What Does a Short Sale in Real Estate Mean?

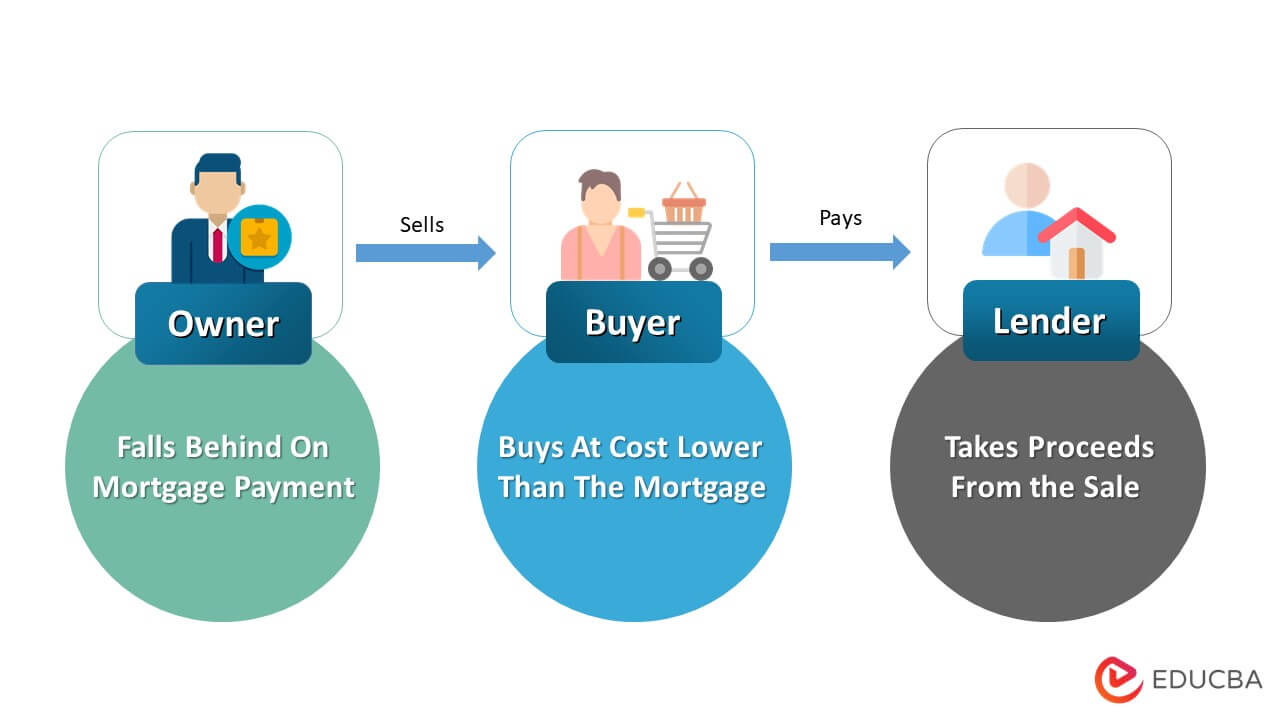

A short sale in real estate is a voluntary process where the homeowner sells the property for a lower amount– less than the actual price– to pay off the mortgage.

For example, Anna purchases a house with a mortgage of $2,500,000. A few months after the purchase, she is laid off from work and cannot pay the mortgage. Therefore, she sells her property at $2,000,000 to another buyer and uses the fund to pay off her mortgage.

A short sale happens when a property owner falls behind on mortgage payments and is in a financial crisis. Thus, the real estate owner sells their property to a third party for less than the actual price. Then, the proceedings from the sale go to the lenders. However, if the proceeds are insufficient, a deficiency judgment warrant is issued against the defaulting debtor.

Key Highlights

- A borrower sells the mortgaged property for less than the loan balance.

- Selecting a professional lender and hiring an experienced short-sale agent can be an excellent strategy.

- The short sale process can finish in a few weeks or last more than a year.

- While a short sale is a voluntary approach to settling a pending mortgage, foreclosure is an involuntary method by the lender to take over the property.

- Opting for a short sale can be more useful in the Real Estate Industry than facing foreclosure. It can help borrowers mitigate financial losses and preserve their credit standing.

How Does a Short Sale in Real Estate Work?

- A real estate short sale arises when the property owner is in financial distress.

- It mostly happens when there is a downturn in the housing market, such as the recession of 2007-2009

- In this case, the owner prepares to trade their property for a lower amount and pay the lender with the funds obtained.

- As the payment is less than the mortgage amount, the lender can waive the remaining amount or opt for a deficiency judgment.

- In case of deficiency judgment, the lender sends the borrower a legal notice to pay the remaining debt, and the borrower has to make other arrangements.

- Finally, if the lender waives the debt after the proceedings, the income will be taxed in the US. However, it will not be for tax purposes in India.

Short Sale in Real Estate Process

Persuade the Lender

- The borrower must make sure that the lender agrees on a short sale

- They should be persuasive and list their valid financial difficulties, such as job loss, disability, etc

Determine a Price

- After the lender agrees on the sale, the owner must decide on a selling price. They must ensure that the final value also includes the expense of selling the home.

- However, there might be a shortfall after the sale. Therefore, the lender can still demand a full/portion of the payment in some areas.

Complete the Paperwork and Look for a Buyer

- Collect all necessary evidence to show that the owner has a financial issue, such as divorce paper, bank statement, medical expenses, termination letter, etc

- Create a proposal including all documents and start searching for a buyer for the property after completing the paperwork. You might find interested buyers looking for houses for sale Springfield Oregon in your search.

Submit Proposal

- Once the documentation and the buyer are ready, present the offer to the bank.

- Ensuring that the request has all the required information, like why making the mortgage payment is difficult

- Adding any proof can help fasten the process.

How Long Does a Short Sale in Real Estate Take?

- Generally, a short sale approval can last from weeks to months. Sometimes it can also take up to a year.

- The process involves many factors which may hinder the approval, and thus the process can delay

- Additionally, as the bank officials have a majority of proposals, it takes excess time to review the new proposals.

- Approaching an agent can help reduce the time taken for approval.

Strategies of Short Sale in Real Estate

- The buyer, seller, and lender can hire a professional agent for the best deal.

- The owner can opt for a loan modification that reduces the loan arrangement.

- Selecting an ethical and reliable lender can be the best way to mitigate the loan, as they can reduce or waive it.

Short Sale vs. Foreclosure

| Short Sale | Foreclosure |

| A short sale is a voluntary proposal to sell a property for less than what the owner owes as a mortgage. | Foreclosure is an involuntary process where the mortgage lender or the financial institution seizes the owner’s property through a legal forum. |

| The borrower can still negotiate with the lender | There is no room for negotiation in this case |

| The process may take several months | The procedure is quick |

| As the borrower cannot pay the entire debt, they may have to pay the rest in the future. | As the entire ownership comes to the lender, the borrower does not owe anything else to the lender. |

Advantages and Disadvantages

| Advantages | Disadvantages |

| Since it is a voluntary process, the buyer and the seller have choices in the deal and can avoid foreclosure. | As the property trade happens for a significantly lower amount, the seller and the buyer may lose. |

| The borrower can approach an agent to reduce the time required for approval. | Sometimes the appointed agent may give wrong information, delaying the process. |

| It has less impact on the credit score. | The lower selling value may hamper the healthy competition among the investors of a similar property. |

Final Thoughts

A short sale in real estate is selling a property at a meager price rather than the market price. The buyer and seller should understand all aspects of the deal before entering into such contracts. Experts with Short Sales and Foreclosure Resource certification have received specific training in short sales, lender negotiations, and buyer protection. Therefore, hiring them can be beneficial.

Frequently Asked Questions(FAQs)

Q1. What are the disadvantages of a short sale?

Answer: One drawback of a short sale is the loss the seller experiences when the property is sold for a considerably lower sum. Additionally, if the buyer/seller chooses an agent and if the agent provides incorrect information, the sale may result in a significant loss.

Q2. What is the difference between a foreclosure and a short sale?

Answer: In a short sale, the owner starts the procedure to exit their financial situation (unable to pay the mortgage). In contrast, a foreclosure is when a lender begins by possessing the property. If required, they evict the homeowner who fell behind on payments.

Q3. Is buying a short sale in real estate a good idea?

Answer: A short sale has mixed results. In the case of a buyer, they may end up with a profit. Short sales may need a lot of time for the seller and even result in a loss. Additionally, the bank may deny the deal and go ahead with the foreclosure for more profit.

Recommended Articles

This article is a guide to short sales in real estate. We discuss its definition, process, strategies, and more. Read the following articles to learn more,