Introduction to Advantages and Disadvantages of Accounting

Did you know that in 2022, Tesla’s revenue was around $81,462 million, while Apple reached a staggering $90,146 million in revenue, mainly due to the success of the iPhone? At the same time, a significant accounting scandal in 2023 involving PwC Australia shook up the financial landscape and questioned the ethical considerations involved in business practices. These examples demonstrate how accounting is an indispensable tool in understanding and analyzing the financial health of companies and how it impacts the broader economy. In this article, you will learn a few advantages and disadvantages of accounting.

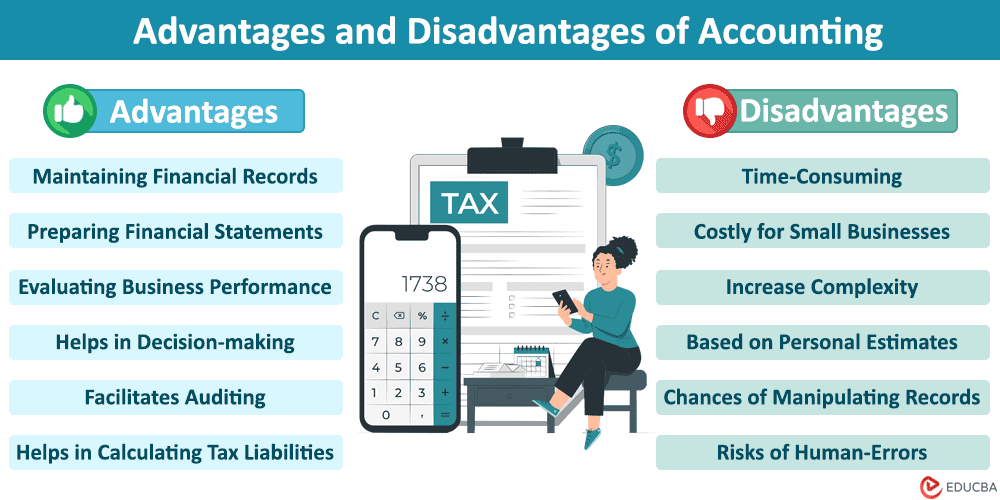

Advantages of Accounting

1. Maintenance of Financial Records

Accounting involves periodic and organized recording of all financial transactions during a certain time, like a month or a fiscal year. It helps accountants because remembering every transaction is not practical or reliable. Therefore, by keeping all timely records, they can keep track of every transaction in the books of accounts.

2. Preparation of Financial Statements

Proper recording of all transactions helps create financial statements, like balance sheets, income statements, and cash flow statements. This information is important for understanding the financial position of a business. Accounting also ensures that all financial statements adhere to accounting standards so investors and stakeholders uniformly accept them.

3. Evaluation of Business Performance and Growth

Accounting information allows businesses to assess their performance by analyzing financial statements using key financial indicators and measures. It provides a clear idea of a company’s finances and helps compare how its financial position has changed over time. In addition, when financial statements follow the same standard rules, it’s easier to compare one company to another in the same industry. This way, businesses can see how they’re doing compared to others.

4. Benefits in Data-Driven Decision-making

Accounting also helps make informed decisions about financial issues, investments, business expansions, etc. It also includes decisions about a product or service’s price to evaluate profitability and efficiency. Evaluation of business performance also helps in making decisions to improve areas of improvement, budgeting, and future financial planning.

5. Facilitates Auditing

Audit is necessary and involves careful examination and review of financial information for accuracy. It ensures that all records are valid, and here, financial statements serve as evidence for the auditing process. In addition, it also makes sure that the company makes financial statements according to standard rules and regulations and may even sometimes identify fraudulent transactions.

6. Helps in Calculating Tax Liabilities

Tax departments or authorities rely on accounting data for calculating income tax, value-added tax, and direct and indirect tax. This data provides insight into planning and making decisions like tax-deduction strategies or tax-saving options.

7. Ensures Compliance with Legal terms

It also ensures that all recording and preparation of financial records and statements adhere to legal and regulatory (national and international) requirements. It builds trust among stakeholders and investors in the company’s provided data. In addition, these records may act as financial evidence in court in any legal transaction disputes.

Disadvantages of Accounting

1. Time-Consuming

Accounting can be slow because it involves carefully recording, organizing, and analyzing financial transactions. It leads to disadvantages for businesses that need quick decision-making.

2. Might be Costly for Small Businesses

Besides being time-consuming, implementing proper and standard accounting practices can burden small businesses financially. It can be costly for companies with limited or low-profit income.

3. Increase Complexity

It can become difficult to understand financial standard terms, accounting principles, and conventions if one is unfamiliar with them. In addition, it is challenging for businesses to keep and maintain records with huge transactions with global operations.

4. Based on Personal Estimates

Even though recording all transactions is based on evidence, sometimes, few financial records involve subjective judgments or estimates. Therefore, it is not accurate to consider data based on estimates and can lead to false interpretations. Accountants may use different valuation methods, and the account data may be biased.

5. Chances of Manipulating Records

Accountants may sometimes manipulate or misrepresent data to show higher profits for investors or may change financial records to reduce tax. It will indirectly reflect the wrong financial position of the company and can lead to an accounting scandal.

6. Risks of Errors

Accounting requires careful methods of keeping records, and any errors by humans in data entry or calculations can lead to inaccuracies in financial records.

Final Thoughts on Advantages and Disadvantages of Accounting

Accounting is an essential part of financial budgeting and forecasting. Its advantages lie in providing valuable information for making informed decisions, while its disadvantages lie in not providing 100% accurate data.

Recommended Articles

We hope this article on “Advantages and Disadvantages of Accounting” was helpful to you. To learn more about related topics, please refer to our article below.