment * 100

Relevance and Use of Accounting Rate of Return Formula

It is important to understand the concept of accounting rate of return because it is used by businesses to decide whether or not to go ahead with an investment based on the likely return expected from it. Also, the accounting rate of return can be used for ranking investments according to expected return or set a minimum benchmark return for selection. In short, the higher the accounting rate of return, the better is the asset.

Accounting Rate of Return Formula Calculator

You can use the following Accounting Rate of Return Calculator

| Incremental Accounting Income | |

| Initial Investment | |

| Accounting Rate of Return | |

| Accounting Rate of Return = |

|

||||||||||

|

Recommended Articles

This is a guide to the Accounting Rate of Return Formula. Here we discuss how to Calculate the Accounting Rate of Return along with practical examples. We also provide an Accounting Rate of Return calculator with a downloadable excel template. You may also look at the following articles to learn more –