Updated July 24, 2023

Accounting Formula (Table of Contents)

What is the Accounting Formula?

The term “Accounting Formula” refers to the basic accounting equation, which is the foundation of a balance sheet. To put it simply, the accounting formula is the final presentation of the double-entry accounting technique that defines the structure of a balance sheet. A balance sheet comprises of three major categories: total assets, total liabilities and total equity.

The accounting formula can be expressed such that total assets are the summation of total liabilities and total equity. Mathematically, it is represented as,

Otherwise, it also is expressed such that total equity is the difference between total assets and total liabilities. Mathematically, it is represented as,

Example of Accounting Formula (With Excel Template)

Let’s take an example to understand the calculation of Accounting in a better manner.

Example #1

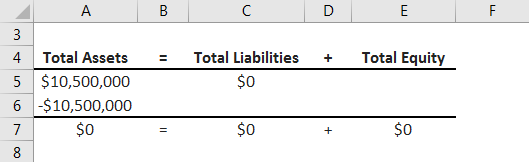

Let us take the example of a company named ZXC Inc. that recently purchased a machine with cash. The company purchased a machine worth $10.5 million using part of its available cash. Calculate the balance sheet impact of the given transaction by using the concept of accounting formula.

Solution:

The given transaction leads to a debit entry of the machinery account (+$10.5 million) and a cash account’s credit entry (-$10.5 million). Now, let us sum up the effect of the transaction on the balance sheet by using an accounting formula,

Therefore, it can be seen that the above-mentioned transaction effects simply the total asset side in the balance sheet since both machinery account and cash account form part of the asset. Effectively, there is no change in the balance sheet size as the cash account decrease offsets the machinery account increase.

Example #2

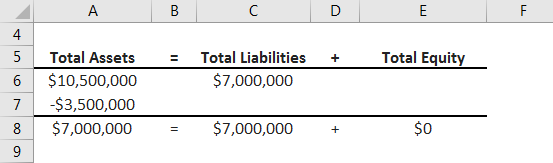

Let us take the example of an equipment purchase that has been funded by a mix of available cash and bank loan. The subject company has bought a piece of equipment worth $10.5 million that has been funded by cash of $3.5 million and a bank loan of $7.0 million. Calculate the balance sheet impact of the given transaction by using the concept of accounting formula.

Solution:

The given transaction leads to a debit entry of the equipment account (+$10.5 million) and credit entry of the cash account (-$3.5 million), and a bank loan account (+$7.0 million). Now, let us sum up the effect of the transaction on the balance sheet by using an accounting formula,

Therefore, it can be seen that the above transaction impacts both sides of the balance sheet. The increase in machinery accounts is partly offset by a cash account decrease, while bank loan funds the remaining. As such, the balance sheet size increased by $7.0 million.

Accounting Formula – Example #3

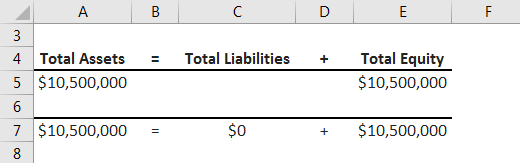

Let us take the example in which company-funded machinery purchase worth $10.5 million entirely through the infusion of equity capital. Calculate the balance sheet impact of the given transaction by using the concept of accounting formula.

Solution:

The given transaction leads to a debit entry of the machinery account (+$10.5 million) and a credit entry of the equity capital account (-$10.5 million). Now, let us sum up the effect of the transaction on the balance sheet by using an accounting formula,

Therefore, it can be seen that the above transaction impacts both sides of the balance sheet. The increase in machinery account is balanced by increase equity capital. As such, the balance sheet size increased by $10.5 million.

Explanation

The formula for Accounting Formula can be calculated by using the following steps:

Step 1: Firstly, determine the value of all the items that the company owns. These items can be either tangible or intangible in nature, and they are aggregately known as assets. Plant & machinery, inventory, cash, liquid investment, etc., are some of the usual examples of assets.

Step 2: Next, determine the value of all the obligations of the company, which is the amount that the company is liable to pay. These items can be either long-term or short-term and are collectively known as liabilities. Bank loans, trade payable, taxes payable, etc., are some of the examples of liabilities.

Step 3: Next, figure out the value of the total equity of the company. It is the aggregate of capital raised in the form of share capital and retained earnings, including profit generated in the business.

Step 4: Finally, the accounting formula can be represented as total assets equivalent to the summation of total liabilities and total equity, as shown below.

Total Assets = Total Liabilities + Total Equity

Relevance and Use of Accounting Formula

The accounting formula concept is very important as it is considered one of the basic accounting principles that form the foundation of a balance sheet. It is a put presentation of the double-entry accounting system. It is a kind of check that whether the total assets are equal to the sum of the total liabilities and total equity; if not, then there is some issue with the accounting entries.

Recommended Articles

This is a guide to the Accounting Formula. Here we discuss how to calculate the Accounting Formula along with practical examples. We also provide Accounting with a downloadable excel template. You may also look at the following articles to learn more –