Updated July 31, 2023

Required Rate of Return Formula (Table of Contents)

- Required Rate of Return Formula

- Examples of Required Rate of Return Formula (With Excel Template)

- Required Rate of Return Formula Calculator

Required Rate of Return Formula

The Required return is a minimum return or profit what an investor expects from doing business or buying stocks with respect to the risks associated with it for running a business or holding the stocks.

It can otherwise be called Hurdle Rate. This is the minimum return an investor required for compensating the level of risk associated. Riskier projects have high return meanwhile less risky have low returns. Both Returns and risk are directly proportional to each other. So based on the tolerance over the risk by the investor, the required rate of return May change. This factor is mostly considered in stock markets. The required rate of return formula acts as a decision maker as it calculates how much minimum Return an investor can expect by investing for a company.

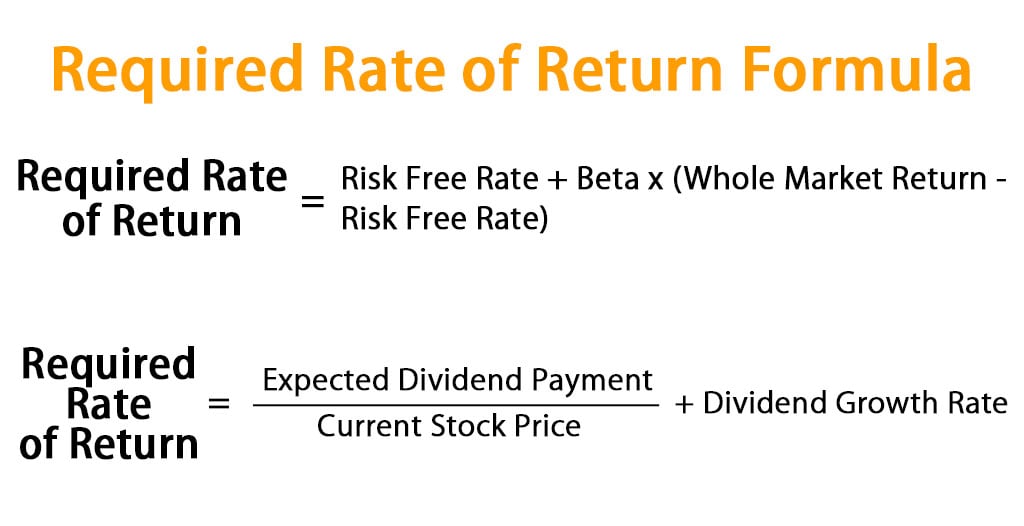

The Required Rate of Return Formula can be calculated using “Capital Asset Pricing Model (CAPM)” which is widely used where there are no dividends. However this method considers some factors while assessing, it considers some factors such as, assume that you took the stock with no risk, the whole market return, and overall cost of funding a project (Beta). The Mathematical formula for the required rate of Return is,

Alternatively, the required rate of Return can also be calculated using the Dividend Discount Approach (known as ‘Gordon Growth Model’) where Dividend takes place. This Formula considers certain factors such as current stock price, Dividend growth at a constant rate, dividend payment. It is mathematically represented as,

Examples of Required Rate of Return Formula (With Excel Template)

Let’s take an example to understand the calculation of the Required Rate of Return formula in a better manner.

Example #1

CAPM

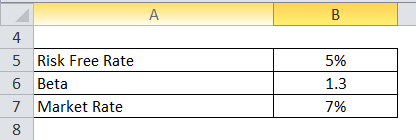

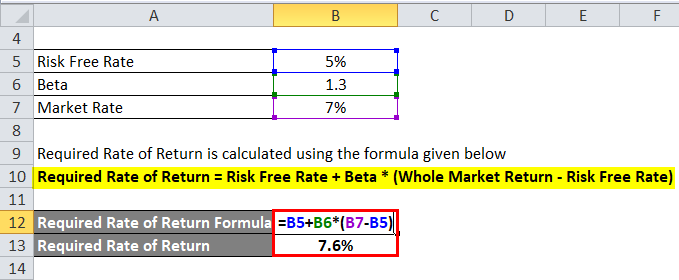

Here is an example to calculate the required rate of return for an investor to invest in a company called XY Limited which is a food processing company. Let us assume the beta value is 1.30. The risk free rate is 5%. The whole market return is 7%.

Required Rate of Return is calculated using the formula given below

Required Rate of Return = Risk Free Rate + Beta * (Whole Market Return – Risk Free Rate)

- Required Rate of Return = 5% + 1.3 * (7% – 5%)

- Required Rate of Return = 7.6%

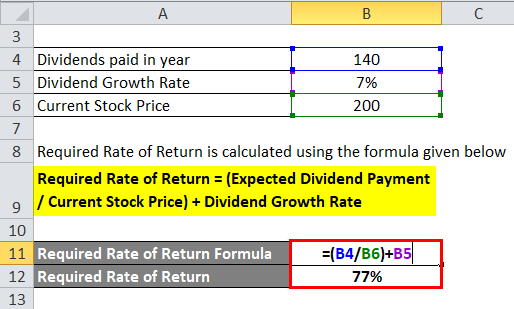

Dividend Discount Model

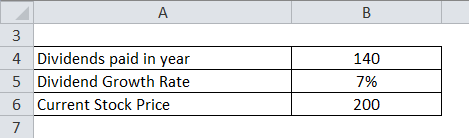

For this model consider XY Limited is paying dividends of Rs.140 per stock. The dividend growth rate is 7%. The current stock price is RS.200.

Required Rate of Return is calculated using the formula given below

Required Rate of Return = (Expected Dividend Payment / Current Stock Price) + Dividend Growth Rate

- Required Rate of Return = (140 / 200) + 7%

- Required Rate of Return = 77%

Example #2

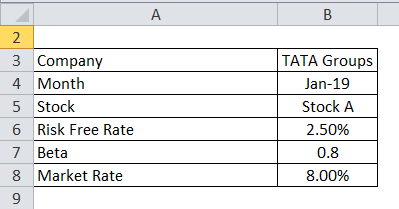

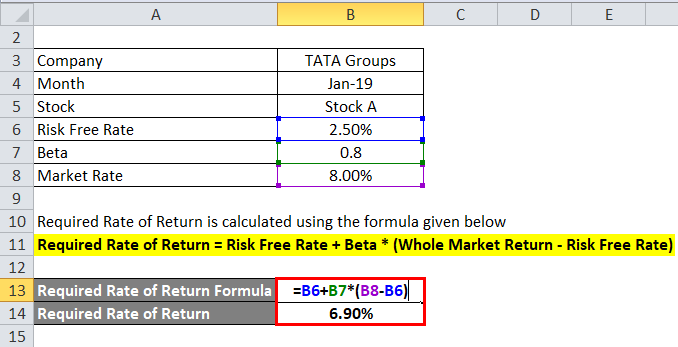

CAPM

Let us take the real-life example of Tata Group of company with the following information available.

Required Rate of Return is calculated using the formula given below

Required Rate of Return = Risk Free Rate + Beta * (Whole Market Return – Risk Free Rate)

- Required Rate of Return = 2.50% + 0.8 * (8% – 2.50%)

- Required Rate of Return = 6.90%

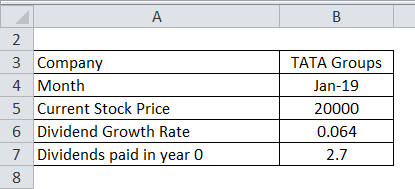

Dividend Discount Model

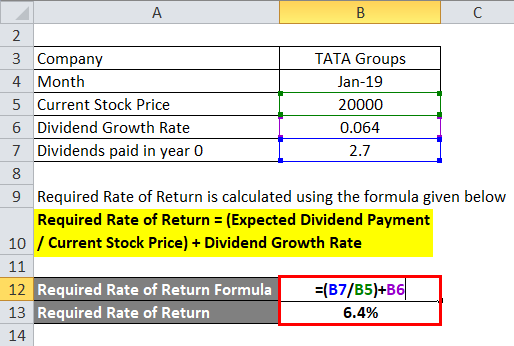

Let us take the real-life example of Tata Group of company with the following information available.

Required Rate of Return is calculated using the formula given below

Required Rate of Return = (Expected Dividend Payment / Current Stock Price) + Dividend Growth Rate

- Required Rate of Return = (2.7 / 20000) + 0.064

- Required Rate of Return = 6.4 %

Explanation

- CAPM: Here is the step by step approach for calculating Required Return.

Step 1: Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk. Practically any investments you take, it at least carries a low risk so it is not possible with zero risk rate. In India, the government 10 years bond interest rate is around 6% (least Risk rate) can be taken for this benchmark.

Step 2: β is the Beta coefficient value of Stocks which is the measure of the volatility in comparison to the market or benchmark. It is the tendency of a return to respond to swing in the market. That is how much risk investment will add to the portfolio in the market. This can be computed by dividing the covariance of the Asset and Market return’s product by the product of the variance of the Market.

Good Beta value is 1 as per the standard index. Beta with lesser than 1 has a low risk as well as low returns. A beta value greater than 1 has a high risk and high yield.

Step 3: Whole Market Return is the return expected from the market. You can get the market return by searching in the net or you can refer the standard index such as NIFTY 50 index.

Step 4: Finally, the Required rate of return is got by applying the values which were forecasted as shown below.

- Dividend Discount Model: On the other hand, the following steps help in calculating the required rate of return by using the alternate method. This model is only applicable when a company has a stable dividend per stock rate.

Step 1: Firstly, the Expected dividend payment is the payment expected to be paid next year.

Step 2: Current stock price. If you are using the newly issued common stock, you will have to minus the floating costs from it.

Step 3: The Growth rate of the dividend is the stable dividend rate a company has over a period of time.

Step 4: Finally, the required rate of return is calculated by applying these values in the below formula.

Required Rate of Return = (Expected Dividend Payment / Current Stock Price) + Dividend Growth Rate

Relevance and Uses

The required rate of return formula is a key term in equity and corporate finance. Investment decisions are not only limited to Share markets. Whenever the money is invested in a business or for business expansion, an analyst looks at the minimum return expected for taking the risks. These decisions are the core reasons for multiple investments. So it calculates the present dividend income value while evaluating stocks. As well as, it calculates the present free cash flow into equity. For capital projects, it helps to determine whether to pursue one project versus another or not. It is the minimum return amount, an investor considers acceptable with respect to its capital cost, inflation, and yield on other projects.

Required Rate of Return Formula Calculator

You can use the following Required Rate of Return Calculator.

| Risk Free Rate | |

| Beta | |

| Whole Market Return | |

| Required Rate of Return Formula = | |

| Required Rate of Return Formula = | Risk Free Rate + Beta x (Whole Market Return - Risk Free Rate) |

| = | 0 + 0 x (0 - 0) = 0 |

Recommended Articles

This has been a guide to Required Rate of Return formula. Here we discuss How to Calculate Required Rate of Return along with practical examples. We also provide the Required Rate of Return Calculator with downloadable excel template. You may also look at the following articles to learn more –