What is the WACC Formula?

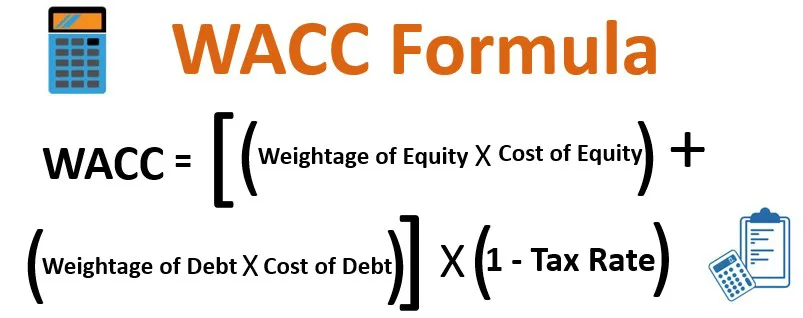

The term “WACC” is the acronym for a weighted average cost of capital (WACC), a financial metric that helps calculate a firm’s cost of financing by combining the cost of debt and the cost of equity structure. Simply put, the WACC formula helps companies determine how much they should pay to use someone else’s money to invest in their business.

It is a complex formula that takes the percentage of a company’s capital that comes from debt and multiplies it by the cost of that debt. Similarly, it takes the percentage of capital that comes from equity (when people buy company shares) and multiplies it by the cost of that equity. Finally, it adds those two numbers to get the company’s WACC. This value indicates the minimum rate of return that a company needs to generate to compensate both shareholders and lenders.

Formula for WACC

OR

Where

- E is the market value of the company’s equity

- D is the market value of the company’s debt

- V is the total market value of the company (E + D)

- E/V is the weightage of the equity

- D/V is the weightage of the debt

- Re is the cost of equity

- Rd is the cost of debt

- T is the corporate tax rate

How to Calculate the WACC Formula? – Explained

1. Calculate Equity’s Market Value

Determine the market value of the company’s equity (E). It is the company’s total number of outstanding shares multiplied by the current market price per share.

2. Calculate Debts’ Market Value

Determine the market value of the company’s debt (D). It is the outstanding amount of debt the company owes to its creditors, such as bonds, loans, or other financial obligations. It is present in a company’s balance sheet.

3. Add Both Market Values

Determine the total market value of the company (V). It is the sum of the market value of equity and the market value of debt (V = E + D).

4. Find the Cost of Equity

Calculate the cost of equity (Re). It is the return shareholders require based on the company’s equity riskiness. One commonly used method to calculate Re is the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, the market risk premium, and the company’s beta.

5. Find the Cost of Debt

Determine the cost of debt (Rd). It is the interest rate a company pays banks and other lenders on its debt. Its calculation includes dividing the interest expense by the total debt outstanding.

6. Evaluate the Capital Structure

Determine the proportion of debt and equity in the company’s capital structure. Each financing source’s weight is in the company’s total capital structure. The computation of the weight of debt is D/V, and the equity weight is E/V.

7. Consider Tax Deductions

Adjust the cost of debt for tax deductions by multiplying it by the complement of the corporate tax rate (1 – Tc). It reduces the cost of debt, as interest payments are tax-deductible.

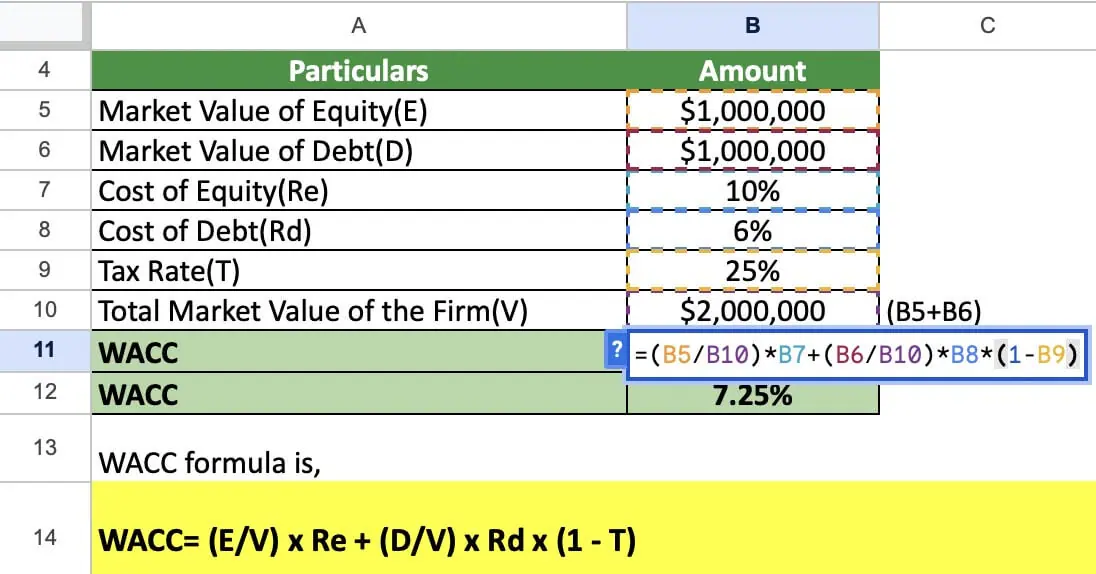

8. Compute WACC

Plug in the values for each of these components into the WACC formula:

WACC = (E/V x Re) + (D/V x Rd x (1 – Tc))

Variables Affecting the WACC Formula

- Capital structure: The proportion of debt and equity financing used to fund a company’s operations influence the weighting of their respective cost of capital in the WACC formula.

- Cost of Equity: There are many factors, including the risk-free interest rate, the company’s beta, and the expected market rate of return, that can influence the cost of equity.

- Cost of Debt: Factors such as prevailing market interest rates, the creditworthiness of the company, and the collateral or securities the company pledges to the lender, affect the borrowing costs.

- Corporate Tax Rate: Interest payments are tax deductible, so the tax rates a business pays on its income can affect borrowing costs.

- Market Risk Premium: The expected rate of return in the market can affect the cost of investing in stocks. It is because investors expect higher returns from investing in stocks than from risk-free investments such as government bonds.

- Industry Risks: Companies operating in high-risk industries such as technology and biotech may have higher capital costs due to the uncertainty of future cash flows.

- Economic Conditions: General economic conditions such as inflation, interest rates, and general market volatility can affect a company’s cost of capital.

WACC Formula Excel Examples

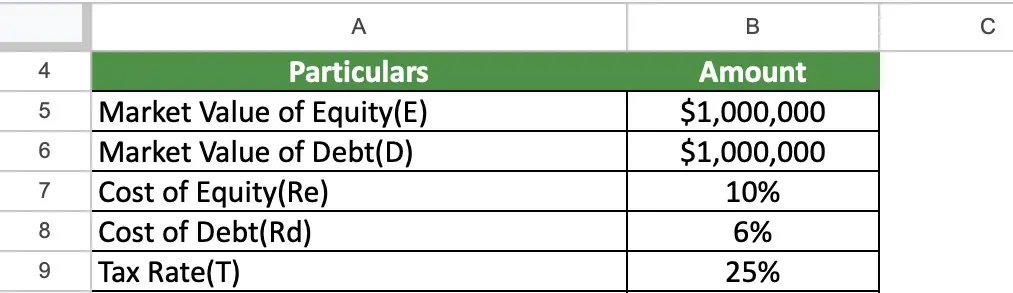

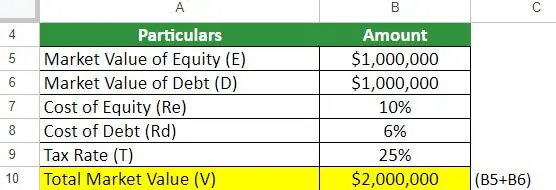

Example #1

Company ABC has a capital structure of 50% equity and 50% debt. The company’s equity cost is 10%, while the cost of debt is 6%. The company’s tax rate is 25%. What is the WACC for the company if the market value of equity and the market value of debt are both $1000,000?

Given,

Solution:

Step #1: Calculate the Firm’s Total Market Value (V)

Market Value (V) = Market Value of Equity (E) + Market Value of Debt (D)

=$1000,000 + $1000,000

= $2000,000

Step #2: Substitute all the Information in the Formula

WACC = (E/V) * Re + (D/V) * Rd * (1 – T)

= ($1000,000/$2000,000) * 10 + ($1000,000/$2000,000) * 6 * (1-25)

=7.25%

WACC for company ABC is 7.25%.

Example #2

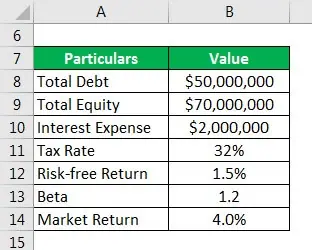

During FY22, DCF Inc’s real estate investment generated a return of 5.5%. As per their latest annual report, the company has an outstanding debt of $50.0 million and common equity valued at $70.0 million. It also has incurred $2.0 million interest expense on its debt. On the other hand, the risk-free rate of return, market return, and beta are 1.5%, 4.0%, and 1.2x, respectively. Calculate WACC using the given information and check whether the 5.5% investment return exceeds the cost of capital if the tax rate is 32%.

Given,

Solution:

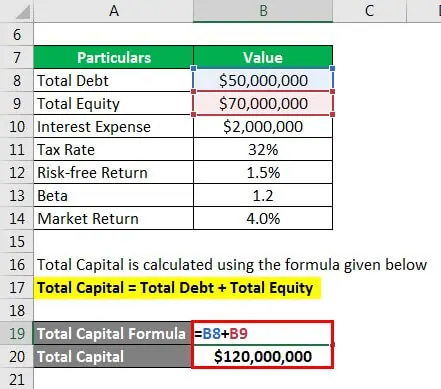

Step #1: Calculate the Total Capital Using the Formula

Total Capital = Total Debt + Total Equity

= $50,000,000 + $70,000,000

= $120,000,000

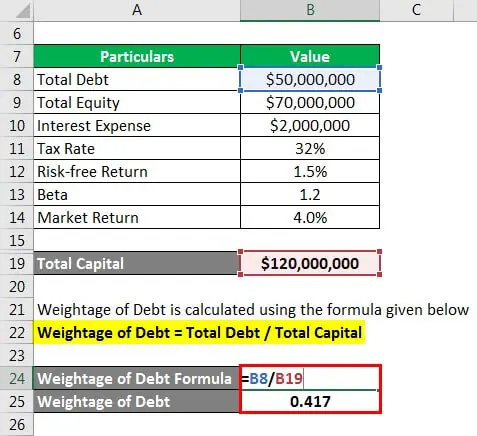

Step #2: Calculate the Weightage of Debt Using the Formula

Weightage of Debt = Total Debt / Total Capital

= $50,000,000 / $120,000,000

= 0.417

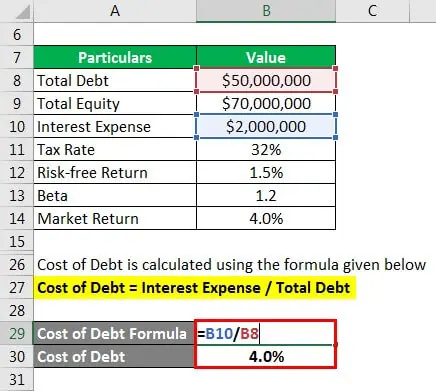

Step #3: Calculate the Cost of Debt Using the Formula

Cost of Debt = Interest Expense / Total Debt

= $2,000,000 / $50,000,000

= 4.0%

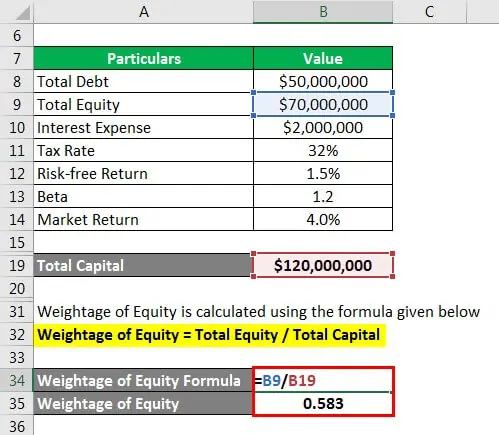

Step #4: Calculate the Weightage of Equity Using the Formula

Weightage of Equity = Total Equity / Total Capital

= $70,000,000 / $120,000,000

= 0.583

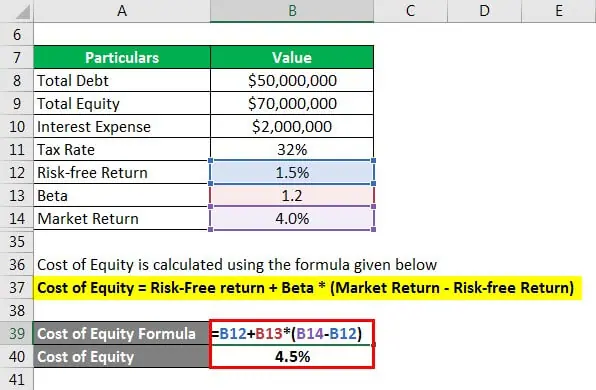

Step #5: Calculate the Cost of Equity Using the Formula

Cost of Equity = Risk-Free return + Beta * (Market Return – Risk-free Return)

= 1.5% + 1.2 * (4.0% – 1.5%)

= 4.5%

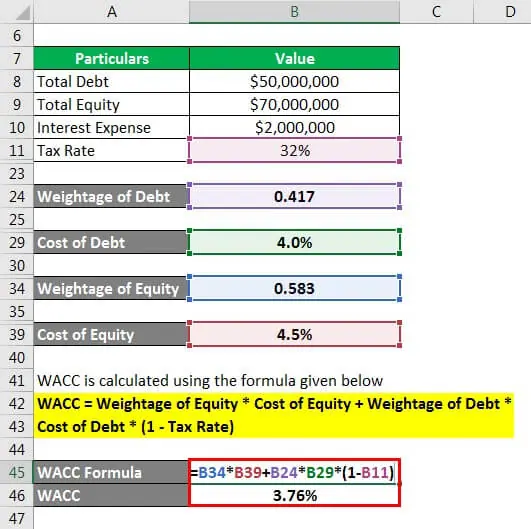

Step #6: Calculate the WACC Using the Formula

WACC = Weightage of Equity * Cost of Equity + Weightage of Debt * Cost of Debt * (1 – Tax Rate)

= 0.583 * 4.5% + 0.417 * 4.0% * (1 -32%)

= 3.76%

As per the given information, the WACC is 3.76%, comfortably lower than the investment return of 5.5%. Hence, it is a good idea to raise the money and invest.

Example #3

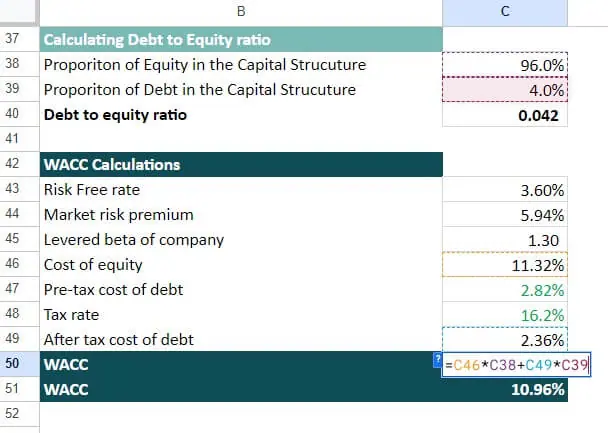

Using its annual report, let us calculate the weighted average of the cost of capital (WACC) for Apple Inc.

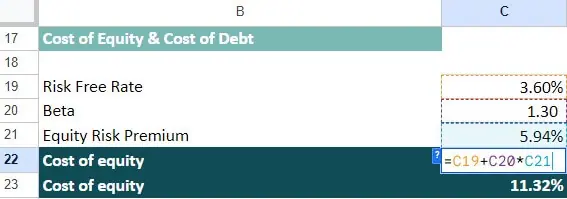

Step #1: Determine the Cost of Equity

The cost of equity formula is:

Ke = Risk Free Rate (Rf) + Equity Risk premium (Rm – Rf) * Beta

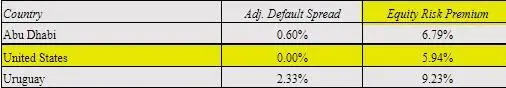

1. For a Risk-free rate, we use a 10-year Treasury Rate of 6 as of 29 March 2023.

(Source: Bankrate)

2. For 2023, the United States Equity Risk Premium (Rm – Rf) is 94%.

(Source: Stern NYU EDU)

3. According to yahoo finance, the Beta for Apple Inc., as per the trends of the last 5 years, is 30

(Source: Yahoo Finance)

4. Therefore, the cost of equity is:

Ke = Risk Free Rate (Rf) + Equity Risk premium (Rm – Rf) * Beta

= 3.6 + 5.94 * 1.3

= 11.32 %

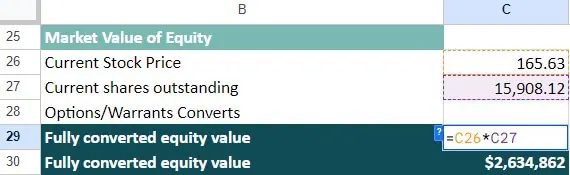

Step #2: Calculate the weightage of equity and debt:

1. Total Equity = Number of shares outstanding x current price

The current share price of Apple’s stock is 165.63. Moreover, we can find the number of shares outstanding in the company’s annual report. It is 15,908,118,000, i.e.15,908.118 million shares.

Total Equity = Number of shares outstanding x current price

= 15,908.118 * 165.63

= 2,634,862

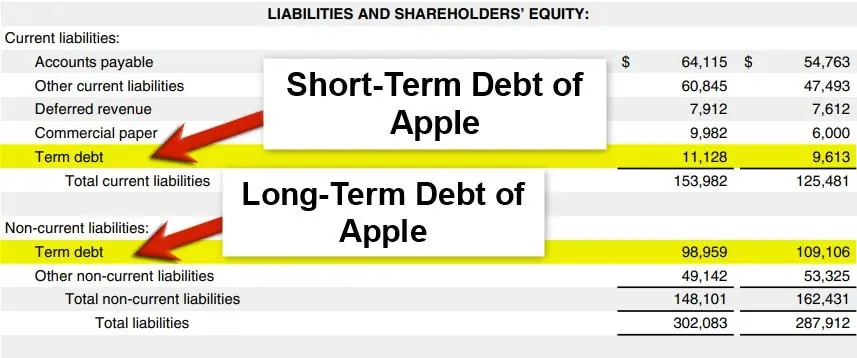

2. Total Debt = Short-Term Debt + Long-Term Debt

We can find the short and long-term debt in a company’s balance sheet. Apple’s Short term debt is 11,128 million, and Long term debt is 98,959 million for 2022.

Total Debt = Short-Term Debt + Long-Term Debt

= 11,128 + 98,959

= 110,087 million

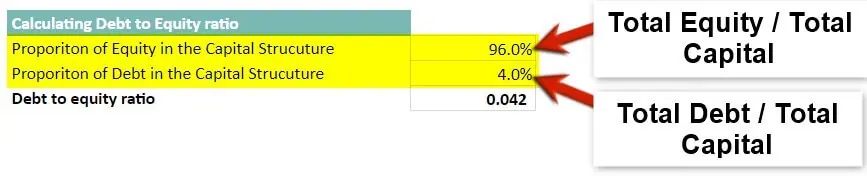

3. Calculate the weightage of equity and weightage of debt

Weightage of Equity = Total Equity / (Total Debt + Total Equity)

= 2,634,862 / (110,087 + 2,634,862)

= 96%

Weightage of Debt = Total Debt / (Total Debt + Total Equity)

= 110,087 / (110,087 + 2,634,862)

= 4%

Step #3: Calculate the WACC of Apple Inc.

1. Calculate the Pre-tax Cost of Debt.

While performing financial modeling of Apple Inc, we can find out the interest rate on long-term liabilities during the creation of its Debt Schedule. This interest rate is the pre-cost of debt. In our case, the pre-tax cost of debt comes to 2.82%. We explain the detailed calculation in the comprehensive Financial Modeling Course.

We would need the tax rate to calculate the after-tax cost of debt. The tax rate can be calculated by dividing the taxes by the company’s pre-tax income. Apple’s taxes in 2022 were $19,300, and income before tax was $119,103.

Tax Rate = Income Tax / Income Before Taxes

= (19,300 /119,103)

= 16.2%

2. Calculate the After-Tax Cost of Debt

After-Tax Cost of Debt = Pre-Tax Cost of Debt * (1-Tax Rate)

= 2.82 * (1 – 16.2)

= 2.36%

3. Calculate the weighted average cost of capital (WACC)

WACC = E/V * Ke + D/V * Kd * (1 – Tax Rate)

Weightage of Equity * Cost of Equity + Weightage of Debt * After-Tax Cost of Debt

= 96 * 11.32 + 4 * 2.36

= 10.96%

We determine that Apple’s WACC is 10.96%. The industry average for the sector is 8.3% with 1.2% deviations. It indicates that Apple’s WACC is higher than the industry average. It further signifies that Apple pays a higher cost of capital to investors and lenders than the other companies in the industry.

Tips for Interpreting the WACC Formula

- Compare the WACC to the company’s return on invested capital (ROIC): If the company’s ROIC is higher than its WACC, it suggests that the company is generating a return on its investments that exceeds its cost of capital. It is generally viewed as positive and may indicate that the company is creating value for its shareholders.

- Understand the components of the WACC: The WACC calculation includes the cost of equity, the cost of debt, and the weight of each element in the company’s capital structure. Understanding the computation of each component and how they contribute to the overall WACC can help interpret the results.

- Consider the company’s risk profile: The cost of capital is directly related to the level of risk associated with a company’s operations. Companies operating in higher-risk industries or with a higher level of leverage may have a higher cost of capital. Therefore, it is essential to consider the company’s risk profile when interpreting the WACC.

- Compare the WACC to industry benchmarks: It can be helpful to compare a company’s WACC to industry benchmarks to understand how it performs relative to its peers. Suppose a company’s WACC is significantly higher than its peers. In that case, it may indicate that the company is facing higher capital costs due to specific factors such as poor credit rating or higher debt levels.

- Be mindful of limitations: As discussed earlier, the WACC formula has certain limitations. Therefore, it is crucial to consider these limitations when interpreting the results and to use the WACC as a starting point for further analysis rather than relying solely on it for decision-making.

Relevance and Use of WACC Formula

It is essential to understand the concept of the WACC formula as it plays a vital role in financial management decisions. The formula’s primary purpose is to assess the overall cost of funds based on the contribution of debt and equity in the company’s capital structure.

Typically, a company’s management uses the formula to evaluate if they should purchase a new asset with equity, debt, or a mix of both. On the other hand, investors and creditors use it to evaluate if it is worth investing in or lending a loan to an entity. A higher WACC means the investment is less likely to create value, and investors might look for other prospects.

Limitations of the WACC Formula

The following are the limitations of the WACC formula:

- Assumptions: This formula uses several assumptions, including capital structure, business environment, etc. However, in practice, these assumptions may differ from the actual value of those aspects.

- Calculation Difficulties: These include subjective assumptions regarding the cost of debt, cost of equity, and capital structure. As a result, these estimates do not reflect the company’s true cost of capital. Moreover, it is difficult to accurately calculate the cost of capital.

- Unavailability of Data: The formula relies on accurate and up-to-date data on a company’s capital structure, interest rates, and market risk. In case of unavailability of this data, the final calculator might be inaccurate.

- No consideration of project risks: It assumes that all projects the company undertakes have the same level of risk. In reality, different projects carry different levels of risk, which can affect the actual cost of capital for those projects.

- No consideration of external factors: It does not account for external factors such as government policies, regulatory changes, or market conditions that may impact a company’s cost of capital.

- Ignore company-specific factors: It assumes that all companies in the same industry have the same cost of capital. In contrast, companies have specific characteristics that affect their cost of capital, such as brand value, management expertise, or market position.

WACC Formula Calculator

| Market Value of the Company (E) | |

| Market Value of the Company’s Debt (D) | |

| Total Market Value of the Company (V) | |

| The cost of equity (Re) | |

| The cost of debt (Rd) | |

| Tax Rate (T) | |

| Weighted Average Cost of Capital (WACC) | |

| WACC = | (E/V x Re) + (D/V x Rd x (1 - T)) |

| = | (0/0 * 0) + (0/0 x 0 x (1 - 0)) = 0 |

Frequently Asked Questions (FAQs)

Q1. What is WACC in simple terms?

Answer. WACC calculates the amount a company spends to obtain finances for its business operations. Essentially, it means that the company must earn from its investments to pay returns to its investors.

Q2.What does a 12% WACC mean?

Answer. A 12% WACC implies that the business must earn a minimum 12% return to satisfy the investors. If the company makes more than 12%, it creates value for its shareholders, but if it earns less than 12%, it destroys value for its shareholders.

Q3. What is a good WACC formula value?

Answer. A good WACC value differs from industry to industry depending on a company’s risk profile and the prevailing market conditions. Generally, a lower WACC value indicates that a company is generating higher returns and may be more profitable, while a higher value suggests lower profitability.

Recommended Articles

This was an EDUCBA guide to WACC Formula. To learn more, please read the recommended articles,