Updated July 27, 2023

Degree of Financial Leverage Formula (Table of Contents)

- Degree of Financial Leverage Formula

- Examples of Degree of Financial Leverage Formula (With Excel Template)

- Degree of Financial Leverage Formula Calculator

Degree of Financial Leverage Formula

As its name suggests, financial leverage is the leverage that a company is getting by using debt in its capital structure. An increase in debt in capital structure will increase the financial risk because debt comes with interest payments which the company has to pay irrespective of whether they are making money.

The degree of financial leverage is an important parameter that measures the sensitivity of earnings per share (EPS) to the change in Operating profit (EBIT). This ratio is vital in determining the financial risk associated with the company’s operations.

A high degree of financial leverage signifies that even a small change in leverage can significantly impact the company’s profitability, and a low degree of financial leverage indicates lower financial risk. The reason behind this is really simple; higher leverage increases the interest payments, which is a fixed cost. So if the returns are good, this fixed cost will be spread across, which is good for business, but if a business is not going well, this fixed cost will become troublesome for the company.

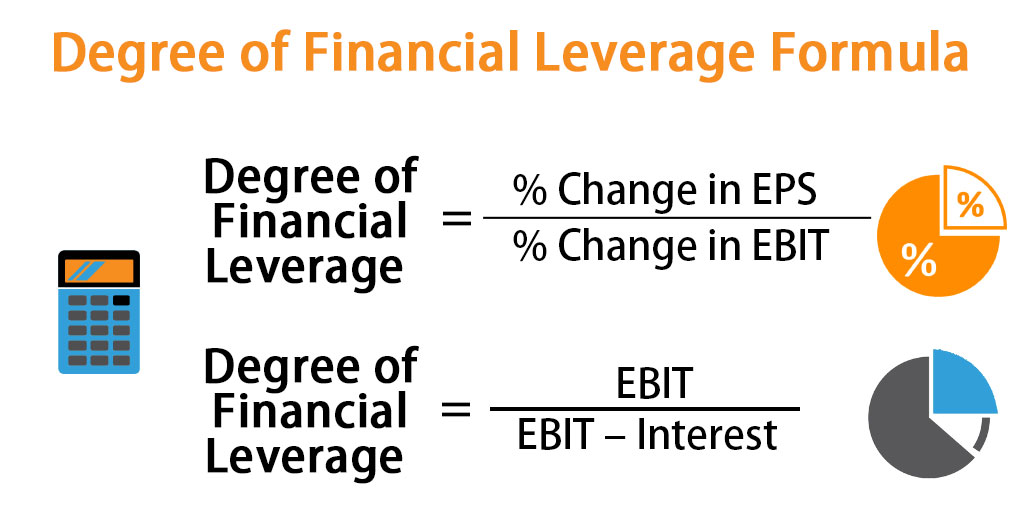

There is no single formula to calculate the degree of financial leverage, and different methods are used based on the purpose of analysis. Two of the methods to calculate the degree of financial leverage is given by:

- EBIT – Earnings before Interest and Tax, also called Operating Profit

- EPS – Earnings per Share

Examples of Degree of Financial Leverage Formula (With Excel Template)

Let’s take an example to understand the calculation of the Degree of Financial Leverage in a better manner.

Degree of Financial Leverage Formula – Example #1

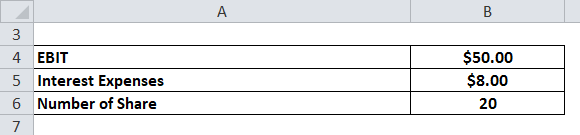

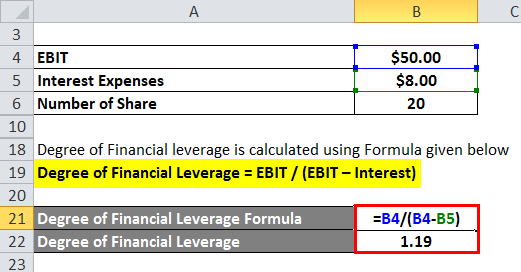

Let’s say company X has an operating income (EBIT) of $50 million and interest expense for that year is $8 million. This is a listed firm on a stock exchange with 20 million shares outstanding. Let’s ignore the tax effect for now.

The formula to calculate Net Earning is as below:

Net Earning = EBIT – Interest Expenses

- Net Earning = $50 -$8

- Net Earning = $42

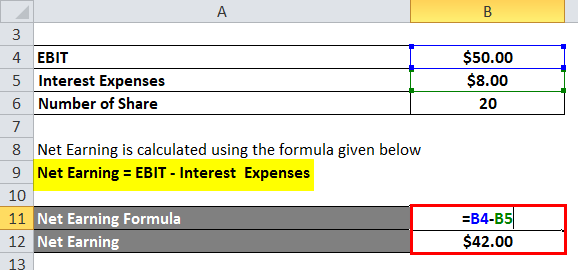

The formula to calculate Earning Per Share is as below:

Earning Per Share = Net Earning / Number of Shares

- Earning Per Share = $42 / 20

- Earning Per Share = $2.10 per share

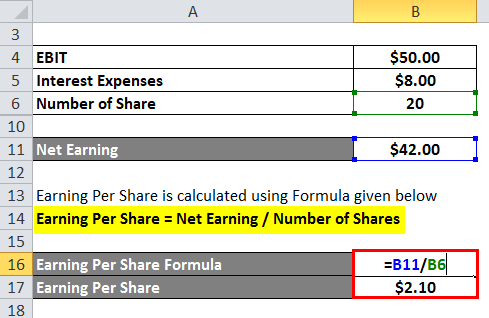

The formula to calculate The degree of financial leverage is as below:

Degree of Financial Leverage = EBIT / (EBIT – Interest)

- Degree of Financial Leverage = $50 / ($50 – $8)

- Degree of Financial Leverage = 1.19

It means that a 1% change in EBIT will change EPS by 1.19%

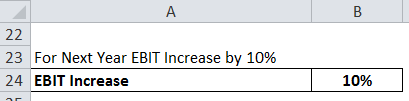

So if for next year, let’s say, EBIT changes by 10%,

So

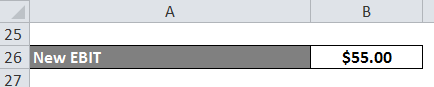

- New EBIT = 50 * 1.1

- New EBIT = $55 million

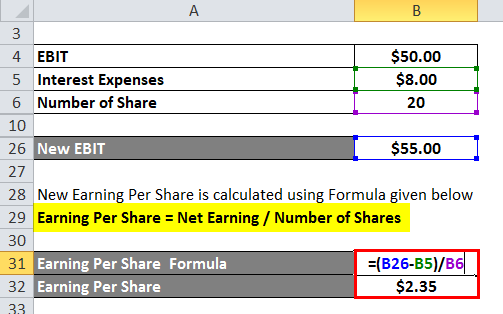

The formula to calculate New Earning Per Share is as below:

Earning Per Share = Net Earning / Number of Shares

- Earning Per Share = ($55 – $8) / 20

- Earning Per Share= $2.35 per share

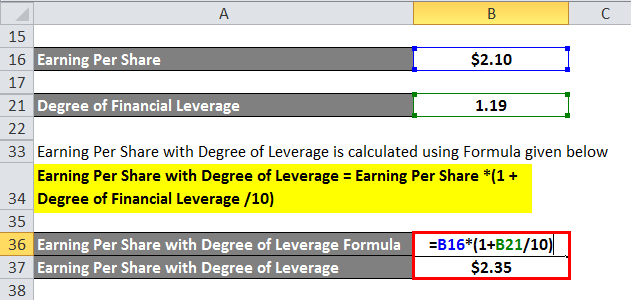

The formula for Earning Per Share with a Degree of Leverage is as below:

Earning Per Share with Degree of Leverage = Earning Per Share *(1 + Degree of Financial Leverage /10)

- Earning Per Share with Degree of Leverage = $2.10 * (1 + 1.19 / 10)

- Earning Per Share with Degree of Leverage = $2.35 per share

Degree of Financial Leverage Formula – Example #2

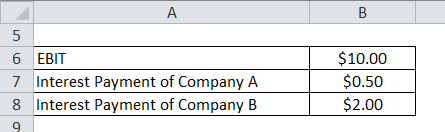

Now let’s take 2 companies with the same operating earnings but a different level of leverage and see their degree of financial leverage. Company A and B have EBIT of $10 million, but company A has less debt in its capital structure, so its interest payment is $0.5 million. But company B has higher debt and interest, say $2 million.

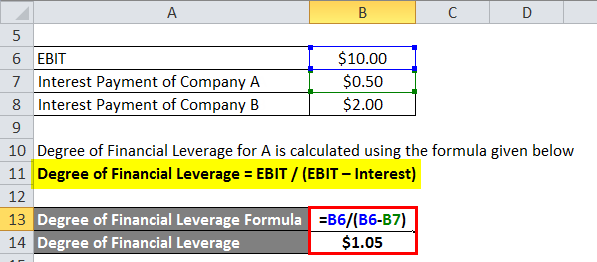

The formula to calculate The degree of Financial Leverage for A is as below:

Degree of Financial Leverage = EBIT / (EBIT – Interest )

- Degree of financial leverage for A = $10 / ($10 – $0.5)

- Degree of financial leverage for A = $1.05

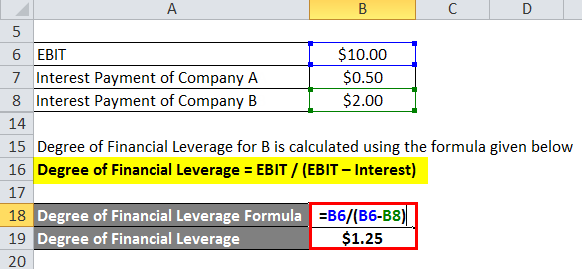

The formula to calculate the degree of Financial Leverage for B is as below:

Degree of Financial Leverage = EBIT / (EBIT – Interest )

- Degree of financial leverage for B = $10 / ($10 – $2)

- Degree of financial leverage for B = $1.25

It means that Company B is more sensitive toward change in EBIT than Company A. 1% change in EBIT will change B’s earnings per share by 1.25%, whereas the same change in EBIT will only result in a 1.05% change in A’s earnings per share.

Explanation of Degree of Financial Leverage Formula

Companies use leverage in their capital structure to increase their return on equity. But leverage, As discussed above, is a very dangerous concept. If a company is not certain about its earnings and profitability, that can be a tricky road. Leverage can multiply the effect on return but can also put a company in bankruptcy. That is why companies should keep a close eye on their leverage and its effect on profitability, and the degree of financial leverage helps them achieve that.

Degree of financial leverage few important parameters of any business financials, i.e. operating income, earning per share, and debt payments (interest expenses). Companies with higher EPS are considered to be favorable investments compared to companies with lower EPS. This is because higher EPS generally results in higher income for investors. Similarly, any business with good operating profits is a good investment since it efficiently uses resources. But debt obligations have the capacity to change the whole equation. Companies with good EPS and EBIT in one period can be distressed if their performance is not good and debt obligations are high.

Relevance and Uses

In a way, the degree of financial leverage helps companies determine the amount of debt they can comfortably manage in their capital structure. The more stable the operating income is, the more stable the EPS will be, and therefore a company can incorporate more debt in its structure. If the operating income is unstable, the company will not have an appetite to include debt since that will further increase the financial risk. But anyone who is using this ratio has to keep in mind that this ratio is not the same for all companies and varies from industry to industry. Companies operating in banking, manufacturing, and retail will generally have a higher degree of financial leverage.

Generally, a higher degree of financial leverage indicates higher risk, which is why many companies operating with a higher degree of financial leverage opt for bankruptcy. The simple reason is they were not making enough profits to cater to their financial obligations.

Degree of Financial Leverage Formula Calculator

You can use the following Degree of Financial Leverage Calculator

| EBIT | |

| Interest | |

| Degree of Financial Leverage | |

| Degree of Financial Leverage = |

| |||||||||

|

Recommended Articles

This has been a guide to the Degree of Financial Leverage formula. Here we discuss How to Calculate the Degree of Financial Leverage and give practical examples. We also provide a Degree of Financial Leverage calculator with a downloadable Excel template. You may also look at the following articles to learn more –