Updated July 24, 2023

Difference Between CFA vs CAIA

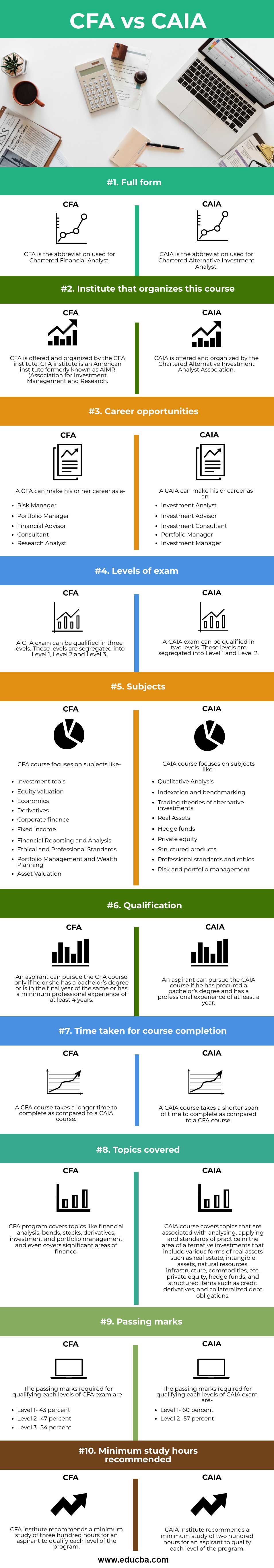

CFA is the short form for Chartered Financial Analyst, whereas CAIA is for Chartered Alternative Investment Analyst. CFA institute organizes the CFA course, whereas the Chartered Alternative Investment Analyst Association organizes the CAIA course. CFA vs CAIA In this, a CFA course can be qualified in three levels, whereas a CAIA course is qualified on two levels. The CFA course focuses on ethical and professional standards, asset valuation, investment tools, portfolio management, and wealth planning.

On the other hand, the CAIA program focuses on subjects like qualitative analysis, indexation and benchmarking, and trading theories of alternative investments. A CFA can apply for the role of a portfolio manager, financial adviser, consultant, chief executive, corporate financial analyst, risk manager, relationship manager, and research analyst. In contrast, a CAIA can apply for the title of the analyst at private equity funds or hedge funds, investment consultant, investment advisor, portfolio manager, and investment manager.

Head To Head Comparison Between CFA vs CAIA (Infographics)

Below are the Top 10 Differences between CFA vs CAIA:

Key Differences Between CFA vs CAIA

The key differences between a CFA and a CAIA course are enlisted and discussed in detail below:

- CFA stands for Chartered Financial Analyst, whereas CAIA stands for Chartered Alternative Investment Analyst.

- The CFA Institute organized a CFA course (formerly known as AIMR), whereas the Chartered Alternative Investment Analyst Association organized a CAIA course.

- A CFA can apply for the job titles of risk manager, financial advisor, portfolio manager, research analyst, and consultant. In contrast, a CAIA can apply for the job titles of investment analyst, investment advisor, investment consultant, portfolio manager, and investment manager.

- A CFA course can be qualified in three levels, namely Level 1, Level 2, and Level 3, whereas a CAIA course can be qualified into two levels, namely Level 1 and Level 2.

- A CFA course offers aspirants the knowledge and expertise in investment tools, derivatives, economics, equity valuation, corporate finance, fixed income, asset valuation, portfolio management and wealth planning, financial reporting, analysis, and ethical and professional standards. A CAIA course offers aspirants the knowledge and expertise in qualitative analysis, real assets, trading theories of alternative investments, indexation and benchmarking, hedge funds, private equity, risk and portfolio management, structured products, and professional standards and ethics.

Exam Fees (Updated 2023)

| CFA Exam Costs | CAIA Exam Costs |

|

|

Exam Date (Updated 2023)

| Levels | CFA Exam Dates | Levels | CAIA Exam Dates |

|

Level 1

|

14-20 February 2023 |

Level 1

|

6-17 Mar 2023 (in-person)

6-12 Mar 2023 (online)

|

| 16-22 May 2023 | |||

| 22-28 August 2023 |

4-15 Sep 2023 (in-person)

4-10 Sep 2023 (online)

|

||

|

Level 2

|

23-27 May 2023 | ||

| 29 August -2 September 2023 |

Level 2

|

20-31 Mar 2023 (in-person)

20-26 Mar 2023 (online)

|

|

|

Level 3

|

21-23 February 2023 | ||

| 29 August -5 September 2023 | 18-29 Sep 2023 (in-person) 18-24 Sep 2023 (online) |

CFA vs CAIA Comparison Table

Let’s discuss the top comparison between CFA vs CAIA:

| Basis of comparison | CFA | CAIA |

| Full-Form | CFA is the abbreviation used for Chartered Financial Analyst. | CAIA is the abbreviation used for Chartered Alternative Investment Analyst. |

| Institute that Organizes this Course | CFA is offered and organized by the CFA Institute. CFA Institute is an American institute formerly known as AIMR (Association for Investment Management and Research. | CAIA is offered and organized by the Chartered Alternative Investment Analyst Association. |

| Career Opportunities |

A CFA can make his or her career as a:

|

A CAIA can make his or her career as an:

|

| Levels of Exam | A CFA exam can be qualified in three levels. These levels are segregated into Level 1, Level 2, and Level 3. | A CAIA exam can be qualified on two levels. These levels are segregated into Level 1 and Level 2. |

| Subjects |

CFA course focuses on subjects like:

|

CAIA course focuses on subjects like:

|

| Qualification | An aspirant can pursue the CFA course only if he or she has a bachelor’s degree or is in the final year of the same, or has a minimum professional experience of at least 4 years. | An aspirant can pursue the CAIA course if he has procured a bachelor’s degree and has a professional experience of at least a year. |

| Time is taken for course completion. | A CFA course takes a longer time to complete as compared to a CAIA course. | A CAIA course takes a shorter span of time to complete as compared to a CFA course. |

| Topics Covered | The CFA program covers topics like financial analysis, bonds, stocks, derivatives, investment, and portfolio management and even covers significant areas of finance. | CAIA course covers topics that are associated with analyzing, applying, and standards of practice in the area of alternative investments that include various forms of real assets such as real estate, intangible assets, natural resources, infrastructure, commodities, etc., private equity, hedge funds, and structured items such as credit derivatives, and collateralized debt obligations. |

| Passing Marks |

The passing marks required for qualifying for each level of the CFA exam are:

|

The passing marks required for qualifying for each level of the CAIA exam are:

|

| Minimum study hours Recommended | CFA Institute recommends a minimum study of three hundred hours for aspirants to qualify for each program level. | CAIA Institute recommends a minimum study of two hundred hours for aspirants to qualify for each program level. |

Conclusion

A CFA course may take a longer duration to complete in comparison to a CAIA program. The CFA course covers stocks, derivatives, financial analysis, investment and portfolio management, bonds, and even legitimate finance.

On the other hand, a CAIA course covers topics on the due analysis, application, and standards of practice in the areas of alternative investment that comprise various ranges of real assets such as real estate, natural resources, intangible assets, infrastructure, commodities, etc., private equity, hedge funds, and structured items such as credit derivatives, and collateralized debt obligations.

A CFA course recommends the candidates devote at least 300 hours of study time to prepare for each level of the CFA exams. In contrast, a CAIA course recommends its candidates devote at least 200 hours of study time to prepare for each level of CAIA exams.

Recommended Articles

This is a guide to CFA vs CAIA. Here we discuss the CFA vs CAIA key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –