Updated July 31, 2023

Difference Between Chief Executive Officer vs Managing Director

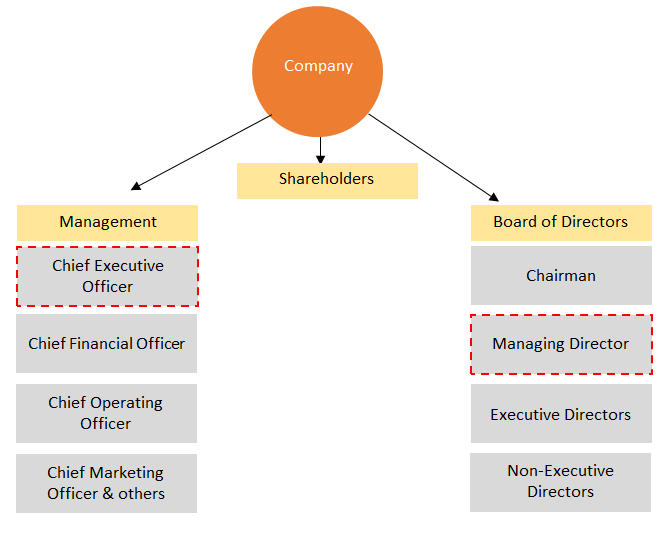

The two key and senior-most company members are the Chief Executive Officer and Managing Director. The duties of the CEO are often confused with those of the MD and vice versa. However, both Chief Executive Officer vs Managing Director can perform duties similarly to each other. Still, the mere existence of these two corporate titles indicates that there will be a substantial difference in their roles. Both report to the Board of Directors. More recently, organizations have started identifying the significance of the two roles and incorporated them into their structure.

Chief Executive Officer: A senior executive of a company’s management who makes important decisions related to a company.

Managing Director: A senior member of the Board of Directors after the Chairman / Vice-Chairman who manages the everyday operations of the company

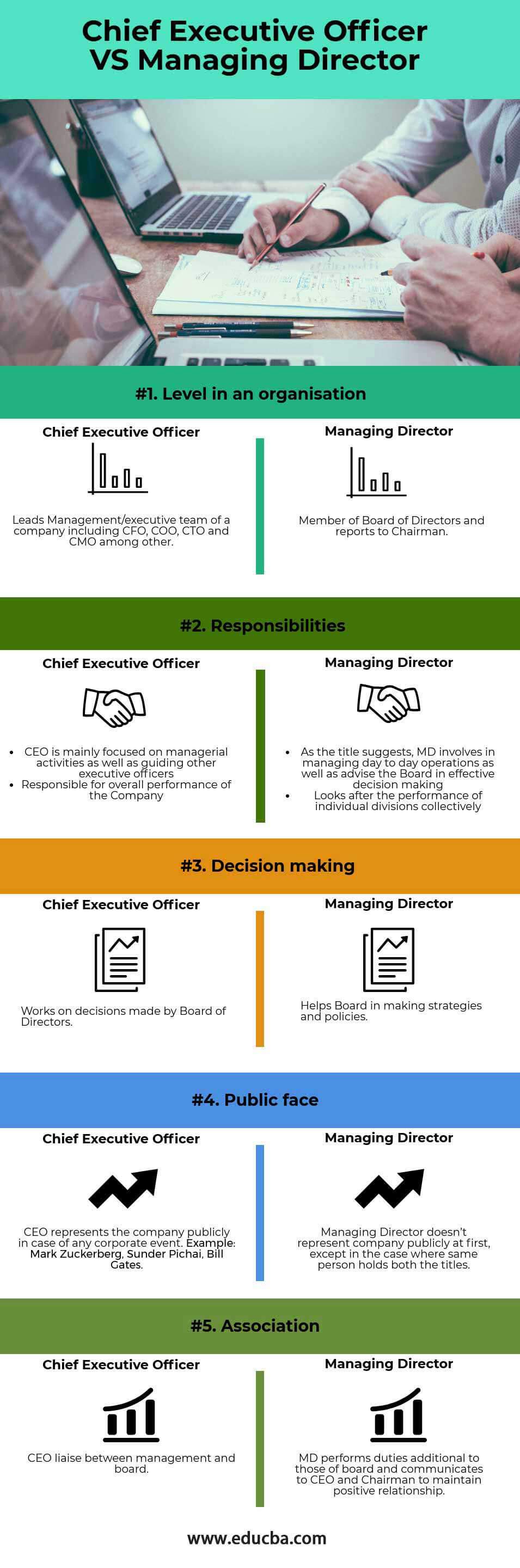

Chief Executive Officer vs Managing Director Infographics

Below is the top 5 difference between Chief Executive Officer vs Managing Director.

Key Differences Between Chief Executive Officer vs Managing Director

Both Chief Executive Officer and Managing Director are the organization’s topmost and most important positions. Let us discuss some of the major differences :

CEO & MD plays a vital role in an organization. There are a few pointers that differentiate one from another:

- CEO leads the management of the company, while MD is led by the Chairman of the Board

- CEO is focused on future-oriented goals, whereas MD handles day to day operations of the company

- As a firm representative, the CEO handles the outside world, like media and other public events, whereas MD plays the main role inside the firm.

- Both Chief Executive Officer vs Managing Director reports to the Chairman. On the other hand, in many cases, MD reports to the CEO as well.

- Main responsibilities:

1. CEO

- Achieving strategic goals set up under corporate governance

- Making long-term and short-term strategies for the company

- Appointing managers and heads of various departments

- Proposed delegation of power to other executives, which is approved by the Board of Directors

2. MD

- To attain goals in line with the mission and vision devised by the Board of Directors

- Reviewing the performance of the company of various departments and taking corrective measures

- The hiring of supporting staff and supervising people of various departments such as sales, production, procurement, etc

- Monitoring expenditures and keeping the profitability of the company intact

- Supporting CEO for improvement of operations

Figure:1 – Corporate Structure of a Company

Chief Executive Officer vs Managing Director Comparison Table

Let’s look at the topmost Comparison between Chief Executive Officer vs Managing Director

| Basis Of Comparison | Chief Executive Officer | Managing Director |

| A level in an organization | LeadsManagement/executive team of a company, including CFO, COO, CTO, and CMO, among other | Member of the Board of Directors and reports to the Chairman |

| Responsibilities | CEO is mainly focusing on managerial activities as well as guiding other executive officers

Responsible for the overall performance of the Company |

As the title suggests, MD involves in managing day-to-day operations as well as advising the Board in effective decision making

Looks after the performance of individual divisions collectively |

| Decision making | Works on decisions made by the Board of Directors | Helps the Board in making strategies and policies |

| Public face | CEO represents the company publicly in case of any corporate event. Examples: Mark Zuckerberg, Sundar Pichai, Bill Gates | Managing Director doesn’t represent the company publicly at first, except in the case where the same person holds both the titles |

| Association | CEO liaises between management and the board | MD performs duties additional to those of the board and communicates with the CEO and Chairman to maintain a positive relationship |

Common Goals of Chief Executive Officer vs Managing Director

- Running a firm successfully: Irrespective of internal and external factors, the ultimate goal of the CEO & MD is to achieve a business objective and run the company’s operations smoothly.

- Code of conduct: The CEO / MD expects to maintain integrity as a CEO is no less than a firm representative of the outside world. On the other hand, MD mainly represents the firm internally by leading and motivating company employees and by setting up examples.

- Accountable to the Board of Directors: The CEO / MD must keep the Board informed on the status of policies, goals, and targets defined under corporate governance.

CEO and MD as Separate Roles

The increasing complexities in the current business environment have increased the importance of having two different positions. The concept of separate MD and CEO started from US-based firms, and it got acceptance by the UK and European-based entities due to increased difficulties in the corporate environment.

Although the roles and responsibilities of both titles depend on factors such as legal structure, size of the company, and Article of Association defined under Corporate Governance, which may vary from company to company, in small organizations, creating a different level is not required.

Scenarios that Define the Roles

Multiple titles:

In many cases, a person can hold both CEO and MD simultaneously, subject to laws defined by the Article of Association.

- A person with multiple titles like CEO, MD, and Chairman is mainly found where the company belongs to Founder or has been running as a family business for generations. Example: Mukesh Ambani – Chairman and Managing Director of Reliance Industries; Mark Zuckerberg – CEO and Chairman of Facebook

Ideal practice:

Separating these two posts is desirable and considered a good governance practice in public and large private companies as it avoids overlapping powers & authority.

Example:

Elon Musk, CEO and Ex-Chair of Tesla resigned as Chairman in October 2018 under fraud charges.

- These allegations came to light after his statement of taking his company (Tesla) private, indicating unreported funds’ availability.

- As a part of a settlement agreed by SEC, he had to step down as Chairman along with a penalty of $20m while keeping the position of CEO intact.

- The main objective of separating his position of CEO from Chairman is to make him focus solely on the company’s operation and not on shareholders’ demand.

Conclusion

Chief Executive Officer vs Managing Director has a common goal of managing and executing operations where the MD can play an advisory role. Avoiding dysfunctional group dynamics and maintaining the independence of individual roles is considered ideal by ensuring that the same person does not hold the same position. Their main goal is to run a business successfully and maximize shareholder wealth. The functional role of the two might be similar to each other, but there will always be legal distinctions between the two. While the primary authority to define missions, visions, and governance is vested in shareholders and the Board of Directors. Board further delegates the powers to the CEO and MD to manage the organization and routine operations of the company. CEO / MD is answerable to the Board of Directors for the performance and all circumstances that may significantly impact an organization.

Recommended Articles

This has been a guide to the top difference between Chief Executive Officer vs Managing Director. Here we also discuss the Chief Executive Officer vs Managing Director key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.