Advantages and Disadvantages of Mutual Funds – Introduction

Have you ever wondered why mutual funds are advertised so much? Mutual funds have become a popular investment option for individuals who usually want to diversify their portfolios. However, have you ever considered the pros and cons of investing in mutual funds? As they say, it’s important to understand both sides of the coin before making any investment decisions. Let’s dive into the advantages and disadvantages of mutual funds.

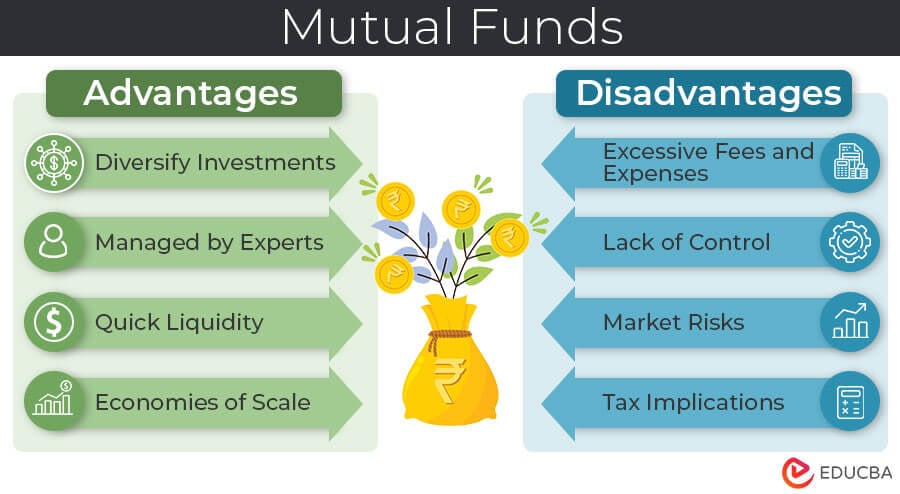

Advantages of Mutual Funds

Here are some advantages of mutual funds:

1. Helps Diversify Investments

When you invest in mutual funds, you can invest in different types of securities like stocks, bonds, and other assets. This helps you to be safer with your money because if one of these security does badly, you still have different types to make money from. This makes your overall investment more diversified, secure, and profitable in the long term.

2. Managed by Expert Fund Managers

Experienced professionals manage mutual funds. This makes investing easier for busy or inexperienced individuals as they don’t have to worry about making investment decisions or analyzing market trends. Instead, they can rely on the expertise of the fund managers to make the best investment decisions.

3. Offers Quick Liquidity

You can easily buy or sell mutual funds on any business day. Because of this, they are known as liquid investments. This flexibility allows investors to quickly access their money when they need it.

4. Benefits of Economies of Scale

When many investors pool their money together in a mutual fund, it creates economies of scale. This means that the mutual fund can negotiate lower transaction costs and fees than individuals can. These savings can positively impact the returns for the investors in the fund. In other words, because the mutual fund is able to reduce costs, investors are likely to earn more money on their investment.

5. Accessible For Small Investors

Mutual funds provide an easy way for small investors to start investing with relatively little money. Thus, investors can participate in a diversified portfolio of stocks or bonds, which would be challenging to assemble individually. In other words, mutual funds provide an accessible entry point for small investors who want to start investing in the stock or bond market.

6. Choice to Automatically Reinvest

Many mutual funds offer the option of automatic dividend reinvestment. It is when the mutual fund managers automatically use any dividends or capital gains to purchase additional shares. This can accelerate the compounding of returns over time as the number of shares in the fund increases. Essentially, this feature allows investors to reinvest their earnings into the fund without additional effort.

Disadvantages of Mutual Funds

Here are some disadvantages of mutual funds:

1. Contains Excessive Fees and Expenses

Mutual funds have extra fees and costs like management and sales charges. These can take away from the amount of money you earn over a long period of time.

2. Investors Lack Control Over Investments

This means that when someone invests in mutual funds, they have the authority to make choices about their investments to fund managers. This can be a disadvantage for those who like to be in control of their portfolios and make decisions actively.

3. Increased Market Risks

When you invest in mutual funds, you should be aware that their value can go up or down based on market conditions. This means a risk is involved, and you may not always get the return you were hoping for. Additionally, if the economy experiences a downturn or interest rates fluctuate, it can negatively impact the fund’s performance.

4. Includes Tax Implications

When you invest in a mutual fund, and it makes money by selling its investments for more than it paid, you might have to pay taxes on those profits. Even if the overall return of the fund is good, you could owe taxes on your share of the gains. This can cut into your overall earnings from the investment.

5. Causes Over-diversification

While diversification is an advantage, excessive diversification can lead to over-diversification. When you have too many investments, the good ones don’t impact your overall portfolio as much.

6. Performance Incentives for Fund Managers

Fund managers are often evaluated based on their ability to achieve returns better than market benchmarks or their peers. However, this pressure to outperform can sometimes lead to risky investment decisions to achieve these goals. This can be problematic for investors relying on fund managers to make sound investment decisions.

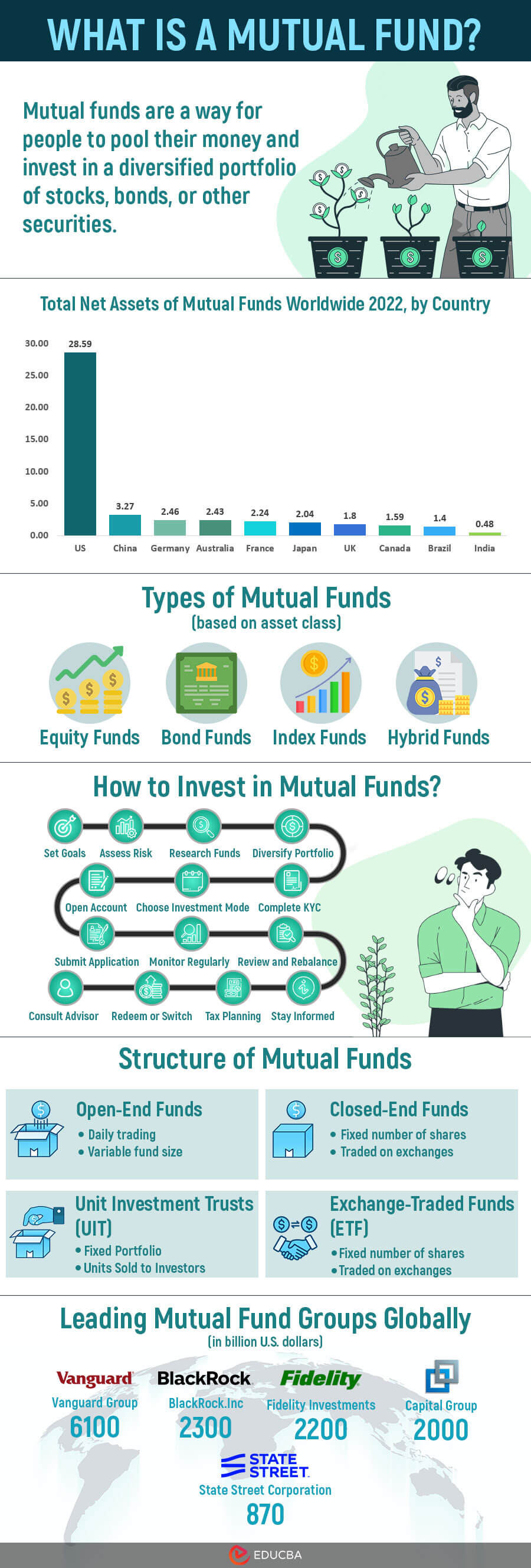

Infographics

Final Thoughts

Before investing, individuals should consider the advantages and disadvantages of mutual funds based on their financial goals, risk tolerance, and level of involvement in managing their portfolios. Achieving a well-balanced investment strategy requires understanding the nuanced dynamics of mutual funds and making informed decisions to align with one’s overall financial objectives.

Recommended Article

We hope you found this article on the advantages and disadvantages of mutual funds helpful. Refer to the following recommendations to view similar articles.