Updated July 6, 2023

What is a Trust Fund?

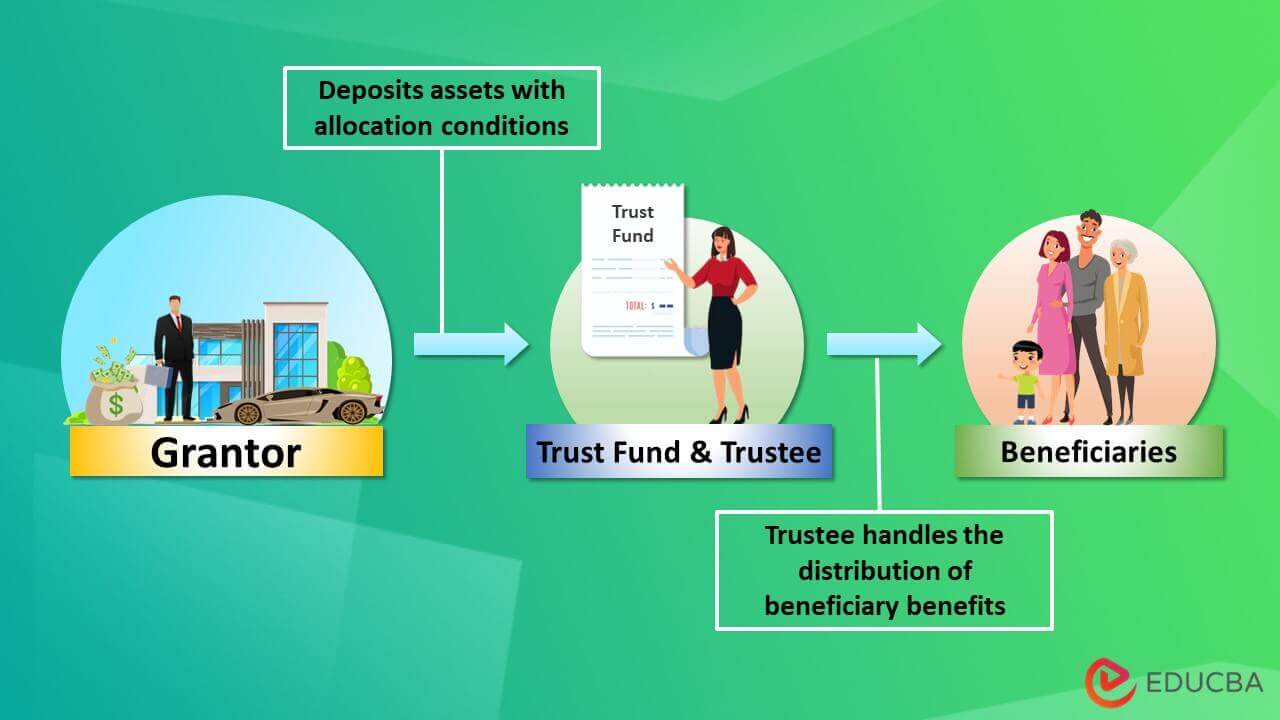

A Trust Fund is where a legal entity (trustee) beholds an individual/organization’s assets for the benefit of a third-party (beneficiary).

For example, suppose Ms. Swift owns a successful textile business. As she wants to focus on another industry, she hands this business to a fund. She wishes that the profits split into three divisions; each for her family, reinvestment in the business, and investments. Therefore, now the trustee of the fund manages all of these finances.

In a trust fund, a trustee is responsible for its management. The trustee oversees the fund’s process and appropriately ensures money usage. These funds provide Financial advantages to the beneficiaries, i.e., family or close friends, if they abide by the trust’s conditions. It also provides tax benefits.

Key Highlights

- It is an arrangement where a person or entity holds assets for another person’s benefit

- There are numerous types of funds, including revocable & irrevocable, blind, funded, and other trusts

- The primary costs to set up a fund can start from a few hundred ranging up to $5000 or more

- It can be helpful for an individual wanting to provide for their family and secure their future.

How Does a Trust Fund Work?

- It establishes guidelines for the distribution of assets to beneficiaries. It involves a grantor, beneficiary, and a trustee

- A grantor specifies the conditions under which the accumulation, retainment, and disbursement of the assets occurs

- The beneficiary receives the assets or other advantages from the fund. Depending on the grantor’s goals, some states may provide more benefits than others

- The trustee maintains the assets and carries out its instructions. Therefore, working with an experienced trustee is crucial

- Finally, after the grantor’s death or when the contract ends, the assets/property goes to the beneficiaries.

Types

Blind:

- A blind trust is where the grantor and beneficiaries have no discretion over the management of the assets

- The trustee makes all the decisions about the investments, purchases, and sales

- They are often helpful when the grantor and the beneficiary have a conflict of interest.

Funded:

- A funded trust is where the grantor adds assets to the fund gradually throughout their lifetime

- These are often helpful in facilitating saving while providing financial support.

Spendthrift:

- A spendthrift trust has a design that protects the assets of the beneficiary from their own spending habits

- The trustee has discretion over the funds, and the beneficiary cannot access the funds directly.

Charitable:

- The purpose of this trust is to donate money or property to a charity

- The beneficiary does not gain anything from the funds, as all the assets go to charity.

Revocable & Irrevocable:

- Here, the grantor can change the rules of the trust and even revoke it if necessary

- Compared to a revocable trust, in an irrevocable trust, the grantor transfers ownership to the trust. The grantor will have no control over the assets

- Upon the grantor’s passing, all funds become an irrevocable trust.

Who Needs It?

- Typically, parents who want to provide for their children’s future, such as education or medical needs, create a trust fund

- It can be for an individual, organization, or charity for any specific purposes

- It can also provide money for the beneficiary’s maintenance or general welfare.

How Much Money is Needed for the Trust Fund?

- The costs to establish a trust fund are flexible. It varies depending on the asset and the trust type

- Generally, it is only a minor percentage (1-2%) of the grantor’s income

- Apart from the agent/attorney fees, which can be $1000-$1500, the money to set up a fund can range from $100 to $5000

- They should also consider that the amount at maturity should be enough to cover foreseeable emergencies, beneficiaries’ education, medical costs, death, etc.

Setup

- To set up a trust fund, first determine the purpose, such as education, medical expenses, death benefits, etc

- The person establishing the trust sets its terms and can specify when distributions will take place and what kind of distribution will take place

- After the significant decisions, the grantor should look for a trustworthy and reliable trust manager

- The official documentation is the next necessary step, where the grantor, along with their trusty manager, prepares all required legal documents like PAN card, tax forms, etc

- Finally, the trust creator deposits the assets to the fund after the process.

Advantages and Disadvantages

|

Advantages |

Disadvantages |

| Trust funds can reduce inheritance taxes, leaving more money to the beneficiaries | The beneficiary cannot mortgage or collateral the assets to get a loan |

| They can shield beneficiaries’ priceless assets, like a family business | There is a loss of control after the transfer of the assets to an irreversible trust rather than a living trust |

| It generates income and gains for the duration of the fund. | It involves a lot of paperwork and records and can be full of hassles. |

Final Thoughts

Trust funds are a great way to help your loved ones in their time of need. It is an asset that benefits one or more people through inheritance or an agreement such as a will or trust. The trustee can manage and distribute the property according to instructions in the trust agreement.

Frequently Asked Questions (FAQs)

Q1. What is a student loan trust fund?

Answer: A student loan trust fund is specifically for paying off student loans. The idea behind these funds is to help students pay for their education without taking on additional debt. It is an excellent option for financially unwell families wanting to provide their children access to higher education.

Q2. What is a government trust fund?

Answer: A government trust fund is an account created by Congress to hold public money for a specific purpose or program. For example, the social security and Medicare funds collect money from employees/employers to use for retirement benefits. In addition, the Federal Highway Fund collects taxes from gasoline sales to pay for road construction and maintenance.

Q3. Is the income from the trust funds taxed?

Answer: No, the trust fund income is not taxed. However, there may be some taxes that apply, depending on the utility of the fund. Those funds are taxable if the beneficiary receives money from the trust and uses it for personal or family expenses.

Q4. Do trust funds earn interest?

Answer: Yes, they do earn interest. The trust funds made an effective interest rate of 2.5% in 2021, while the average debt they bought that year’s 12 monthly rates was 1.4%. The interest rate for new special issue debt purchased by the Social Security funds increased from 1.625% in January to 4.250% in November 2022.

Q5. Do trust funds pay monthly?

Answer: The payment period may depend on the grantor. They receive funds from a trust fund in accordance with the grantor’s trust regulations. For instance, the beneficiary might get all the money at once, or payments might come monthly or quarterly.

Q6. What happens to the assets placed in a trust fund?

Answer: When an individual (grantor) establishes a trust fund, they have to name a beneficiary. The beneficiary inherits the capital in the event of the grantor’s death. Meanwhile, while the grantor is alive, the funds are distributed as per their wish. For example, the beneficiary can receive a percent of funds every year or once in a lump sum when the grantor passes away.

Q7. How much money do trust funds usually have?

Answer: Trust funds usually hold around $4,000,000. The amount that the trust funds distribute on a regular basis is approximately around $250,000. However, the amount varies depending on the grantor and the trust fund company.

Q8. What is a trust fund’s maturity duration?

Answer: On average, trust funds can last as long as the grantor is alive and a few years after that. Additionally, under the circumstances, like revoking the trust, or early distribution of all funds, the fund can mature sooner. However, the beneficiaries can only run the fund for a maximum of 21 years after the grantor’s death.

Recommended Articles

This was a guide to trust funds. We discussed its definition, types, and more. To learn more, please read the following articles,