Updated July 29, 2023

Salvage Value Formula (Table of Contents)

- Salvage Value Formula

- Examples of Salvage Value Formula (With Excel Template)

- Salvage Value Formula Calculator

Salvage Value Formula

The value of particular machinery (any manufacturing machine, engineering machine, vehicles etc.) after its effective life of usage is known as Salvage value. In other words, when depreciation during the effective life of the machine is deducted from Cost of machinery, we get the Salvage value.

The formula for Salvage Value –

Where,

- S = Salvage Value

- P = Original Price

- I = Depreciation

- Y = Number of Years

Examples of Salvage Value Formula (With Excel Template)

Let’s take an example to understand the calculation of Salvage Value formula in a better manner.

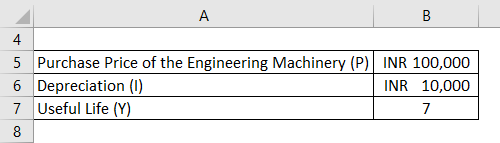

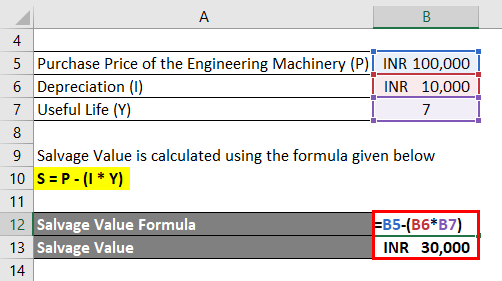

Salvage Value Formula – Example #1

Engineering machinery costing INR 100,000 has a useful life of 7 years. The amount of depreciation is INR 10,000 / year. Calculate the Salvage value of the machinery after 7 years.

Solution:

Salvage Value is calculated using the formula given below

S = P – (I * Y)

- Salvage Value =INR 100,000 – (INR 10,000 * 7)

- Salvage Value =INR 100,000 – 70,000

- Salvage Value = INR 30,000

Therefore, the salvage value of the machinery after its effective life of usage is INR 30,000.

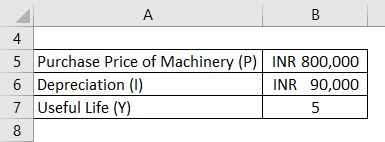

Salvage Value Formula – Example #2

Proctor & Gamble has installed machinery costing INR 800,000 has a useful life of 5 years. The amount of depreciation is INR 90,000 / year. Calculate the Salvage value of the machinery after 5 years.

Solution:

Salvage Value is calculated using the formula given below

S = P – (I * Y)

- Salvage Value =INR 800,000 – (INR 90,000 * 5)

- Salvage Value =INR 800,000 – 4,50,000

- Salvage Value = INR 350,000

Therefore, the salvage value of the machinery after its effective life of usage is INR 350,000.

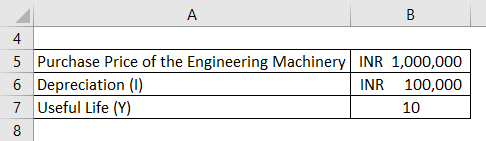

Salvage Value Formula – Example #3

BHEL Limited installed Engineering machinery costing INR 1,000,000 has a useful life of 10 years. The amount of depreciation is INR 100,000 per year. Calculate the Salvage value of the machinery after 10 years.

Solution:

Salvage Value is calculated using the formula given below

S = P – (I * Y)

- Salvage Value =INR 1,000,000 – (INR 100,000 * 10)

- Salvage Value =INR 1,000,000 – 10,00,000

- Salvage Value = INR Nil

Therefore, the salvage value of the machinery after its effective life of usage is Nil.

Explanation

Salvage value actually tries to capture the remaining scrap of a particular machine, after its useful life of usage. Most of the time Companies buys new machinery after completion of the effective life of usage and sells the old machine on the basis of its scrap value. Again, the depreciation which was provided during the effective life of the machinery (in terms of money) actually revolves within the working capital of the company. The cost and installation of the machinery of new come from the bank balance of the company.

The salvage value formula requires information like purchase price of the machinery, depreciation amount, mode of depreciation, expected life of the machinery etc. to get the actual value of the scrap or the salvage amount of the machinery. Sometimes due to better than expected efficiency level, the machine tends to operate smoothly in spite of completion of tenure of expected life.

Depreciation is calculated in monetary terms. Due to regular wear and tear of the machinery, the efficiency level decreases and the output tends to decrease in the course of time. Thus to reflects this in the Financial statement of the Business, Depreciation is treated as an expense and is calculated in monetary terms. There are two types of depreciation methods which are used in Finance. These are “Straight-line depreciation” and “Diminishing balance method of depreciation”. In Straight-line depreciation fixed amount of depreciation is followed whereas in Diminishing balance, a fixed rate is followed and the amount of depreciation decreases along with the changing value of the opening balance of the machinery.

Thus, after deducting the depreciation over the expected years, the remaining amount is treated as the ‘Salvage amount’ and in the language of Finance, it is believed the operating power of the machinery is finished and the value of the parts is only available for sale.

Relevance and Uses of Salvage Value Formula

- Most of the Business (primarily manufacturing) are dependent on machines and their business is highly dependent on the productivity of the existing machines. Nature, quality, the effectiveness of their products is highly dependent on the way of production of the products. Thus, all the above criteria have to be fulfilled to make the product cost effective and efficient both for the consumer’s and manufacturer’s point of view. Thus, to stay in the competition higher efficiency is required for the machine.

- Before buying a machine, any manufacturer prepares its budget which includes the effective life, number of units it can produce, working life, installation costs, cost of replacement etc. Tracking of the effectiveness of the machine is required so as to track the performance of the machine and it would be compared with the expected performance.

- The scrap value is also important during the selling of the machinery which determines the selling price as the amount is re-utilized for purchasing of new machinery. However, the scrap value might be a barometer of resale value but the Selling price is determined by the buyer. It also depends on the demand and supply of the particular machine in the open market. Sometimes a higher price can be obtained when there are a higher demand and lesser supply of that particular machinery.

- The manufacturer sometimes uses the machine more than the expected life of the machinery when the efficiency level of the machine is intact and the Management feels that the products which are produced from the machine are still fit for the competition and the method of production is still relevant and vice versa. In some cases, the machine becomes operational before the expected tenure, so the salvage value becomes Nil in those kinds of situations.

Salvage Value Formula Calculator

You can use the following Salvage Value Calculator

| P | |

| I | |

| Y | |

| Salvage Value Formula = | |

| Salvage Value Formula = | P – (I * Y) |

| = | 0 – (0 * 0) |

| = | 0 |

Recommended Articles

This has been a guide to Salvage Value formula. Here we discuss how to calculate Salvage Value along with practical examples. We also provide a Salvage Value calculator with downloadable excel template. You may also look at the following articles to learn more –