Updated July 10, 2023

Zombie Company – Definition

A zombie company is a business that is no longer profitable but continues to operate because its owners are unwilling or unable to shut it down. With little or no income, they continue to run day after day. These companies generate income from investments or other sources.

Most of which goes towards covering the company’s expenses. A few payments are primarily overhead costs such as paying employees and maintaining facilities. They often have high levels of debt, low morale, and little chance of turning things around. However, one can revive a zombie company with effort and get it back on track.

Key Takeaways

- A zombie company is a business that is struggling to stay afloat. It appears to be operational but is barely scraping by.

- A company can become a zombie due to poor management, high debt, and low productivity.

- Some steps to revive a zombie business include reducing expenses, increasing revenues, and improving communication and organizational structure.

- BSNL, Exxon Mobil, and airline companies like Delta and Boeing are a few examples.

How to Identify a Zombie Company?

A company is typically considered a zombie if it has a negative net income for three consecutive years and its debt is higher than its equity. In other words, the company isn’t generating enough cash to cover its basic expenses, let alone turn a profit.

It is when a corporation is not seeing any development and growth. The company is inefficient because it lacks the capital to reinvest. They are uncompetitive survivors, contributing to reduced global output. They also tend to struggle with creative thinking because there’s no incentive for them to think outside the box.

Examples of Zombie Company

Exxon Mobil Corporation (NYSE: XOM)

In February 2019, Exxon Mobil Corporation announced its fourth-quarter and full-year 2018 results. The company reported a net loss of $2 billion for the quarter and $20.8 billion for the year. It was the first time Exxon had declared a quarterly loss since 2002.

Exxon has been investing heavily in its downstream business. Investments in projects to bring new refining capacity online and expand existing facilities. Investments like these can cause near-term losses but increase profits over the long term. They were made to sustain growth rates and maintain competitive positions with other oil companies.

However, they also make it more difficult for companies to sustain profitability when prices are low, which is what happened.

Boeing Co (NYSE: BA)

It all started with the 737 Max. The 737 Max was Boeing’s attempt to compete with the new Airbus A320neo. But what was supposed to be a game-changer for Boeing turned into a nightmare. The plane was involved in two deadly crashes, and the grounding of the 737 Max fleet led to Boeing’s problems. The company has since racked up billions of dollars in losses, and its share price has plummeted. But despite all this, Boeing is still a zombie company.

Delta Air Lines, Inc. (NYSE: DAL)

2017 Delta Air Lines, Inc. reported its first annual loss in eight years. The company had to report a $5.7 billion write-down on the value of its aircraft. In the fourth quarter of 2018, the company announced restructuring its business and reducing costs. It included reducing its workforce by 20%, or 9,000 employees.

In 2019, the company reported a $2.3 billion net loss. It is important to note that even though companies like Delta are posting losses, they are still profiting from some regions of their operations. However, these profits do not compensate for losses incurred elsewhere in the company.

For example, during the same time as its $2.3 billion net loss, Delta also made $621 million from passenger revenue and a profit from cargo sales at Alaska Airlines Group LLC, of which it owns 49%.

Why Does a Business Become a Zombie Company?

There are many reasons why a business might become a zombie company. It could be due to a change in the marketplace, new competition, or poor management. A few common reasons are,

High Debt: From 2009 to 2016, interest rates were nearly zero percent worldwide. Extremely low-interest rates urge enterprises to incur debt. However, the additional debt may be unsustainable if interest rates rise. Thus, it can become difficult for companies with no profit to repay the debt.

Borrowing in another currency: Firms that borrow in a foreign currency are subject to currency depreciation. For example, if Eastern European enterprises borrow in Euros, they may presume stable exchange rates. Nevertheless, if the currency’s value falls relative to the Euro, the domestic cost of servicing the Euro debts rises. Thus, the cost of debt interest payments may exceed their profits.

Obsolete Technology: A company that falls behind in technology cannot match consumer preferences. Thus, it will be left with a complete inventory and no profit to repay the debt.

Deflation. In a deflationary environment, prices for goods and services decline. This decrease in prices leads to a reduction in the value of debt. As the value of debt decreases, the amount of debt a company owes increases. The high level of debt that many companies carry is one reason we see zombie companies.

Competition: It is when a business cannot keep up with the industry’s changes. It is when a company is experiencing increased competition from an up-and-coming competitor and cannot stay put. It can be due to several factors, such as poor management or a flawed business model.

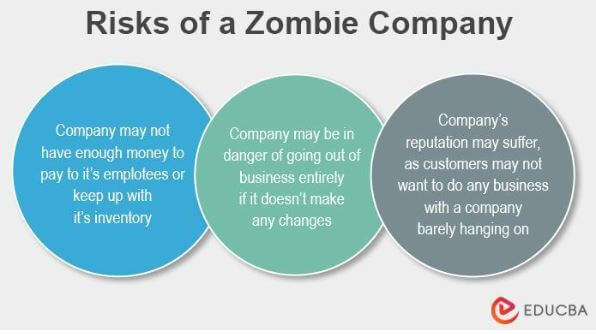

Zombie Company – Risks

A zombie company is a business that barely survives due to low demand or poor management. It can be risky for numerous reasons.

- They often operate without any profits, which can lead to financial instability.

- They may not have any income, making it challenging to keep the business afloat.

- Zombie companies often have a lot of debt, making it difficult to repay their creditors.

All of these factors can ultimately lead to the collapse of the company. The risk increases if several high-risk investments are already on the company’s balance sheet.

Ways to Revive a Zombie Company

Many zombie companies are profitable, but their profits are used to prop up other parts of the business that are losing money. It can be a vicious cycle that is difficult to break out of, but it is possible. Here are a few ways to revive a zombie company:

- Find new sources of revenue

- Cancel projects or move them in-house

- Identify and prioritize tasks with high returns

- Develop new products & services and Improve efficiency by adopting best practices

- Downsize by restructuring essential functions and exiting low-growth markets. Ask suppliers for discounts on materials and equipment

- Consider outsourcing production to cheaper countries

- Work on cost control measures, such as implementing lean manufacturing.

Conclusion

In short, a zombie company is a business that has no chance of ever becoming profitable yet continues to operate without any real purpose. These companies are often kept afloat by government subsidies or loans, and their existence can harm the economy as a whole. It’s usually not enough to cover the losses when they make money.

frequently Asked Questions(FAQs)

Q1. What is meant by a zombie company? Example of Zombie Company

Answer: A zombie company is a firm that would be insolvent if not for constant infusions of capital from its lenders. Zombie companies are often kept afloat by low interest rates and lax lending standards.

Some examples of zombie companies include General Motors, American Airlines, and Macy’s.

Q2. How do zombie companies survive?

Answer: Zombie companies keep afloat with low-interest rates and access to capital. Loans from central banks and government investments are also a significant help. These firms typically have high debt levels and are less productive than their healthier counterparts.

Q3. How to identify and revive a zombie company?

Answer: A zombie company is a business that appears to be operating normally but is insolvent. It has no capital profit to reinvest in the company. It also has high debt and lower equity. One can revive a zombie company by creating a new business model, raising capital, and restructuring the organization.

Q4. What is a zombie startup?

Answer: A zombie startup is a company that has been able to raise money from investors but has not been able to generate enough revenue to cover its costs. In other words, it’s a company that is bleeding cash.

Recommended Articles

To learn more about a zombie company, visit the following links.