Updated July 26, 2023

Introduction to Horizontal Integration Example

Horizontal Integration refers to the merger of two concerns at approximately the same level in the production supply chain hierarchy. They may belong to different industries but come together to improve economies of scale and increase synergies.

It is different from vertical integration, in which entities occupying different stages in the supply chain are merged. Over the years, there has been much horizontal integration in the real world, which has helped in the growth of the entities and helped them capture an increasing market size. Here we will look at some of the latest real-life examples of horizontal integration to get an idea of what motivations lead to this process and how it has benefited businesses:

Examples of Horizontal Integration Example

Some of the recognized examples are described below:

Example 1: Basic

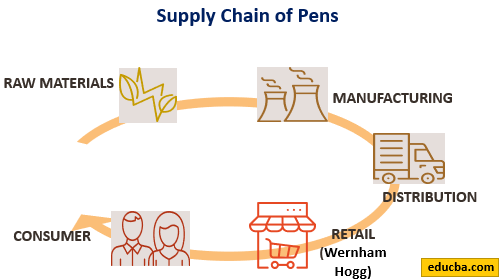

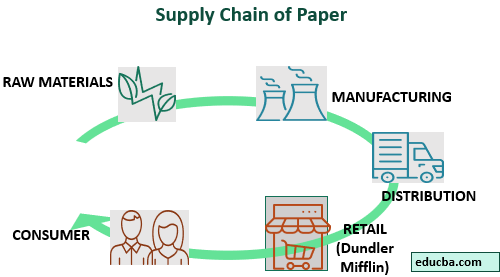

- Wernham Hogg and Dundler Mifflin are involved in retailing pens and paper, respectively. This is the last step in bringing the product to the eventual buyers. Other entities involved in procuring the raw materials, manufacturing them, and distributing them to the retailers handle the early part of the supply chain. Given that the market for the two products isn’t diametrically different, certain entities are common to both, illustrated by the following table below:

- If Hogg and Mifflin merge together, this would be termed horizontal integration. The resultant entity formed would engage in the retailing of pens and paper. The new entity will considerably lower the cost of manufacturing and distribution by having common partners. Also, the new entity could enhance its production capacity and ensure that the synergies between the products could be shared. Although entities of the same industry are integrating, the products involved are diverse.

Example 2: Practical – Disney & Pixar

- The Walt Disney Company established itself in 1923 as an animation studio and subsequently expanded into live-action film production, television, and theme parks. After a slew of successful ventures till the early 21st century, it began to experience a stage of stagnation and was looking at ways to reinvent itself.

- Pixar started off in 1986 with a contribution from Steve Jobs as an American computer animation studio. In 1995 it produced its first film, Toy Story, which began a successful foray into animation movie-making.

- The proposed merger by Walt Disney was a prime example of horizontal integration working in the same industry. Apart from the usual benefits of the coming together of the finest entities in the industry, it also worked to ward off potential competition for Disney and thus continue and potentially improve its market share.

- In 2006, Disney acquired Pixar in a $7.4 billion deal. Disney merged its existing expertise in 2D animation with the state-of-the-art production value of Pixar and has since consistently delivered great works in the movie-making business. Pixar retained its core values and did not allow Disney to change the winning culture that defined Pixar. The best of both organizations has thus come together to become one of the biggest production houses in the world.

Example 3: Practical (India) – ACC & Damodar Cement

- ACC (Associated Cement Companies) Cement expanded its coverage in eastern India by acquiring Damodar Cement in 2005. It had earlier expanded in the ready-mix concrete plant section, but this was the first expansion regarding cement capacity. The chairman of ACC then described the merger as one that would bring in operating efficiencies, productivity, and economies of scale.

- The merger was said to increase the capacity by 1.5 lakh ton. After the merger, ACC invested $3 million to improve the grinding capacity and better utilization of raw materials in Damodar cement. Usually, horizontal integrations such as these are subject to high scrutiny such that it may not allow a monopoly in a particular sector to the adversity of the customers there.

Example 4: Practical – Vodafone & Hutchison

- Vodafone was established in 1983 as Racal Telecom in the United Kingdom, while Hutchison Essar was founded 1985 in Hong Kong as a telecommunication services provider to several Asian countries. Sometimes, it is not just the acquiring entity’s interest that gives rise to the merger; it could also be the underperforming entity that attracts the merger. For Hutchison, the urban markets were below par, with falling average revenue per user. It wanted additional funds to expand its business operations in Europe. Overall the lower returns on its investments were not making things easier.

- For Vodafone, the objective was to consolidate its position as one of the leading telecommunications companies with increased expansion in markets such as India, where Hutchison had already established itself for a few years. The Western markets had reached a saturation point, making this deal appear as an ideal opportunity for a growth trajectory in developing countries.

- Vodafone acquired a 67% stake in Hutchison Essar, valued at $11.1 billion. There was a considerable increase in the net profit ratio, return on investment, and earnings per share post the merger.

Conclusion – Horizontal Integration Example

Horizontal Integration generally occurs between firms with similar products, operations, or services. Even when a merger between two different industries takes there is a common point in terms that are used. While operational efficiency and overhead cost reduction are known as the effective outcomes of vertical integration, it cannot be denied that horizontal integration facilitates better market capture, reduces competition, and increases product dealings. The improvement in economies of scale more than offsets the cost incurred as part of the integration deal.

However, the Sysco acquisition of US Foods in 2015 showed increased jurisdiction on such mergers. The Federal judge ruled against the deal due to concerns that it would create over 75% market control and stifle competition. That said, there are future lined-up horizontal integration deals that show no signs of diminishing anytime soon.

Recommended Articles

This is a guide to the Horizontal Integration Example. Here we discuss the Introduction, top 4 Examples of Horizontal Integration, and a detailed explanation. You can also go through our other suggested articles to learn more –