Updated July 13, 2023

What is Rolling Budget?

The rolling Budget is defined as a continuous budget that has to be regularly updated when the period of the budget expires. Thus, the rolling budget signifies continuation apprising the existing budget placed by the management, and is also regarded as the extension of the existing budget. Therefore, it is also classified as a rollover budget.

Explanation of Rolling Budget

It is also termed the rollover, which is the continuation of the existing budget. The rolling budgets generally consist of the targets placed by the organization’s management. The rollover budgets are updated on an annual basis, quarterly basis, as well as every month.

The rollover budget also helps establish the benchmarks that the employees anticipate earning. It additionally places financial and performance-oriented goals in place for the current fiscal period. When the current fiscal period expires, the budgeting team reviews the budget again. If the budget requires some additions, it is accordingly modified and rolled over to the next fiscal period. The management and maintenance of the rolling budgets generally require hiring skilled resources as there are various methodologies to create the rolling budget. It can be prepared using incremental budgeting, activity-based budgeting, kaizen-based budgeting, and on zero-based budgeting. Generally, if the targets established by the management are of very high levels, it can cause severe attrition for the organization.

The employees may get demotivated from the work itself and may then look out for a better role. Generally, management should look forward to and adapt to the kaizen-based rolling budget by assessing and reviewing the continual scope of improvements in how the organization delivers outputs and achieves better results. The scope of continuous improvement ensures that the organization displays more productivity, quality, and efficiency.

Examples of Rolling Budget (With Excel Template)

Let’s take an example to understand the calculation of the Rolling Budget in a better manner.

Example #1

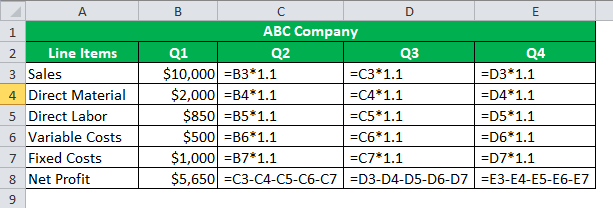

Let us take the example of the ABC company. The business is keen to establish a rolling budget to generate favorable earnings for themselves. It is assumed that the business grows at the rate of 10 percent on quarter to quarter basis. The sales are expected to be $10,000, and the direct material and direct labor will be $2,000 and $850, respectively. The variable costs amount to $500, and the fixed costs are $1,000. Basis the constant growth rate helps the business formulate a rolling budget.

The below excel template displays the computations of the rolling budget: –

The following are the results:

| ABC Company | ||||

| Line Items | Q1 | Q2 | Q3 | Q4 |

| Sales | $10,000.00 | $11,000.00 | $12,100.00 | $13,310.00 |

| Direct Material | $2,000.00 | $2,200.00 | $2,420.00 | $2,662.00 |

| Direct Labor | $850.00 | $935.00 | $1,028.50 | $1,131.35 |

| Variable Costs | $500.00 | $550.00 | $605.00 | $665.50 |

| Fixed Costs | $1,000.00 | $1,100.00 | $1,210.00 | $1,331.00 |

| Net Profit | $5,650.00 | $6,215.00 | $6,836.50 | $7,520.15 |

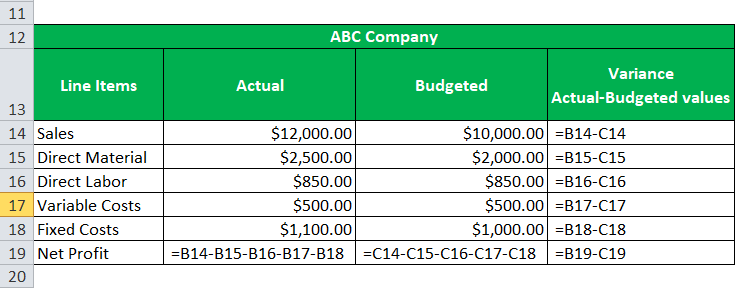

The business, on actual levels, generated sales of $12,000, incurring $2,500 and $850, respectively, for the direct materials and direct labor. The variable costs amounted to $500, and the fixed cost amounted to $1,100 respectively. Help the management perform variance analysis, basis the results, and suggest whether they should roll out a similar budget for the upcoming quarters.

The following are the computations in Excel that display variance analysis computation: –

The following are the results: –

| ABC Company | |||

| Line Items | Actual | Budgeted | Variance Actual-Budgeted values |

| Sales | $12,000.00 | $10,000.00 | $2,000.00 |

| Direct Material | $2,500.00 | $2,000.00 | $500.00 |

| Direct Labor | $850.00 | $850.00 | $0.00 |

| Variable Costs | $500.00 | $500.00 | $0.00 |

| Fixed Costs | $1,100.00 | $1,000.00 | $100.00 |

| Net Profit | $7,050.00 | $5,650.00 | $1,400.00 |

The management should continue using the current budget structure and roll it over to the upcoming quarters.

Factors Affecting the Rolling Budget

- It generally requires the management’s attention since such a budget is not static but dynamic. Therefore, it needs updated parameters on a regular basis.

- The rolling budget generally adopts the learner’s approach as there is requires the involvement of limited and authorized individuals that basically help create and maintain such budgets.

- It is prepared continuously and generally requires more time in preparation than static budgets.

- It also requires revision on a regular basis to the dynamic nature of such models.

Advantages

Following are the advantages are given below:

- The Preparation of the rolling budget generally requires less time, wherein such budgets are generally classified as the extension of the existing one in place and may also incorporate necessary modifications to it.

- In the event of any unanticipated happening, the rolling budget could be easily modified.

- It can be utilized to assess actual performance concerning the existing budget.

- The rolling budget shares better insights, objectives, and responsibility for the company’s employees and management.

- It highlights potential weaknesses as well as strengths that prevail in the organization. In order to eliminate any key weaknesses and work towards developing strengths, it aids in setting up the planning phase.

- It additionally helps in performing the variance analysis.

Disadvantages

Following are the disadvantages are given below:

- The rolling budget generally functions well if there is robust management in place along with skilled manpower.

- It can create conflicts and a state of confusion and make employees lose focus on their work due to constant and abrupt changes.

- It should not be applied to those organizations where the conditions do not modify on a frequent basis and there is no incorporation of transformation policies in place.

- Employees may get demotivated if the organization’s goals and objectives are difficult to achieve.

- Updating and maintaining the rolling budget could also be very hard and expensive. It requires absolutely skilled manpower to assess actual performance with the budgeted performance. Moreover, it requires additional manpower to update such budgets on a regular basis.

Conclusion

The rolling budget is defined as the extension of the existing budget in place. The frequency of the existing budget could be monthly, yearly, or on quarterly basis. The rolling budget is also classified as the budget rollover. In short, It can be compared continuous budget or a type of budget that brings in new waves, and it is in continuation with the existing budget. On the other hand, it can be dynamic, requiring frequent revision or updating. Therefore, to formulate a comprehensive rolling budget, the management generally hires experts from the finance field.

Recommended Articles

This is a guide to Rolling Budget. Here we also discuss the introduction, example of a rolling budget, and advantages and disadvantages. You may also have a look at the following articles to learn more –