Updated July 28, 2023

Purchasing Power Parity Formula (Table of Contents)

- Purchasing Power Parity Formula

- Examples of Purchasing Power Parity Formula (With Excel Template)

- Purchasing Power Parity Formula Calculator

Purchasing Power Parity Formula

Purchasing power parity is an economic indicator used to calculate the exchange rate between different countries to exchange goods and services of the same amount.

The formula of Purchasing Power Parity is as follows:

Where,

- S = Exchange Rate

- P1 = Cost of goods in Currency 1

- P2 = Cost of goods in Currency 2

Examples of Purchasing Power Parity Formula (With Excel Template)

Let’s take an example to understand the calculation of Purchasing Power Parity in a better manner.

Suppose the US dollar is equal to 60 Indian rupees.

( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here; in the US, he had bought similar cups for $3. So here, $3 = 180. For Rs 180, he could buy 15 cupcakes in India. Therefore, the PPP ratio for the exchange of cupcakes is $3 = 120, which is $1 = 40.

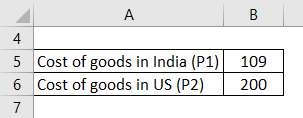

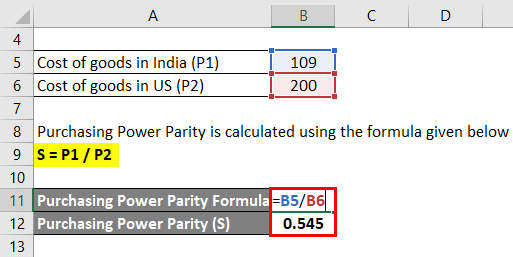

Example #1

Burger King offers the king paneer burger in India for Rs 109; in the US, it offers the same burger for $4. So, from the above information, we must calculate the exchange rate or the purchasing power parity.

Solution:

- P1 = 109

- P2= $4 (1$=50) = 4*50 = 200

S = P1 / P2

- Purchasing Power Parity = 109/200

- Purchasing Power Parity = 0.545

So purchasing power parity between India and US is 0.545 for the paneer king burger.

From the above example, we can understand the exchange rate between the dollar and the Indian rupee. We can say that the dollar is overvalued compared to the Indian currency and vice versa.

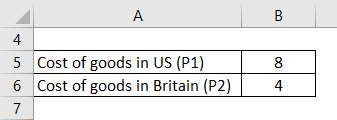

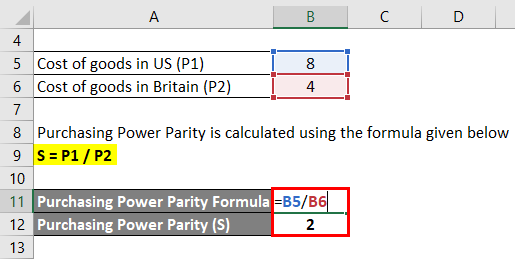

Example #2

Company ABC has its business of fast food in the US and Britain. They sell pizza and other food items. In the US, they sell one pizza for $8; in Britain, they sell the same pizza for 4 pounds. So from the above information, we need to calculate the purchasing power parity with the help of the exchange rate.

Solution:

- P1 = $8

- P2 = 4 £

S = P1 / P2

- Purchasing Power Parity = 8 / 4

- Purchasing Power Parity = 2.

So here, the exchange rate between the US and Britain is 2. From the above example, we can say that US Currency is more overvalued than Britain.

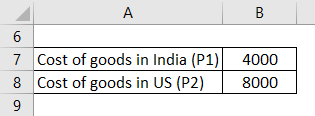

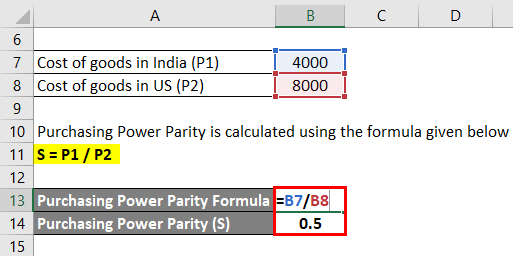

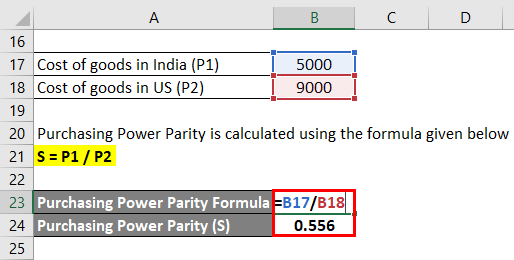

Example #3

Company A produces rice and wheat and exports them all over the world. In India, the selling rate for wheat is 1 quintal = 4000 Rs, and for rice, it is 1 quintal = 5000 Rs. And in the US, the wheat and rice selling rates are 8000 and 9000 per quintal, respectively. So calculate purchasing power parity.

Solution:

First, we will calculate for wheat:

S = P1 / P2

- Purchasing Power Parity = 4000 / 8000

- Purchasing Power Parity = 0.5

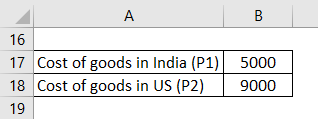

Secondly, we will calculate for rice:

S = P1 / P2

- Purchasing Power Parity = 5000 / 9000

- Purchasing Power Parity = 0.556.

Explanation

We typically calculate the exchange rate between different countries in purchasing this formula. Purchasing power parity is used for adjusting the exchange rates of two different currencies to make them at par with the purchasing power of each other. In other words, expenditure on commodities should be the same in both currencies when accounted for the exchange rate.

Purchasing power parity is used to compare the income level in different countries. Thus PPP makes it easy to understand and interpret data of each country.

Purchasing power parity is used to calculate exchange so we can buy the same goods and services in every country.

S = P1 / P2.

So, in the formula, P1 is the price of goods in one currency, and P2 is the price of goods in another. S is the exchange rate used to buy goods and services in other countries with the same amount of money.

Relevance and Use of Purchasing Power Parity

Purchasing power parity has more relevance and importance from the point of view of the world economy for the exchange of goods and services from different countries. PPP helps to exchange goods and services of the same amount with the same amount of expenses.

Different countries have different living standards and living costs, so in such cases, PPP helps us understand the economy and exchange goods and services. It also helps to compare the output within the different countries. Hence, PPP is the economic indicator to calculate the exchange rate.

Recommended Articles

This is a guide to Purchasing Power Parity Formula. Here we have discussed how to calculate Purchasing Power Parity and practical examples. We have also provided a Purchasing Power Parity calculator with a downloadable Excel template. You may also look at the following articles to learn more –