Updated October 26, 2023

Net Cash Flow Formula (Table of Contents)

What is the Net Cash Flow Formula?

The term “net cash flow” refers to the cash generated or lost by a business over a certain period of time, which may be annual, quarterly, monthly, etc. In other words, it is the difference between a company’s cash inflow and outflow during the reporting period. The net cash flow is also the difference between the opening and closing cash balances of a reporting period.

The formula for net cash flow can be derived by adding cash flow from operations, cash flow from investing, and cash flow from financing. The Mathematical representation of the formula is as below:

Examples of Net Cash Flow Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Cash Flow in a better manner.

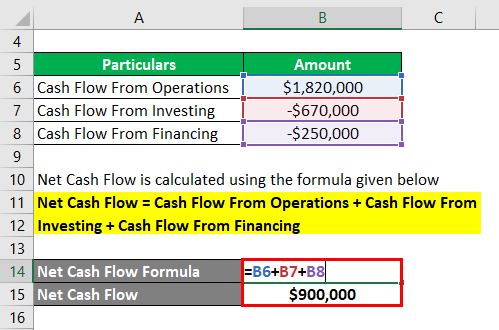

Net Cash Flow Formula – Example #1

Let us take the example of a company, DFR Ltd., which is in the business of manufacturing furniture. The company’s senior management wants to assess its cash flow during the year. The finance department provided the following details about the cash flow during the year.

- Cash flow from operations: $1,820,000

- Cash flow from investing: -$670,000

- Cash flow from financing: -$250,000

Help the senior management calculate the net cash flow for the year.

Solution:

The formula to calculate Net Cash Flow is as below:

Net Cash Flow = Cash Flow From Operations + Cash Flow From Investing + Cash Flow From Financing

- Net Cash Flow = $1,820,000 + (-$670,000) + (-$250,000)

- Net Cash Flow = $900,000

Therefore, the net cash flow of DFR Ltd. for the year was $900,000.

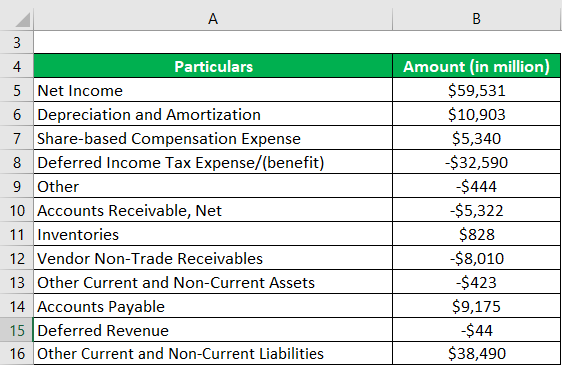

Net Cash Flow Formula – Example #2

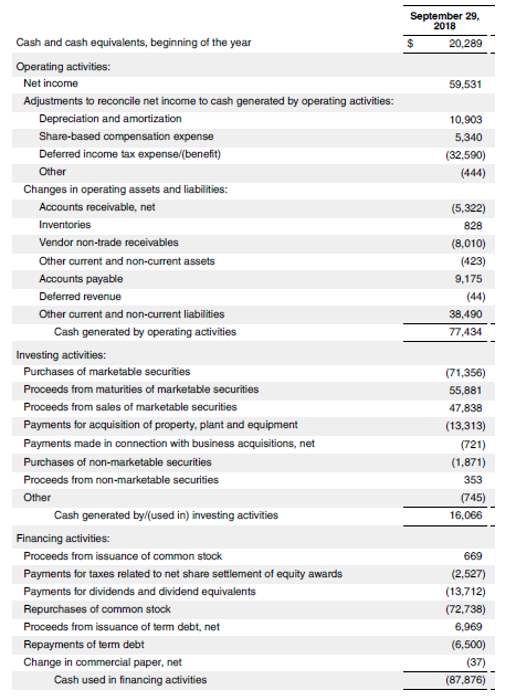

Let us take the example of Apple Inc. to illustrate the calculation of net cash flow. According to the annual report for the year 2018, the following information is available:

Calculate the net cash flow of Apple Inc. for the year 2018 based on the given information.

Solution:

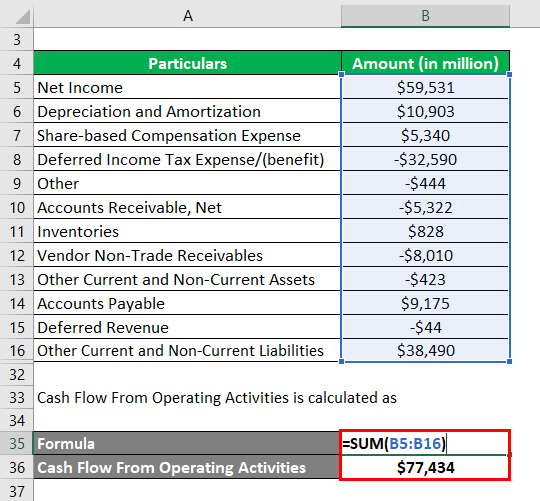

The formula to calculate Cash Flow From Operating Activities is as below:

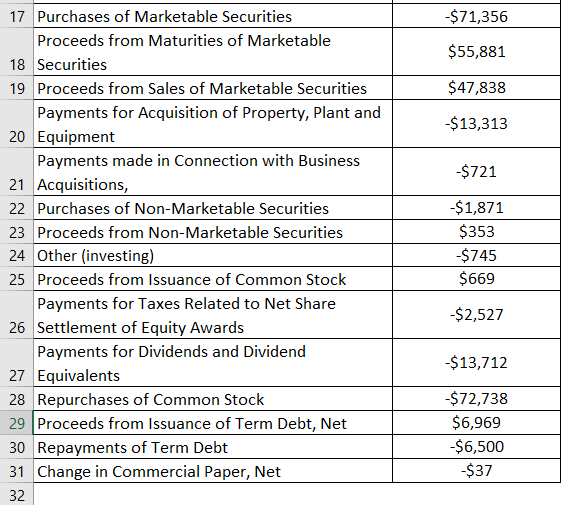

Calculation of Cash Flow From Investing Activities:

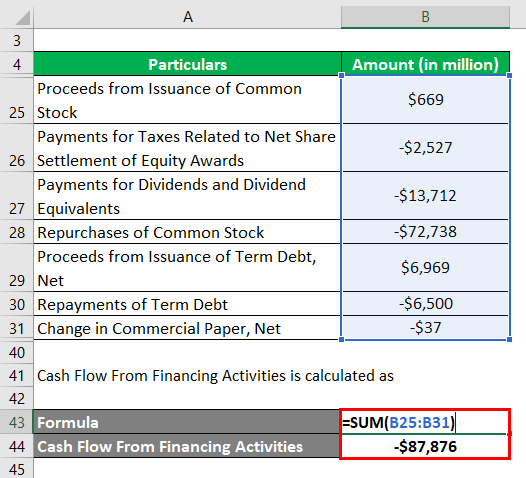

Calculation of Cash Flow From Financing Activities:

The formula to calculate Net Cash Flow is as below:

Net Cash Flow = Cash Flow From Operations + Cash Flow From Investing + Cash Flow From Financing

- Net Cash Flow = $77,434 Mn + $16,066 Mn + (-$87,876 Mn)

- Net Cash Flow = $5,624 Mn

Therefore, the net cash flow of Apple Inc. for the year 2018 stood at $5,624 Mn.

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for net cash flow can be derived by using the following steps:

Step 1: Firstly, determine the cash flow generated from operating activities. It captures the cash flow originating from the company’s core operations, including cash outflow from working capital requirements. It adjusts all non-operating expenses (interest) and non-cash items (depreciation).

Step 2: Next, determine the cash flow generated from the investing activities, which primarily include cash outflow in the form of capital expenditure or investment in stocks/bonds, or cash inflow of dividends earned from investments.

Step 3: Next, determine the cash flow generated from the financing activities, which captures cash inflow for additional debt raised or infusion of equity, while cash outflow includes debt repayment, dividend payment, interest payment, etc.

Step 4: Finally, the formula for net cash flow can be derived by adding cash flow from operations, cash flow from investing, and cash flow from financing, as shown below.

Net Cash Flow = Cash Flow From Operations + Cash Flow From Investing + Cash Flow From Financing

Relevance and Use of Net Cash Flow Formula

It is important to understand the concept of net cash flow as it is a good indicator of the liquidity position of companies. Typically, long-term positive cash flows indicate a healthy position, and such companies can comfortably meet their short-term obligations without liquidating their assets. On the other hand, long-term low or negative cash flow indicates weak financial health, and such companies may even be on the brink of bankruptcy. So, this is how a trend in cash flow can help assess a company’s financial health.

Net Cash Flow Formula Calculator

You can use the following Net Cash Flow Calculator

| Cash Flow From Operations | |

| Cash Flow From Investing | |

| Cash Flow From Financing | |

| Net Cash Flow | |

| Net Cash Flow = | Cash Flow From Operations + Cash Flow From Investing + Cash Flow From Financing | |

| 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to the Net Cash Flow Formula. Here we discuss how to Calculate the Net Cash Flow and practical examples. We also provide a Net Cash Flow calculator with a downloadable Excel template. You may also look at the following articles to learn more –