Updated July 10, 2023

What is Diluted EPS?

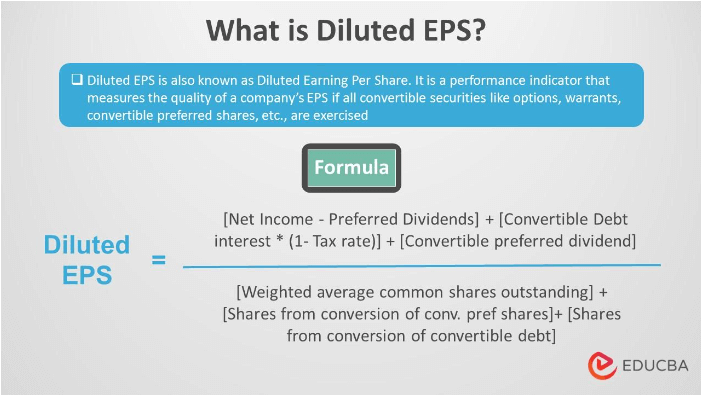

Diluted EPS is also known as Diluted Earnings per share. It is a calculation that measures a company’s EPS quality. The calculation includes an estimate of all convertible securities changed to stock shares.

EPS calculates how much an investor earns on each share. It only uses the company’s profit and outstanding shares for the calculation. On the other hand, Diluted EPS calculates the same value but also takes into account the convertible securities.

All companies have a few securities like options, warrants, preferred shares, bonds, etc. These are potentially convertible, i.e., can be converted into outstanding shares. Thus, the conversion of such securities can abruptly modify the EPS value, causing investors a loss.

Therefore, considering it the worst scenario, diluted EPS calculates the EPS assuming all convertible securities are exercised.

Key Takeaways

- Diluted EPS measures the EPS of a company, assuming all the convertible securities were converted to outstanding shares.

- The basic EPS only calculates the EPS considering the current outstanding shares. However, it takes into consideration convertible securities as well.

- Diluted EPS gives an accurate value of EPS suspecting the worst-case scenario. It provides a weighted average that helps investors make investing decisions.

- Diluted EPS is an easy method to calculate the company’s profitability. It evaluates the performance without considering the share prices.

Basic EPS vs. Diluted EPS

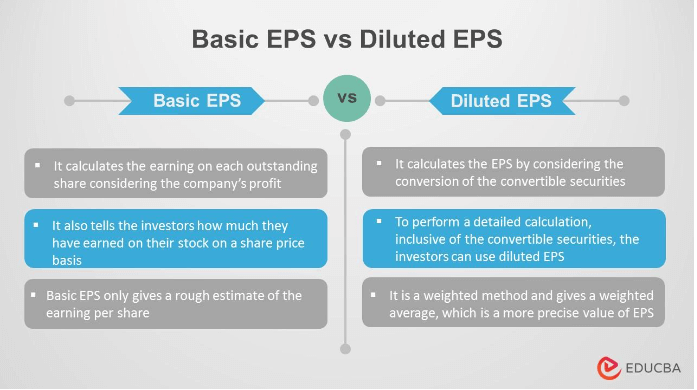

Basic EPS calculates the value of each outstanding share of common stock, considering the company’s profit. It helps investors understand the return on their investments. It also tells the investors how much they have earned on their stock on a share price basis.

Diluted EPS, on the other hand, is a more weighted method to calculate EPS. As the number of shares outstanding can fluctuate, one can use a weighted average method like diluted EPS. It calculates the EPS by considering the conversion of the convertible securities. It dilutes the EPS value.

Why are Diluted Earnings Per Share Important?

When an investor looks to buy stocks or shares of a company, knowing the company’s profitability is necessary. By calculating basic EPS, one can only find a rough estimate of the earnings per share value.

Most companies have convertible securities like bonds and additional shares as equity and converting those can alter the outstanding shares. Although, it is unlikely that all holders exercise their convertible securities altogether. Conversions happen only when the security holders foresee growth potential.

Still, having an accurate value of EPS in the worst-case scenario can be helpful. Thus, to perform a detailed calculation inclusive of the convertible securities, the investors can use diluted EPS. It gives a weighted average, a more precise value of share earnings.

How are Earnings Per Share Calculated? With Example

EPS can be calculated simply by dividing net income earned in a given reporting period less of the preferred dividend by the number of shares outstanding.

Let us express it through a formula:

The weighted average common share outstanding

[If the capital structure (the number of shares) changes during the reporting period, use a weighted average of equity shares for the calculation; else, use the number of outstanding shares.]

Preference Dividends:

- If Preference shares are cumulative, then deduct declared dividends.

- If Preference shares are non-cumulative, then deduct only one year’s dividends.

The weighted average common share outstanding:

The number of shares outstanding in a company often changes due to the company issuing new shares, buybacks of existing shares, and other financial instruments such as ESOP converted into shares. Hence, this method incorporates any changes in the number of outstanding shares over a particular reporting period. It is a significant number; it is helpful to calculate key financial measures such as EPS for the period.

Example:

There is a manufacturing company, “Future Manufacturers,” with expertise in making FMCG Products. It has 200,000 shares outstanding at the beginning of the year 2021. After the first six months, “Future manufacturers” issues additional 200,000 shares. The total outstanding shares have now increased to 400,000. At the yearend, “Future manufacturers” reports a profit of $401,000 and a distributed preference dividend of $1000.

Which amount of shares should you take for the EPS calculation? 200,000 or 400,000?

If you use 200,000 shares, then EPS would be $2 (EPS=$401,000 – $1000 /200,000), and for 400,000 shares, the EPS would be $1 (EPS=$401,000 – $ 1000/400,000).

Is it a big difference in EPS? Yes. It is one of the main reasons that we prefer to use a weighted average method. That ensures the financials will be as accurate as possible if the number of shares changes over time.

- First, multiply outstanding shares by the reporting period those shares are covered.

- Then, add all the resulting values.

Look at the following chart

| Fraction weighted shares | |||

| Dates | Share Outstanding | The reporting period | Weighted shares |

| First six months of 2021 | 200,000 | 6/12 | 200,000*6/12=100,000 |

| Last six months of 2021 | 400,000 | 6/12 | 400,000*6/12=200,000 |

| The weighted average number of shares | 100,00 + 200,000 = 300,000 | ||

Now let us calculate the EPS of Future manufacturers.

We have a Formula for the calculation of EPS,

Here we have the details of Future manufacturers,

- Net income = $401,000

- Preference dividend = $1000

- Weighted number of outstanding shares =300,000

So,

EPS = ($401,000 – $1000) / 300,000 = $400,000 / 300,000 = $ 1.33 per share

That is the Basic EPS calculation.

Calculation of Diluted EPS – Formula & Example

Convertible Debt

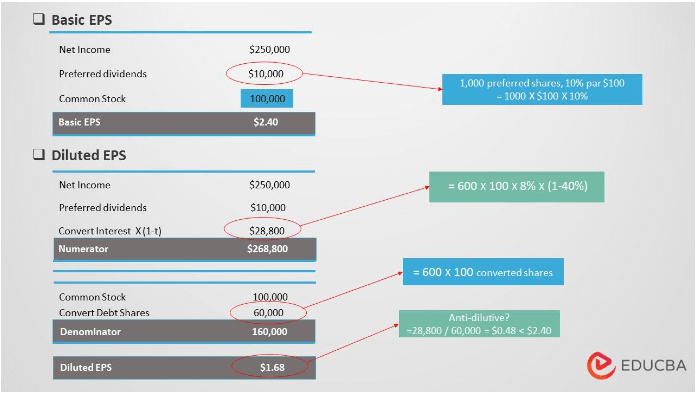

Let us calculate EPS for the scenario where all convertible debt is exercised. Anyhow, if exercised debt increases EPS, they are called Anti-Dilutive Securities. They are thus ignored and not recorded. Before calculating it, one needs to check if this security is anti-dilutive.

To check whether the convertible debt is anti-dilutive, calculate,

If this number is less than basic EPS, convertible debt is dilutive. Thus, include it in the formula.

Even convertible debts are added to the equation to calculate diluted EPS.

Effect of Convertible Debt on Numerator:

If convertible bonds are dilutive, the bond’s after-tax-interest expense would not be considered an interest expense for diluted EPS. Thus, add Interest expense multiplied by (1-Tax rate) to the numerator.

Effect of Convertible Debt on Denominator:

The basic EPS denominator is adjusted for the equivalent number of common shares created by exercising all convertible debt.

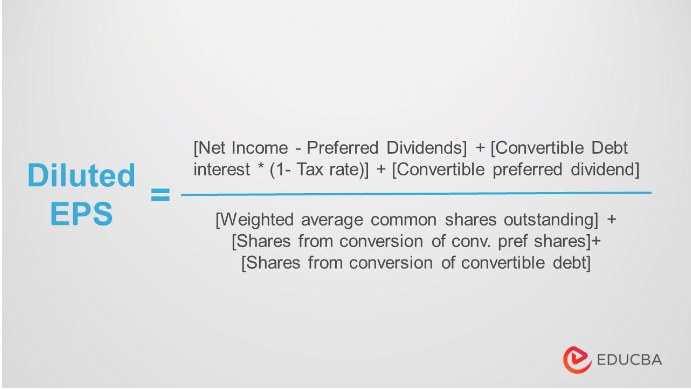

Therefore, the formula for diluted EPS is,

Diluted EPS =

(Net income –preferred dividends) + (Convertible Debt interest) * (1- Tax rate) / Weighted average common shares outstanding + shares from conversion of convertible debt

Example 1:

In 2021, KK Enterprise reported a net income of $250,000 and had 100,000 shares of common stock.

KK Enterprise issued 1,000 shares of 10%, par $100 preferred stock outstanding.

KK Enterprise issued, at par, 600, $1,000, 8% bonds, each convertible into 100 shares of common stock.

Compute the diluted EPS. Assume a tax rate of 40%.

Convertible Preferred Stock

Effect on Numerator

If a convertible preferred stock is dilutive, add convertible preferred dividend to the previously calculated income from continuing operations less preferred dividends.

Effect on Denominator

To adjust the basic EPS denominator, you need to consider the equivalent number of common shares that would be created by converting all convertible preferred stock.

Then, the formula becomes,

Diluted EPS =

(Net Income – Preferred Dividends) + (convertible preferred dividend) / Weighted average common shares outstanding + shares from conversion of Conv. Pref. shares

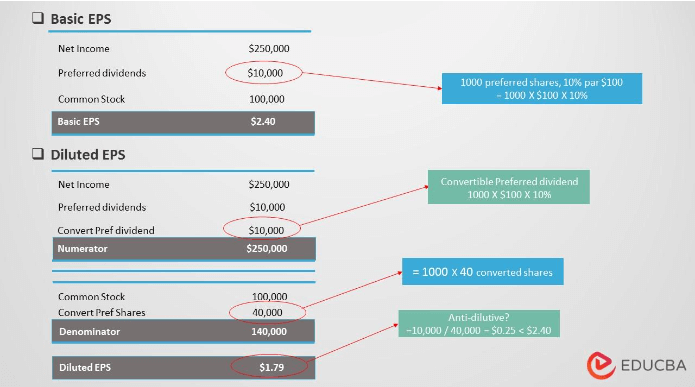

Example 2:

In 2021, KK Enterprise reported a net income of $250,000 and had 100,000 shares of common stock.

In 2021, KK Enterprise issued 1,000 shares of 10%, par $100 preferred stock outstanding, each convertible into 40 shares.

Compute the diluted EPS. Assume a tax rate of 40%.

Advantages of Diluted Earnings Per Share

- An excellent method for determining the profitability of the company.

- Easy-to-grasp method and simple to calculate.

- Evaluates solely on the company’s performance and does not consider the stock market prices of the company.

Frequently Asked Questions(FAQs)

Q1. What is Diluted EPS? Why is it important?

Answer: Diluted EPS (Earnings per Share) is the diluted value of a company’s EPS. It calculates EPS by including the scenario where all convertible securities, like convertible debts, convertible preferred shares, bonds, etc., are changed to shares outstanding.

Diluted EPS determines the profitability of the company. It helps investors decide whether the investment will be successful or not.

Q2. What is the difference between basic EPS and diluted EPS?

Answer: Basic EPS considers only the company’s profit to calculate the EPS. While diluted EPS additionally considers the potentially convertible securities like bonds, debts, and preferred shares. It is a weighted method and gives a weighted average.

Q3. How to calculate diluted EPS? What is the formula for diluted EPS?

Answer: To calculate diluted EPS, consider the conversion of convertible securities.

The formula is,

Diluted EPS= [Net Income – Preferred Dividends] + [Convertible Debt interest * (1- Tax rate)] + [Convertible preferred dividend] /

[Weighted average common shares outstanding] + [Shares from the conversion of convertible preferred shares] + [Shares from the conversion of convertible debt]

Q4. What is a good diluted eps? Is a higher diluted EPS better?

Answer: The lower the diluted EPS, the better. As higher dilution lessens the EPS, it is not a good sign. Thus, a good EPS should be lower in value.

Recommended Articles

To learn more about diluted EPS, you can view the following articles.