Updated August 9, 2023

Part – 7

In our last tutorial, we understood the capital structure of the firm. This article will understand the features of convertible bonds.

Short-term Borrowings: Short-term debt of $5.2million

Revolver: Short-term debt of $14.2 million as it matures within one year

Bonds: Long-term debt of $68 million and Short-term Debt of $12 million

Convertible Bonds

Classification of convertible bonds depends on the current market expenditure. If the current market price (CMP) exceeds the conversion price, one treats all the bonds as long-term debt. However, if the current market price (CMP) is greater than the conversion price, one converts all the bonds to common equity.

Here, CMP = $21 per share

Conversion Price = $25

Since the CMP is less than the conversion price, one should treat $7 million as long-term debt.

Convertible Preferred Stock

Classification of convertible preferred stock depends on the current market price. If the current market price (CMP) is less than the conversion price, all the convertible preferred stock should be treated as Preferred Equity. However, if the current market price (CMP) exceeds the conversion price, all the convertible preferred stock should be converted to common equity.

CMP = $21 per share

Conversion Price = $20 per share.

CMP > Conversion Price.

Hence, one must convert the preferred stock to common equity.

$9 million should be treated as common equity.

What’s Next

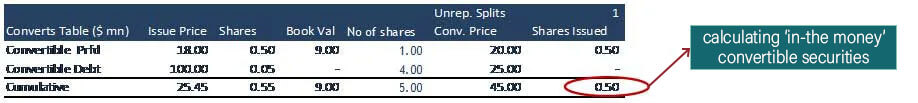

In this article, we understood convertible bond features. Our next article will calculate ‘the money stock options.