Updated October 18, 2023

Mergers and Acquisitions in India – Mergers and acquisitions, as we know, imply an alliance of two or more companies future. Where a merger leads to the formation of a new company, acquisition leads to the purchase of a company by another, and no new company is formed.

In the recent past, India has seen great potential in the case of mergers and Acquisitions (M&A) deals. It is being played vigorously in many industrial sectors of the economy. Many Indian companies have been growing inorganic to gain access to new markets, and many foreign companies are targeting Indian companies for their growth and expansion. It has spread far and wide through various verticals on all business platforms.

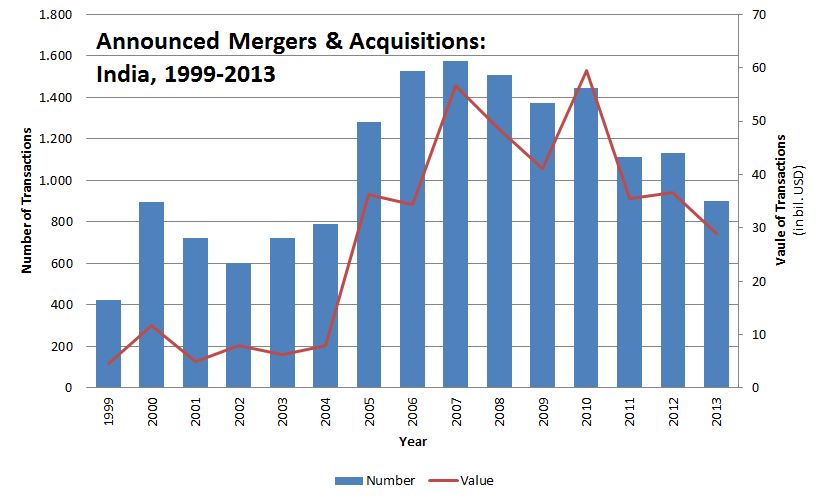

The volume of M&A deals has been trending upward, particularly in pharmaceuticals, FMCG, finance, telecom, automotive, and metals. Various factors that led to this robust growth of mergers and acquisitions in India were liberalization, favorable government policies, economic reforms, the need for investment, and the dynamic attitude of Indian corporations. Different degrees of openness to foreign investors in almost all sectors have attracted this market and enabled industries to grow.

History of Mergers and Acquisitions in India

The post-World War period was regarded as an era of M&As. M&As occurred in industries like jute, cotton textiles, sugar, banking & insurance, electricity, and tea plantations.

However, after independence, very few corporations came together during the initial years, and when they did, it was a friendly negotiated deal. The lower number of companies involved in mergers and acquisitions was due to the provisions of the MRTP Act 1969. Firms had to follow a pressurized procedure to obtain approval, which was a deterrent.

Although this doesn’t mean that mergers and acquisitions in India were uncommon during this controlled system, in some instances, the government has encouraged unions to revive ailing units. Additionally, the creation of the Life Insurance Corporation (LIC) and nationalization of the life insurance business resulted in the takeover of 243 insurance companies in 1956.

The concept of mergers and acquisitions in India was not very popular until 1988. This year saw an unfriendly takeover by Swaraj Paul to overtake DCM Ltd., which later turned out to be ineffective.

After the economic reforms that took place in 1991, there were considerable challenges in front of Indian industries both nationally as well as internationally. The intense competition compelled Indian companies to opt for M&A, which later became a vital option for them to expand horizontally and vertically. Indian corporate enterprises started refocusing on core competence, market share, global competitiveness, and consolidation.

The early nineties saw M&A transactions led by Indian IT and pharmaceutical firms primarily to place themselves near their significant clients in other developed economies and break into new markets for expansion.

Against this backdrop, Indian corporate enterprises undertook restructuring exercises primarily through M&A to create a formidable presence and expand their core areas of interest. Since then, India has been considered one of the top countries entering mergers and acquisitions, and there has been no looking back. However, the complications involved in the acquisition process have also increased, caused by evolving legal frameworks, funding concerns, and competition norms constraining the deal’s success.

Drivers of Mergers and Acquisitions in India

- Right to entry: Acquisitions abroad permit Indian companies to gain access to developed markets across the globe.

- Technology transfer: This is one of the main advantages and drivers that urge companies to get into M&A deals. Corporations often require technologies to manufacture a particular product or service unavailable in India. In such situations, acquiring/collaborating with companies abroad gives them access to the technologies.

- New Product Mix: It is often not profitable for companies to manufacture products themselves due to cost constraints or requirements of huge investments. In such a scenario, an alliance with another company can give them the right to sell and diversify their product range.

- Hedging Country Risks: Companies also attempt to reduce their reliance on the Indian markets and escape the local business cycles through mergers and acquisitions.

Recent Trends of Mergers and Acquisitions in India

Various factors facilitate mergers and acquisitions in India. Government policies, resilience in the economy, liquidity in the corporate sector, and vigorous attitudes of Indian businessmen are the critical factors behind the fluctuating trends of mergers and acquisitions in India.

Considering the trends in previous years, the Year 2012 saw a slowdown in mergers and acquisitions in India. It hit a three-year low by almost 61% from its preceding year. This was majorly caused by the challenging macroeconomic climate created due to the eurozone crisis and other domestic reasons such as inflation, fiscal deficit, and currency depreciation. However, that year also saw a critical trend that emerged: the increase in domestic deals compared to cross-border M&As. The domestic agreement value stood at USD 9.7 billion, up by almost 50.9% compared to 2011.

The country is strong enough in its rudiments, which will drive its business and economic growth.

Challenges to Mergers and Acquisitions in India

With the increase in the number of M&A deals in India, the legal environment is increasingly becoming more and more refined. M&A forms a significant part of the economic transactions in the Indian economy. There are a few challenges with mergers and acquisitions in India, which have been discussed below;

1. Regulatory Ambiguity: M&A laws and regulations are still developing and trying to catch up with the global M&A scenario. However, because of these reasons, interpreting these laws sometimes goes for a toss since there is ambiguity in understanding them.

Several regulators interpreting the same concept differently increase confusion in the minds of foreign investors. If the Indian system wants to attract investments from foreign economies, it must resolve the issue adversely affecting deal certainty.

2. Legal Developments: There have been consistently new legal developments, such as the Competition Act 2002, the restored SEBI Takeover Regulations in 2011, and the notification of limited sections of the new Companies Act 2013, which have led to issues in India relating to their interpretations and effect on the deals valuations and process.

3. Shareholder Involvement: Institutional investors in the minority position have actively observed the investee companies. Proxy advisory companies closely scrutinize the related party transactions, several executives’ appointments, and remuneration. In some cases, the approval of minority shareholders is necessary. After revamping, the powers of minority shareholders now include the ability to sue the company for oppression and mismanagement.

These issues challenge the growth of mergers and acquisitions in India, which needs thoughtful attention from the government to make our market attractive for foreign investment.

On a positive note Confederation of Indian Industry (CII), the Reserve Bank of India (RBI), and the Securities and Exchange Board of India (SEBI) – the three primary regulators of mergers and acquisition activities – have been striving hard to liberalize further the norms that have been one of the most significant contributors to the country’s industrial expansion.

Major Mergers and Acquisitions in India

- Bharti Airtel acquired Kuwait-based Zain Telecom’s African business for USD 10.7 billion, considered the largest-ever cross-border deal in an emerging market.

- The biggest deal in the Pharmaceutical sector was acquiring the generic drug unit of Piramal Health Care by USA-based Abbot Laboratories (ABT) for USD 3720 million.

- In the Banking, Financial Services, and Insurance sectors, the biggest deal was by Hinduja group, when it acquired Luxembourg-based KBL European Private Bankers SA for USD 1.69 billion.

- Tata Chemicals took over British salt based in the UK with a deal of US $ 13 billion. Tata made one of the most successful mergers and acquisitions in 2010, which gave them even more power and vital access to British Salt’s facilities. British Salt annually produces about 800,000 tons of pure white salt from its facilities.

- The merger of Reliance Power and Reliance Natural Resources in a deal of US $11 billion is another big deal in the Indian industry. This merger enabled convenience Reliance Power to handle all its power projects as it now enjoys easy accessibility to natural gas.

- In domestic mergers, ICICI Bank’s acquisition of Bank of Rajasthan at about Rs 3000 Crore was a great move by ICICI to enhance its market share across the Indian boundaries, especially in northern and western regions.

- The takeover of Corus by Tata Steel in 2007 is considered the most prominent Indian takeover, with a deal value worth $7.6 billion, making Tata Steel the fifth largest steel company.

- Vodafone has acquired a 52% interest in Hutchison Essar from the Hong Kong-based Hutchison Telecommunications International for about US$10.83 billion.

- Imperial Energy, India’s biggest exploration company, Oil and Natural Gas Corporation (ONGC), bought Imperial Energy Plc for $2.58 billion to tap Siberian deposits and compensate for diminishing output at home.

- Aditya Birla Group’s Hindalco Industries, India’s largest non-ferrous metals company, acquired the Canada-based firm Novalis in an all-cash transaction for $6 billion.

- In 2008, Tata acquired Britain’s most famous automobile manufacturers, Jaguar and Land Rover, in a $2.3 billion contract with Ford, their American owner.

- Subhash Chandra’s Essel Packaging (EPL) acquired the Swiss tube packaging major Propack to become the world’s largest in laminated tubes.

- In 2006, Ranbaxy Laboratories(RLL) created news when it announced the acquisition of 3 drug makers in Europe, all within a week. Allen S.p.A, a GlaxoSmithKline (GSK) division in Italy, Romania’s largest independent generic drug producer, Terapia, and drug maker Ethimed NV in Belgium.

- In 2007, Pharmaceutical and biotechnology major Wockhardt bought the fourth largest independent, integrated pharmaceutical group in France, Negma Laboratories. At a deal of $265 million, Wockhardt became the most prominent Indian pharmaceutical company in Europe, with more than 1,500 employees based in the continent.

- In 2008, Bennett Coleman & Co, India’s largest media group and the holding company of the Times of India group, bought Virgin Radio in the UK in a $53.2 million deal with SMG Plc.

- Mahindra & Mahindra acquired 90 percent of Schoneweiss, a leading company in the forging sector in Germany. The deal took place in 2007 and consolidated Mahindra’s position in the global market.

- Sterlite Industries, a part of the Vedanta Group 2008, signed an agreement regarding acquiring copper mining company Asarco for $ 2.6 billion.

Future Outlook

India is becoming a highly sought-after destination for M&A deals. This also means it is now more vulnerable to the impulses and uncertainties of the global economic scenario. Considered to be the lifeblood of Indian business now, it needs support and constancy to ensure it remains progressive in the coming years.

India must concentrate on refining the processes and increasing the simplicity of business abroad and the legalities involved. It is not wrong to say that the mergers and acquisitions in India and the system related to them are in the infant stage. Still, this economy is vast enough to provide opportunities for foreign investments.

The key to success is keeping fundamentals in place, i.e., to bring into line acquisitions to the entire business strategy, plan and execute a vigorous integration process, and take adequate awareness of all relevant regulatory norms.

Mergers and Acquisitions in India Infographics

Learn the juice of this article in just a single minute: Mergers and Acquisitions in India Infographics.

Recommended Articles

Here are some articles that will help you get more details about the Business Future – Mergers, so go through the link.