Updated July 24, 2023

Cash Flow Formula (Table of Contents)

What is the Cash Flow Formula?

The term “cash flow” refers to the amount of cash generated by a business during a given period of time in its normal course of business.

There are primarily two major cash flow formula-

- Operating cash flow

- Free cash flow

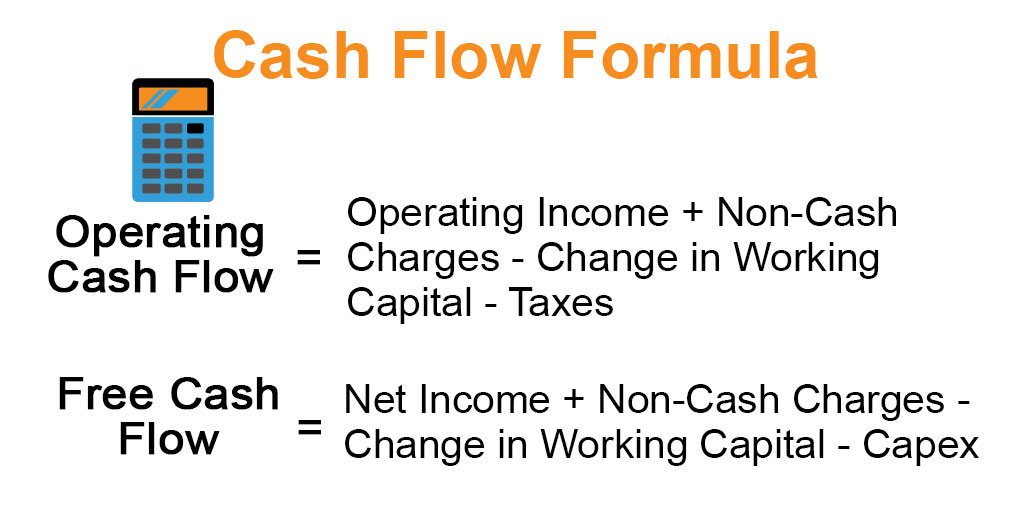

The operating cash flow indicates the cash generated by a company’s core business operation over a certain period of time. The formula for operating cash flow can be expressed as the addition of operating income or EBIT and non-cash charges (depreciation or amortization) minus change in working capital requirements and taxes paid. Mathematically, it is represented as,

The free cash flow indicates the residual cash remaining in the business after supporting the working capital requirement and capital expenditure or capex plans. The formula for free cash flow can be expressed as the addition of net income and non-cash charges minus change in working capital requirement and capex. Mathematically, it is represented as,

Examples of Cash Flow Formula (With Excel Template)

Let’s take an example to understand the calculation of Cash Flow in a better manner.

Cash Flow Formula – Example #1

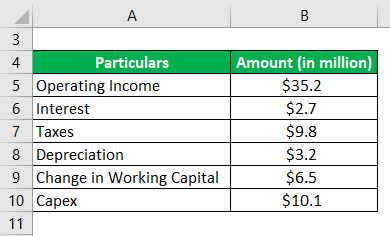

Let us take the example of a car retail dealer in the town of Nuremberg, Germany. The management of the company decided to evaluate its operating cash flow and free cash flow for the year 2018. Please help the management with the help of the following available data:

Solution:

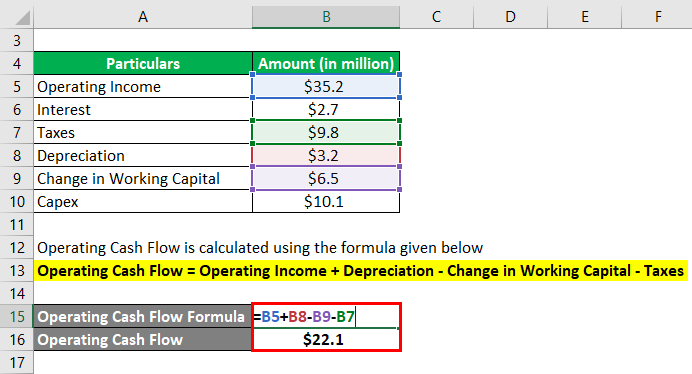

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Operating Income + Depreciation – Change in Working Capital – Taxes

- Operating Cash Flow = $35.2 million + $3.2 million – $6.5 million – $9.8 million

- Operating Cash Flow = $22.1 million

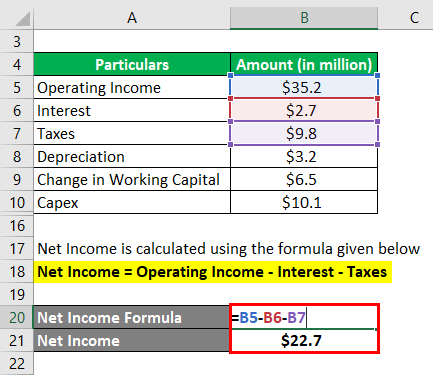

Net Income is calculated using the formula given below

Net Income = Operating Income – Interest – Taxes

- Net Income = $35.2 million – $2.7 million – $9.8 million

- Net Income = $22.7 million

Free Cash Flow is calculated using the formula given below

Free Cash Flow = Net Income + Depreciation – Change in Working Capital – Capex

- Free Cash Flow = $22.7 million + $3.2 million – $6.5 million – $10.1 million

- Free Cash Flow = $9.3 million

Therefore, the company generated operating cash flow and free cash flow of $22.1 million and $9.3 million respectively during the year 2018.

Cash Flow Formula – Example #2

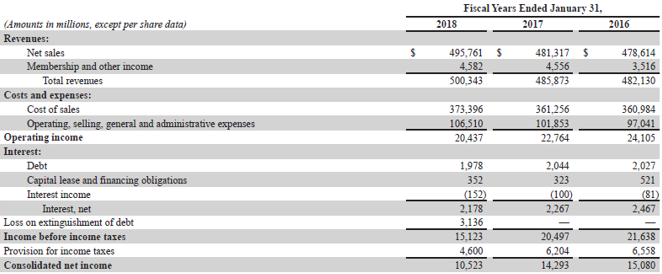

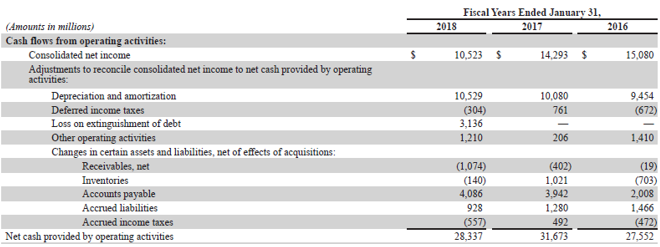

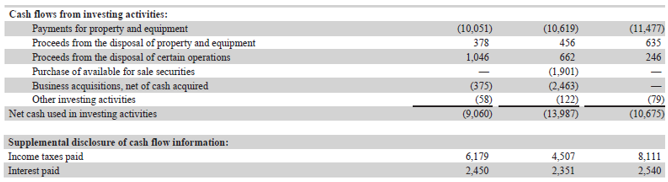

Let us take the example of Walmart Inc. to illustrate the computation of the cash flow formula. According to the annual report for 2018, the following information is available:

Solution:

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Operating Income + Depreciation & Amortization + Decrease in Working Capital – (Income Tax Paid – Deferred Tax Paid)

- Operating Cash Flow = $20,437 million + $10,529 million + $3,243 million – ($6,179 million – $304 million)

- Operating Cash Flow = $28,334 million

Free Cash Flow is calculated using the formula given below

Free Cash Flow = Net Income + Depreciation & Amortization + Decrease in Working Capital – Capex

- Free Cash Flow = $10,523 million + $10,529 million + $3,243 million – $10,051 million

- Free Cash Flow = $14,244 million

Therefore, Walmart Inc. generated operating cash flow and free cash flow of $28,334 million and $14,244 million respectively during 2018.

Source: Walmart Annual Reports (Investor Relations)

Explanation

The formula for operating cash flow can be derived by using the following steps:

Step 1: Firstly, determine the operating income of the company from the income statement. It is the income generated from the business before paying off interest and taxes.

Step 2: Next, determine the expenses that are non-cash in nature. Examples of such expenses are depreciation, amortization, etc.

Step 3: Next, determine the change in working capital requirement, which is the difference between current assets (like inventories and trade receivables) and current liabilities (like trade payables) from the balance sheet. Please note that an increase in current asset and a decrease in current liabilities means cash outflow and vice versa.

Step 4: Next, determine the taxes paid by the company during the period, which is easily available as a separate line item in the income statement.

Step 5: Finally, the formula for operating cash flow can be derived by adding operating income (step 1) and non-cash charges (step 2) and then deducting change in working capital (step 3) and taxes (step 4) from the result as shown below.

Operating Cash Flow = Operating Income + Non-Cash Charges – Change in Working Capital – Taxes

The formula for free cash flow can be derived by using the following steps:

Step 6: Firstly, determine the net income of the company from the income statement.

Step 7: Same as step 2 above.

Step 8: Same as step 3 above.

Step 9: Next, determine the capital expenditure incurred by the company during the year. It can be computed from the change in gross block or from the cash flow from investing activities.

Step 10: Finally, the formula for operating cash flow can be derived by adding net income (step 6) and non-cash charges (step 7) and then deducting change in working capital (step 8) and capex (step 9) from the result as shown below.

Free Cash Flow = Net Income + Non-Cash Charges – Change in Working Capital – Capex.

Relevance and Use of Cash Flow Formula

The cash flow formula concept is very important because it indicates how well the company is managing its cash generated from the core business. Theoretically, positive cash flow is indicative of healthy liquidity, although it may also mean that the company is not investing in growth opportunities. On the other hand, continuous negative cash flow for several years may be a warning signal of weak financial health, possibly even bankruptcy. So, in this way, cash flow can tell you a lot about a company’s going concern.

Recommended Articles

This is a guide to Cash Flow Formula. Here we discuss how to calculate Cash Flow along with practical examples. We also provide an excel template. You may also look at the following articles to learn more –