Updated July 28, 2023

Stockholder’s Equity Formula (Table of Contents)

- Stockholder’s Equity Formula

- Examples of Stockholder’s Equity Formula (With Excel Template)

- Stockholder’s Equity Formula Calculator

Stockholder’s Equity Formula

Stockholder’s Equity is an accounting term and refers to assets created by the company after paying off all of its debts. It is important to understand the meaning of a Stockholder.

The company provides shares of the company in exchange for the money given by the people to the company. Hence, people holding shares in the company are called shareholders or stockholders. These are the owners of the company. As owners, shareholders or stockholders are liable for sharing all the profits and losses of the company. Profit is shared in the form of dividends to shareholders.

Hence, Stockholder’s Equity in common language is capital invested by the owners in the company.

Stockholders’ Equity represents the company’s financial health. It represents the survival of the company in the long run. Stockholder’s Equity is a very vital tool for analyzing the Company. Positive Stockholder’s Equity represents the healthy company, and negative Stockholder’s Equity represents the weak health of the company.

Stockholder’s Equity consists of Paid-up Capital, Retained Earnings, and Treasury Stock.

The formula for Stockholder’s Equity–

Formula 1:

OR

Formula 2:

Examples of Stockholder’s Equity Formula (With Excel Template)

Let’s take an example to understand the calculation of Stockholder’s Equity in a better manner.

Example #1

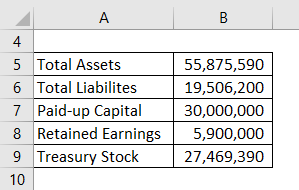

Total Assets of XYZ & Company is Rs. 55,875,590/-, Total Liabilities is 19,506,200/-, Paid-up Capital is Rs.30,000,000/-, Retained Earnings by the Company is 59,00,000/-, Treasury Stock is Rs. 27,469,390/-. Calculate the Stockholder’s Equity of XYZ & Company.

Solution:

Formula 1:

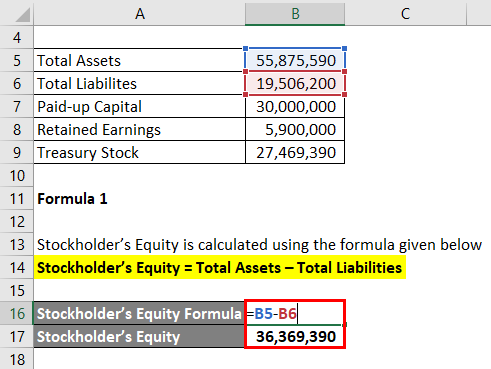

Stockholder’s Equity is calculated using the formula given below

Stockholder’s Equity = Total Assets – Total Liabilities

- Stockholder’s Equity = 55,875,590 – 19,506,200

- Stockholder’s Equity = 36,369,390

Example #2

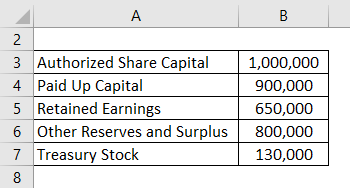

Calculate StockHolder’s Equity from the following information:

Solution:

The formula to calculate Stockholder’s Equity is as below:

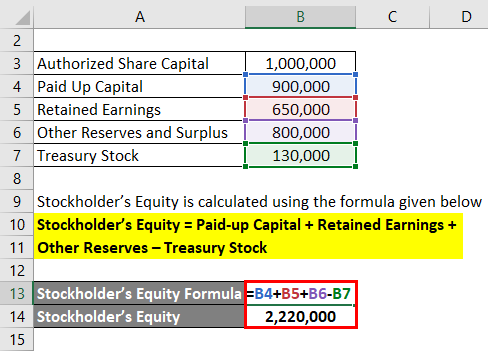

Stockholder’s Equity = Paid-up Capital + Retained Earnings + Other Reserves – Treasury Stock

- Stockholder’s Equity = 900,000 + 650,000 + 800,000 – 130,000

- Stockholder’s Equity = 2,220,000

Hence, StockHolder’s Equity is Rs. 2,220,000.

Example #3

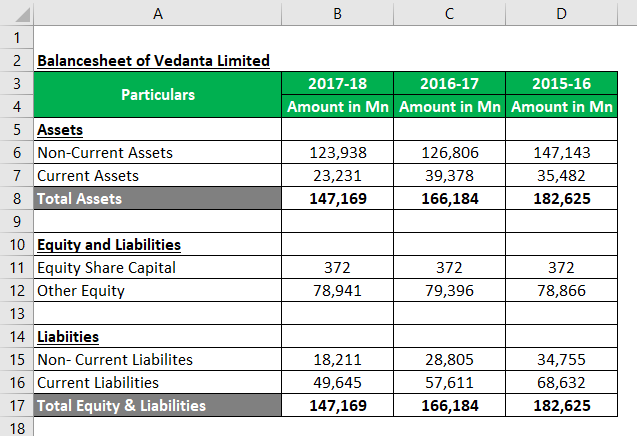

Let’s take a practical example of Vedanta Limited. Below is the Balance sheet as of 31.03.2018. Calculate the Stockholder’s Equity for Three Years.

Balance Sheet

Solution:

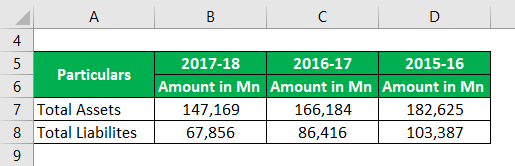

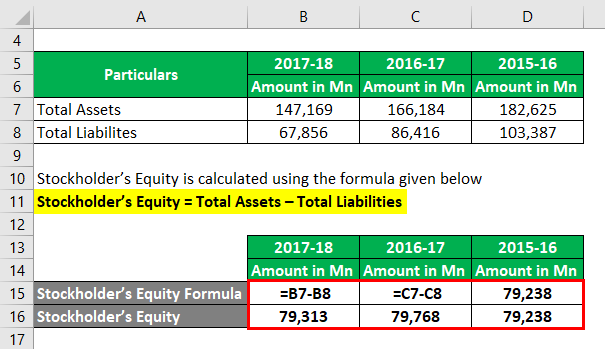

For Formula 1

Stockholder’s Equity = Total Assets – Total Liabilities

For 2017-18

- Stockholder’s Equity = 147,169 – 67,856

- Stockholder’s Equity = 79,313

For 2016-17

- Stockholder’s Equity = 166,184 – 86,416

- Stockholder’s Equity = 79,768

For 2015-16

- Stockholder’s Equity = 182,625 – 103,387

- Stockholder’s Equity = 79,238

Now, we will calculate Stockholder’s Equity by using another formula.

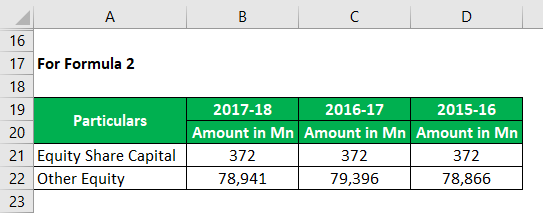

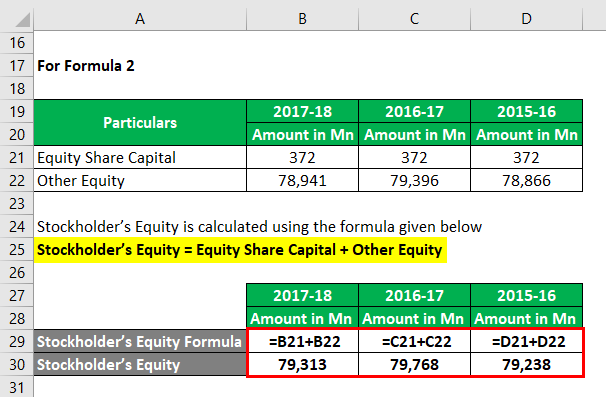

For Formula 2

The formula to calculate Stockholder’s Equity is as below:

Stockholder’s Equity = Equity Share Capital + Other Equity

For 2017-18

- Stockholder’s Equity = 372 + 78,941

- Stockholder’s Equity = 79,313

For 2016-17

- Stockholder’s Equity = 372 + 79,396

- Stockholder’s Equity = 79,768

For 2015-16

- Stockholder’s Equity = 372 + 78,866

- Stockholder’s Equity = 79,238

The above calculations show that Stockholder’s Equity for the year 2017-18 is low compared to last year i.e. 2016-17.

Explanation

The first formula of Stockholder’s Equity can be interpreted as the Number of Assets left after paying off all the Debts or Liabilities of the business. Positive Stockholder’s Equity represents the company has sufficient assets to pay off its debt. It has a positive impact on a Company’s financial growth. In the same way, Negative Stockholder’s Equity represents the weak financial health of the company.

The second formula represents items that form Stockholder’s Equity. The following are the component of Stockholder’s Equity:

- Paid-up Capital: Amount paid by the Shareholder or Stockholder

- Retained Earnings: Amount of Profit generated by the Company which is kept in the Company for future growth and expansion and is not distributed to shareholders.

- Treasury Stock: Amount spent by the company to buy back shares due to some financial reasons.

Relevance and Uses

As explained above, Stockholder’s Equity is the excess assets over liabilities. To analyze a company’s growth, one cannot rely on profits earned by the company. Stockholders’ Equity shows whether a company has sufficient assets to repay its debt and whether it can survive in the long run.

The calculation of the book value of shares of the company utilizes Stockholder’s Equity. Analysts use the book value of the company’s shares to assess how the market value is priced relative to the book value of the company’s shares.

As discussed above, it is also used for analyzing the health of a company and survival in the long run.

Stockholder’s Equity Calculator

You can use the following Stockholder’s Equity Calculator

| Total Assets | |

| Total Liabilities | |

| Stockholder's Equity Formula | |

| Stockholder's Equity Formula = | Total Assets – Total Liabilities |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Stockholder’s Equity formula. Here we have discussed how to calculate Stockholder’s Equity and practical examples. We have also provided the Stockholder’s Equity calculator with a downloadable Excel template. You may also look at the following articles to learn more –