Updated July 31, 2023

Operating Margin Formula (Table of Contents)

- Operating Margin Formula

- Examples of Operating Margin Formula (With Excel Template)

- Operating Margin Formula Calculator

Operating Margin Formula

The financial industry commonly utilizes operating margin as a popular measure to gauge the profitability of a company or firm. It quantifies the profit generated per dollar of revenue or sales after accounting for and covering variable production costs such as raw materials and wages.

It does so before accounting for and paying taxes or interest. This can also be termed EBIT. The formula for calculating Operating Margin is:

Examples of Operating Margin Formula (With Excel Template)

Let’s take an example to understand the calculation of the Operating Margin formula in a better manner.

Example #1

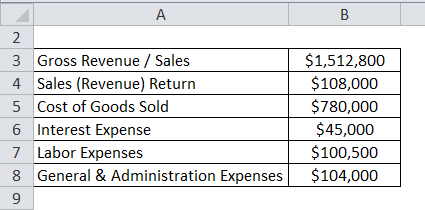

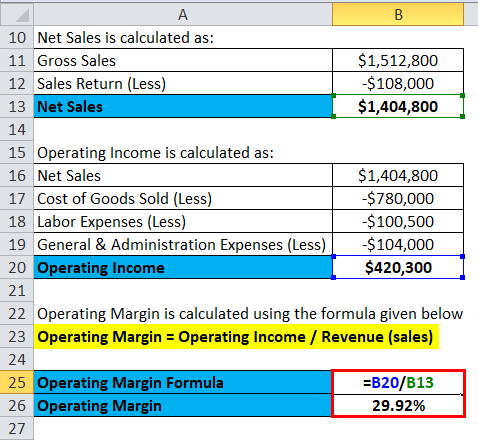

Let’s take the example of ABC company, and below are the extracts from its income statement.

Solution:

Now to calculate the operating profit margin, we first need to calculate two figures, i.e., operating income and the revenue or net revenue.

Revenue Calculation:

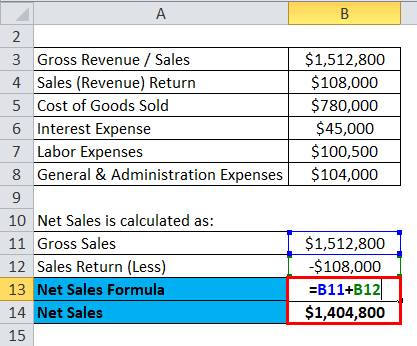

Operating Income Calculation:

The formula to calculate Operating Margin is as below:

Operating Margin = Operating Income / Revenue (sales)

- Operating Margin = $420300 / $1404800

- Operating Margin = 29.92%

Example #2

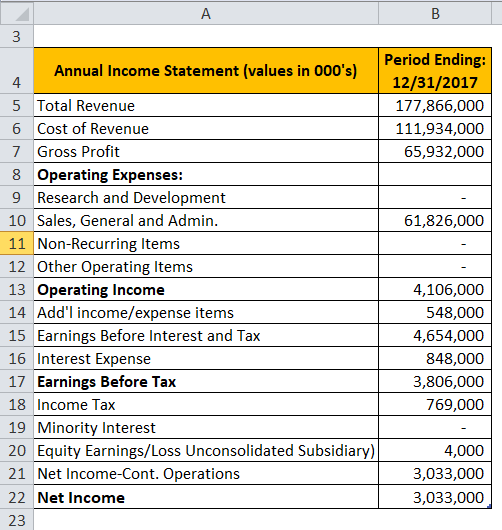

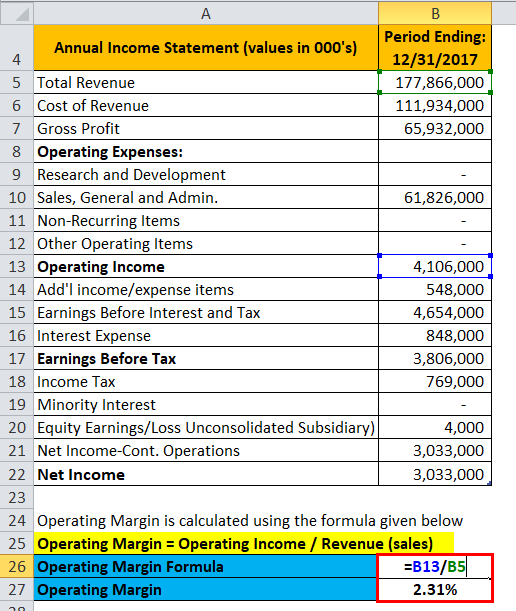

Below is the extract of the income statement from the annual report of Amazon Inc., and we will calculate its operating margin by using the formula mentioned above.

So now we have both figures, the operating income calculated after accounting for operating expenses, and the total revenue figure is already provided.

Operating Margin = Operating Income / Revenue (sales)

- Operating Margin = 41,06,000 / 17,78,66,000

- Operating Margin = 2.31%

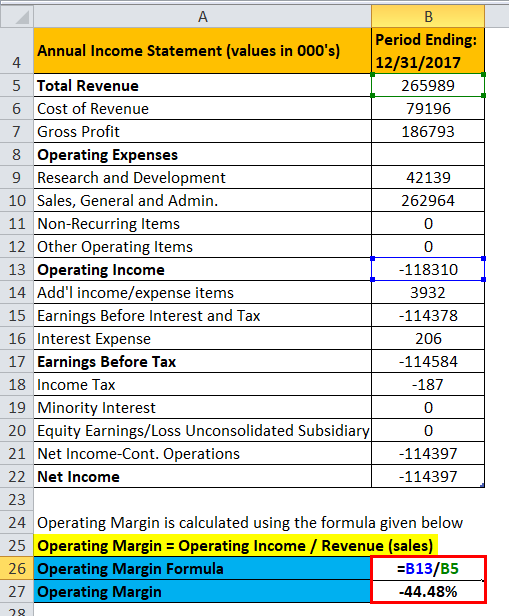

Example #3

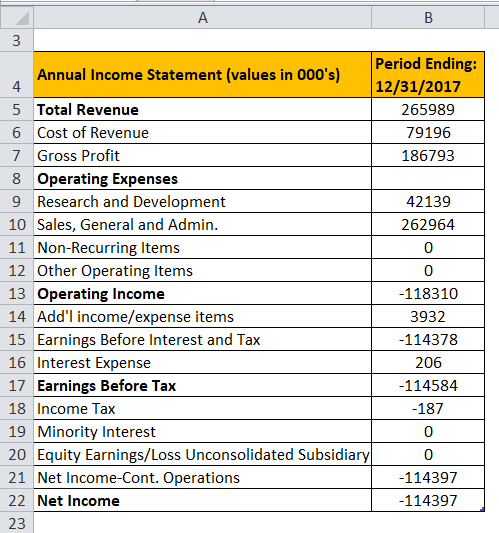

Below is the extract of the income statement from the annual report of EXAS Company Financials, and we will calculate its operating margin by using the formula mentioned above.

So now, here again, we have both figures, the operating income calculated after accounting for operating expenses, and the total revenue figure is already provided.

Operating Margin = Operating Income / Revenue (sales)

- Operating Margin = -118,310 / 265,989

- Operating Margin = -44.48%

The interesting thing here is that the company is making losses in running its business as the EBIT margin, i.e. (Earning Before Interest and Tax) is negative.

Explanation of the Operating Margin Formula

Operating income is the profit of the company or the business after all operating expenses are accounted for or deducted from the revenue or the sales receipts. It will represent how much a company or firm makes from its core operations. It will not include other income sources that are not directly related to its core or the main business activities. It is not the same as the net income in that it will not include the expenses of interest and taxes.

This gives a good idea to the creditors and the investors if the firm’s or the company’s main or core business is profitable before considering any other non-operating expenses.

Sales revenue or net sales is the figure which is the monetary amount, and the same has been obtained from selling services and goods to the business customers, excluding the sales return or the merchandise returned and the allowances or the discounts offered to them. This can be realized either as credit sales or cash sales.

So when one divides the operating income by the Revenue figure, they will arrive at a figure depicting how many portions of revenue is the operating profit.

Relevance and Uses

A business that can generate the operating profit or operating income rather than operating at a loss gives a positive signal to the existing creditors and potential investors. This would mean that the company’s or the firm’s operating margin will create value for its shareholders and serve continuous loans to the lenders. The higher the company’s operating margin, the lesser its financial risk compared with a lower ratio.

Since the operating profit or the operating margin helps determine how much profit the company or the firm has made from its main or core operations, which ensures profitability and efficiency. And that’s the main reason the operating margin is one of the most significant profitability ratios.

While finding out the profit margin, the investors should look at the gross profit margin and the net profit margin. Still, along with that, they should seek the operating margin as well as, in turn, it will surely bridge the gap to understand how the firm or the company is performing operationally.

Operating Margin Formula Calculator

You can use the following Operating Margin Calculator.

| Operating Income | |

| Revenue (Sales) | |

| Operating Margin Formula | |

| Operating Margin Formula | = |

|

|

Recommended Articles

This has been a guide to the Operating Margin formula. Here we discuss How to Calculate the Operating Margin along with practical examples. We also provide Operating Margin Calculator with a downloadable Excel template. You may also look at the following articles to learn more –