Updated July 13, 2023

Difference Between Cost Center vs Profit Center

People often get confused between cost center and profit center, like which is what exactly. The primary difference between a cost center and a profit center is that a cost center is a department or sub-division within an organization that is responsible for managing the organization’s cost. At the same time, the profit center is also a sub-division in an organization that focuses on maximizing profits by intensifying revenue generation. This article, Cost Center vs Profit Center, would help you understand the differences between the two types of business sub-divisions in more detail.

What is Cost Center?

A cost center is a sub-division within an organization that is responsible for managing the costs incurred within the organization. Typically, it is that part of the business that doesn’t generate any revenue but ensures proper functioning of the key revenue-generating units, and in that process, it incurs costs. The management allocates costs based on these cost centers, focusing on limiting the costs of the cost centers while ensuring that the functions are not impacted. In this way, cost centers help in cost budgeting and cost control.

For instance, various support functions within an operating concern are indispensable parts of the business, such as the accounts & finance department, administration department, human resource department, etc.

What is Profit Center?

A profit center is a sub-division within an organization responsible for maximizing profit by increasing revenue generation from the business. Since it utilizes all the available business resources to generate revenue, it has revenues and costs. Allocating revenues and costs to all the profit centers helps identify the profitability of the various revenue-generating units. In this way, it helps the management make decisions about various profit-generating business operations. In this case, the management’s focus is to increase revenues and reduce costs to optimize the overall profitability of the business units.

A manufacturing company considers the production and sales departments as the profit centers, while a retail store considers the different product categories as the profit centers.

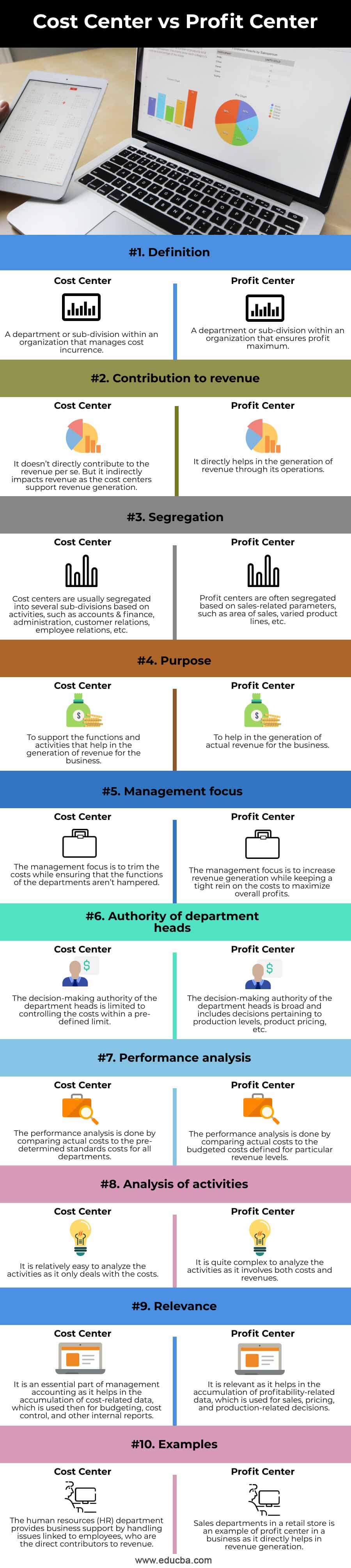

Head To Head Comparison Between Cost Center vs Profit Center (Infographics)

Below is the top Comparison between Cost Center vs Profit Center:

Key Differences Between Cost Center vs Profit Center

Some of the key differences between a cost center and a profit center are as follows:

- An organization determines the incurred costs by establishing sub-divisions called cost centers. In contrast, it ascertains the revenue generated and incurred costs for sub-divisions known as profit centers to determine the profit.

- The primary responsibility of a cost center is to minimize costs. Conversely, a profit center focuses on both minimizing costs and maximizing profit through increased revenue generation.

- To evaluate the performance of a cost center, one compares the actual incurred cost with the standard cost. On the other hand, the performance evaluation of a profit center involves analyzing the actual cost against the budgeted cost.

- A single profit center can have multiple associated cost centers.

Cost Center vs Profit Center Comparison Table

Below is the 10 topmost comparison between Cost Center vs Profit Center:

|

Head |

Cost Center |

Profit Center |

| Definition | A department or sub-division within an organization that manages cost incurrence. | A department or sub-division within an organization that ensures maximum profit. |

| Contribution to Revenue | It doesn’t directly contribute to the revenue per se. But it indirectly impacts revenue as the cost centers support revenue generation. | It directly helps in the generation of revenue through its operations. |

| Segregation | Cost centers are usually segregated into several sub-divisions based on activities, such as accounts & finance, administration, customer relations, employee relations, etc. | Profit centers are often segregated based on sales-related parameters, such as area of sales, varied product lines, etc. |

| Purpose | To support the functions and activities that help generate revenue for the business. | To help in the generation of actual revenue for the business. |

| Management Focus | The management focus is to trim the costs while ensuring that the functions of the departments aren’t hampered. | The management focuses on increasing revenue generation while keeping a tight rein on the costs to maximize overall profits. |

| Authority of Department Heads | The decision-making authority of the department heads is limited to controlling the costs within a pre-defined limit. | The decision-making authority of the department heads is broad and includes decisions about production levels, product pricing, etc. |

| Performance Analysis | The performance analysis compares actual costs to the pre-determined standard costs for all departments. | The performance analysis compares actual costs to the budgeted costs defined for particular revenue levels. |

| Analysis of Activities | It is relatively easy to analyze the activities as it only deals with the costs. | It is quite complex to analyze the activities as it involves both costs and revenues. |

| Relevance | It is an essential part of management accounting as it helps accumulate cost-related data, which is used then for budgeting, cost control, and other internal reports. | It is relevant as it helps accumulate profitability-related data, which is used for sales, pricing, and production-related decisions. |

| Examples | The human resources (HR) department provides business support by handling issues linked to employees, who directly contribute to revenue. | Sales departments in a retail store are an example of a profit center in a business as it directly helps generate revenue. |

Conclusion

So, it can be seen that both cost center and profit center are important parts of any business. Without appropriate support from cost centers, it would be very difficult to sustain a business for a long period of time. But on the other hand, profit centers help achieve the desired profit levels, which is the focus of most stakeholders and external parties.

Recommended Articles

This has been a guide to the difference between Cost Center vs Profit Center. Here we also discuss the Cost Center vs Profit Center key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –