Updated July 31, 2023

Difference Between Entrepreneurship vs Management

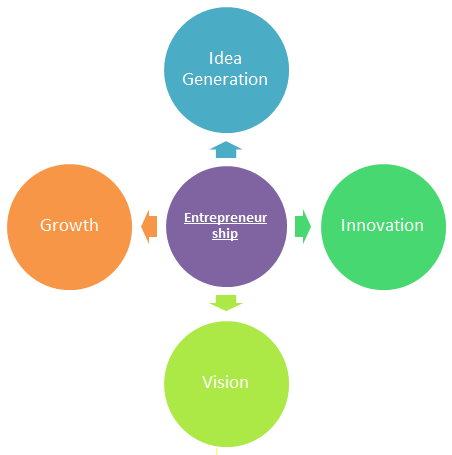

Entrepreneurship is the control and deployment of resources to create an innovative economic organization for the purpose of profit and growth under the condition of risk and uncertainty. A successful and sustainable business requires entrepreneurship and innovation. Entrepreneurship is a mindset, an attitude, and a particular approach to doing things. Entrepreneurship often requires creativity and innovation while addressing a new opportunity or concern in a new way. Management is one of the arts of getting things done through and with people in a formally organized group. So management is an individual or group that accepts responsibilities to run the organization. Management generally brings all the’ (Men and Women, Money, Machines, Materials, Methods, and Markets) together to run the business and achieve the organization’s objective.

Entrepreneurship

An entrepreneur is a person who starts or develops new enterprises by taking all other necessary resources together for the production to get started. In the long run, they are also called a businessman. An entrepreneur is a person who tries to transform an idea into reality by using available resources. The entrepreneur’s role is vital, and they have full power and authority in the business. In short, entrepreneurship is setting up businesses or businesses taking up financial risks in the hope of profit.

An entrepreneur is a person who takes risks and uncertainty in business. An entrepreneur is a person who leads the organization in the market no matter how many competitors will come later, but their position will remain untouched. Starting a business generally requires business concepts, ideas, new service technology, People for support, a process by which a service or product will be delivered, and money to run all activities.

Entrepreneurship Activities

- Creating or planning a new product.

- Entering into new markets and strategizing the next marketing move.

- Finding a new business venture.

- Taking an idea and executing them.

Some of the Young successful entrepreneur’s areas listed below –

- Ritesh Agarwal – Oravel Stays Pvt. Ltd.

- Farhad Acidwalla – Rockstah Media

- Advait Thakur – Apex Infosys India

Management

Focusing on corporate goals and ensuring that the task has been completed according to the plan are the responsibilities of management. Management is an individual or group that accepts responsibilities to run the organization.

Some of the key features of Management as listed below

- Getting work done through people.

- Result oriented.

- Leadership skill.

- Time management.

- It’s a group activity and not an individual activity.

- Separate from ownership.

- Use a professional approach at work.

- Reliability

So management is nothing but the process of running an organization with the help of available resources and achieve goal or objectives which an entrepreneur sets. So management is the employee of a company. Some of the primary functions of management are.

- Planning

- Organizing

- Directing

- Coordinating and controlling

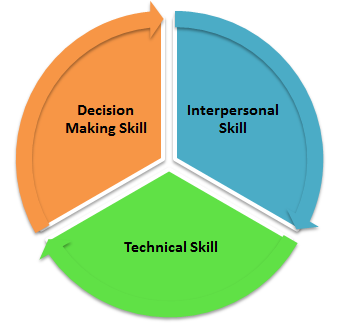

The above-listed functions links directly to below mention skills in graphics.

Management Skills

So management is simply directing employees on what to do. Management overall is about an organization, and its role is to ensure that a company’s all moving parts are working properly together and to guide the organization towards goal and achievement. So management is a critical element in the growth of an organization.

Head To Head Comparison Between Entrepreneurship vs Management (Infographics)

Below is the top 9 difference between Entrepreneurship vs Management

Key Differences Between Entrepreneurship vs Management

Let us discuss some of the major differences between Entrepreneurship vs Management.

- Entrepreneurship is the process of creating an enterprise by taking a financial risk to get a profit. In contrast, management is the art of getting things done through proper planning, organizing, directing, and controlling.

- An entrepreneur is focused on a new business venture, whereas the main focus of management is to manage the ongoing operation.

- Ownership of an organization stays with the entrepreneur, whereas management is an employee of the organization.

- The entrepreneur will get profit as a reward, whereas management will be paid for their work.

- An entrepreneur is a risk-taker, and management doesn’t take any risks.

- Entrepreneurs hold all the right to enjoy the complete financial freedom of the business, whereas Management doesn’t enjoy the complete financial freedom of the business.

- An entrepreneur is an innovator, whereas management executes an innovative idea.

- Management is a wide range of organization studies; it includes all, whereas Entrepreneurship is One of the management parts.

Entrepreneurship vs Management Comparison Table

Let’s look at the top 9 Comparisons between Entrepreneurship vs Management.

| The Basis of Comparison | Entrepreneurship | Management |

| Meaning | It is a process of creating an enterprise by taking a financial risk to get a profit. | It is an overall business activity done through and with people in a formally organized group. |

| Function | Business start-up and venture | Look after an ongoing operation. |

| Status | Owner | Employee |

| Rewards | Profit for risk-bearing | Salary as a reward for work |

| Risk | A risk associated with entrepreneurship | Management does not accept any risk. |

| Goal | Entrepreneurs set the goal. | Management implies the goal set by the entrepreneur. |

| Decision Making | Decide on personal perception and gut feelings. | Decide after collecting detailed information and reaching an operative conclusion. |

| Fraud | An entrepreneur is not getting involved in fraudulent behavior. | A manager may get involved or cheat by not working hard. |

| Innovation | Is the innovator | Is the executor |

Conclusion – Entrepreneurship vs Management

After analysis of the above points, it is clear that Entrepreneurship vs management is two different terms of use in business. Management is concerned with the management of the current operation with available resources. The entrepreneur focuses on the new venture and capitalizing on new opportunities. Successful Entrepreneurship requires creativity and innovation in addressing new opportunities in a new way. Entrepreneurship can’t be taught; on the other hand, management can be taught. An entrepreneur is the backbone of the economic development of countries.

Recommended Articles

This has been a guide to the top difference between Entrepreneurship vs Management. Here we also discuss the Entrepreneurship vs Management key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.