Updated July 28, 2023

High Low Method (Table of Contents)

High Low Method

In any business, three types of costs exist Fixed Cost, Variable Cost, and Mixed Cost (a combination of fixed and variable costs).

The high-low method separates fixed and variable costs from the total cost by analyzing the costs at the highest and lowest levels of activity. It compares the highest level of activity and the lowest level of training and then compares costs at each level.

This is a very important concept in cost accounting and is very useful in determining fixed and variable costs related to the product, machinery, etc., and is also used in budgeting activities. It is a very simple method to analyze the cost without getting into complex calculations.

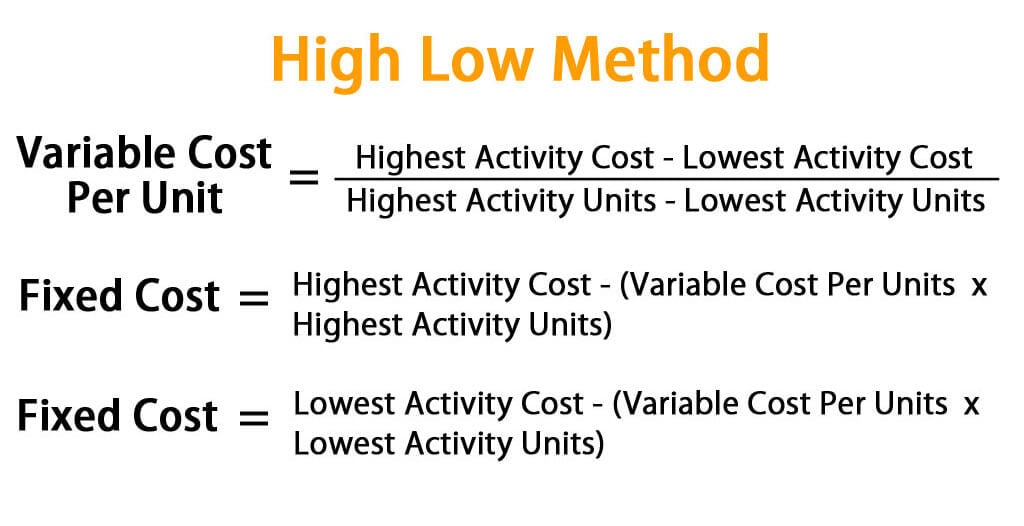

Formula For High Low Method:

In the high-low method, we start with determining variable costs first. The formula for variable cost in this method is given by:

Once we have arrived at variable costs, we can find the total variable cost for both activities and subtract that value from the corresponding total cost to find a fixed cost.

Or

Examples of High Low Method (With Excel Template)

Let’s take an example to understand the calculation of the High Low Method in a better manner.

High Low Method – Example #1

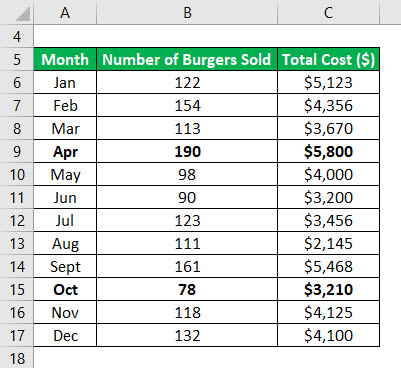

Let’s say you have a small business, and you sell burgers. For the last 12 months, you have noted the monthly cost and the number of burgers sold in the corresponding month. Now you want to use a high-low method to segregate fixed and variable costs.

Data Table:

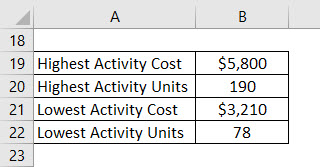

Determine the highest and lowest activity point. So the highest activity happened in the month of April, and the lowest was in the month of October.

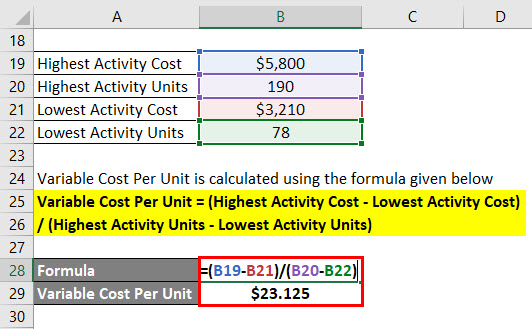

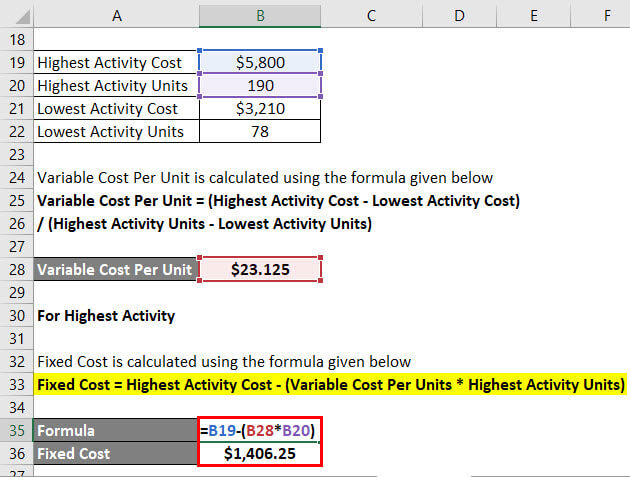

You can calculate the Variable Cost Per Unit using the formula below:

Variable Cost Per Unit = (Highest Activity Cost – Lowest Activity Cost) / (Highest Activity Units – Lowest Activity Units)

- Variable Cost Per Unit = ($5,800 – $3,210) / (190 – 78)

- Variable Cost Per Unit = $23.125

For the Highest Activity

Fixed cost is calculated using the formula given below

Fixed cost = Highest Activity Cost – (Variable Cost Per Units * Highest Activity Units)

- Fixed Cost = $5,800 – ($23.125 * 190)

- Fixed Cost = $1,406.25

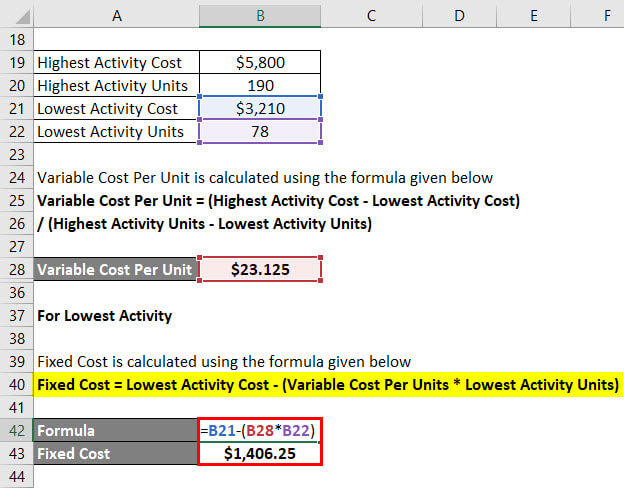

For the Lowest Activity

Fixed cost is calculated using the formula given below

Fixed cost = Lowest Activity Cost – (Variable Cost Per Units * Lowest Activity Units)

- Fixed cost = $3,210– ($23.125 * 78)

- Fixed Cost = $1,406.25

So basically Total cost equation is given by = 23.125x + 1406.25

Where x is the number of burgers sold in a particular month.

Since you have the total cost equation now, you can use this to calculate your cost any month.

High Low Method – Example #2

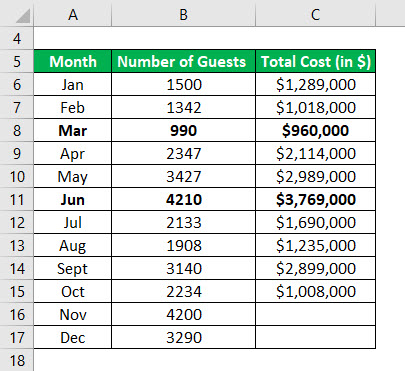

Let’s say you are a hotel manager and are concerned about the cost of which the hotel is incurring, and you want to derive a model to predict future cost based on historical cost. You have collected data for the last 10 months and want to see the cost for the next 2 months.

Data Table:

Determine the highest and lowest activity point. So the highest activity happened in the month of Jun, and the lowest was in the month of March.

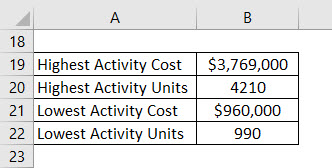

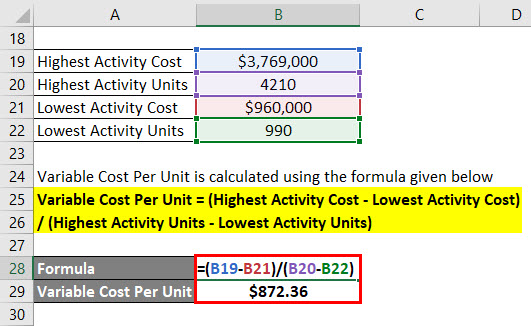

To calculate the variable cost per unit, use the following formula

Variable Cost Per Unit = (Highest Activity Cost – Lowest Activity Cost) / (Highest Activity Units – Lowest Activity Units)

- Variable Cost Per Unit = ($3,769,000 – $960,000) / (4210 – 990)

- Variable Cost Per Unit = $872.36 per unit

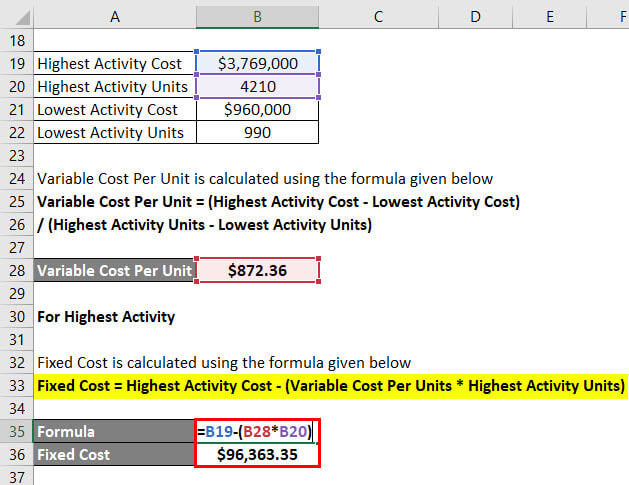

For the Highest Activity

Fixed cost is calculated using the formula given below

Fixed cost = Highest Activity Cost – (Variable Cost Per Units * Highest Activity Units)

- Fixed Cost = $3,769,000 – ($872.36 * 4210)

- Fixed Cost = $96,363.35

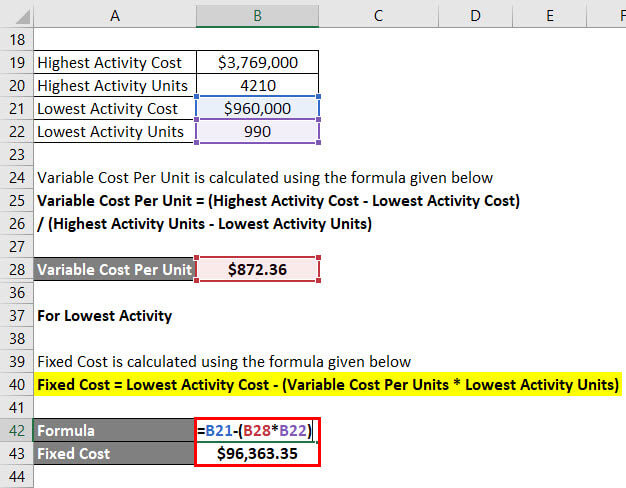

For the Lowest Activity

Fixed cost is calculated using the formula given below

Fixed cost = Lowest Activity Cost – (Variable Cost Per Units * Lowest Activity Units)

- Fixed cost = $960,000 – ($872.36 * 990)

- Fixed Cost = $96,363.35

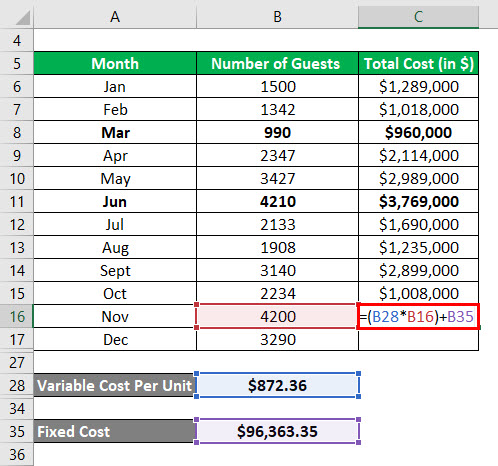

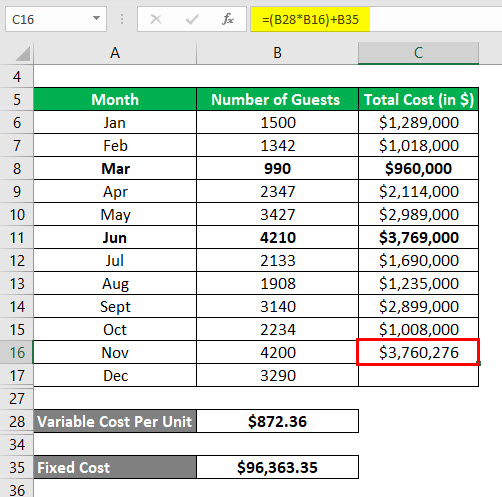

Calculation of Total Cost

Total Cost = (Variable Cost Per Unit * x) + Fixed Cost

Where x is the number of guests in a particular month.

The calculation for the total cost for the month of November is as follows:

The result will be as given below.

- Total Cost = ($872.36 * 4200) + $96,363.35

- Total Cost = $3,760,276

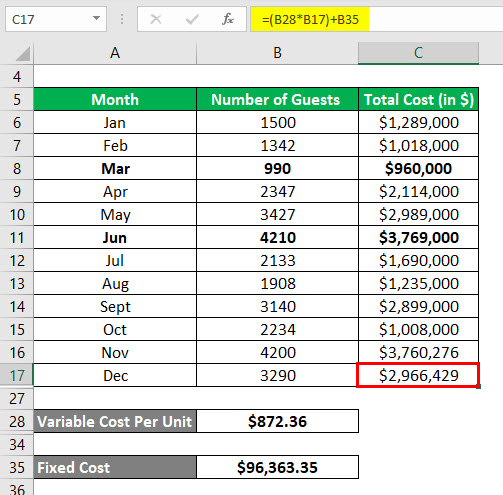

Similarly, For Dec, Month’s Total Cost is calculated as follows:

- Total Cost = ($872.36 * 3290) + $96,363.35

- Total Cost = $2,966,429

Explanation

Although calculating the high-low method is straightforward and aids in forecasting future costs, its limited application stems from certain limitations:

- The first limitation is that this method assumes a linear relationship between cost and activity which is not always the case.

- Secondly, it only assumes two activity levels and does not represent the entire data set correctly.

- If there are changes in fixed or variable costs with time, this method does not capture that.

Because of all those limitations, this method is ineffective in producing accurate and precise results.

Relevance and Uses of High Low Method

As discussed above, the high-low method is simple, easy to understand, and quick to work around. Using the high-low method does not require complex tools or programming. However, limitations associated with this tool reduce its practical application. We should be really careful while using this tool because it is more prone to give inaccurate results. The reason for that is straightforward. Various elements impact costs, and predicting them effectively requires more than two variables. Furthermore, as the production level reaches a certain point, businesses require an additional fixed investment that this model does not capture. So one should be careful using this method.

Recommended Articles

This has been a guide to the High Low Method. Here we discuss calculating the variable and fixed costs using a high-low method with examples and a downloadable Excel template. You may also look at the following articles to learn more –