Updated July 10, 2023

What is a Trust Account?

A trust account is a legal arrangement where a grantor lets a third party manage the assets for the trust’s beneficiary. The grantor (settler) is the trust’s creator, and the third party is known as the trustee.

Typically, the beneficiary can be an individual or a group who shares a professional or personal relationship with the grantor. The trusts’ assets can be anything of value, such as real estate, bonds, stocks, etc.

Key Takeaways

- A trust account is a setting that allows a trustee to manage the grantor’s assets on behalf of its beneficiaries.

- The four most common types are living, testamentary, revocable, and irrevocable trust accounts.

- Families set up these accounts for their children, who can claim the assets after fulfilling laid conditions. Upon that, attorneys use these for their clients’ payments.

- These accounts have both limitations and benefits. For example, it is a complex and expensive structure but provides privacy and helps avoid legal hassles.

Purpose of a Trust Account

Banks or trust companies are the ones that set up trust accounts for their clients. It is usually for the legal protection of the assets of an individual or a group. It ensures that the allocation of assets is as per the beneficiaries’ wishes. While opening such an account, the grantor determines the purpose of the account.

- For instance, parents set up a college trust for children in their early years such that the funds could dispense when they attend a university.

- It can also be for minors, which they can redeem once they attain the legal age.

- On the other hand, attorneys create these accounts to ensure that the client’s funds do not mix with the law firm’s.

How Does it Work?

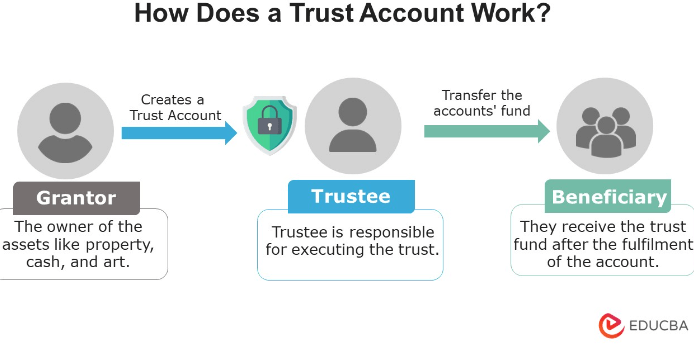

- When grantors create a trust account, they give the trustee the responsibility to manage the assets.

- The trustees handle the trust until the transfer to the intended beneficiaries. In case of any unexpected events, the grantor, in most cases except for irrevocable trust, can make changes to the account.

- A trust ensures the assets are transferred safely from the trustees to the beneficiaries. These also separate one’s assets from their portfolio, protecting the assets from potential creditors. In the real estate industry, these are legal obligations. They are responsible for properly managing the funds and keeping them compliant with the applicable legislation.

Types of Trust Accounts

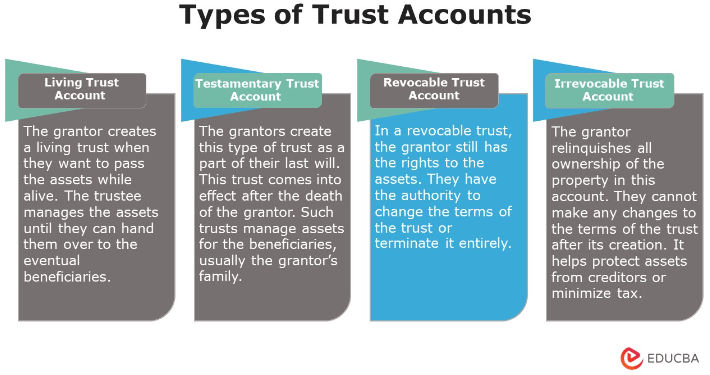

a) Living Trust Account

- The grantor creates a living trust when they want to pass the assets while alive.

- The trustee manages the assets until they can hand them over to the eventual beneficiaries. It helps transfer the grantor’s assets to the inheritors without legal hassle.

b) Testamentary Trust Account

- The grantors create this type of trust as a part of their last will.

- This trust comes into effect after the death of the grantor.

- Such trusts manage assets for the beneficiaries, usually the grantor’s family.

c) Revocable Trust Account

- As the name suggests, in a revocable trust, the grantor still has the rights to the assets.

- They have the authority to change the terms of the trust or terminate it entirely.

- Usually, they use this account in estate planning to manage the assets.

d) Irrevocable Trust Account

- In contrast to the revocable account, the grantor relinquishes all ownership of the property in this account.

- They cannot make any changes to the terms of the trust after its creation.

- However, it helps them protect their assets from creditors or minimize their taxable estate.

How to Set it Up?

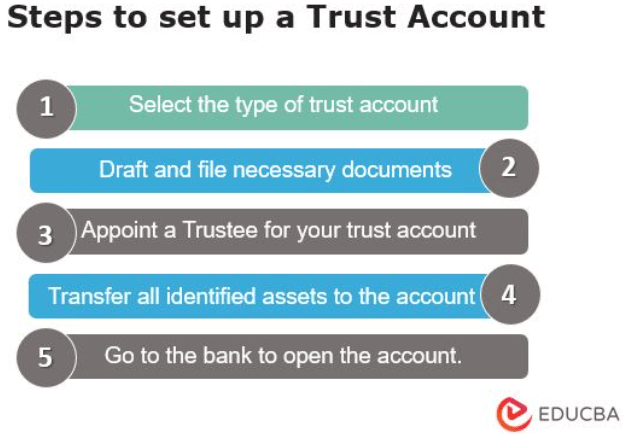

The process of setting up involves the following steps.

- Select the Trust type: Select the type of trust that best suits the intended purpose. The intention behind the trust will decide the form of account one needs to open.

- Draft and File documents: The state laws dictate how to draft the trust. For example, in some states, the grantor must fill out the trust documents with the state probate court. Research the precise process in your state and do the needful.

- Appoint a Trustee: The grantor needs to appoint a trustee who is over 18, mentally competent, and without a criminal record. The trustee is responsible for executing the terms of the trust. In some cases, the grantor can also appoint himself as the trustee of the trust.

- Transfer assets: In this step, they need to identify all the assets for the trust. The settler must transfer assets requiring legal titles to the trustee’s name. These are assets such as real estate, cars, bank deposits, etc. In the case of assets like art and jewelry, the grantor must transfer the right to the trustee.

- Go to the Bank: The bank will set up the trust based on the recommendations mentioned in the trust’s documents.

Example of Trust Account

Let us understand the working with the help of an example.

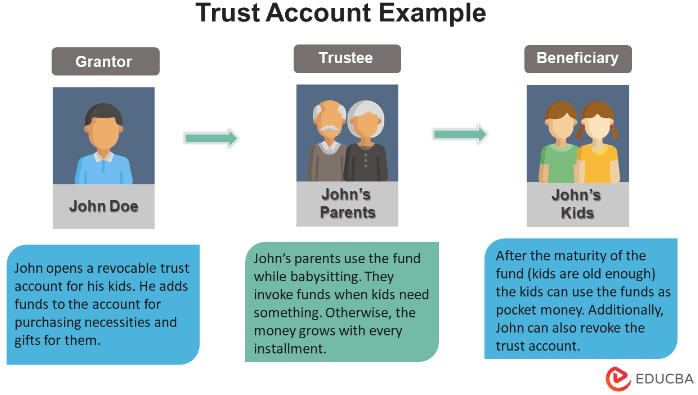

Let us assume that John Doe gives his parents some funds to purchase necessities and gifts for his kids when they babysit. They usually babysit the kids twice every month. In this case, John is the grantor, his parents are the trustee, and his kids are the beneficiary.

John’s parents can only invoke those funds when the kids need something. Otherwise, the money in the trust grows with every installment. Once the kids are old enough, they can use the funds as pocket money, or John can revoke the trust.

Rules & Regulations of Trust Account

As the trustees bear the responsibility of trusts, they must follow a few rules.

- They should maintain all accounts and funds separately. They should not mix those with their firms or other trusts.

- Never use any of the trusts’ assets for personal or professional needs; unless it is for the trust’s grantor or beneficiaries.

- Maintain records for all transactions from the grantor or to the beneficiaries. Keep a regular check on the balance.

- Verification of the assets is a crucial step for account managers. They should not blindly trust the grantor or beneficiaries and perform verification when necessary.

Advantages & Disadvantages

The following are some advantages:

- The structure of trusts results in more privacy and limited liability for the asset owners.

- It provides flexibility in the distribution of assets among the beneficiaries.

- It significantly reduces the chances of legal hassles or court challenges.

The following are some disadvantages:

- The structure is very complicated, creating problems if there is a need for external borrowing.

- In some cases, it becomes costly to establish and maintain trust.

- It results in a large volume of additional paperwork.

Frequently Asked Questions(FAQs)

Q1. Define a trust account. Name the types of trust accounts.

A trust account is an agreement where a grantor lets a trustee manage the assets for the ultimate beneficiary of the trust account. The most common types include living, testamentary, revocable, and irrevocable trust accounts.

Q2. How to open a trust account? Why do people use trust accounts?

To open a trust account, one needs to select the trust type depending on its purpose, draft & file the documents, appoint a trustee, and then transfer assets to the trust.

Grantors usually create trusts to protect their assets. It ensures that the assets under the trust are allocated and managed safely for the benefit of the eventual beneficiaries.

Q3. What is a trust account in a bank?

A trust account in a bank refers to a financial account held by a trust that a trustee handles. The trustees usually use those to meet incidental expenses and disseminate assets under the trust to the beneficiaries after the grantor’s death.

Q4. Do trust accounts pay interest? Are they taxable?

A trust account that holds liquid funds can be called a typical bank account. So, like any other bank account, a trust account also earns interest and is paid to the trust beneficiaries.

The trust doesn’t pay any taxes for the interest income. However, the trust beneficiaries are liable to pay taxes on the income they receive from the trust. So, it means that the interests are taxable.

Q5. What is the purpose of a trust account in real estate?

A trust account is considered a legal obligation in the real estate industry. It helps in managing funds and maintaining compliance with the applicable legislation.

Recommended Articles

This article explains everything about trust accounts, from meaning, purpose, types, advantages, and disadvantages, to examples. It also talks about how one can set it up. To learn more about them, visit the following links.