Updated July 7, 2023

Definition

Hazard insurance protects a home or other property from damage caused by natural and man-made disasters such as fires, storms, vandalism, and theft. The property owner pays the required yearly premium according to the terms and conditions of the policy. The owner will receive compensation if the policy covers the damage.

For example, Hurricane Ida caused an estimated insured loss of about $36,000 in 2021. Owners with hazard insurance could claim the amount according to the terms of their policy.

Key Highlights

- It covers the home’s structure against natural and man-made disasters ranging from earthquakes and floods to theft and vandalism.

- Mortgage lenders sometimes need owners to have hazard coverage in place. The coverage must depend on the type of disasters affecting the owner’s area.

- People purchase it in areas prone to floods and earthquakes to protect their homes. However, it only covers some kinds of disasters.

- The cost depends on various factors, like the owner’s credit score and the property’s location.

- The owner does not pay a separate premium. The home insurance policy includes it.

How Does Hazard Insurance Work?

- As hazard insurance covers a wide range of disasters, selecting the right policy is crucial. For example, if the owner lives in the mountains, the policy must include coverage for landslides.

- Once the owner decides on the best hazard insurance, they should contact the company.

- The insurance company then sends an inspector to inspect the property and determine its market value. The premium that the owner must pay is calculated based on this.

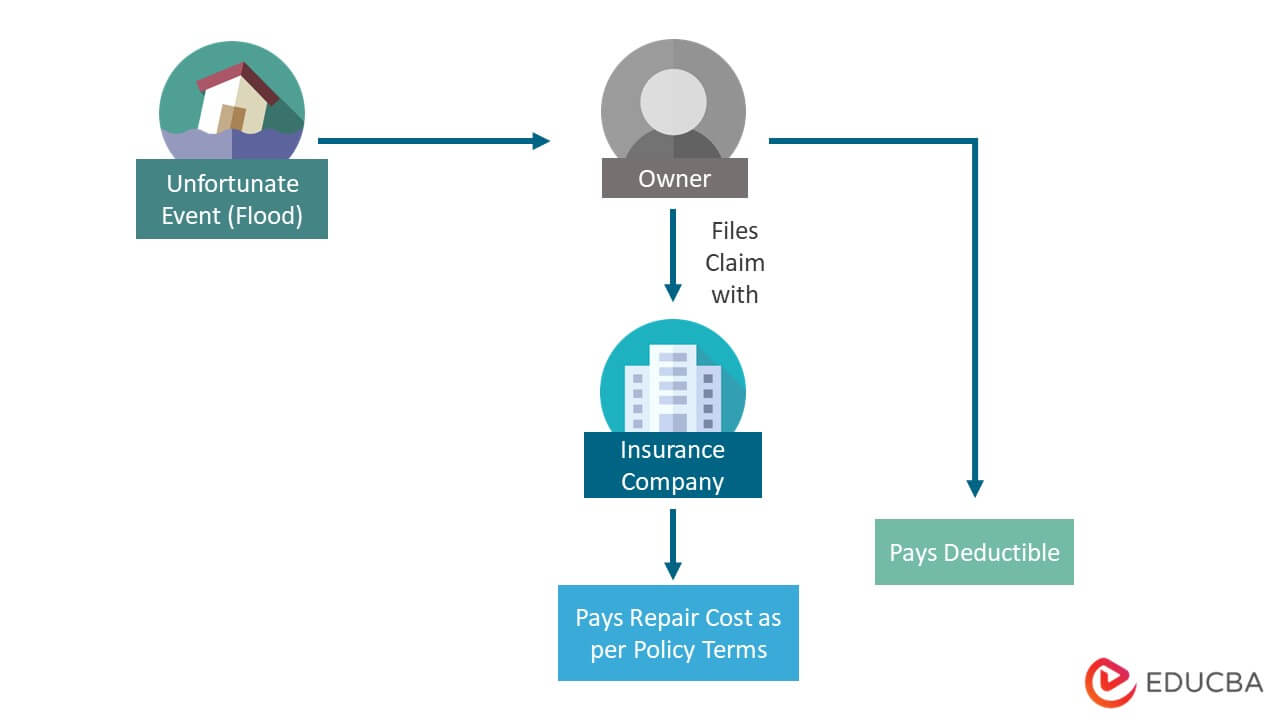

- When such an unfortunate event occurs, the owner must file an insurance claim and provide the insurance company with details about the event, including photos and videos if available.

- After inspecting the loss, the insurance company pays the owner the repair cost.

- However, the owner must pay a deductible out of their own pocket. A deductible is the portion of a claim that you agree to pay. This is usually 5% of the total amount claimed.

Assume your hazard insurance policy has a $500 deductible, and a hurricane causes $3,000 in damage. In that case, you must pay $500 while your insurance company pays $2,500.

What Does Hazard Insurance Cover?

Hazard insurance provides coverage for several different kinds of disasters. This includes natural disasters, man-made disasters, and malfunctions in household equipment. These include:

- Flood and landslide damage

- Fire and smoke damage

- Wind, hail, and tornado damage

- Theft and vandalism

- Short-circuits, overheating appliances, and pipe bursts

Types of Hazard Insurance

There are two broad types:

- Named perils insurance– Provides coverage if the cause of damage is included in the policy.

- Open perils insurance– Provides coverage against hazards not specified in the policy.

The events must occur accidentally and untimely for the policy to be valid. For example, if a short circuit occurs due to a wire that has been faulty for over a month, the owner will not be eligible for the claim.

It is also equally important to understand what the policy does not cover. The coverage changes depending on where the property owner lives. Damage to any personal or household items or injury sustained during a disaster is not covered under this insurance. It only protects the owner’s home and not its contents.

Certain high-risk areas come with their specific coverage. For example, the owner will have to purchase separate flood insurance if the area is prone to floods. Other situations where the policy may not apply are insect infestations, mold, and fungus attacks, or general wear and tear of the house.

Hazard Insurance vs. Homeowners Insurance

|

Hazard Insurance |

Home Insurance |

| It covers structural damage from disasters. | It covers all kinds of liability to a home. |

| Covers the entire property and not the contents within the property. | Covers personal belongings, legal costs, and other structures like fences and garages. |

| It is a sub-section of the home insurance policy. | It is a complete policy protecting homes from various liabilities. |

| Mortgage lenders require hazard insurance in place before lending. | Mortgage lenders do not require other kinds of coverage. |

| Terms and conditions change from area to area. | Terms and conditions remain similar in different places. |

| It does not cover daily living expenses in case of a disaster or property loss. | It provides for daily expenses (hotel stays and meals) if the owner cannot live in their home due to disasters or other unlikely events. |

An important aspect to note is that hazard insurance is excluded from home insurance in certain areas. This usually occurs when the property’s area is specifically prone to certain weather events. In this case, it becomes too expensive for the owner to include hazardous coverage within the home insurance.

What is Hazard Insurance Mortgage?

If the homeowner wants to put their house on mortgage, having hazard insurance coverage in their home insurance policy is mandatory. This is because it covers the entire property structure that the lenders are concerned with.

Generally, the home insurance policy satisfies the mortgage lender’s needs. However, depending on geographical area, the lender may require additional hazard coverage for events like cyclones. Moreover, the lender needs it because damage can decrease the property’s value.

Conclusion

The bottom line is that it is wise for anyone with a home or property to purchase hazard insurance. The owner must speak with an insurance agent and get the right kind of protection for their home.

Frequently Asked Questions(FAQs)

Q1. Is having hazard insurance mandatory?

Answer: Having hazard insurance is not mandatory. It only becomes necessary when the owner decides to mortgage the property. People who have homes in disaster-prone areas should have the policy ready in case of a calamity.

Q2. What does hazard insurance not cover?

Answer: Hazard insurance does not cover any personal belongings on the property or damage caused due to faulty appliances. Floods and earthquakes require separate insurance and do not fall under hazard insurance.

Q3. What does the price of the insurance depend on?

Answer: The policy’s price largely depends on how expensive the property is and the risk level associated with the area. The rates tend to be higher for more expensive and high-risk properties. Credit score can also be a significant factor while determining the price.

Q4. Does hazard insurance come with a homeowner’s insurance policy?

Answer: Hazard insurance is a subsection of home insurance. It usually comes with the home insurance policy, although the clauses and details change from policy to policy. Some policies may not include a hazard cover. It has to be purchased separately. Therefore, the policy must be specific to the owner’s area.

Recommended Articles

This article guides you through Hazard Insurance. We discuss its definition, how it works, what it covers, and more. To know more, read the following articles,