Updated November 17, 2023

Difference Between Analyst vs Associate

Investment Bank Analyst is the lowermost designation in the hierarchy of an investment bank. In terms of the work-life of an Investment Banking Analyst, involves slogging for long hours in front of your PC, a lot of work pressure and stress, monotonous activities, enormous Excel data feeding, etc. However, all this turns fruitful once you move up the ladder, start handing deals on your own, and get paid well, along with good incentives. An Associate must take care of many things and perform various activities simultaneously. Associates gradually build sector expertise in their line of business and start identifying business opportunities in their sectors.

Let us study much more about Analyst vs Associate in detail:

Investment banks are financial institutes that assist corporations, governments, and institutions typically in carrying out either of the following activities:

- Merger & Acquisition.

- Raising funds through Equity Markets (i.e. Equity Capital Market Deals).

- Raising funds through Debt Markets (i.e. Debt Capital Market Deals).

Some of the well-known investment bankers are:

- JP Morgan

- Bank of America Merill Lynch

- Citi Bank

- Barclays Capital

- Goldman Sachs

- Morgan Stanley

- Barclays

- Credit Suisse

- Deutsche Bank

The typical organizational hierarchy of an investment bank is as follows (from lower to higher):

- Analyst

- Associate

- Vice President

- Senior Vice President

- Managing Director

Above mentioned hierarchy could differ from organization to organization by adding some more intermediate positions, but more or less, it remains in the same order.

In this Analyst vs Associate article, we will discuss the role of Analyst vs Associate in an investment bank. Both Analyst and Associate designations exist in front-end and back-end roles in an investment bank, but here we would be talking about the front-end role (i.e. client-facing role) in an investment bank.

Before starting with the comparison, the Following are some of the key skills required to work in an investment bank:

- Financial Modeling.

- Relationship Management.

- Negotiation Skills.

- Pitchbook preparation and presentation skills.

- Business Valuation.

- Sales, Marketing, and Business Development.

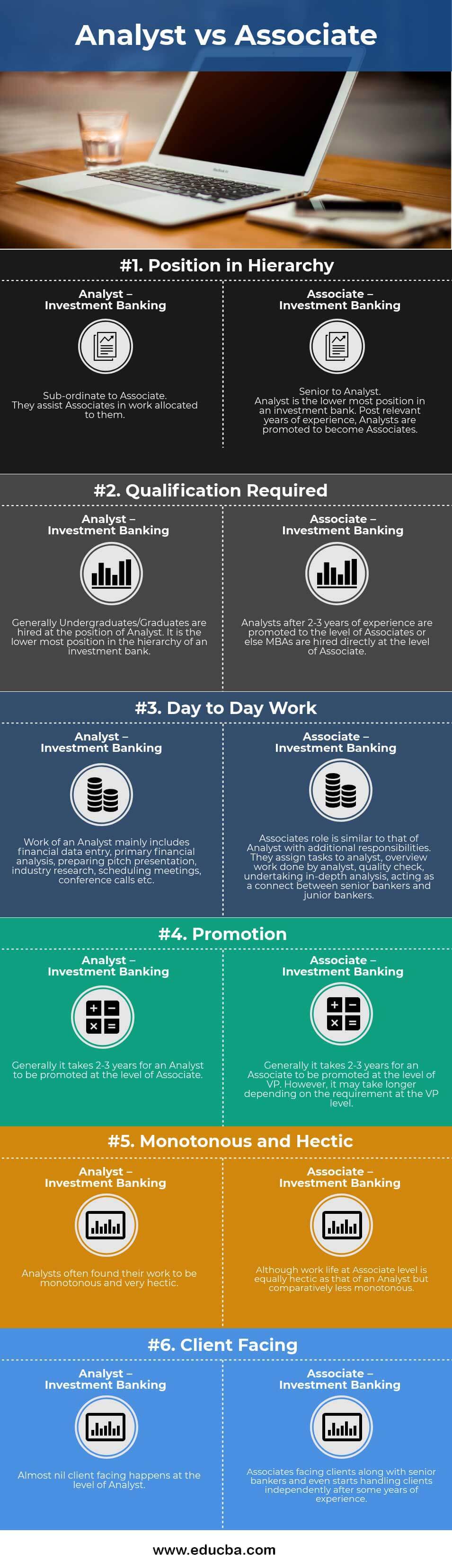

Head To Head Comparison Between Analyst vs Associate (Infographics)

Below is the top 6 difference between Analyst vs Associate :

Key Differences Between Analyst vs Associate

Both Analysts vs Associate are popular choices in the market; let us discuss some of the major differences:

Analyst

Generally, companies hire graduates from top colleges at the Analyst level under a two-year or three-year program.

However, top-grade investment banks like JP Morgan hire Chartered Accountants, Chartered Financial Analysts, and MBAs from top colleges as Investment Banking Analysts. There is a good gap in the salaries of a graduate hired as an Investment Banking Analyst and an MBA/CA/CFA hired at the same level. Despite being an entry-level point of an investment bank, the best of the students from top colleges are shortlisted for the role, and only the best of the best get through the stringent interview process.

Candidates need an adequate skill set to qualify for an investment banking analyst role. Some of the key skills required are:

- Good Finance Knowledge.

- Good Excel Skills.

- Good Communication Skills.

- Good PowerPoint Skills.

- Ability to understand Macro and Microeconomics and its impact.

Day to Day work of an Investment Banking Analyst mostly revolves around the following activities:

- Data Entry of Financials.

- Pitch Presentation.

- Preliminary Analysis of Sector and Company.

- Arranging for Meetings, Conferences, etc.

- Correlating Macro and Micro Economic Parameters.

Associate

After spending 2-3 years as an Investment Banking Analyst, based on your capabilities and developed skillset, you will most likely be promoted to Associate Investment Banker. Investment Banks prefer in-house promotion rather than lateral hiring at an Associate level, as Analysts working with them are well-trained and understand the organization’s culture better. However, one must have adequate experience working in another investment bank to be eligible for lateral hiring in Investment banks.

Investment banks typically have three main business verticals i.e. Merger & Acquisition, Equity Capital Market, and Debt Capital Market. An Analyst supports all three functions and is pooled in as required. However, at the Associate level, investment bankers are segregated based on an area of specialization. Going ahead, Associates in respective business verticals focus on expanding their line of business.

Day to Day work of an Associate is similar to that of an Analyst but with more sophistication, detail, and specialization. Associates supervise analysts working under them and guide them based on the requirement; they review the work of analysts, undertake in-depth company analysis, perform due diligence, takes care of compliances being met, accompany seniors in client meeting and client presentation, and eventually handle complete deal on their own. The work life of an associate is equally hectic but comparatively less monotonous. After spending 2-3 years as an Associate, he can be promoted to the VP level.

Analyst vs Associate Comparison Table

Below is the topmost Comparison between Analyst vs Associate :

| Basis Of Comparison |

Analyst – Investment banking |

Associate – Investment banking |

| Position in Hierarchy | Sub-ordinate to Associate.

They assist Associates in work allocated to them. |

Senior to Analyst.

An analyst is the lowest position in an investment bank. Post relevant years of experience, Analysts are promoted to become Associates. |

| Qualification Required | Generally, Undergraduates/Graduates are hired in the position of Analyst. It is the lowest position in the hierarchy of an investment bank. | Analysts after 2-3 years of experience, are promoted to the level of Associate, or else MBAs are hired directly at the level of Associate. |

| Day To Day Work | The work of an Analyst mainly includes financial data entry, primary financial analysis, preparing pitch presentations, industry research, scheduling meetings, conference calls, etc. | The associate’s role is similar to that of an Analyst with additional responsibilities. They assign tasks to an analyst, overview work done by an analyst, quality check, undertake in-depth analysis, and act as a connection between senior bankers and junior bankers. |

| Promotion | Companies generally take 2-3 years to promote an Analyst to Associate. | Companies generally take 2-3 years to promote an Associate to VP. However, it may take longer, depending on the requirement at the VP level. |

| Monotonous and Hectic | Analysts often found their work to be monotonous and very hectic. | Although work-life at the Associate level is equally hectic as an Analyst’s, comparatively less monotonous. |

| Client Facing | Almost nil client-facing happens at the level of Analyst. | Associates are facing clients along with senior bankers and even start handling clients independently after some years of experience. |

Conclusion

Although Investment Banking seems glamorous and a high-paying career opportunity for newly qualified job aspirants, it is equally challenging. It requires a lot of hard work and effort. Many people, who join investment banks looking only at its glamorous side, often leave this career field due to incapacity to handle the pressure and stress associated with it. One must be on its toes in an Investment Bank to identify and grab the opportunity before anyone else. Hence, it’s a good career option who seriously want to pursue it, knowing all the pros and cons, as it might be a bumpy ride, but it’s equally rewarding if you can make it through.

Recommended Articles

This has been a guide to the top difference between Analyst vs Associate. We also discuss the Analyst vs Associate key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –