Updated August 19, 2023

What are Dividends?

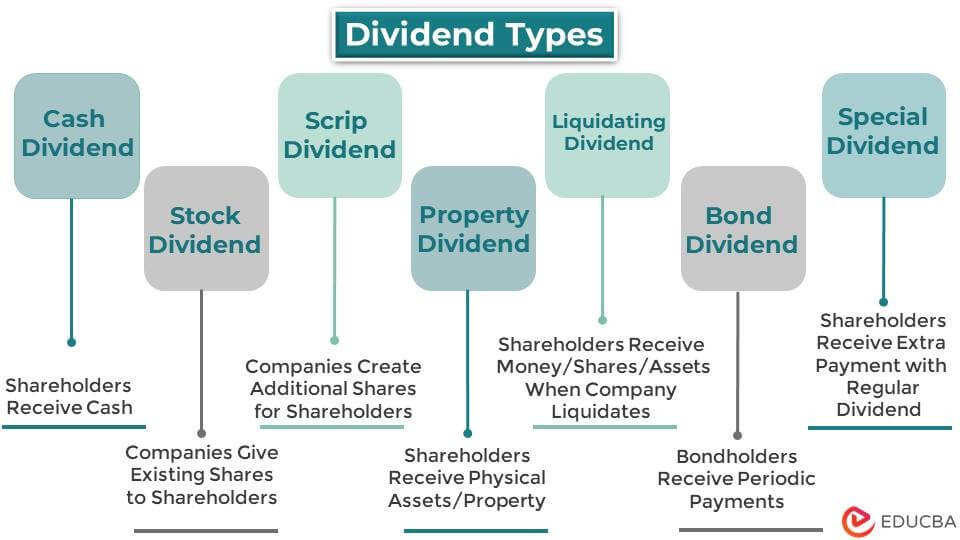

Dividends are part of a company’s profits distributed to its shareholders. There are seven types of dividends: cash, stock, property, scrip, special, bond, and liquidating.

The company’s board of directors decide to pay dividends and its types. It depends on the company’s financial performance, cash flow, investment opportunities, and other considerations.

How Do Dividends Work?

Here’s how types of dividends typically work:

- Announcement: The company’s board of directors will pay its shareholders dividends. The announcement usually includes the dividend amount per share and the payment date.

- Record date: The company sets a record date by which investors must own the shares to be eligible for the dividend payment. Investors who own the shares on or before the record date will receive the dividend payment.

- Ex-dividend date: It is typically two business days before the record date. Investors who plan to buy shares on or after the date of ex-dividend will not be eligible to receive the dividend payment for that period.

- Payment date: The company distributes the dividend payment to eligible shareholders on the payment date.

- Taxation: Dividends are generally taxable income for shareholders in the year they are received. The tax rate depends on the shareholder’s income tax bracket.

Types of Dividends

We have prepared an Excel template for the journal entries for the types of dividends.

#1 Cash Dividend

This type of dividend pays the amount by transferring money to shareholders. The company transfers the money through cash, cheque, or electronically.

After a company declares the dividend, the shareholders become liable for the payment. Before the company pays, it must arrange enough cash to pay off the dividends.

Here are some latest examples of companies that issued cash dividends in 2023:

| Company | Amount |

Date |

|

Coca-Cola |

$0.46 | 3rd April 2023 |

|

PepsiCo |

$1.15 |

31st March 2023 |

| Johnson & Johnson | $1.13 |

7th March 2023 |

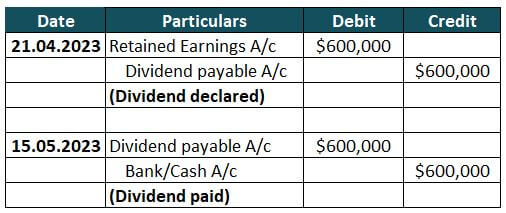

Example: Cash Dividend Journal Entry

Marini Incorporation decided to give a dividend of $2.00 per share on 300,000 outstanding shares in the board meeting held on April 21st, 2023, payable on May 15th, 2023. Let’s record the above transaction in journal entries.

Solution:

We calculate the total amount of dividends declared as follows:

= 300,000 x $2

= $600,000

Journal entries to record the above transactions:

Explanation:

- Journal Entry on 21.04.2023: This entry represents the declaration of dividends. The company reduces retained earnings by debiting it with $600,000 and credits the Dividend payable account with the same amount, reflecting the obligation to pay dividends to shareholders.

- Journal Entry on 15.05.2023: This entry represents the payment of dividends to the shareholders. The company reduces the liability recorded for dividends payable by debiting the Dividend payable account with $600,000 and credits the Bank/Cash account with the same amount, reflecting the actual cash outflow or funds transfer to shareholders.

#2 Stock Dividend

A stock dividend is a special way of gifting shareholders by giving them extra shares of ownership for free instead of giving dividends as cash.

But there are some rules for how we treat a stock dividend. It depends on how many shares the company gives out compared to the total number of shares it already has.

- If the company gives out less than 25% of all the shares it already has, it’s called a stock dividend. It means the company shares a small amount of extra shares with the shareholders.

- But if the company gives out more than 25% of all the shares it has, then it’s not called a stock dividend anymore. It’s called a stock split. It means the company divides its existing shares into smaller pieces to give to the shareholders.

For example, Microsoft announced a special dividend of $3 per share in 2003 and paid it by issuing shares of its stock.

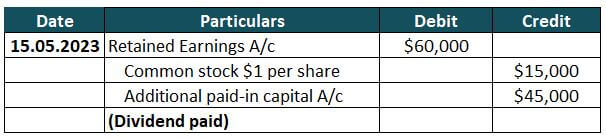

Example: Stock Dividend Journal Entry

Marini Incorporation declared a stock dividend of 15,000 shares. The fair value of the share is $4 per share, and the par value is $1. Let’s record the entries for the above transaction, payable on May 15th, 2023.

Solution:

Journal entries to record the above transactions:

Explanation:

- Retained Earnings A/c debited with $60,000: Represents reduced accumulated profits not distributed as dividends.

- Common Stock A/c credited with $15,000: Reflects the value of the declared stock dividend, which distributes additional shares to existing shareholders.

- Additional Paid-in Capital A/c credited with $45,000: Represents the excess value of the stock dividend over the shares’ par value. It reflects the amount shareholders have paid beyond the par value for their shares.

#3 Scrip Dividend

Sometimes, a company doesn’t have enough extra money to give its shareholders as dividends, but it still wants to share something valuable. Therefore, instead of giving cash, the company creates new shares of ownership and provides them to shareholders. It is called a scrip dividend. It differs from a stock dividend because, in the case of a stock dividend, the company already has extra shares of ownership that it can give to shareholders without needing to create new shares.

But, when the company gives a scrip dividend, they make new shares and give them to all the shareholders. It makes each shareholder own a bigger part of the company, even though they didn’t receive cash.

Therefore, when a company pays a scrip dividend, it increases the number of shares outstanding, but its total value remains the same.

The following companies issued scrip dividends in the year 2023:

|

Company |

Amount (p = Price Per Additional Share) | Date |

|

Barclays bank |

5p | 31st March 2023 |

| HSBC | 18.539p |

27th April 2023 |

| Pennon Group | 12.96p |

5th April 2023 |

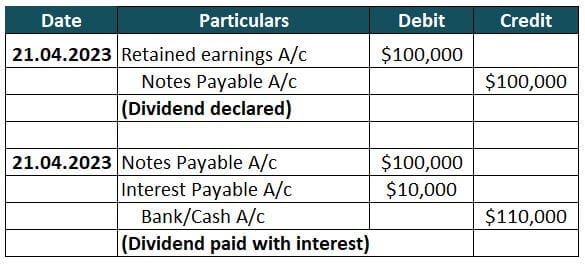

Example: Scrip Dividend Journal Entry

Marini Incorporation declared a dividend of $100,000 to its shareholders on April 21st, 2023, as a scrip dividend with an interest of 10% p.a. Now, we need to record the above transaction.

Solution:

Journal entries to record the above transactions:

Explanation:

- Journal Entry on 21.04.2023: This entry reflects the declaration of a scrip dividend. We debit the retained earnings account to reduce the accumulated profits by the dividend amount declared. Simultaneously, the Notes Payable account is credited, representing the obligation to issue notes to the shareholders instead of cash.

- Another Journal Entry on 21.04.2023: This entry records the scrip dividend payment and interest payable. We debit the notes payable account to reduce the liability owed to shareholders. In contrast, we debit the interest payable account to account for the accrued interest on the notes. The Bank/Cash account is credited to reflect the outflow of funds to fulfill the dividend payment.

#4 Property Dividend

A property dividend differs from regular types of dividends because the company provides the shareholders with non-monetary things like land, buildings, assets, and inventories instead of giving money. The company does this when it does not have enough cash reserves to pay off dividends.

When the company gives a property dividend, it has to track how much those items are worth. It is called the “fair market value.”

The company then records the asset in its books at the fair market value.

- If the market value is more than the asset’s book value (a value that the company thinks the asset is worth), it’s called a gain.

- If the fair market value is lower, it’s called a loss.

The company records this difference to track how it affects its finances.

Example: Property Dividend Journal Entry

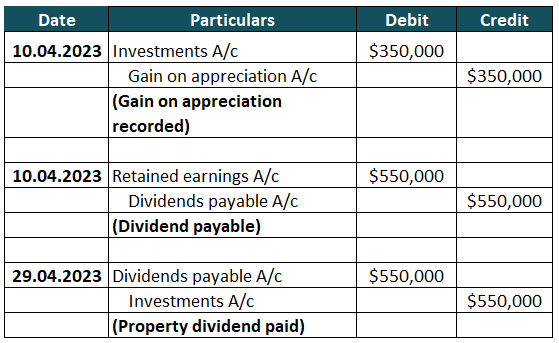

The Marini Incorporation declared a property dividend on April 10th, 2023 where; the dividend was payable on April 29th, 2023. The book value of the investment as of April 10th, 2023, was $350,000, and the fair market value on the same date was $550,000. Now let’s record the above transaction.

Solution:

Journal entries to record the above transactions:

Explanation:

- Journal Entry on 10.04.2023: This entry records the increase in the value of investments (represented by the Investments A/c) due to appreciation. The Gain on appreciation A/c is credited to reflect the value growth.

- Journal Entry on 10.04.2023: This entry records the declaration of property dividends. Retained earnings, which represent accumulated profits, are debited, indicating a decrease in retained earnings. Property Dividends Payable A/c is credited to reflect the liability of the company to pay dividends to its shareholders.

- Journal Entry on 29.04.2023: This entry records the payment of property dividends to the shareholders. Property Dividends Payable A/c debits to reduce the company’s liability, while Investments A/c is credited to indicate the reduction in the value of investments due to distributing them as dividends.

#5 Liquidating Dividend

A liquidating dividend is a dividend payment that a company makes to its shareholders when it liquidates its assets or goes out of business. A liquidating dividend means distributing the company’s remaining assets to its shareholders after all debts and obligations have been satisfied.

The mode of payment here can vary depending on the company’s situation and the terms of the liquidation. Generally, the dividend is in cash from the company’s remaining assets. However, in some cases, the companies pay the dividend in the form of assets, such as property or inventory, rather than cash.

Moreover, a liquidating dividend differs from a regular one because it doesn’t depend on the company’s earnings or profits. Instead, it depends on the company’s remaining assets, which may include cash, securities, or other property that the company can sell to generate some money.

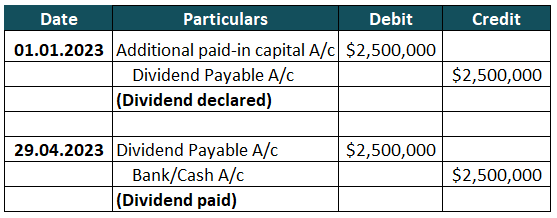

Example: Liquidating Dividend Journal Entry

Marini Incorporation declared a liquidated dividend of $2,500,000 on January 1st, 2023. The date of payment of dividends is April 29th, 2023. Now we need to record the above transaction.

Solution:

Journal entries to record the above transactions:

Explanation:

- Journal Entry on 01.01.2023: This entry represents the declaration of dividends. The company reduces its additional paid-in capital account by $2,500,000 and creates a liability in the form of a dividend payable account for the same amount. It indicates the intention to distribute dividends to the shareholders.

- Journal Entry on 29.04.2023: This entry records the actual payment of dividends. The company reduces its liability in the dividend payable account by $2,500,000. It decreases its cash or bank balance by the same amount, indicating the outflow of funds to fulfill the dividend payment obligation.

#6 Bond Dividend

Bond dividends, also known as bond interest or coupon payments, are the periodic payments made to bondholders for a bond. Bonds are debt securities issued by companies or governments to raise capital, and they pay interest to the bondholders in exchange for using their money.

Companies typically pay them semi-annually or annually, although some bonds may have different payment schedules. The amount of the bond dividend is typically a fixed percentage of the bond’s value, also known as the bond’s par value or principal. It’s important to note that bond dividends differ from stock dividends, which are payments made to shareholders for holding a stock. Both bonds and stocks offer investors income. However, they are different types of securities with different risks and returns.

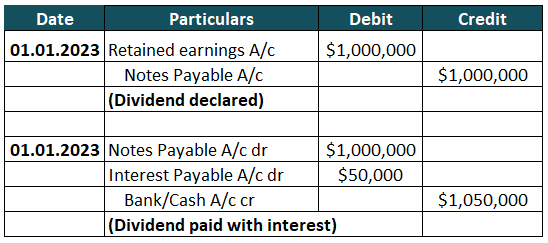

Example: Bond Dividend Journal Entry

Marini Incorporation. is a company that issued a $1,000,000 dividend with an interest rate of 5% p.a. due on January 1, 2023. Let’s record the above transaction.

Solution:

Journal entries to record the above transactions:

Explanation:

- Journal entry on 01.01.2023: This journal entry records a company’s dividend declaration. It reduces the company’s retained earnings account by the dividend amount and creates a liability to shareholders.

- Journal entry on 01.01.2023: This entry applies when a company receives a loan and incurs interest expense. We debit the notes payable account, interest payable, and bank/cash account is credited. The company pays the payable account after the end of the tenure.

#7 Special Dividend

A special dividend is a non-recurring payment made by a company to its shareholders, along with regular dividend payments. Unlike recurring or regular payments, it is a one-time payment.

A company exercises this type of dividend when they have excess cash or are willing to distribute a part of it to its shareholders. Unlike regular dividends, special dividends are not guaranteed and can vary widely in terms of the amount paid and the timing of the payment. They can also be a one-time event without expecting future special dividend payments.

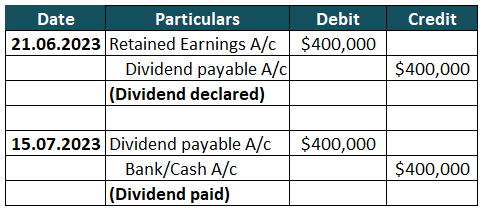

Example: Special Dividend Journal Entry

Marini Incorporation declares a special dividend of $4.00 per share of $100,000 on June 21, 2023, payable on July 15, 2023. Now, let’s create a journal entry for it.

Solution:

We calculate the total amount of dividends declared as follows:

= 100,000 x $4

= $400,000

Journal entries to record the above transactions:

Explanation:

- Journal entry on 21.06.2023: This journal entry represents a dividend declaration by the company. We debit the retained earnings account, indicating a reduction in the company’s earnings. The Dividend Payable account is credited, representing a liability owed to the shareholders until the company pays the dividend.

- Journal entry on 15.07.2023: This journal entry represents the payment of a dividend previously declared by the company. The Dividend Payable account is debited for the dividend amount, indicating reduced liability owed to shareholders. The Cash account is credited for the same amount, representing the actual payment of the dividend to the shareholders.

Dividend and Financial Modeling

While performing financial modeling, companies include dividends in the cash flow projections of the financial model. These include expected dividends that the company will pay over the period and any changes in dividend policy.

Moreover, when creating financial models, it’s important to consider the potential tax implications of dividend payments. It is because the income received from dividends is often subject to different tax rates than other investment income types.

Financial modeling may also include dividend reinvestment plans (DRIPs). Shareholders can use DRIPs to reinvest their dividend payments. That is, they can use their dividends to buy more company shares to increase the overall value of their investment.

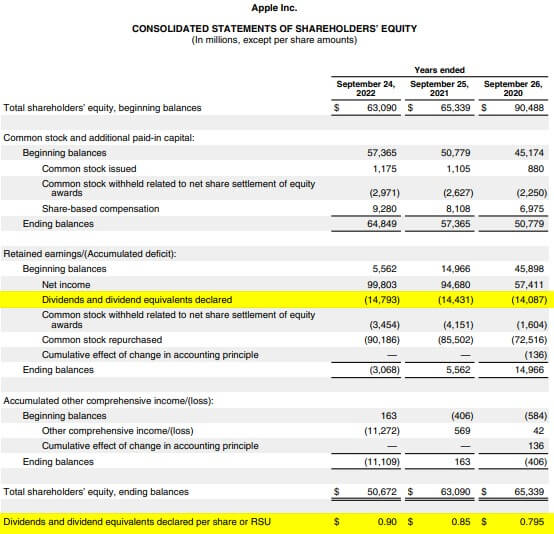

You can understand it better by looking at the financial statement of Apple Inc. for FY22.

Source: Apple Inc. Income Statement for the FY22.

Here, we can see that dividends and dividends equivalent declared for the company have increased over the years. Moreover, the dividends and dividend equivalents declared per share or RSU has also increased.

It means the company has been increasing its dividends and equivalents, possibly due to growth and profits. The increase per share means shareholders receive a larger portion of earnings. It indicates financial stability and a strong dividend policy, a positive sign for investors.

Frequently Asked Questions (FAQs)

Q1. What is the formula of dividends per share?

Answer: The formula for calculating dividends per share (DPS) is DPS = Total Dividends / Number of Shares Outstanding

For example, if a company paid a total dividend of $10 million for the year and has 1 million shares outstanding, the DPS would be:

DPS = $10,000,000 / 1,000,000 = $10

It means that each share an individual owns received a dividend payment of $10 per share in that year.

Q2. What is a fixed dividend?

Answer: Unlike regular dividends, which may vary from one payment to the next based on the company’s earnings or profits, a fixed dividend is a predetermined payment agreed upon by the company and its shareholders. Thus, a fixed dividend is a consistent type of dividend payment set at a specific amount or rate that remains the same over time.

Q3. What is the objective of dividends?

Answer: The primary objective of a dividend is to give away a portion of a company’s profits to its shareholders. By giving out dividends, the company gives something back to the shareholders and helps them make money from their investments. It can also make its stock more appealing to investors.

Q4. What are the two main types of dividends?

Answer: The two main types of dividends are cash and stock.

|

Cash Dividends |

Stock Dividends |

| Companies give shareholders a portion of their profits in cash. | Companies give shareholders additional shares of stock instead of cash. |

Recommended Articles

It is EDUCBA’s guide to types of dividends, where we discussed the types along with proper examples and journal entries. To learn more, you may also have a look at the following articles: