Updated July 21, 2023

Loss Ratio Formula (Table of Contents)

What is the Loss Ratio Formula?

In the insurance industry, the term “loss ratio” refers to the financial ratio that indicates the number of claims and benefits paid during the given period as a percentage of the amount of premium earned in the same period.

In other words, the loss ratio indicates the losses incurred by the insurers, brokers, and underwriters in the form of claims and benefits during a period.

The formula for loss ratio is expressed as the summation of losses incurred due to policyholders’ claims/benefits and other adjustment expenses during the given period divided by the total premium earned during that period. Mathematically, it is represented as,

Example of Loss Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Loss Ratio in a better manner.

Loss Ratio Formula – Example #1

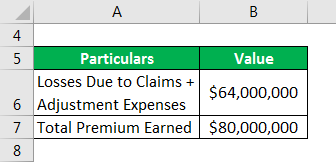

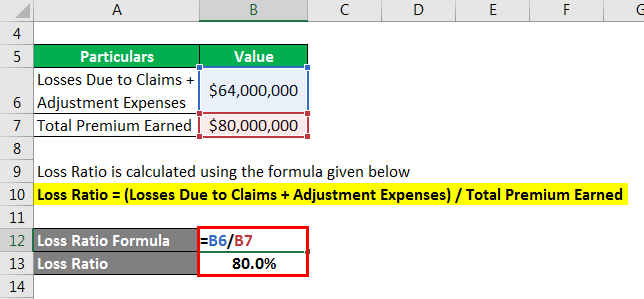

Let us take the example of an insurance company to illustrate the calculation of the loss ratio. In the year 2021, the company earned a total premium of $80 million, while it incurred $64 million in the form of policyholders’ claims and benefits as well as other adjustment benefits. Calculate the loss ratio of the insurance company for the year 2021.

Solution:

The Loss Ratio is calculated using the formula given below

Loss Ratio = (Losses Due to Claims + Adjustment Expenses) / Total Premium Earned

- Loss Ratio = $64 million / $80 million

- Loss Ratio = 80.0%

Therefore, the loss ratio of the insurance company was 80.0% for the year 2021.

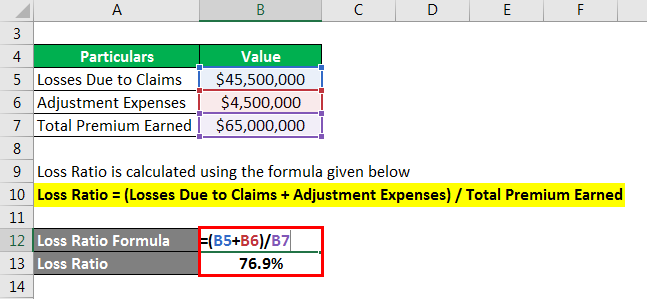

Loss Ratio Formula – Example #2

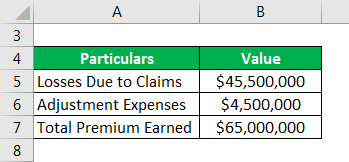

Let us take the example of another insurance company for which the following information for the year 2021 is available. Calculate the loss ratio of the insurance company based on the given information.

Solution:

The Loss Ratio is calculated using the formula given below

Loss Ratio = (Losses Due to Claims + Adjustment Expenses) / Total Premium Earned

- Loss Ratio = ($45.5 million + $4.5 million) / $65.0 million

- Loss Ratio = 76.9%

Therefore, the loss ratio of the insurance company was 76.9% for the year 2021.

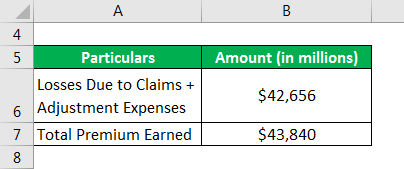

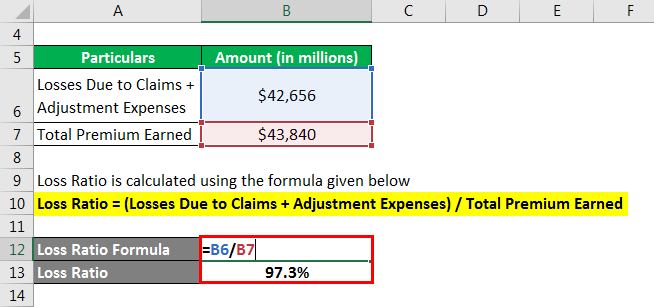

Loss Ratio Formula – Example #3

Let us take the example of Metlife Insurance Company or Metlife Inc. in order to illustrate the concept of loss ratio for real-life companies. During 2021, the company earned a total premium of $43,840 million, while it expensed $42,656 million in the form of policyholder benefits and claims. Based on the available information, Calculate Metlife Inc.’s loss ratio for the year 2021.

Solution:

The Loss Ratio is calculated using the formula given below

Loss Ratio = (Losses Due to Claims + Adjustment Expenses) / Total Premium Earned

- Loss Ratio = $42,656 million / $43,840 million

- Loss Ratio = 97.3%

Therefore, Metlife Inc.’s loss ratio for the year 2021 was 97.3%.

Source Link: Metlife Inc. Balance Sheet

Explanation

The formula for the Loss Ratio can be calculated by using the following steps:

Step 1: Firstly, determine the number of claims and benefits paid by the insurance company to the insured parties during the period. The claims are only paid when the covered risk event actually happens.

Step 2: Next, determine the number of other adjustment expenses, which is the aggregate of the expenses incurred by the insurance company in investigating and settling the insurance claims.

Step 3: Next, determine the amount of premium received by the insurance company from the insured parties during the period. The premium is paid in exchange for the risk coverage offered by the insurance company. These payments are either periodic in nature or maybe one-time payment.

Step 4: Finally, the formula for loss ratio can be derived by dividing the summation of losses due to claims made by the policyholders (step 1) and other adjustment expenses (step 2) by the total premium earned (step 3) during the period as shown below.

Relevance and Use of Loss Ratio Formula

- The concept of loss ratio is very important for the insurance industry as it is used to assess the impact of the claims on the profitability of all the players involved in the insurance industry, such as insurers, brokers, and underwriting agents.

- Typically, the loss ratio is mapped even at the level of an insurance policy or a relationship with a partner company and that kind of granular investigation simply indicates how seriously the industry takes this ratio.

- The single number loss ratio can be used to determine the performance of an insurance company: the lower value of lass ratio means better profitability and hence better performance. As such, all the successful companies operating in the industry keep a close look at the loss ratio of each account.

- Theoretically, an insurance company can stay solvent and make money only if their claims pay-out is lower than the premiums collected during the given period of time. Otherwise, if an insurance company continues to incur higher claims pay-out as compared to premiums earned, then it will be in losses and will soon run into financial distress, such as default on future claims. Therefore, it is important that insurance companies maintain a healthy loss ratio to stay in the race.

Loss Ratio Formula Calculator

You can use the following Loss Ratio Formula Calculator

| Losses Due to Claims | |

| Adjustment Expenses | |

| Total Premium Earned | |

| Loss Ratio | |

| Loss Ratio = | (Losses Due to Claims + Adjustment Expenses)/Total Premium Earned |

| = | ( 0 + 0)/0 = 0 |

Recommended Articles

This is a guide to the Loss Ratio Formula. Here we discuss how to calculate the Loss Ratio along with practical examples. We also provide a Loss Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –