Introduction to Statement of Cash Flows

The cash flow statement shows the inflow and outflow of funds during a given period. It reflects the cash movement in various particulars of the balance sheet and income statement under operating, investing, and financial activities.

Examples of Statement of Cash Flows

Given below are examples of statements of cash flow:

Example #1

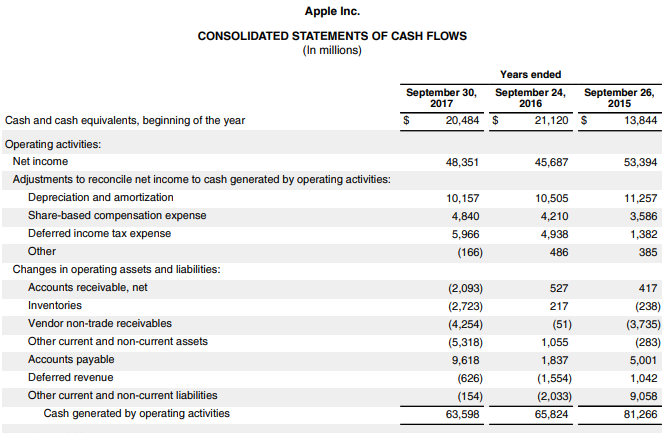

Below is the extract of the Cash Flow Statement of Apple Inc showing cash flow from operating activities:

The above statement is prepared as per the indirect method. In the Indirect method, cash flow from operating activities is derived from the net income by adjusting non-cash expenses and other current assets and current liabilities components.

Non-Cash Expenses

- Depreciation and amortization worth $ 48351 Mn

- Share-based compensation Expenses Worth $ 10157 Mn

- Deferred income tax expense worth $ 5966 Mn

- Other Misc. non-cash income worth $ 166 Mn

Are added and deducted from the net income.

In addition, balance sheet items like current assets and current liability items are duly adjusted to the bet income.

The Rule is that

- An increase in current liability increases the cash flow.

- The decrease in current liability reduces the cash flow.

- An increase in the current asset reduces the cash flow.

- The decrease in the current asset increases the cash flow.

Based on the Given Rule

Debtors, Inventories, Non-tradeable Vendors, Creditors, and other current assets and liabilities are adjusted to arrive at the cash generated by the operating activity.

At the end of the period, cash from the operating activity is generated worth $ 63598 Mn.

This shows the company has good operative conditions, also boosting the operating margin.

Example #2

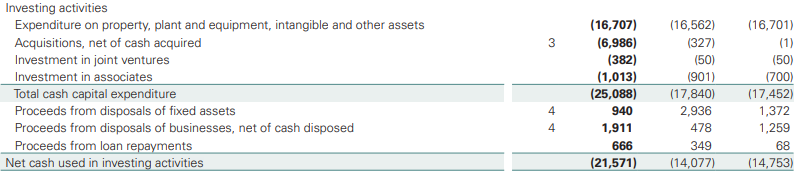

Below is the extract of the cash flow statement of British Petroleum showing cash flow from investing activities ( fig in $ Mn)

The main business of British Petroleum is to sell petrol at the retail level through petrol pumps. Its main assets are Owned Petrol pumps, Oil and Gas properties, Oil Depots, storage tanks, Intellectual properties, intangibles related to the brand BP, transportation trucks, and furniture.

These assets must be maintained with due care to ensure the smooth running of the business.

From the above extract, it is evident that:

- The company has invested heavily in fixed assets, intangibles, and property plants and equipment.

- Moreover, the company has also acquired a few entities worth $ 6986 Mn to expand its horizon and cover new geographies.

- Also, to enhance the skills and capacity of working, BP has undertaken joint ventures in Joint ventures and Associates worth $ 1395 Mn.

- It has sold out the assets and earned an income of $ 940 Mn.

- Also, various segments and operations are sold out at $ 1911 Mn, which shows the stability of investment income.

Thus, on an overall basis, one can say that the cash flow of British petroleum from investment activities is highly appropriate and shows the business’s solvency.

Example #3

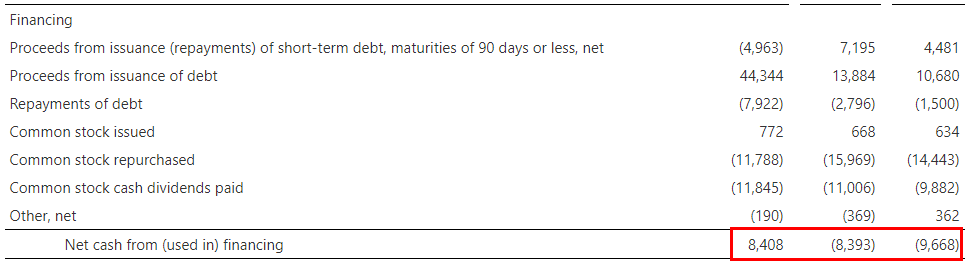

Below is the extract of the cash flow statement of Microsoft Corporation showing cash flow from Financing activities ( fig in $ Mn)

The main business of Microsoft Corporation is Information technology. It develops software, platforms, and customized applications for business needs.

Microsoft is one of the most cash-rich companies in the world. It is one of the most stable corporations that earn thousands of dollars every second.

In the above extract, we can observe that:

- Loans worth $ 12885 Mn are repaid with interest.

- Also, Microsoft has issued debentures and bonds worth $ 44344 Mn in public

- The company has issued further equity capital of $ 772 Mn and bought back its own shares worth $ 11788 Mn.

- The company is highly cashed rich; hence it has declared a dividend worth $ 11845 Mn to its shareholders.

The above particulars show that the company is maintaining a high level of cash-to-asset ratio, as a result of which they can maintain goodwill in the market, which helps them in obtaining borrowings, issuing debt instruments, buying back its own shares, and over and above all of these, to pay the dividend to the shareholders.

Example #4

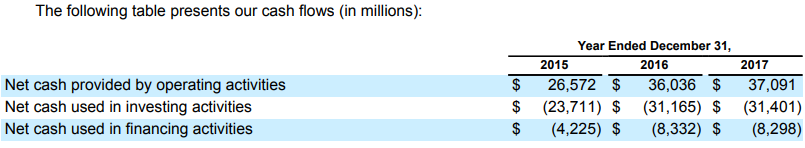

Below is the extract of the cash flow statement of Alphabet Inc., showing cash flow from Financing activities ( fig in $ Mn)

Alphabet Inc, popularly known as Google, pioneered the internet search engine and data mart. It has the largest data mart presently on the earth. It is the backup of many industries, which can be stopped if Google stops working.

The extract above shows the cash flows for 3 years at Alphabet Inc.

One can understand below points from the given extract:

- Cash flow from operating activities has grown throughout the 3 years. This shows the expansion of 40% in revenue terms, which reflects the expansion of operations of Google gradually. Its advertisement expense helps it earn a lot of cash, and with digital media, it can cover the market with almost 50% of the online advertisement industry.

- Cash flow from investing activity displays an increase in the investment made by the company to increase its operations globally. Cash flow from investing activity has grown at 32% cumulatively in 3 years. Google is considered a pioneer in acquiring start-ups and actively seeks to leverage the new skills and youth power available within them.

- Google has a high brand value. People will rely on any activity with which Google is associated. Based on this goodwill, Google can obtain borrowings from the institution, issue debt instruments, and raise capital. Moreover, Google can repay the borrowed funds duly on time with interest. The repayment of debt in the last 3 years has almost doubled. One can clearly understand that reserves and cash have increased with Google, which has helped them repay their borrowed funds.

Conclusion

Thus, from the above, we can understand that the Cash flow statement briefly highlights the corporation’s cash movement. From the same, we can verify the major chunk of the heads in which corporations are expanding.

Recommended Articles

This is a guide to a Statement of Cash Flows. Here we discussed the introduction, examples of the cash flow statement, and a detailed explanation of the Statement of Cash Flows. You may also look at the following articles to learn more –