Information Ratio Formula (Table of Contents)

- Information Ratio Formula

- Examples of Information Ratio Formula (With Excel Template)

- Information Ratio Formula Calculator

Information Ratio Formula

Information ratio, or appraisal ratio, is one of the most important ratios used in active management strategy. The information ratio measures the portfolio’s return over and above the benchmark’s return and compares that return with the volatility of those returns.

The benchmark here is usually an index which is a representation of the market. In other words, the information ratio is risk-adjusted return relative to benchmark return. The information ratio measures portfolio managers’ performance, skills, and ability to generate a return over the benchmark. It is also used to measure the consistency in that performance by using tracking errors. Tracking error is a standard deviation of the excess return. A low tracking error signifies portfolio is generating returns over benchmark consistently over time, and high tracking error indicates that returns are very volatile and inconsistent.

The information ratio is very similar to the Sharpe ratio. Still, the difference between these two is that benchmark in the Sharpe ratio is a risk-free rate, whereas in the Information ratio, it is the benchmark’s expected return. So if the benchmark is the same as the risk-free rate, both ratios will be the same.

Information ratio helps us in comparing different funds by standardizing the returns. The formula for the Information ratio is as below:

- Portfolio Return = Portfolio return for the period

- Benchmark Return = Return on the fund used as a benchmark

- Tracking Error = Standard deviation of the difference between the portfolio and benchmark returns

Examples of Information Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Information Ratio in a better manner.

Information Ratio Formula – Example #1

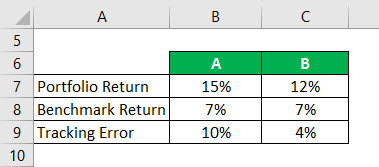

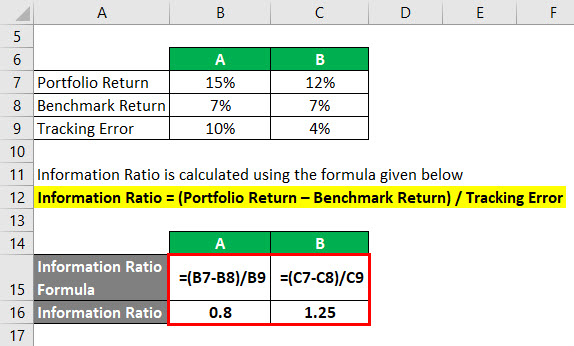

Let’s say you have some money you have saved and want to invest that now in the market. You have down-selected 2 funds, A and B, in which you want to invest, but now you are confused about choosing one among them. To do that, you have decided to compare the Information ratio of both funds. You have used the S&P 500 index as a benchmark.

Solution:

The formula to calculate Information Ratio is as below:

Information Ratio = (Portfolio Return – Benchmark Return) / Tracking Error

For A

- Information Ratio = (15% – 7%) / 10%

- Information Ratio = 8% / 10%

- Information Ratio = 0.8

For B

- Information Ratio = (12% – 7%) / 4%

- Information Ratio = 5% / 4%

- Information Ratio= 1.25

At face value, it seems that fund A is better than fund B, but the information ratio of B is higher than A. This is an indication that Fund B is more consistent in generating excess returns, as compared to Fund A.

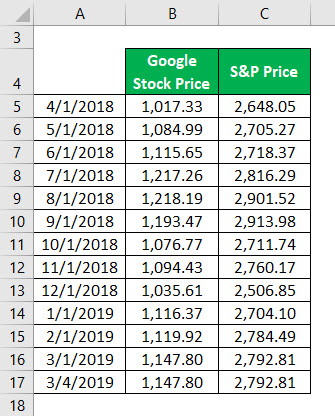

Information Ratio Formula – Example #2

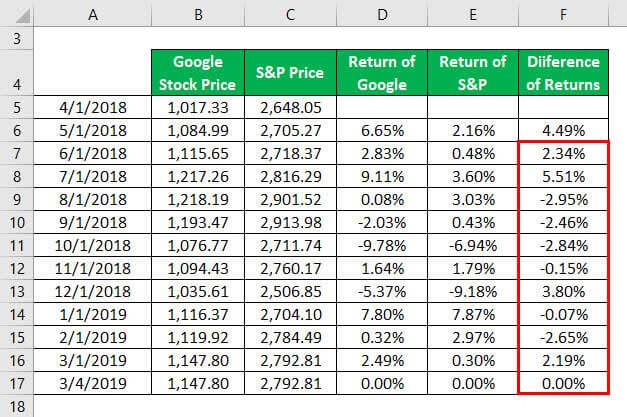

Let’s take Google as an example and calculate the information ratio using the public data available. We are taking the S&P 500 index as a benchmark.

Solution:

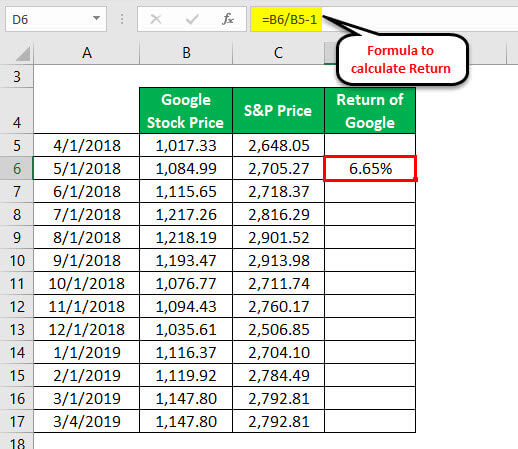

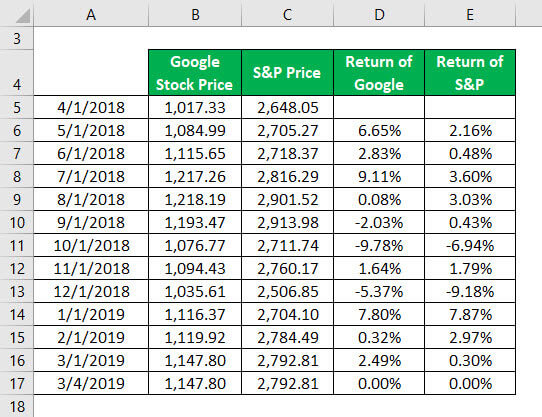

Take the historical share price of Google on a monthly basis and calculate the year-on-year return.

Perform the same activity with the Rest of Google Price and with the S&P index also.

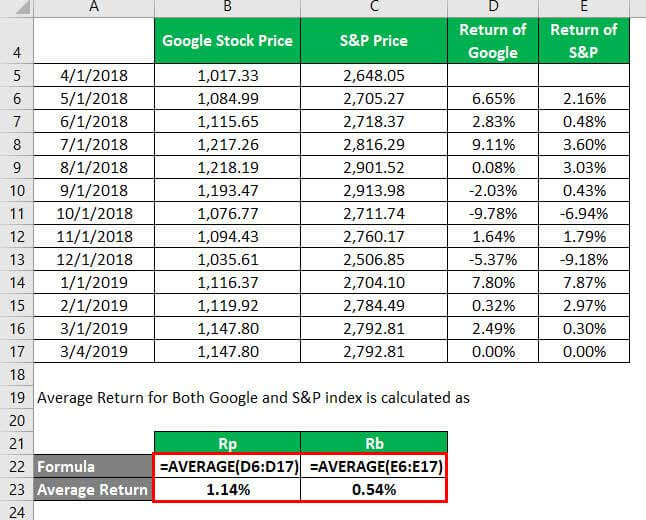

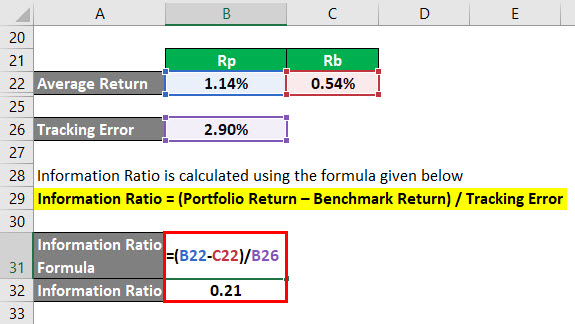

The calculation for Average Return for Both Google and S&P index is as below:

Rp – Average Return of Google

Rb – Average Return of S&P

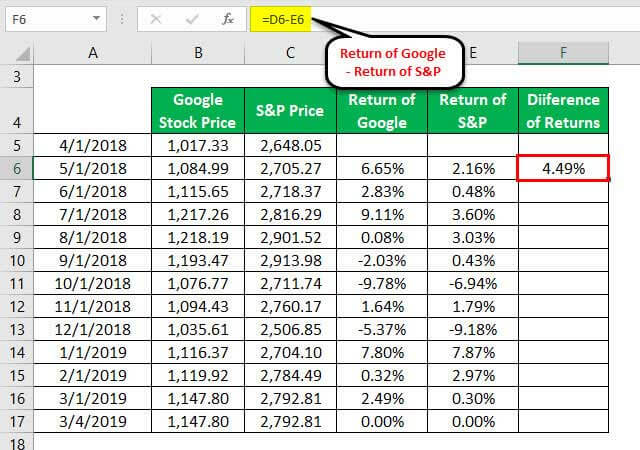

To calculate the tracking Error, we must calculate the difference between both returns.

Similarly, for the other data.

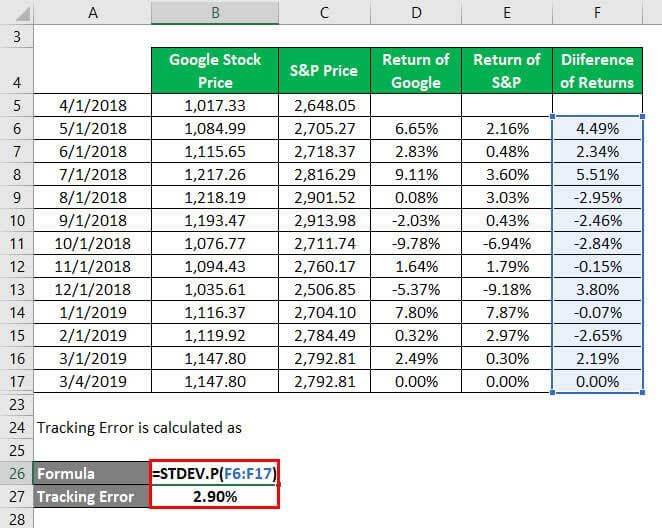

Calculation of Tracking Error:

The formula to calculate Information Ratio is as below:

Information Ratio = (Portfolio Return – Benchmark Return) / Tracking Error

- Information Ratio = (1.14% – 0.54%) / 2.90%

- Information Ratio = 0.60% / 2.90%

- Information Ratio = 0.21

Explanation

Investors can adopt two types of investment strategies: Active Management and Passive management. In Active management, an investor tries to beat the benchmark and obtain over and above benchmark returns. On the other hand, in passive management, investors usually try to mimic the benchmark’s performance or invest in the benchmark itself. Portfolio managers using active management strategies usually have to put much effort into achieving those returns. So they charge hefty fees for management. But it is really necessary to keep track of the excess return and also the consistency of that.

Information ratio helps us in measuring the success of an active management strategy. It considers the excess returns over the benchmark and the standard deviation of those excess returns. It helps us determine the consistency in the fund’s performance and ensure that those excess returns do not result in good luck.

Relevance and Uses of Information Ratio Formula

The information ratio is primarily used as a performance measure by fund managers. Since it takes the return and adjusts that with the volatility, it is more practical compared to Sharpe Ratio. The general rule of thumb is that the higher the Information ratio, the better the performance and consistency. If IR is negative, it means that the portfolio manager cannot even achieve the benchmark return, let alone the excess return. But sometimes, different investors interpret the Information ratio differently. This depends upon the fact that what level of risk tolerance the investor has. Various factors like age, goals, needs, etc., will determine investors’ risk appetite, and these parameters vary from investor to investor. So other financial ratios, along with information ratios, should also be looked at before making any decision.

Information Ratio Formula Calculator

You can use the following Information Ratio Calculator

| Portfolio Return | |

| Benchmark Return | |

| Tracking Error | |

| Information Ratio Formula | |

| Information Ratio Formula = |

|

|

Recommended Articles

This has been a guide to the Information Ratio formula. Here we discuss how to calculate Information Ratio along with practical examples. We also provide an Information Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –