Updated July 29, 2023

Debt to Asset Ratio Formula (Table of Contents)

- Debt to Asset Ratio Formula

- Examples of Debt to Asset Ratio Formula (With Excel Template)

- Debt to Asset Ratio Formula Calculator

Debt to Asset Ratio Formula

The term Debt to Asset ratio is used to analyze what portion of Asset is funded by Debt capital. A business can use mainly two sources of capital to support its business- Equity and Debt. Business deploys capital to either purchase Assets (Current or non-Current) or to fund its operational expense.

(There are different school of thoughts regarding what all liabilities should be included in the term Debt while calculating Debt to Asset Ratio. Some group of Analyst advocates to consider all sort of liabilities to be included in Debt other than common shareholder’s capital whereas the other group are the proponents of considering only interest bearing liabilities as Debt. The article would be considering only interest-bearing liabilities as debts for explaining the Debt to Asset ratio.)

The formula for Debt to Asset Ratio is:

- Total Debts: It includes interest-bearing Short term and Long term debts.

- Total Assets: It includes Current Assets and Non-Current Assets.

Step 1: You can find interest bearing short term debt under the current liabilities section in the Liability side of the Balance Sheet and long term debt under the non-current liabilities section in the Liability side of the Balance Sheet.

Step 2: You can find the Total Assets current as well as non-current assets from the current and non-current assets section of the Asset side of the balance sheet, respectively.

Step 3: Once you performed the above steps to arrive at the Debt to Asset Ratio, you have to divide total debt with total assets.

Examples of Debt to Asset Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Debt to Asset Ratio formula in a better manner.

Example #1

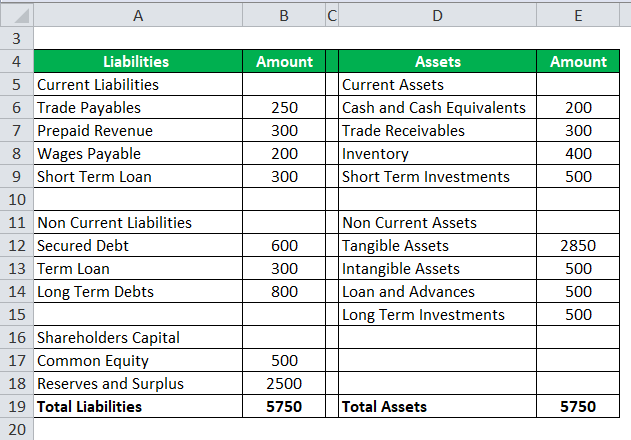

Let’s consider an example to calculate Debt to Asset Ratio, assume company ABC is an FMCG company. At the end of the financial year Balance sheet of ABC looks like this.

Solution:

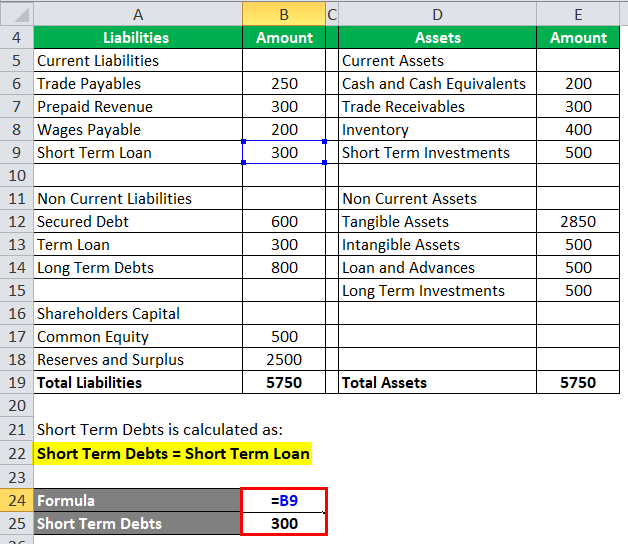

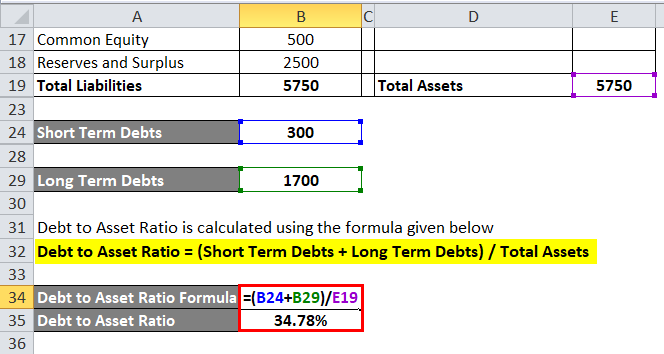

Short Term Debts is calculated as:

Short Term Debts = Short Term Loan

Short Term Debts = 300

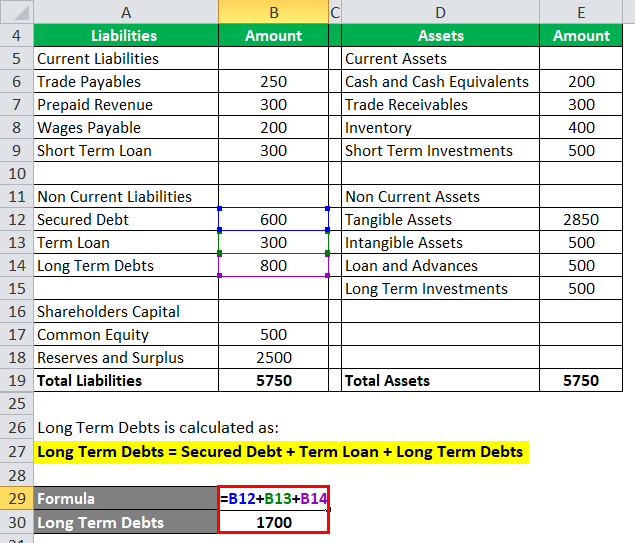

Long Term Debts is calculated as:

Long Term Debts = Secured Debt + Term Loan + Long Term Debts

- Long Term Debts = 600 + 300 + 800

- Long Term Debts = 1700

Debt to Asset Ratio is calculated using the formula given below

Debt to Asset Ratio = (Short Term Debts + Long Term Debts) / Total Assets

- Debt to Assets Ratio = (300 + 1700) / 5750

- Debt to Assets Ratio = 2000 / 5750

- Debt to Assets Ratio = 34.78%

Example #2

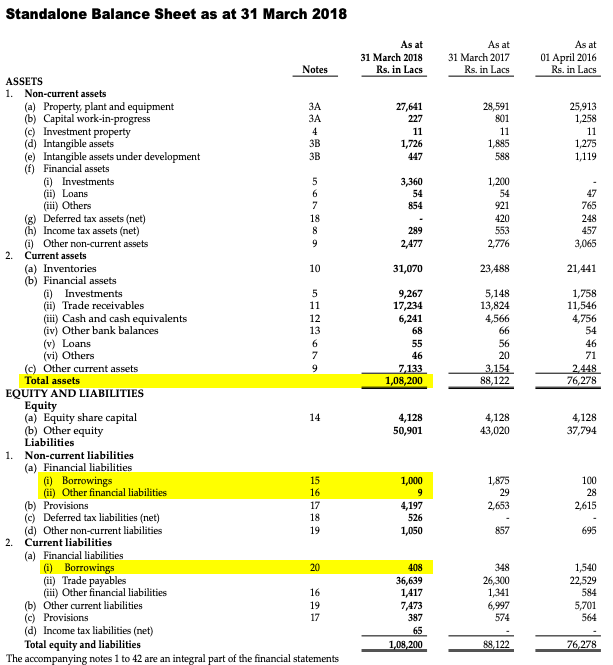

Let’s take another example, this time; we are taking the financials of IFB industries. A publically traded stock in NSE and BSE. The company IFB Industries Ltd is into manufacturing and selling consumer durable goods such as Washing machines and Microwave ovens.

This is the balance sheet of IFB Industries Ltd for the period FY18 (Figures are in INR Lacs)

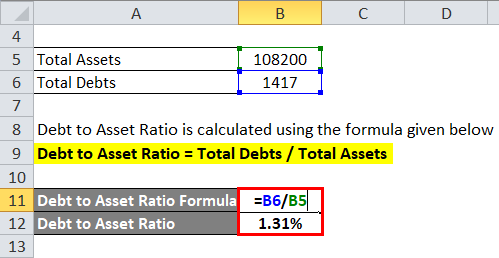

Solution:

Total Assets can be figured out from the asset side of the Balance Sheet

Total Assets =1,08,200 for the period ending 31st March 2018

Total Debts is calculated as:

- Total Debts = Borrowings (15) + Other Financial Liabilities (16) + Borrowings (20)

- Total Debts = 1000 + 9+ 408

- Total Debts =1417

Debt to Asset Ratio is calculated using the formula given below

Debt to Asset Ratio = Total Debts / Total Assets

- Debt to Asset Ratio = 1417 / 1,08,200

- Debt to Asset Ratio = 1.31%

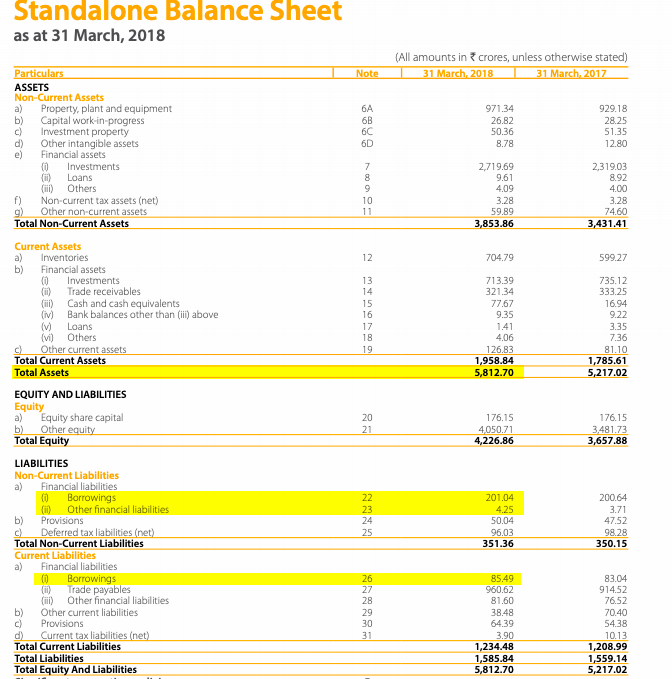

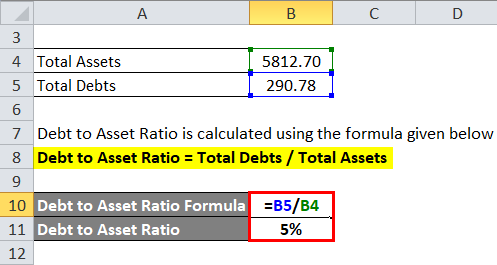

Example #3

Let’s consider one more example; the company in the example is Dabur India Ltd. The company is in FMCG vertical.

This is the balance sheet of Dabur India Ltd for the period FY18 (Figures are in INR crores)

Solution:

Total Assets can be figured out from the asset side of the Balance Sheet

Total Assets = 5812.70 for the period ending 31st March 2018

Total Debts is calculated as:

- Total Debts = Borrowings (22) + Other Financial Liabilities (23) + Borrowings (26)

- Total Debts = 201.04 + 4.25 + 85.49

- Total Debts = 290.78

Debt to Asset Ratio is calculated using the formula given below

Debt to Asset Ratio = Total Debts / Total Assets

- Debt to Asset Ratio = 290.78 / 5812.70

- Debt to Asset Ratio = 5%

Relevance and Uses

For a business to operate and grow, it has to make revenue as well as capital expenditure. For this, firms can take capital either in the form of Equity or Debt. Each source of capital has advantages and disadvantages.

Debt is relatively less costly compared to equity for the Business. But business can’t run fully on debt. So business has to mix its capital structure with equity and some part with debt.

There are industry benchmarks for an optimum capital structure that are perceived to be ideal.

The debt to Asset ratio formula calculates what percent of a Business’s asset is funded using debt. Lesser the usage of debt is perceived to be sub-optimal usage of low-cost capital since debt is a cheap cost of capital and interest expense is a tax-deductible expense, optimum use of debt in the capital structure will help to maximize the shareholder’s wealth.

At the same time, excess debt in the capital structure perceived to be risky as debt is an interest-bearing instrument and demands fixed payments periodically. If the business is not performing well and operating profit is not enough to cover the fixed debt obligation, then this can trigger an event of default and take the company to bankruptcy.

The debt to Asset ratio is mainly used by Analyst, Investors, .and Lenders who track the company for various purpose.

- If Debt to Asset Ratio is >100%: This situation is extremely risky; this means the company has eroded all its net worth and has been making losses, and entire assets, as well as losses, are funded by Debts.

- If Debt to Asset Ratio is = 100%: This situation is also considered to be risky, this means the company has lost all the net worth, and the entire assets are funded by Debt.

- If Debt to Asset Ratio is < 100%: This situation is considered to be less risky, this indicates the Assets of the company are funded by a mix of Debt and Equity Capital.

There is no single Debt to Asset Ratio which is considered to be optimal. The company under evaluation is considered to be safe if its Debt to Asset Ratio is in line with the Industry benchmark in which it is operating.

The debt to Asset Ratio formula is very important to assess the Financial Risk of a Company.

Debt to Asset Ratio Formula Calculator

You can use the following Debt to Asset Ratio Calculator.

| Total Debts | |

| Total Assets | |

| Debt to Asset Ratio Formula | |

| Debt to Asset Ratio Formula | = |

|

|

Recommended Articles

This has been a guide to Debt to Asset Ratio formula. Here we discuss How to Calculate the Debt to Asset Ratio along with practical examples. We also provide Debt to Asset Ratio Calculator with a downloadable excel template. You may also look at the following articles to learn more –