Updated November 6, 2023

Difference Between EBIT vs EBITDA

When Costs of Materials, labor, Rent, employee costs, Depreciation, and other costs are deducted from Income or Revenue, the Profits we get are called Earnings before Interest and Taxes (EBIT) or the Operating Income of the Company. EBIT stands for Earnings before Interest and Taxes, which appears in the Company’s Income Statement. EBITDA, on the other hand, stands for Earning before Interest, Taxes, Depreciation, and Amortization, which can also be extracted from any company’s Income Statement. So when Depreciation is not included within the operating expense, we get EBITDA.

Let us study much more about EBIT and EBITDA in detail:

- EBIT stands for Earnings before Interest and Taxes. All the business’s operating expenses are deducted from Income, and the residue is Operating profit. Operating profit denotes a company’s operational efficiency- how well the costs (primarily working) are being managed and the degree to which the Operating profit margin measures it.

- Operating profit margin we can get by Operating Profit as a percentage of Sales. A higher operating profit margin rate is believed to denote better management efficiency.

- For example, when the Operating profit margin improves from 18.8% in a particular Financial Year from 17% in comparison to the previous year, it is believed that the company has taken certain measures to reduce operating costs, and it replicates the Operating Margin and vice versa.

- EBITDA stands for Earnings before Interest, Taxes, Depreciation, and Amortization. Only the intrinsic value of the fixed assets gets eroded, whereas the real cash remains within the Balance sheet and circulates within the working capital itself. Sometimes analysts prefer to exclude depreciation expense because no cash transaction is involved during depreciation.

- So when the amount of depreciation charged is added back, we get EBITDA. But in capital-intensive businesses like Telecom, Real Estate, Airlines, etc., depreciation does impact more than any other Business, say Information Technology and FMCG. This is because of the higher amount of fixed assets involved in it.

- Thus the difference between EBITDA and EBIT margins would be higher for a capital-intensive business. Thus, the real earnings can be visible when EBITDA is considered.

A study of the Income statement of Jubilant Foodworks would shine light on the course of business during the last two years.

| Financials of Jubilant Foodworks (INR in Mn) | ||

| Particulars (INR in Cr.) | FY18 | FY17 |

| Net Revenue | 29804 | 25461 |

| Material Costs | 7514 | 6160 |

| Employee Costs | 6041 | 5845 |

| Rent Expenses | 3157 | 2986 |

| Other Expenses | 8628 | 8003 |

| EBITDA | 4464 | 2466 |

| EBITDA Margin | 15% | 10% |

| Depreciation | 1559 | 1512 |

| EBIT | 2905 | 954 |

| EBIT Margin | 10% | 4% |

| Other Income | 227 | 145 |

| Exceptional Item | – | 122 |

| PBT | 3133 | 978 |

| Tax | 1068 | 305 |

| PAT | 2064 | 673 |

And the margin has been improved drastically. The above example indicates that the EBITDA margin has expanded from 10% to 15% in FY18 from FY17, which is a 50% improvement. But the EBIT margin has improved from 4% to 10%, which is a 2.5% improvement because of the ‘Depreciation, which has been taken into account. Depreciation increased from INR 1512 million in FY17 to INR 1559 million in FY18, a jump of 23.35%.

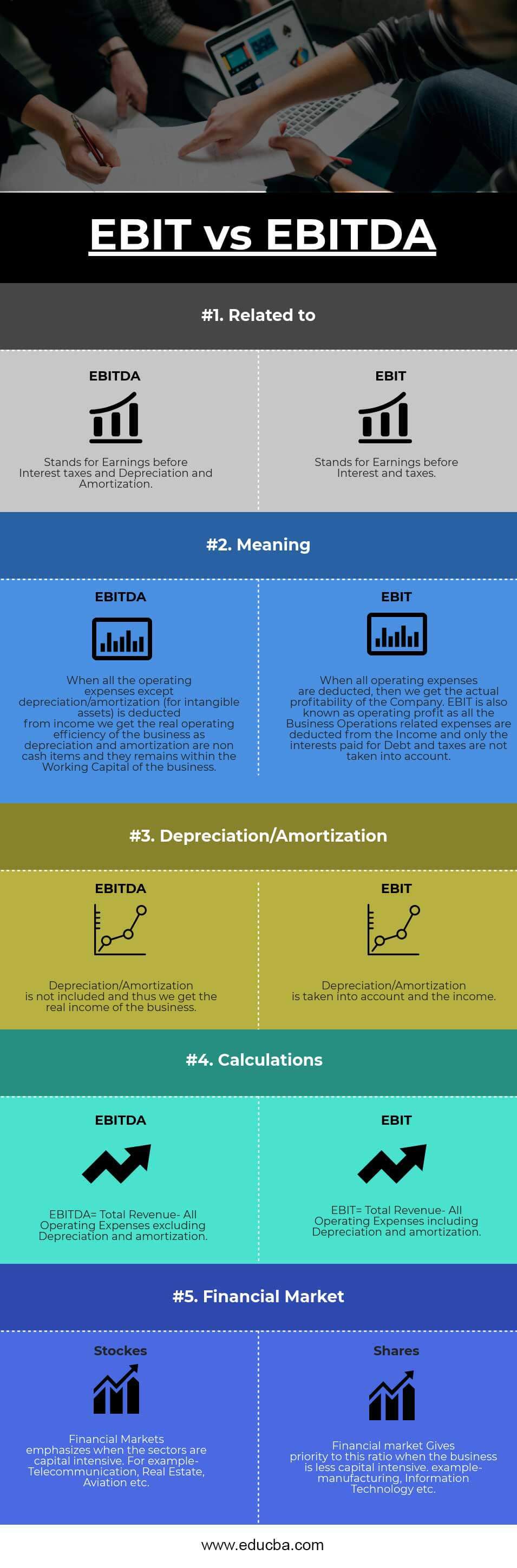

Head To Head Comparison Between EBIT vs EBITDA (Infographics)

Below is the top 5 difference between EBIT vs. EBITDA

Key Differences Between EBIT vs EBITDA

Both EBIT vs. EBITDA are popular choices in the market; let us discuss some of the major differences between EBIT and EBITDA:

- EBIT measures operational efficiency with the inclusion of Depreciation/amortization within the operating expenses, whereas EBITDA measures operational efficiency without the Depreciation/amortization; thus, the erosion from fixed assets and intangible assets is not excluded as it is a non-cash item.

- The primary factor is Depreciation or amortization; the higher the depreciation/ amortization, the wider the gap between EBIT vs EBITDA. In the case of less capital-intensive businesses, the EBIT vs. EBITDA margin almost remains the same.

- The EBITDA margin is a worthy indicator of operational efficiency in the case of sectors like Telecommunications, Aviation, Real Estate, etc., as a huge amount of non-cash items are involved in these kinds of businesses. Thus, the real income, in most cases, is overshadowed if the Depreciation is deducted.

- Changes in depreciation methods may give certain different results when both EBIT vs. EBITDA are calculated. As we know, Depreciation/amortization is the prime factor; a sudden change in the amount of Depreciation can hinder the past ratios too.

EBIT vs EBITDA Comparison Table

Below is the Topmost Comparison Between EBIT vs EBITDA

| The Basis of Comparison | EBITDA | EBIT |

| Related to | Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization | It stands for Earnings before Interest and taxes |

| Meaning | Deducting all operating expenses except for depreciation/amortization (for intangible assets) from income yields the true operating efficiency of the business. Depreciation and amortization, being non-cash items, remain within the business’s working capital. | Deducting all operating expenses gives us the actual profitability of the company. The income has removed all business operations-related expenses, leaving only the interests paid for debt and taxes as exceptions. This process is known as calculating the operating profit or EBIT. |

| Depreciation/Amortization | Amortization/Depreciation is not included, and thus, we get the real income of the business. | Depreciation/Amortization is taken into account as income. |

| Calculations | EBITDA Total Revenue- All Operating Expenses excluding Depreciation and amortization. | EBIT Total Revenue- All Operating Expenses, including Depreciation and amortization. |

| Financial Market | Financial Markets emphasize when the sectors are capital intensive. For example- Telecommunications, Real Estate, Aviation, etc. | The financial market Prioritizes this ratio when the business is less capital-intensive. Examples- are manufacturing, Information Technology, etc. |

Conclusion

Both EBIT vs. EBITDA ratios are the key indicators in determining the operational efficiency of a Business. A comparatively higher margin from historic years determines the better operating efficiency of the company. Suppose the company is deriving higher revenues while maintaining the same or lower expenses, and the level of depreciation remains constant. In that case, it can be concluded that the company is improving its operational efficiencies through better cost management. The increase in revenues may also indicate a good product mix. Additions of high-margin products are what a business looks for, and it indicates higher pricing power from the clients or the customer based on higher customer royalty.

Recommended Articles

This has been a guide to the top difference between EBIT and EBITDA. Here, we also discuss the EBIT vs. EBITDA differences with infographics and a comparison table. You may also have a look at the following articles to learn more –