Updated August 2, 2023

What is Perpetuity Formula

Perpetuity can be termed as a type of annuity that gets an innumerable amount of periodic payments. On the other hand, an annuity typically means a consistent payment against a financial instrument. The primary objective of a perpetuity formula is to follow the present and future cash flow.

Here’s the Perpetuity Formula –

Where,

- PV= present value

- D = dividend or coupon for a period

- r = discount rate

The most common examples of the perpetuity formula are when preferred stocks are issued in the UK and in most circumstances they received the dividends prior 2 the equity shareholders’ dividend and the rate of dividend is fixed. The perpetuity formula can calculate the value of preferred stocks for an infinite time frame.

Lowering the rate of discount changes the perpetuity depending on the same payment but a change in the dividend rate. In this case, the denominator also becomes lower and tends to increase the value.

Example of Perpetuity Formula

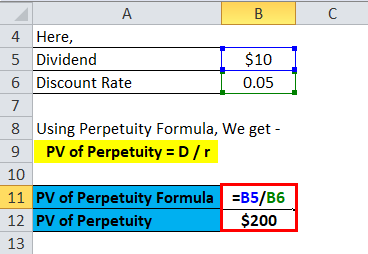

A person has purchased a bond with a coupon payment of $10 per year and it continues for an infinite time frame. Assuming a coupon discount rate of 5%.

Using Perpetuity Formula, We get –

- PV of Perpetuity = D / r

- PV of Perpetuity = $10 / 0.05

- PV of Perpetuity = $200

Therefore, he expected to pay $200 for this perpetuity.

Please note that the above formula fixes the time frame.

How is the Present Growing Formula Derived?

The perpetuity series perpetually grows in terms of periodic payment and is considered indefinite, growing proportionately.

Therefore the formula is as follows:

The perpetuity series is considered to be continued for an infinite period. One can again write and present the formula as the following example:

John has invested in a bond that pays him coupon payments for an infinite period of time. This bond pays John $200 every year. If we assume that the discount rate is 6%, how much John should pay for this bond?

- Dividend = 200

- Discount Rate = 0.06

Using Perpetuity Formula, We get –

- PV of Perpetuity = D / r

- PV of Perpetuity = 200 / 0.06

- PV of Perpetuity = $3333.33

John paid a coupon rate of $333.33 during the purchase of the bond.

Features of Perpetuity Formula

- Perpetuity is called the annuity, which is infinite and does not have an end.

- It is related to the cash payment, which continues forever.

- A particular date should be mentioned from which the perpetuity starts and tends to continue for an infinite future.

Where,

PV represents the present value of a perpetuity

A represents the amount of periodic payment

Besides, the present value of perpetuity can also be determined by the following steps:

Step 1 To find the annual payment, rate of interest, and growth rate of perpetuity

Step 2 Put the actual number into the formula

* Present value of f\growth perpetuity = P / (i-g)

Where P represents annual payment, ‘i’ the discount rate

and ‘g’ is the growth rate.

Explanation of Perpetuity Formula

The perpetuity formula detects the free cash flow in the terminal year of operation, assuming that a company or a going concern will likely continue its operations forever. The formula assumes that the dividend will be paid for an innumerable time frame, resulting in a total amount required.

To understand the perpetuity formula, let’s consider the example of a real estate deal. In this scenario, when one person purchases a property and rents it out, the owner earns income from rent, which is considered infinite in nature. In other words, the expectation is that the income from rent will continue for an infinite time frame, assuming that the property will last indefinitely.

Significance and Use of Perpetuity Formula

One of the contradictions of the perpetuity formula is its value which is infinite in nature.

There might be an argument regarding the finite valuation of a particular cash flow for an infinite time frame.

The future cash flow keeps on falling because of the inflation rate. The present values are high in the early years, and the value of the perpetuity continues to fall with time. Does the real value of payments tend to decrease over time? Thus, the very distant future will have a valuation that will be equivalent to zero, but it won’t be the same value as zero. Therefore we make calculate the value of infinite series with the formula of perpetuity.

In corporate finance, the value of a different stream of cash flows differs over the course of time. Perpetuity is nothing but a stream of cash flows that never ends. So if we purchase perpetuity, it means that its repayment would last till the end of time.

In the case of common stock, we observe that the stockholders receive an infinite dividend, which implies that the equity holder is receiving an infinite stream of future dividends in exchange for the purchase of equity shares.

Similarly, in the case of students who receive a scholarship, the scholarship-giving organization awards the scholarship for a fixed number of years, but they believe that the philanthropic activities’ impact will last for an infinite future.

Perpetuity Calculator

You can use the following Perpetuity Calculator

| D | |

| R | |

| PV of Perpetuity Formula = | |

| PV of Perpetuity Formula = |

|

|

Perpetuity Formula in Excel (With Excel Template)

Here we will do the same example of the Perpetuity formula in Excel. It is very easy and simple. You need to provide the two inputs i.e Dividend and Discount Rate

You can easily calculate the Perpetuity using Formula in the template provided.

Conclusion

The general assumptions which are taken into account in the case of Perpetuity are that the time frame is infinite. In practice, the perpetuity’s current value, which accrues in nature and is expected to deliver a low-value return due to the inflation taken into account, has a finite value.

However, there might be a situation where the value of the perpetuity can change over a period of time, including the same number of payments. This generally happens due to a change in discount or coupon rate. The value of perpetuity increases with a decrease of coupon rate and vice-versa.

Recommended Articles

This has been a guide to a Perpetuity formula. Here we discuss its uses along with practical examples. We also provide you with Perpetuity Calculator with a downloadable Excel template. You may also look at the following articles to learn more –