Updated July 31, 2023

Operating Cycle Formula (Table of Contents)

- Operating Cycle Formula

- Examples of Operating Cycle Formula (With Excel Template)

- Operating Cycle Formula Calculator

Operating Cycle Formula

The operating cycle of a particular company is the number of days it takes to convert its stocks (raw materials and trade goods) into cash. It starts with purchasing Raw materials, manufacturing into processed products and packaging, distribution and Sales, and finally, a cash collection against Trade receivables.

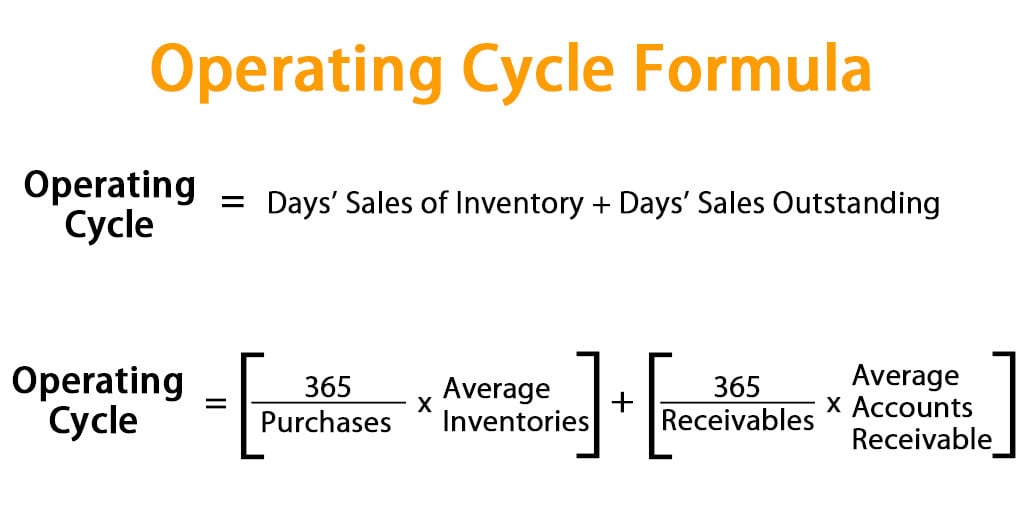

The formula of the Operating cycle is as follows:

Days sales of inventory are equal to the average number of days the company takes to sell its stock. Days sales outstanding, on the other hand, is the period in which receivables turned into cash.

An alternate expanded formula for the operating cycle is as follows:

Examples of Operating Cycle Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

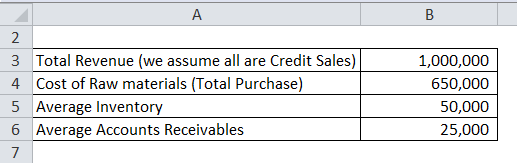

From the given data, calculate the operating cycle of ABC Limited.

Solution:

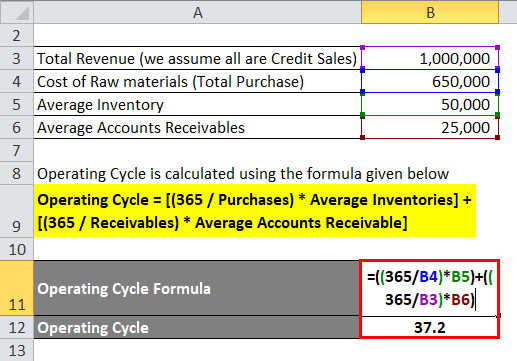

The formula to calculate Operating Cycle is as below:

Operating Cycle = [(365 / Purchases) * Average Inventories] + [(365 / Receivables) * Average Accounts Receivable]

- Operating Cycle = [(365 / 650,000) * 50,000] + [(365 / 1,000,000) * 25,000]

- Operating Cycle = 28.07 + 9.13

- Operating Cycle = 37.2 Days

Thus, the company takes 37.2 days to convert its inventory to cash after Purchasing Raw materials, Manufacturing and processing them into finished products, selling them in credit, and collecting cash from the Debtors.

Example #2

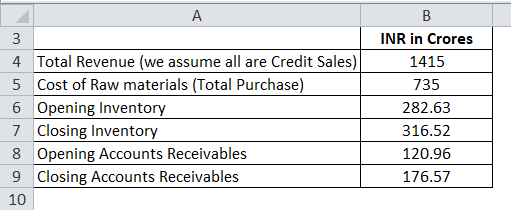

From the following data of VIP Industries, Find out the Operating cycle of the company to understand the Operating efficiency of the Company.

Solution:

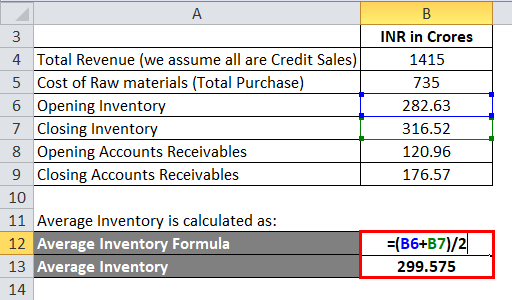

The calculation of Average Inventory is as below:

- Average Inventory = (282.63 + 316.52) / 2

- Average Inventory = 299.575

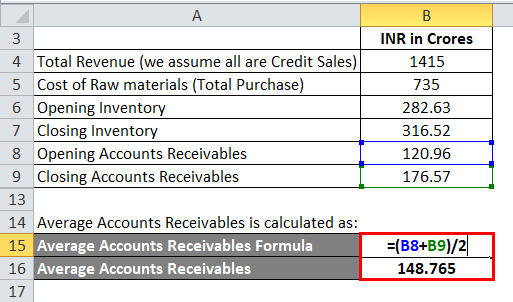

The calculation of Average Accounts Receivables is as below:

- Average Accounts Receivables = (120.96 + 176.57) / 2

- Average Accounts Receivables = 148.765

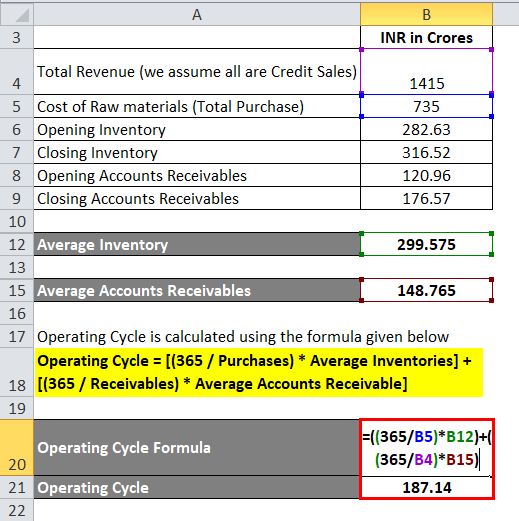

Operating Cycle = [(365 / Purchases) * Average Inventories] + [(365 / Receivables) * Average Accounts Receivable]

- Operating Cycle = [(365 / 735) * 299.575] + [(365 / 1415) * 148.765]

- Operating Cycle = 148.76 + 38.37

- Operating Cycle = 187.14 Days

Thus, the company takes 187.14 Days to convert inventory to Cash.

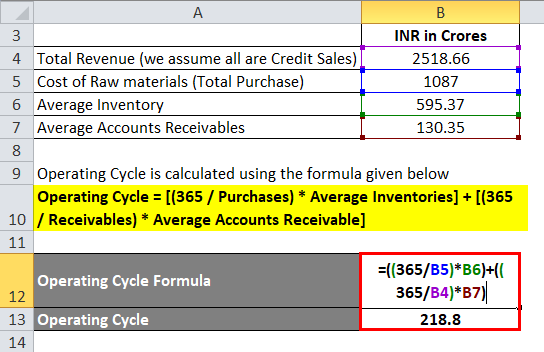

Example #3

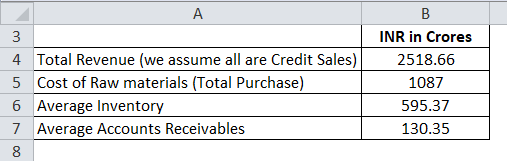

From the following data of Page Industries, Find out the Operating cycle of the company to understand the Operating efficiency of Company.

Solution:

Operating Cycle = [(365 / Purchases) * Average Inventories] + [(365 / Receivables) * Average Accounts Receivable]

- Operating Cycle = [(365 / 1087) * 595.37] + [(365 / 2518.66) * 130.35]

- Operating Cycle = 199.92 + 18.89

- Operating Cycle = 218.8

Thus, the company takes 218.8 Days to convert inventory to Cash.

Explanation of Operating Cycle Formula

The operating Cycle can be summed as the total number of days within which raw materials are purchased, processed, and manufactured into an end product or inventory and sold via a distributor. The amount realization days are being taken into account together.

Operating cycle process:

Cash -> Raw materials purchased -> Manufacturing process -> Work-in-progress -> Packaging -> Distribution-> Sales -> Bills Receivables -> Cash received.

In other words, the operating cycle is the operations that prevailed between cash to cash primarily in a manufacturing business where there is a purchase of Raw Materials, manufacturing with the help of labor, machinery, and land (assets), and converting it into the desired product. Then the product is sold via distributors on credit, and after a specific number of days, the amount is collected from the debtors.

Relevance and Uses

- Calculating the Operating cycle helps the management to understand the situation of Cash inflow and cash outflow in relation to inventory in and inventory out. The relation between Debtors, creditors, and cash with purchase and Distribution can be evolved from the above formula. The number of days the company takes to turn Raw materials into cash is the primary data from the Operating Cycle formula.

- Debtor outstanding days are often regarded as a major tool for analyzing the product demand and the importance of the particular product compared with its peers. In a credit sale, the cash is not received immediately. It is received per the contract with the distributors or retail shops. They generally make quick payments when there is a good demand for the product from the consumer’s end and vice versa.

- Inventory days are also an indication of stock movement which happens inside the company. A lower debtors’ days are what every business wants. It means the products can satisfy customers’ needs, and the distributors are churning them more frequently than the industry, indicating higher demand for the particular product in its category.

Operating Cycle Formula Calculator

You can use the following Operating Cycle Calculator.

| Days' Sales of Inventory | |

| Days' Sales Outstanding | |

| Operating Cycle Formula = | |

| Operating Cycle Formula = | Days' Sales of Inventory + Days' Sales Outstanding | |

| 0 + 0 = | 0 |

Recommended Articles

This has been a guide to the Operating Cycle formula. Here we discuss How to Calculate the Operating Cycle along with practical examples. We also provide Operating Cycle Calculator with a downloadable excel template. You may also look at the following articles to learn more –