Terminal Value Definition

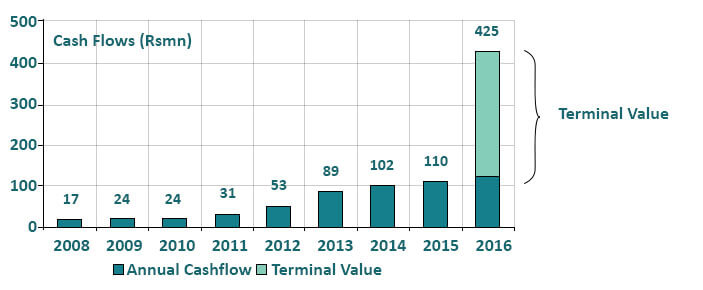

The terminal value captures the company’s value at the end of the forecast period by estimating the business’s perpetuity growth rate and exit multiples, assuming a normalized level of cash flows.

To include the terminal value in the discounted cash flow (DCF) analysis, we add it to the cash flow of the final year of the projections and then discount it to the present day, along with all other cash flows.

How to Calculate Terminal Value?

Terminal values can be calculated based on two methodologies:

1. Perpetuity value

2. Exit multiple.

(Click the picture to enlarge)

Step 1: Calculate Terminal Value

Terminal Value Calculations – Perpetuity Growth Method

Perpetuity value of normalized terminal cash flow

This approach calculates the value of the business on the assumption that it will operate into perpetuity. Two perpetuity formulae need to be useful in a DCF analysis.

Gordon growth perpetuity model

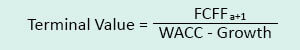

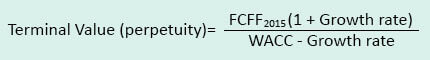

The first method is growing perpetuity, which is a preferred method. Growing perpetuity assumes that the growth of the business will continue and that the necessary new capital will return more than its cost. Growth requires capital spending, and thus growing perpetuity begins with free cash flow rather than EBIT (1 – tax rate).

The formula for growing perpetuity is as follows:

n is the final year of the projection period, and g is the nominal growth rate expected into perpetuity. The nominal growth rate is generally the inflation rate component of the discount plus an expected real growth (or minus a deflation) in the business.

A reasonable range for perpetuity growth is the nominal GDP growth rate of the country.

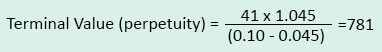

Please note that matching nominal cash flows with nominal discount rates is important.Terminal Value (perpetuity method) of ABC =

When WACC = 10% & Growth rate = 4.5%,

No growth perpetuity model

The second assumes that a company earns its cost of capital on all new investments into perpetuity. As such, the level of investment growth is irrelevant because such growth does not affect the value (i.e., the growth rate is zero, and Capital Expenditure is equal to depreciation and amortization). Such a methodology is appropriate in industries where competition needs to eliminate excess returns, thus driving asset returns to the cost of capital.

To calculate such non-growing perpetuity, use the following formula:

Year n is the final year of the projection.

Very few analysts use the no-growth perpetuity model for calculating Terminal Value.

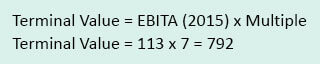

Terminal Value Calculations – Exit Multiple

This approach assumes that the business will be valued on a multiple-market basis at the end of year n. A value is typically determined as a multiple of EBIT or EBITDA. For cyclical businesses, an average EBIT or EBITDA over the course of a cycle is useful rather than the amount in year n. When selecting a multiple, a normalized level should be used. In other words, an industry multiple adjusts to consider the cyclical variations rather than applying a current multiple which can be distorted by industry or economic cycles. Multiples should typically be based on comparing comparable companies and transactions.

Most models will incorporate both valuation approaches and often include sensitivities showing values at various discount rates, growth rates, and terminal multiples. You must discuss relevant growth and terminal multiple assumptions with your team because what defines a reasonable range of parameters varies by company, industry, economic conditions, etc. Extreme caution is advised as the terminal value is often a major part of the total firm value (>60%). The terminal value represents the present value in the final projection year of the company’s free cash flows after the final year. Therefore, it is useful to calculate the EBIT and EBITDA multiples implied by a perpetuity growth terminal value and vice versa as a test of reasonableness.

When the EBITDA transaction multiple is 7x,

Step 2: Terminal Value Reality Check of Assumptions

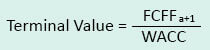

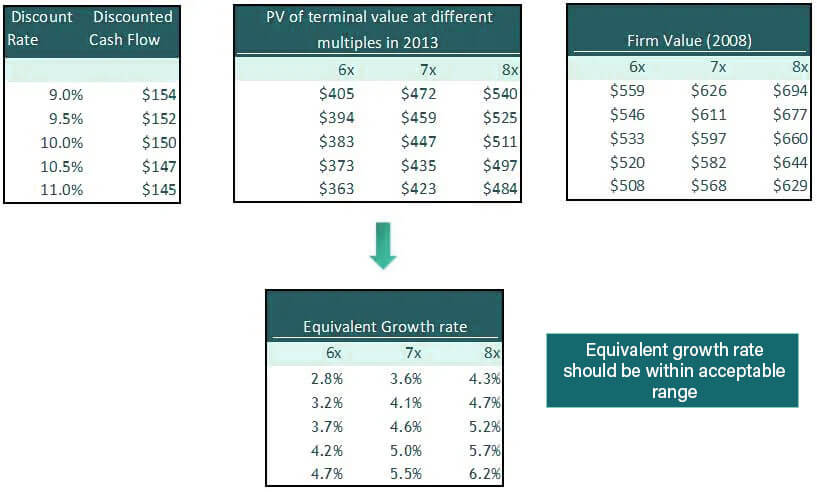

Implied Exit Multiple may be too high or too low or vice versa. Calculating the implied perpetuity growth rate and the Exit multiple is always helpful by cross-linking each other. Thus, the resulting implied growth rate or the Exit multiple should be a reasonable comfort zone.

Calculate the Implied Growth rate and implied Exit multiple for ABC company and double-check if they are reasonable.

For Calculating the Implied Growth Rate

For Calculating Implied Exit Multiple

What next?

Now that we have understood terminal spot check, in our next article, we will Understand Capital Structure. Till then, Happy Learning!

Recommended Articles

Here are some articles that will help you to get more detail about the Methodologies To Know About Terminal Value, so just go through the link.