Updated October 3, 2023

What is a Leveraged Buyout?

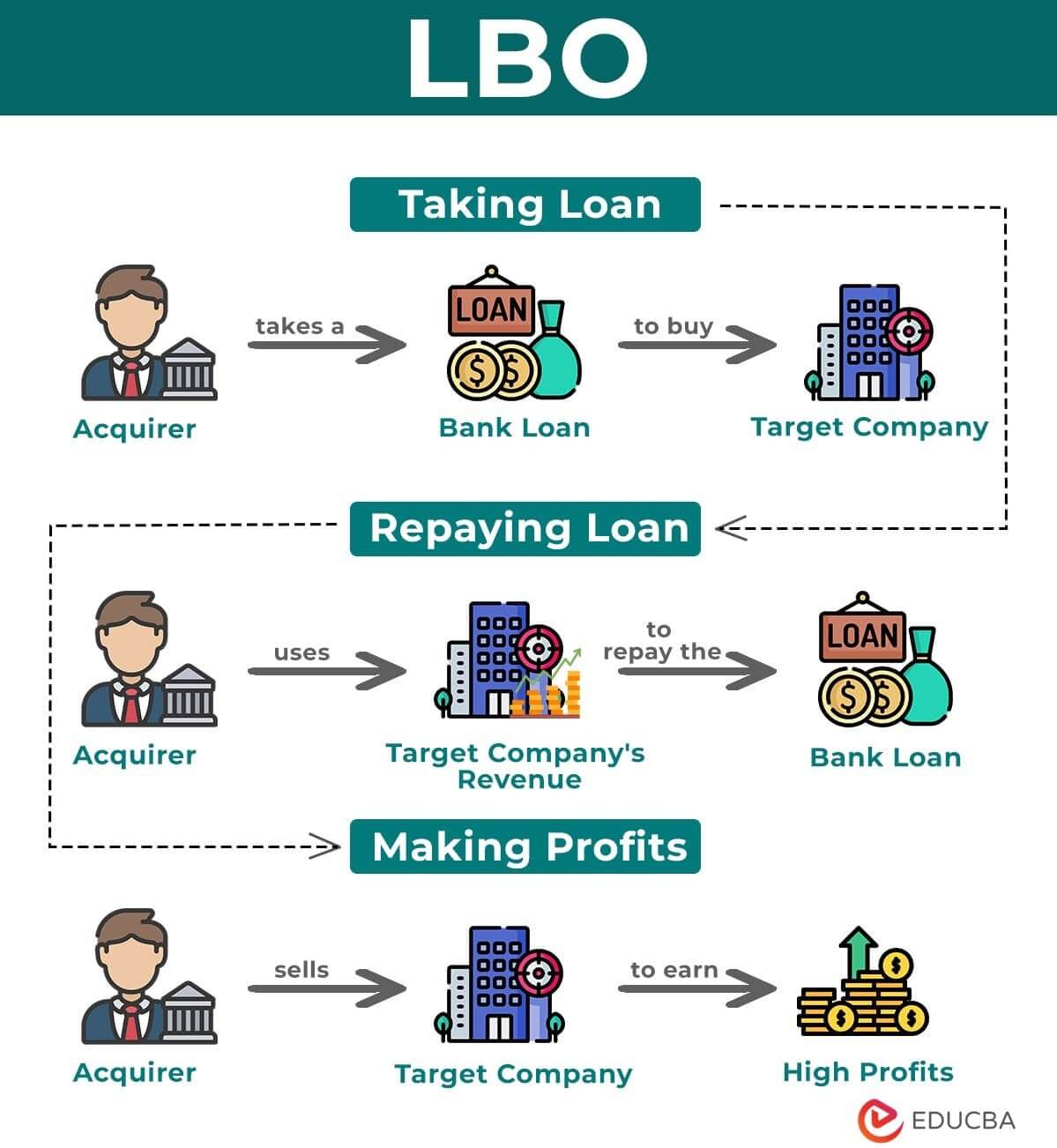

A leveraged buyout (LBO) is a financial term that refers to a situation where a firm or an investor borrows a significant amount of money to buy another firm. It is a common strategy employed in corporate finance and private equity.

In this process, the investor gathers the money required to purchase the firm using a combination of equity and debt. The debt (a loan that the investor takes) covers a huge portion (usually 90%) of the total purchase price. On the other hand, the investor contributes a smaller amount from their own funds as equity.

After successfully acquiring the firm, the investor focuses on improving the company’s operations, reducing costs, and increasing profits. The goal is to generate enough money to pay back the loans and still make a profit. Once the company shows improved performance, the investor has various options: selling it, taking it public by offering shares, or merging it with another company. These options allow the investor to gain a profit and move on to new opportunities. Investors usually sell LBOs within 4 to 7 years of the purchase date.

How Does Leveraged Buyout Work?

Let’s try and understand the step-by-step process of performing an LBO.

1. Identifying the Target

In the first step, the investor identifies the target they wish to invest in. They then start the initial research of the company’s history, profits, and if the company’s vision meets theirs.

Example: A restaurant named “Spanish Delight” is up for sale by the owner, Tony. This prospect attracts the attention of Steve, a fellow restaurant owner, as he thinks it can be a great investment.

2. Perform Due Diligence

After identifying the company, the investor forms a team of lawyers, investment bankers, and accountants. The team starts researching the company’s past financial records, risks associated with them, and the legal terms to come up with a valuation.

Example: Steve researches and gathers information about the restaurant. After necessary due diligence, his team comes up with a valuation of $500,000.

3. Negotiate Terms

After coming up with a valuation, the acquiring company negotiates the contract terms with the target company. When all the parties are happy, they draw the final contract.

Example: While Steve offers to pay $500,000, Tony wants a higher amount. After careful negotiation, the final valuation is set at $650,000.

4. Secure Financing

After finalizing all the details, the acquiring company starts looking for financing. They go to various banks and other sources to ask for loans. In exchange, they offer the assets of the target company as security.

Example: After agreeing to the valuation, Steve goes to a bank to get a loan of $500,000 at 10% interest.

5. Execute the Transaction

After agreeing on all the terms and completing all the due diligence, both parties sit together and complete the sale.

Example: With everything in place, Steve becomes the new owner of Spanish Delight with an 85% stake.

6. Post-Appropriation

After finalizing the deal, the acquiring company takes control of the target company and makes the necessary changes to increase the profitability of the company. Later, they use the acquired company’s profits to repay the loan.

Example: Steve took over the management of the firm, and in three years, Spanish Delight expanded its fast-food empire with more than 25 stores in the USA. Thus, Steve generated more than enough profits from the business to repay the debt.

7. Exit Strategy

In the future, the acquirer might feel it is time to exit the company and cash out on the profit. For that, they must think of an exit strategy beforehand. An exit strategy can be selling the company to another investor or listing it in the public stock market.

Example: After five years, Steve decides to exit the LBO, so he files for an IPO on the New York stock exchange and lists the company for a profit.

Real-World Examples of LBO

1. Manchester United (2003-2005)

Founded in the year 1878, Manchester United FC is one of the oldest and most successful clubs in England and the world. They hold the record for winning the English Premier League a record 20 times.

During the peak of their powers in early 2003, the Glazers family performed a Leveraged Buyout of the football club Manchester United. They slowly started buying shares in Manchester United using a holding company.

Finally, in November 2004, the Glazers were able to purchase a majority share by taking loans of more than $900M (£540M). By the end of 2005, the Glazers owned 100% of the club. The total amount spent by the Glazers was $1.47B (£750 million), making it the biggest takeover in football history at the time.

2. PetSmart (2014)

Petsmart is like Walmart for Pet and Animal products. It was founded in 1986 and is one of the largest pet stores in the world. Petsmart was listed on the public stock exchange in 1993 and has been a highly profitable company ever since. This fact made it a target for a leveraged buyout for many companies like Apollo Global Management, Kohlberg Kravis Roberts, etc., that wanted to privatize Petsmart.

However, in December 2014, PetSmart was taken over by investment firm BC Partners for about $8.7 billion. They paid each investor $83 per share, successfully buying all the shares of the company. Finally, they removed the stock from the market on 2nd July 2015, again declaring PetSmart a private company.

3. Safeway (1986)

Safeway Inc was founded in 1926 after a merger between Skaggs stores and Safeway stores. It is an FMCG store that sells everyday use products like milk, shampoo, soap, etc. It was a highly profitable business and had good growth potential.

So in July 1986, Dart Group approached Safeway Stores Inc with an acquisition offer. Safeway rejected the proposal because they felt they could get a better deal. After that, Dart Group tried a hostile takeover, so Safeway entered into a merger with KKR & Co. KKR & Co bought 73% of Safeway Stores Inc. at $69 per share using leveraged buyout.

Types of Leverage Buyouts

There are various types of leveraged buyouts based on their structure and characteristics.

1. Management Buyout (MBO)

In an MBO, a company’s existing management decides to purchase a majority stake or complete ownership of the company they are currently managing. They may use help from external investors such as banks or other private equity firms to collect the necessary funds for the buyout.

2. Employee Buyout (EBO)

An Employee Buyout (EBO) is similar to an MBO, but with only one difference: instead of the management team, the employees themselves come together to acquire the company. In an EBO, the employees pool their resources, often with the support of external financing, to purchase the business they work for.

3. Divisional Buyout

In a divisional buyout, the acquirer does not acquire the entire target company. Instead, they only buy a specific portion or a division of the company, like if they purchase the marketing division of a multimedia company.

4. Public-to-Private (P2P) Buyout

In a P2P buyout, a group of investors buy a public company and turn it into a private company. To buy the company, the investors pay a higher amount than the actual market value of the company.

5. Secondary Buyout

A secondary buyout is when the current owner, who has acquired the business using LBO, sells it to an acquirer using an LBO. Basically, it is a sale of a firm that was already once acquired in an LBO.

6. Distressed Buyout

As the name suggests, a distressed buyout is a type of acquisition where the acquirer buys a company that is in a state of bankruptcy or financial trouble. The main motive is to restructure and grow the company so the acquirer can earn revenue in the long run.

Leveraged Buyout Financing Methods

Leveraged buyout financing involves different ways of getting money to buy a company. Here are the main types:

1. Senior Debt

Senior debt is a loan that a buyer takes to acquire a company. It’s called “senior” because it’s the most secure investment. As the assets of the target company back the loan, if the buyer can’t repay the loan, the lender can claim those assets. It makes the senior debt less risky, resulting in lower interest rates. Moreover, if the company goes bankrupt, lenders with senior debt are the first to get their money back.

2. Equity Contribution

Equity contribution refers to the money the buyer invests from their own pocket to acquire a company. It’s the riskiest because there is no security or collateral. Also, in case of financial troubles or bankruptcy, the buyer’s equity contribution is at the greatest risk of being lost. However, it can also generate higher returns because the buyer is now the owner and can benefit from the company’s success.

3. Mezzanine Financing

Mezzanine financing sits between senior debt and equity contribution. It is a form of debt where the lender can choose to get ownership of the company under specific conditions. Mezzanine lenders provide funds to the buyer with the expectation of earning interest and having the option to convert their debt into equity. In the event of bankruptcy, mezzanine lenders are repaid after senior debt but before equity contribution.

4. Vendor Financing

Vendor financing is when the target company helps the buyer by providing financial assistance through debt. In this arrangement, the seller lends a portion of the purchase price to the buyer. This benefits both parties: the buyer gains access to additional funds to complete the acquisition, while the seller receives interest on the loan. Vendor financing allows the buyer to make the purchase without having to pay the entire amount upfront.

Why are LBOs Popular?

There are many reasons why an LBO is so popular among investors and takeovers. Here are the main four.

1. Less Investment

Investors mainly go for an LBO because of how it is financially structured. The investor pays a small portion of the total amount and then borrows the rest. This gives the acquirer high spending power and allows them to invest in high-value companies without spending too much of their own money.

2. High Return on Investments

As an LBO, the acquirer invests only a little of their own capital and enjoys high profits on investment. And since they can reinvest the profits back into the company, it is a self-running cycle and generates higher returns each year.

3. Tax Advantages

Some countries give tax reductions on the interest amount that acquirers pay on their loans. It reduces the total tax burden and leaves more money for the acquirer to invest back into the business. It is important to note that not all countries give this benefit, so a detailed study is necessary before investing via an LBO.

4. Gain Decision-Making Power (or) Gain Control

In LBO, the acquirer can get total control of a company if they buy more than 50% of the target company. They can then give strategic direction, make operational decisions, and implement changes without shareholders’ approval.

Top Leveraged Buyout Companies

Below is a list of prominent investment firms known for frequently engaging in leveraged buyouts. These firms purchase and invest in various companies with the goal of generating profits.

| Rank | Name | Net Worth as of May 2023 (in Billions) |

Famous LBOs |

| 1 | Bain Capital | $165 |

|

| 2 | TPG Capital | $137 |

|

| 3 | The Blackstone Group | $60.5 |

|

| 4 | KKR & Co | $57.9 |

|

| 5 | Apollo Global Management | $36.4 |

|

LBO in Private Equity

Most acquiring companies are private equity firms because of the following reasons:

1. Financial Resources: Private equity has a lot of money that it can easily use to acquire a company. It allows private equity to complete complex and high-value LBO transactions.

2. Expertise and Connections: When a private equity firm acquires a business, it provides the company with a lot of experience and connections to the market.

3. Expansion and Value Creation: Private equity firms that perform an LBO usually generate huge profits and also increase the value of the acquired firm before reselling it.

4. Exit Strategy: Private equity firms always have a list of exit strategies in place before they even acquire a firm, which is a great method of ensuring that they don’t face any losses.

Leveraged Buyout vs. Management Buyout

| Particulars | Leveraged Buyout | Management Buyout |

| Meaning | A private company or a third-party investor buys and takes control of another organization. | The management of a company takes over the control of the same company. |

| Objective | The main objective is to invest in a company and make a profit but not spend too much of self capital. | The main objective is for the management to take control of the company and run it as they want. |

| Target Companies | Public and private companies. | Privately-owned companies. |

| Financing | The majority of financing is through debt, and the rest is from the acquirer’s pocket. The ratio can start from 70%-30% and go up to 90%-10%. | The majority of financing is from the management’s personal fund, and the rest is from loans. The ratio is usually 50%-50% |

| Ownership | A third-party company takes control of the organization. | The management takes control of the organization. |

Frequently Asked Questions (FAQs)

Q1. What are the characteristics of a good LBO candidate?

Answer: The target company should have the following to be considered a good LBO candidate are,

- Stable cash flow: A business with a stable income source can be advantageous because it will assist the company in times of loss shortly after the takeover.

- Strong asset structure: Businesses with a strong asset structure can use those assets to get a cheaper loan which will be very beneficial in an LBO.

- Potential for growth and expansion: There must be room for growth in the company’s management, structure, finances, etc.

- Proper management structure: If a company has an efficient management structure, it can transition from the old structure into a new one.

- Low capital expenditure: If the target has lower capital expenditure, they won’t spend their profits on long-term payments; instead, they can be useful for growth and loan repayment.

Q2. Which is the largest LBO? What are examples of a good Leveraged Buyout?

Answer: The largest LBO in history was the acquisition of TXU Energy (Energy Future Holdings) in 2007 at a valuation of $45 billion. However, the buyout was a big failure as it went bankrupt within seven years. Some successful examples of a good LBO are McLean Industries, HCA Healthcare, etc.

Q3. What are the ratios that determine a good LBO candidate?

Answer: Certain ratios aid in the search for a good leveraged buyout candidate.

1. Enterprise value-to-sales Ratio: EV-to-sales ratio is the ratio of the value of the company to total sales. It helps understand what is the current leverage they can offer as an LBO candidate.

2. Debt to EBITDA ratio: This ratio compares the current debt of the company and the EBITDA (Earnings before interest, taxes, and amortization). It shows if the acquirer can take loans in the target company’s name.

3. Free cash flow: This ratio will help you understand how much cash the company has left after finishing all the necessary spending. It is important to calculate FCF because it gives a good clue about the company’s financial health.

Recommended Articles

This article helps you understand the concept of a leveraged buyout in an easy-to-understand and detailed manner. Here are some more articles you should look at.