Updated October 18, 2023

Insurance Sector in India

We all know the fact that our life is inherently risky. Situations such as the sudden death of the family bread earner, critical illness, or loss of life savings highlight the importance of insurance coverage. Won’t it be a time of trauma and stress for you and your near and dear ones? What would you do in such cases if you had not planned for them?

Let me ask you, Can you fight off all those risks and unexpected disasters by yourself? If you think so, it is great. Otherwise, insurance is the best alternative. Insurance rescues you by providing security when you face unexpected incidents. Insurance means you pay a lump sum amount to get protection against an unforeseen accident of a large magnitude.

How Does the Growth of the Insurance Sector in India Work?

The insurance sector in India grows due to the economy of scale. When individuals or companies join insurance coverage, they become part of a group that shares similar risks. The insurance covers the entire group rather than individuals. The premiums are collected from customers to create a pool of funds to pay claims. This sharing of costs among a large group of people helps reduce the financial burden in case of potential disasters, making insurance an effective technique for spreading and transferring risks.

Example:

Harry has a major car accident while returning home from work. The resulting medical expenses could be substantial and devastating without insurance coverage. Treating physical injuries, loss of income, and associated costs can create a significant financial burden. Fortunately, Harry has insurance coverage. This is where the concept of a group or community comes into play. Insurance scheme members help Harry offset his medical expenses and financial burden. In this way, the other group members collectively contribute towards covering Harry’s expenses in a time of need. Understanding the same support would be available to them if they faced a similar situation. This communal approach contributes to the growth of the insurance sector in India.

Must Know Insurance Terms

- Insured: The person or organization covered by insurance is called the insured.

- Insurer: The entity or individual that promises to pay compensation for insurance risk is called the insurer.

- Claims: An official request to the insurer by the insured asking for a payment based on the insurance policy’s terms.

- Insurable risk: Risks for which it is relatively easy to get insurance.

- Coverage: The amount of risk or liability covered by an individual or entity through the insurance services sector.

- Policy: A contract for insurance between the insurance company and the policyholder.

- Premiums: The amount charged for a certain amount of insurance coverage is called the premium.

- Reinsurance: A reinsurer assumes part of a risk originally taken by the insurer, called the primary company.

Okay, so this was about the growth of the insurance sector in India. I am sure you would have got a good gist about it. But wait, we are here to discuss what insurance is and the Insurance sector in India. India is a huge insurance market due to its momentous untapped potential. This sector is believed to improve the standard of living of people in an economy. It provides risk-free lives, promotes entrepreneurship, mobilizes savings, and protects trade and industry, all contributing to human progress. India’s economic growth has seen no small contribution from the Insurance Sector in the Indian industry but major inputs. Read on to learn all about it.

Milestones in the Development of the Insurance Sector in India

India has a rich historical foundation in the growth of its insurance sector, dating back to ancient writings such as Manu (Manusmrithi), Yagnavalkya (Dharmasastra), and Kautilya (Arthasastra), which highlight the concept of pooling resources for use in times of calamities. This early concept laid the groundwork for the modern-day concept of insurance. Subsequently, India underwent significant reforms and evolved, drawing influences from other countries, particularly England.

The life insurance business in India began in the early 1800s with the Oriental Life Insurance Company in Calcutta. The Indian Life Assurance Companies Act enacted the first regulation for the industry in 1912. However, due to intense competition and allegations of unfair practices in the 1950s, the government nationalized the sector, establishing the Life Insurance Corporation (LIC) in 1956, which enjoyed a monopoly until the late 1990s when the private sector was allowed to re-enter the market.

Well, this was particularly about the life insurance sector; the history of the general insurance sector in India can be referred to as early as the 17th century at the time of the Industrial Revolution when trade and commerce were carried out through the sea. This sector’s first establishment was in 1850 in the form of Triton Insurance Company Ltd., in Calcutta, by the British. The General Insurance Sector in India was also nationalized in 1972, establishing the General Insurance Corporation of India as a company that commenced business in January 1973.

In 1999, following the recommendations of the Malhotra Committee report, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry. In the very next year, IRDA allowed foreign companies to open up the sector, permitting them ownership of up to 26%.

The Growth Of The Insurance Sector In India

- India is a growing economy with an increasing working population; disposable income is also increasing.

- People need a secure life for themselves and their families, encouraging them to get insurance.

- As income increases, the spending on consumer goods, automobiles, and travel are various insurance lines.

- The awareness about insurance among people has been increasing along with the number of providers and the range of products available at competitive prices.

- Moreover, the regulatory environment is conducive for the Insurance sector to bloom. All these factors lead to an increase in the universe of potential buyers for insurance, such as individuals, companies, across businesses.

- Insurance companies can focus on microinsurance to ensure coverage in the untapped rural areas, where more than two-thirds of India’s population resides.

The Insurance Sector in India – Issues and Challenges

1. Public vs. Private

Looking at industries that were opened for private participation led to the weakening of the public sector and made it easier for the new arrivals to prosper. This has not been the case with the insurance sector in India, where the Public sector is still dominating after even a decade of opening the doors of this sector. This situation burdens private sector companies to innovate and differentiate themselves to have a better market share.

2. Client Servicing

Making potential customers understand insurance products simply and meaningfully poses a big challenge in front of the insurance sector in Indian companies. Dealing with certain formalities can become complicated if customers do not understand the jargon. The fear of being cheated demotivates them. However, this can be avoided by explaining the terms simply and transparently and briefing them about the offer’s benefits.

3. Staying Profitable

This fact cannot be ignored that profitability is one of the major concerns about this industry. According to research, the break-even period in the life insurance business has increased from the expected 9-10 years to about 13-15 years. The insurance sector is already under the pressure of massive expansion costs but also has to face the problem of diminishing volumes as policy lapses increase year on year. India is a price-sensitive market, and the increasing competition has dropped the premium rates. It is difficult for companies to manage the expense ratio.

Insurance Companies

According to the insurance sector report by IRDA, as of the end of September 2013, fifty-two insurance sector companies are operating in India, out of which twenty-four are in the life insurance business and twenty-seven are in the non-life insurance business.

Insurance companies mainly consist of two parts;

Source- IRDA Annual Report (2012-13)

- Life insurance companies cater to only one insurance product: life insurance. Companies in the public sector include the Life Insurance Corporation of India (LIC). The private sector includes companies like AEGON Religare Life Insurance, Edelweiss Tokio Life Insurance Co. Ltd, Aviva India, Shriram Life Insurance, Bajaj Allianz Life Insurance, HDFC Standard Life Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, IDBI Federal Life Insurance, etc.

- General insurance companies cater to various products in insurance, such as health insurance, marine insurance, car insurance, property insurance, etc., except life insurance. The public sector includes companies like Oriental Insurance Comp. Ltd, United India Insurance Comp Ltd, and New India Assurance Comp Ltd, National Insurance Comp. Ltd and the private sector include Bharti AXA General Insurance, Future Generali India Insurance, HDFC ERGO General Insurance, etc.

The Insurance Sector in India Compared to the Global Scenario

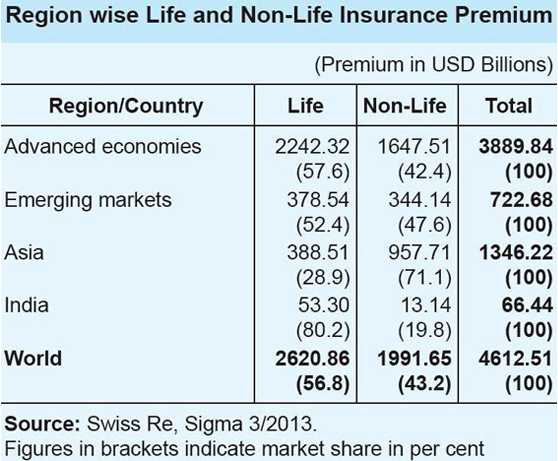

Source- IRDA Annual Report (2012-13)

- Globally, the share of the life insurance business in total premiums was 56.8 percent. However, the share of the life insurance business in the Asian region was only 28.9 percent, which contradicts the global trend.

- For India, the share of the life insurance business in the total insurance business was very high at 80.2 percent, while the share of the non-life insurance business was small at 19.8 percent.

- India ranks 10th among the 88 countries for the life insurance business, per Swiss Re’s data. During 2012, the life insurance premium in India declined by 6.9 percent (inflation-adjusted). The global life insurance premium increased by 2.3 percent during the same period.

- India’s global life insurance market share was 2.03 percent in 2012, against 2.30 percent in 2011. The non-life insurance sector witnessed a significant growth of 10.25 percent (inflation-adjusted) during 2012. The Insurance Sector in India outperformed the global non-life premium, which grew by a mere 2.6 percent during the same period.

- However, the share of Indian non-life insurance premiums in global non-life insurance premiums was small at 0.66 percent, and India ranks 19th in the global non-life insurance market.

Way Ahead

The prospects of the Indian insurance sector look promising and optimistic. The insurance sector registered robust growth at US$ 72 billion in 2012 and is likely to grow to US$ 280 billion by 2020. India’s favorable regulatory environment boosts foreign player participation in this huge untapped. Liberalizing the insurance sector and allowing private participation has enabled its consistent growth over the years. Insurance consumers now have more product choices and insurance providers, leading to higher service quality standards. Raising the foreign direct investment (FDI) limit from 26 percent to 49 percent in the sector is viewed as a key element in stimulating the insurance industry in India.

Quick Statistics and Future Projections

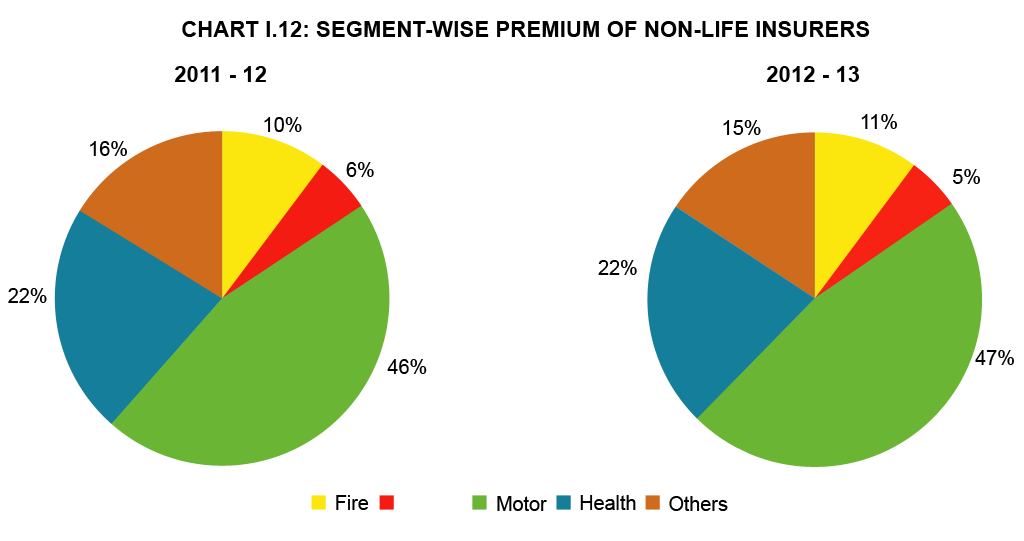

Source- IRDA Annual Report (2012-13)

- Total premiums collected by the general and life insurance industry in FY 2012-2013 were Rs 3.75 trillion (US$ 59.07 billion).

- The general insurance industry grew by 19.6 percent in April–May FY 2013–14.

- Non-life insurers collected premiums worth Rs 13,552.46 crore (US$ 2.13 billion) in the first two months of the current year, compared to Rs 11,333.54 crore (US$ 1.78 billion) during the corresponding period of the previous year.

- The insurance business in India will reach Rs 4 trillion (US$ 63.01 billion) in FY 2013–14, according to Mr. T S Vijayan, Chairman of IRDA.

- The chairman considers that insurance penetration in India has the probability of rising to 5–6 percent from the current 3.86 percent.

- Life Insurance Council, the country’s industry body of life insurers, has forecasted a compounded annual growth rate (CAGR) of 12–15 percent over the next five years for the segment.

- By 2020, it is anticipated that India will have a growing insurable population of 750 million, and life expectancy is projected to reach 74 years around the same period. The council believes that this favorable Indian demography would cause more people to seek out life insurance.

- Also, the council predicts life insurance penetration – a percentage of insurance premium to GDP – to reach 5 percent by 2020 from its current 3.2 percent.

- CII predicts a 5% growth rate for India’s insurance industry in FY 2013-14.

- It also forestalls 60 percent of non-life insurance companies to record average growth of more than 10 percent.

Considering the various factors, we can confidently say that the Indian insurance industry has significant potential for positive growth, driven by the concentrated efforts of the regulator, government, and players in response to the rising demand for insurance.

Recommended Articles

This was all about the Insurance Sector in India. Go through these links to get more insights about the insurance Sector: