Updated November 7, 2023

Advantages and Disadvantages of Venture Capital – Introduction

Imagine you have an excellent business idea, but you cannot make it into an actual business due to lack of funds. This is where venture capital comes in. Venture capital (VC), started in the early 1940s, is where investors provide you the financial support you need to build your own business. It helps early-stage businesses and rising enterprises that have great growth potential.

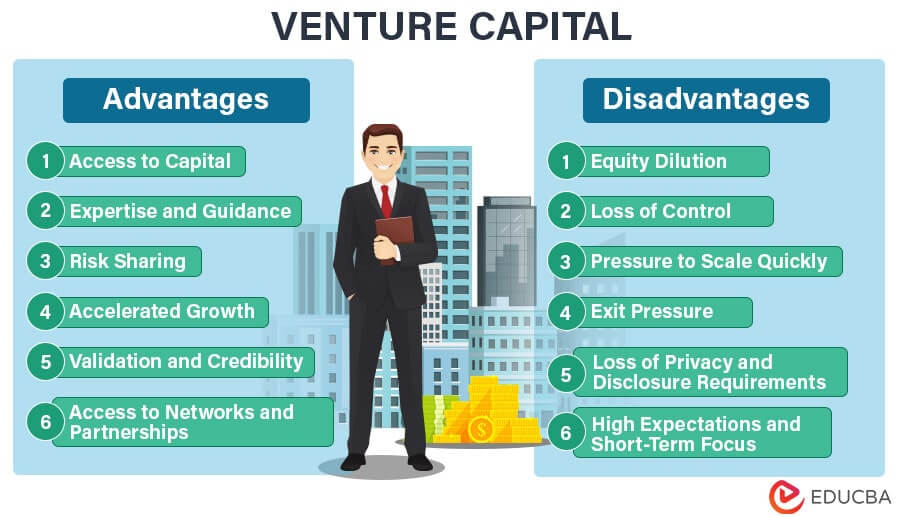

While venture capital offers several advantages, it also comes with its own set of disadvantages. Thus, let us look at the advantages and disadvantages of venture capital with examples.

Advantages of Venture Capital

Let’s look at some advantages of venture capital in detail:

1. Access to Capital

One of the most significant advantages of venture capital is that it gives entrepreneurs access to substantial financial resources. Venture capitalists usually fund startups, making it easier for young business people to gain the required funds.

2. Expertise and Guidance

Venture capitalists often bring valuable expertise, mentorship, and connections. They can help entrepreneurs refine their business strategies and navigate the challenges of scaling their ventures.

3. Risk Sharing

If a venture fails, the burden is shared among the investors, and the entrepreneur is not personally liable. Thus, shared risk makes it easier for entrepreneurs to establish high-risk businesses.

4. Accelerated Growth

With substantial funding, startups can invest in product development, marketing, and expansion, enabling them to capture market share quickly.

5. Validation and Credibility

Venture capital investment can provide a significant vote of confidence in a startup’s potential. It can validate the business model and attract additional interest from customers, partners, and other investors.

6. Access to Networks and Partnerships

Venture capitalists often have extensive networks that can help new businesses create strategic partnerships and collaborations. It can open doors to new opportunities for growth and development.

Disadvantages of Venture Capital

Let’s look at some disadvantages of venture capital in detail:

1. Equity Dilution

When startups raise venture capital, they give a part of their ownership to investors, which dilutes the equity of the founders and early employees. It can result in reduced financial rewards for the original team.

2. Loss of Control

Venture capital often involves giving up a part of control of the company. Thus, while making important decisions, entrepreneurs must consult with their investors, which can limit their autonomy.

3. Pressure to Scale Quickly

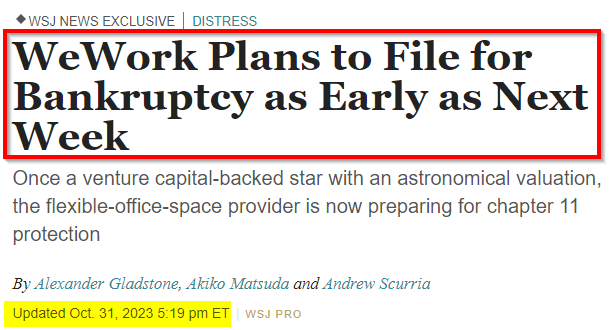

Venture capitalists expect high returns on their investments, which can lead to intense pressure on entrepreneurs. It can result in hasty decisions and a focus on short-term growth over long-term sustainability.

Source: Wall Street Journal

4. Exit Pressure

Venture capitalists expect an exit strategy that provides them with a significant return on investment. It can lead to premature sales, mergers, or initial public offerings (IPOs) that may not align with the long-term vision of the entrepreneurs.

5. Loss of Privacy and Disclosure Requirements

Venture capital investment may require startups to disclose sensitive information about their business, including financials and strategic plans. It can result in a loss of privacy and a competitive disadvantage if sensitive information falls into the wrong hands.

6. High Expectations and Short-Term Focus

Venture capitalists often have high expectations for a quick return on investment, which can lead to a short-term focus on growth and profit. It may not align with the founder’s desire to build a sustainable, long-term business.

Final Thoughts

Venture capital offers access to vital resources, expertise, and networks, but it comes with trade-offs like a loss of control, equity dilution, and short-term pressures. Therefore, entrepreneurs must make informed decisions, considering their long-term objectives and risk tolerance when seeking venture capital financing for their startups.

Recommended Articles

We hope you found this article on the advantages and disadvantages of venture capital helpful. Refer to the following recommendations to view similar articles,