Updated June 20, 2023

Introduction to WPI vs CPI

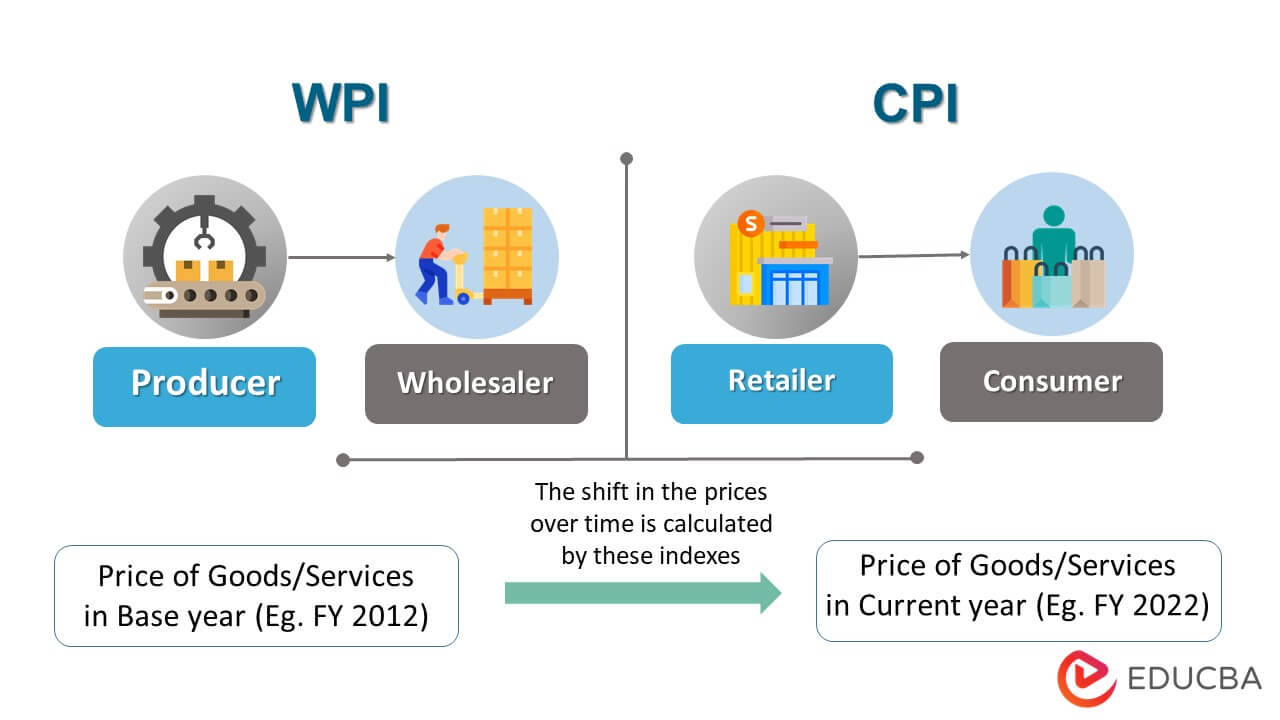

The Wholesale Price Index (WPI) measures and tracks average price fluctuations before converting wholesale goods to retail. For example, suppose the wholesale price for good X was $2500 in 2021, but as the country falls into inflation in 2022, the prices rise to $4000. Therefore, the change in prices is $1500.

In contrast, the Consumer Price Index (CPI) measures price changes for goods & services offered at retail establishments, i.e., products sold directly to customers. For instance, the retail price of cereal in 2021 was approximately $34, which rose to $40 in 2022. Hence, the CPI will measure the change of $6 in percentage.

Key Highlights

- The WPI (Wholesale Price Index) measures the change in price for bulk commodities. On the other hand, the CPI (Consumer Price Index) computes the average difference in the price consumers pay for goods/services over time.

- Although the two indexes are different, they measure similar things, as a price index indicates a rise in the price of goods/services since the previous or base year.

- As CPI reflects changes in the cost of goods and services and how much consumers can buy, it accounts for inflation and economic growth. Further, WPI is also a measure of a country’s inflation rate.

- Both of their formulas fall into a similar equation. WPI index divides the current wholesale price of a product by the cost of the goods in the chosen period, and CPI divides the retail price of the current period by the price in the base period.

What is WPI?

- Wholesalers use this index to evaluate price changes in the stages preceding retail. In simple terms, it assesses cost alterations in goods traded between entities before they reach consumers.

- It is usually expressed as a proportion or percentage, showing the average price change of the goods. Thus, it can be a helpful tool for gauging a country’s level of inflation.

- Most countries publish monthly price indices to show changes in commodity prices. It typically includes commodity prices, but the products included vary with the country.

- They are subject to change to reflect the current state of the economy better. Smaller countries may only compare prices for 100 to 200 products, whereas larger countries may compare prices for thousands of products.

- The United States includes commodities at various production stages, counting many products multiple times. For example, the price index had cotton in raw cotton, cotton yarn, gray cotton items, and cotton clothing.

What is CPI?

- It is an economic indicator measuring the evolution of the general price level of household goods and services in a country.

- CPI can help assess the impact of price changes on rising living costs. It selects products resembling family consumption, such as groceries, footwear, transportation, and other services. After gathering the data, it tracks their prices for a set period, which is usually quarterly or annual.

- It considers products purchased regularly and accounts for the majority of a family’s consumption expenditure.

- If this index is positive during the analysis, it signifies an increase in the index. In other words, the cost of living rises as the prices of basic consumer goods increase.

WPI & CPI Calculation & Examples

The formula to calculate the wholesale price index is as follows,

The formula to calculate the consumer price index is as follows,

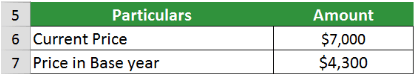

Example 1: WPI

Let us consider 2012 as the starting point to calculate the WPI for 2022. The total price of goods under consideration in 2012 is $4,300, and the cost in 2022 is $7,000.

Given,

Implementing the formula,

Considering that the WPI for the base year is always 100, the WPI for 2022 will be,

163-100 = 63%

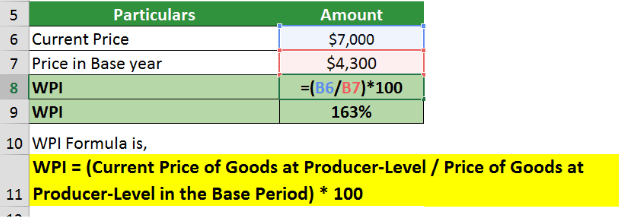

Example 2: CPI

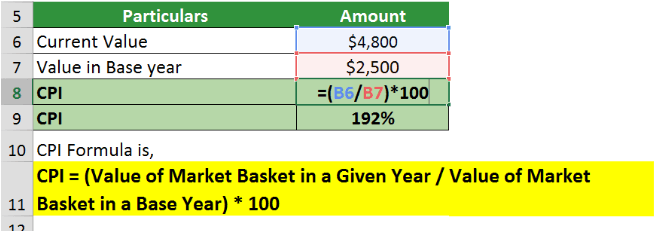

Let us consider 2012 as the base year, and the price of goods & services under consideration in 2012 was $2,500. We need to calculate CPI for 2022 when the total cost of goods & services is $4,800.

Given,

Implementing the formula,

Considering that the CPI for the base year is always 100, the CPI for 2022 will be,

192-100 = 92%

WPI vs CPI – Key differences

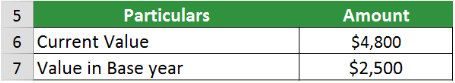

- WPI calculates the average price change at a wholesale level, whereas the CPI calculates the difference in the prices at a retail level.

- While WPI is concerned with the goods that the trading houses trade, CPI is concerned with the goods that the consumers purchase.

- WPI only measures goods, while the CPI measures goods and services.

- It measures inflation in the first stage, and CPI measures inflation in the final stage.

- WPI is the value a retailer/distributor pays. On the other hand, CPI is the price a consumer pays

- WPI articles cover fuel, energy, and manufacturing products, while CPI articles cover education, transportation, communications, recreation, clothing, housing, and healthcare

- Only a few countries use the wholesale index, whereas more than 157 countries primarily use the consumer index.

Comparison Table between WPI vs CPI

| WPI vs CPI as comparison bases | WPI | CPI |

| Full Form | Wholesale Price Index | Consumer Price Index |

| Sense | It calculates the average price change for producer-level goods | It evaluates retail or direct-to-consumer sales price changes |

| Posted By | World Development Indicators for most of the countries and The Ministry of Trade and Industry’s Economic Advisor’s Office for India | The US Bureau of Labor Statistics for the US. Other countries post their CPI on their respective websites. |

| Application | It is only applicable to goods | It applies to both goods and services |

| The measure of inflation | First stage inflation | Final stage inflation |

| Prices Supported By | Manufacturers and full sellers | Consumer-driven prices |

| Number of Items | 697 | Rural areas receive 448 points, while urban areas receive 460 points |

| Goods and Services Covered | Fuel, energy, and industrial products | Education, food, transportation, clothing, housing, health care, and more |

| Base Year / Reference | The financial year | The calendar year |

| Used By | A few countries use it | 157+ countries use it |

| Release Date | Published monthly. | Publishes once a month. |

Conclusion

In the history of WPI and CPI, countries only used the WPI. However, CPI was introduced because the government did not know how it affected ordinary people. In comparison to the WPI, the CPI provides more clarity about inflation and its economy in the overall economy. As a result, monetary policy primarily concerns price stability and controlling inflation. Inflation can be tracked and measured using these indexes. Therefore, countries can calculate the inflation rate using the WPI and the CPI.

FAQs

1. Why is WPI higher than CPI?

Answer: As WPI only considers goods for its index computations, it remains higher. Additionally, the prices of fuel and energy resources are always on the rise, contributing to the wholesale index’s increasing percentage. Comparatively, the service industry has been lower, thus, giving CPI a lower value.

2. Which is better: WPI or CPI? Why is CPI preferable to WPI?

Answer: Many countries prefer CPI to WPI as it accurately measures a country’s economy and inflation levels. In addition, CPI takes services into account that WPI does not. Moreover, the wholesale index focuses on manufacturing firms, whereas CPI focuses on consumer consumption.

3. How is WPI different from CPI?

Answer: The fundamental difference between WPI and CPI is that WPI measures price changes in the first few stages of production, whereas the CPI only counts finished goods. WPI tracks price increases and decreases in the primary market before they reach the retail sector. In contrast, CPI tracks the same for the retail industry.

4. When do the CPI and WPI announcements happen?

Answer: Both CPI and WPI’s announcements happen every month. For CPI announcements in the US, one can visit the US Bureau of Labor Statistics. As WPI isn’t widely used in many countries, one of its announcement sources is World Development Indicators.

Recommended Articles

This article comprehensively differentiates WPI vs CPI. To know more about WPI vs CPI, visit the following articles,