Updated July 29, 2023

Sinking Fund Formula (Table of Contents)

- Sinking Fund Formula

- Examples of Sinking Fund Formula (With Excel Template)

- Sinking Fund Formula Calculator

Sinking Fund Formula

The party establishing a sinking fund regularly sets aside a certain amount of money to repay the debt. The usual way of retiring the debt is by a bond issue.

For example, a company that has issued a bond in the past and raised money; can deposit money regularly in the fund for the purpose of buying back the bond each quarter before maturity. So instead of paying the whole principal amount at the expiry of the bond, the borrower will pay off his debt in installments.

If we talk from an investor’s point of view, the longer the duration of the bond, the higher the risk that the borrower will default. The sinking fund provides an added layer of protection by gradually reducing the principal amount over time, thereby decreasing the likelihood of the borrower defaulting on a smaller principal amount. So sinking funds increase investors’ confidence that the other party will not default.

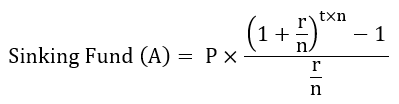

If we want to calculate the accumulated value in the sinking fund, we can use the following formula :

Where

- A – Money accumulated

- P – Periodic contribution,

- r – Interest rate

- t – Number of years

- n – Number of payments per year

In other words, we can see what the Periodic Payment needed by :

Examples of Sinking Fund Formula (With Excel Template)

Let’s take an example to understand the calculation of the Sinking Fund formula in a better manner.

Example #1

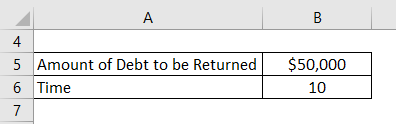

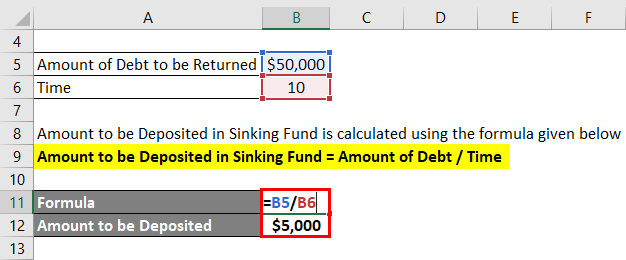

Consider a retail food company, A, which is doing well in its business, and to expand its business operations, they want to raise money through debt. So that is why they have issued $50,000 worth of bonds, which mature in 10 years and have a sinking fund provision.

Solution:

The formula calculates the amount to be deposited in the Sinking Fund.

Amount to be Deposited in Sinking Fund = Amount of Debt / Time

- Amount to be Deposited = $50,000 / 10

- = $5,000

So by establishing a sinking fund, company A must regularly deposit $5000 each year in the fund, which will be exclusively used to retire this debt.

A company can also retire the debt early if there exists an opportunity. So if the market price goes down, they can use this fund to buy back the bonds and issue another bond with a lower price and the remaining time. This will help them to eventually reduce the principal amount of the debt.

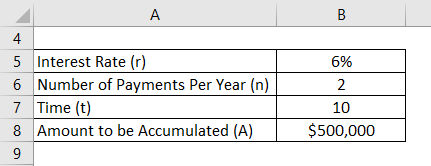

Example #2

Company XYZ issued bonds worth $5 million, having a 10% coupon rate and maturing in 10 years. The company has set up a sinking up to pay off the bond. Coupons are to be paid semiannually, and the market interest rate says 6%.

Solution:

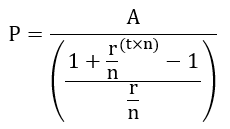

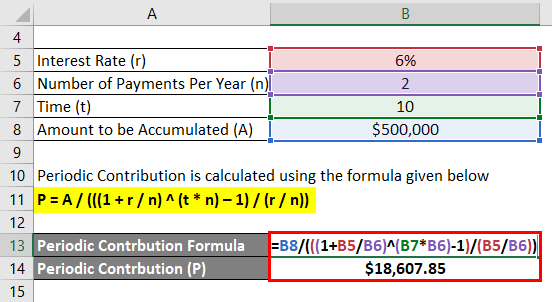

The formula to calculate Periodic Contribution is as below:

P = A / (((1 + r / n) ^ (t * n) – 1) / (r / n))

- Periodic Contribution = $500,000 / (((1 + 6% / 2) ^ (10 * 2) – 1)/(6% / 2))

- Periodic Contribution = $18,607.85

Explanation

Basically, in the sinking funds, since there is sufficient money available to pay off the debt, this helps ensure that the default will not happen, which is the main reason for setting up a sinking fund in the first place. Reducing the principal amount long before it matures is always better, consequently lowering credit risk.

The issuer sets up a custodial account and makes systematic payments to establish a sinking fund. This can happen because payments might not begin until several years have passed. Generally, the amounts to be deposited are fixed, but sometimes variable amounts are also allowed. This is based on a number of factors like earnings levels, the reputation of the issuer, etc.

Sinking funds can be in cash or other bonds (discussed above), or preferred stock. In cash deposits, the trustee will use those funds and repurchase some or all of the bonds on the open market. Suppose instead of cash, we have another debt in the custodial account. In that case, the issuer usually purchases the bonds on the open market if the bonds are trading below par value. Sometimes there can also be a doubling option along with a sinking fund. This allows the issuer to redeem twice the amount prescribed at each step in the sinking fund requirement.

Relevance and Uses of Sinking Fund Formula

There are various ways in which Sinking funds benefit investors. The first and foremost benefit we have discussed above is that by sinking funds, the likelihood of default becomes negligible due to less principal outstanding, thus lowering default risk. Second, if there is an increase in interest rates which will reduce the price of the bonds, investors will have downside protection because the issuer has to at least pay at least the bond’s par value. Third, sinking funds provisions helps create a liquid secondary market for bonds.

Every good thing comes with some flaws in it. So there are also some disadvantages of sinking funds. The upside of the bond price is limited for the investor. So if the bond sells at a higher price, an investor cannot reap that benefit. Also, sometime, investors might have to reinvest their money elsewhere at a lower rate. This is very risky in the case of exercising a doubling option.

At last, we can conclude that sinking funds, because of their simplicity, is very easy to start. However, many people fail or are reluctant to do that. One simple reason is that it needs discipline to regularly keep the specified money aside. People tend to divert from that path which makes sinking funds, from a simple concept a complex thing.

Sinking Fund Formula Calculator

You can use the following Sinking Fund Calculator

| A | |

| r | |

| n | |

| t | |

| Sinking Fund Formula = | |

| Sinking Fund Formula = | A / (((1 + r / n)(t*n)-1) / (r / n)) |

| = | 0 / (((1 + 0 / 0)(0 * 0)-1) / (0 / 0)) = 0 |

Recommended Articles

This has been a guide to Sinking Fund Formula. Here we discuss How to Calculate Sinking Funds along with practical examples. We also provide a Sinking Fund Calculator with a downloadable Excel template. You may also look at the following articles to learn more –