Updated July 5, 2023

Capital Adequacy Ratio Formula (Table of Contents)

- Capital Adequacy Ratio Formula

- Capital Adequacy Ratio Calculator

- Capital Adequacy Ratio Formula in Excel (With Excel Template)

Capital Adequacy Ratio Formula

A Capital adequacy ratio is a percentage of an adequate amount to be maintained to solve the risks situation of banks by them. This is described as a shield for a bank to engross its losses before it becomes insolvent. This is regulated by the Basel Committee on Banking Supervision which is an international regulatory treaty.

It consists of Tier-1 capital, Tier -2 Capital. This is the ratio of Capital to risk-weighted assets which is also known as Capital to Risk-Weighted Asset’s ratio (CRAR). This promotes stability and protects shareholders and banks and make Banks sustained when it meets some risk situation. Tier-1 capital amount is to engross the losses without ceasing the bank. Tier -2 capital is to engross the losses when a bank is in a closing situation. But Tier -2 Capital does not provide much protection for depositors. Capital Adequacy Ratio is calculated using the following formula.

Examples of Capital Adequacy Ratio Formula

Let’s take an example to understand the calculation of Capital Adequacy Ratio formula in a better manner.

Capital Adequacy Ratio Formula – Example #1

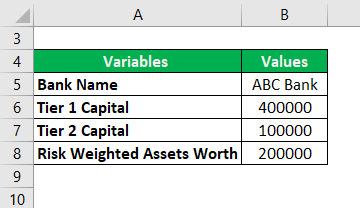

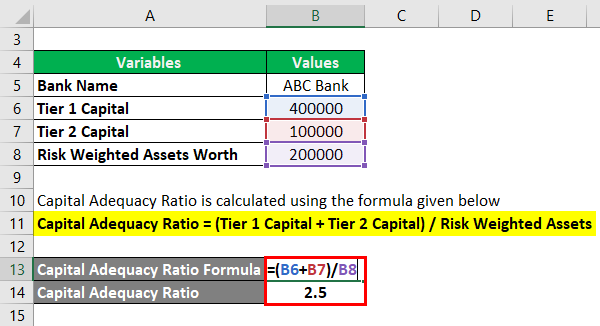

Bank ABC has Tier -1 Capital of Rs.400000 and Tier -2 Capital of Rs.100000. Risk-Weighted Assets are worth of Rs.200000. Now let us calculate the Capital Adequacy Ratio.

Capital Adequacy Ratio is calculated using the formula given below

Capital Adequacy Ratio = (Tier 1 Capital + Tier 2 Capital) / Risk Weighted Assets

- Capital Adequacy Ratio = (400000 + 100000) / 200000

- Capital Adequacy Ratio = 2.5

Which shows poor Capital Adequacy Ratio maintained by ABC.

Capital Adequacy Ratio Formula – Example #2

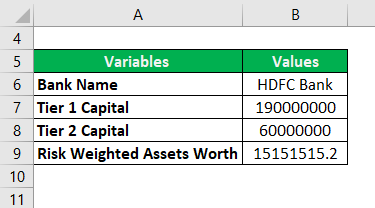

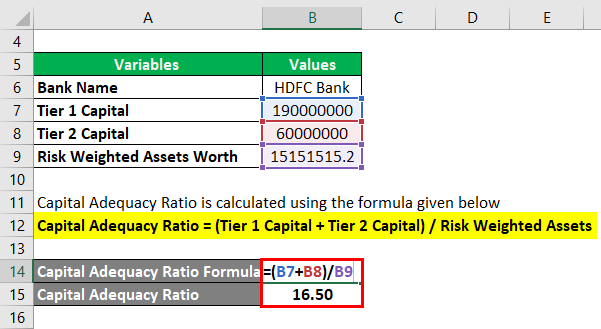

Let’s take the practical example of CAR for HDFC Bank. Let us consider the Tier -1 Capital value is Rs.190000000.00 and Tier-2 Capital value of Rs.60000000 and the Risk Weighted Asset value is evaluated as Rs.15151515.20. Now let us calculate the Capital Adequacy Ratio.

Capital Adequacy Ratio is calculated using the formula given below

Capital Adequacy Ratio = (Tier 1 Capital + Tier 2 Capital) / Risk Weighted Assets

- Capital Adequacy Ratio = (190000000 + 60000000) / 15151515.20

- Capital Adequacy Ratio = 16.50

Which is a high Capital Adequacy Ratio maintained by HDFC and shows it has high stability and efficiency towards the risk-based situation.

Explanation

- Step 1: Tier 1 Capital Value is noted. Tier 1 capital or Core capital can be of 2 types. One is common equity capital and another one is ordinary share. This is a permanent capital amount which can ease the losses by absorbing it and without stopping the bank’s operation. Common stock or ordinary share is the best example of this. This is the permanent, Inspected revenue reserves in the form of Equities, ordinary shares, and intangible assets to engross the losses.

- Step 2: Tier-2 Capital value is noted. Tier -2 Capital is Uninspected Revenue earnings to settle the losses without closing a bank when Bank in a situation it must be closed. After full Tier 1 is used, Tier-2 can come into the picture. Hence it focusses only to save the bank from closing the company, it does provide only a very lesser degree of protection towards the shareholders and investors which sometimes pushes the investors and shareholders into a situation to lose their savings.

- Step 3: Risk-Weighted Assets are noted. A risk-weighted asset is used to calculate the minimum amount that should be kept by any Financial institution to settle out the losses in a risky insolvency situation. The capital requirement to assess the risk differs based on the type of each bank asset. For Example, a loan secured with collateral is considered to be less risky than a Loan with a letter of Credit. Risk-Weighted Asset value is weighed only after looking on the bank’s loan and assessing the risk. Risk score also helps in assessing the risk. For Example, a loan given to the government gives 0.00 % risk score whereas credit to an individual is considered a score of 100.00%.

- Step 4: Then all the noted values are applied in the following formula to get the Capital Adequacy Ratio.

As per the latest Basel III (International Banking Regulatory Committee) norms, the minimum Adequacy Ratio is set as 4.5 %. In India, the RBI has set the CAR as 5.5% which is 1% higher than the Basel III norms recommended %. Higher Capital Adequacy Ratio than 5.5 % is considered to be safe in India.

Relevance and Uses of Capital Adequacy Ratio Formula

Capital Adequacy Ratio ensures that a particular FI is well to do in the risky situation to ease the losses that happens to banks as well as to investors and shareholders. It ensures the solidity and capability of a nation’s financial system by lowering the losses by absorbing the losses in a needful situation hence saving the banks from becoming insolvent. A bank with high CAR is good to manage its financial obligations and risks thus higher the Capacity Adequacy Ratio higher the level of protection of assets. During the closing of a Bank, Tier -2 Capital helps. One should know that during this closing risk, the priority is given to the depositors rather than the bank’s capital. So when a bank registers its loss higher than the capital it has, Depositors lose only their savings.

Capital Adequacy Ratio Calculator

You can use the following Capital Adequacy Ratio Calculator

| Tier 1 Capital | |

| Tier 2 Capital | |

| Risk Weighted Assets | |

| Capital Adequate Ratio (CAR) Formula | |

| Capital Adequate Ratio (CAR) Formula = |

|

|

Capital Adequacy Ratio Formula in Excel (With Excel Template)

Here we will do another example of the Capital Adequacy Ratio formula in Excel. It is very easy and simple.

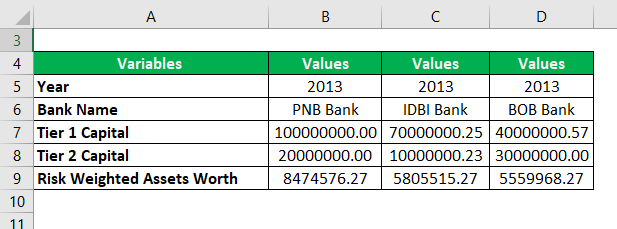

Now let us take the real-life example to calculate Capital Adequacy Ratio for the year 2013 with 3 sets of Different Banks of India.

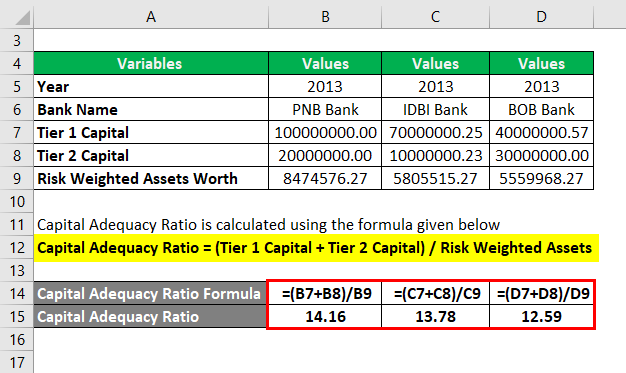

Capital Adequacy Ratio is calculated using the formula given below

Capital Adequacy Ratio = (Tier 1 Capital + Tier 2 Capital) / Risk Weighted Assets

Capital Adequacy Ratio for PNB Bank

- Capital Adequacy Ratio = (100000000 + 20000000) / 8474576.27

- Capital Adequacy Ratio = 14.16

Capital Adequacy Ratio for IDBI Bank

- Capital Adequacy Ratio = (70000000.25 + 10000000.23) / 5805515.272

- Capital Adequacy Ratio = 13.78

Capital Adequacy Ratio for BOB Bank

- Capital Adequacy Ratio = (40000000.57 + 30000000) / 5559968.274

- Capital Adequacy Ratio = 12.59

With the above example, the ratio values are PNB> IDBI > BOB. Though all 3 banks maintain good CAR, among these 3 banks, PNB has high ratio hence it is the higher degree of safety in terms of risk managing among these 3 banks.

Recommended Articles

This has been a guide to Capital Adequacy Ratio Formula. Here we discuss how to calculate Capital Adequacy Ratio along with practical examples. We also provide a Capital Adequacy Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –