Times Interest Earned Formula (Table of Contents)

- Times Interest Earned Formula

- Examples of Times Interest Earned Formula (With Excel Template)

- Times Interest Earned Formula Calculator

Times Interest Earned Formula

Times interest earned coverage ratio is calculated by dividing the earnings before interest and taxes (operating profit) by the interest expenses. Interest expenses are the total interest payable on the total debt by the company in the balance sheet.

The EBIT is reported in the income statement and comes after EBITDA and deducting depreciation. Total interest expense is reported in the company’s income statement during quarterly or annual filings.

Times Interest Earned Formula:

Examples of Times Interest Earned Formula (With Excel Template)

Let’s take an example to understand the calculation of the Times Interest Earned formula in a better manner.

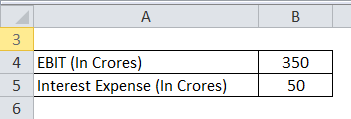

Example #1

Suppose a company’s quarterly EBIT is Rs350 crore, and the total interest expense is Rs 50 crore; then calculate the times interest earned ratio.

Solution:

The calculation for the Times Interest Earned ratio is as below:

Times Interest Earned = EBIT / Interest Expenses

- Times Interest Earned = 350 / 50

- Times Interest Earned = 7

A Times interest earned ratio of 7 signifies that the company can generate operating profit, seven times over the total interest liability for the period. Lenders and investors analyzing the company are always looking for a higher ratio, as a lower ratio signifies that the company is facing a liquidity crisis, which can also lead to a solvency crisis.

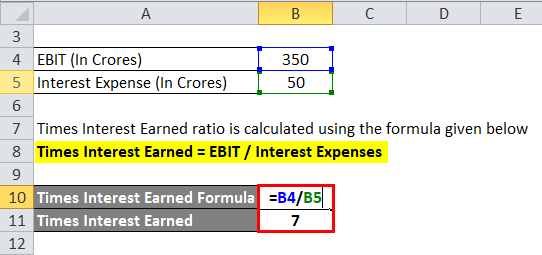

Example #2

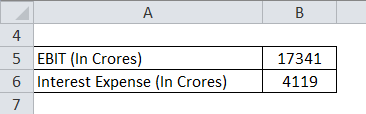

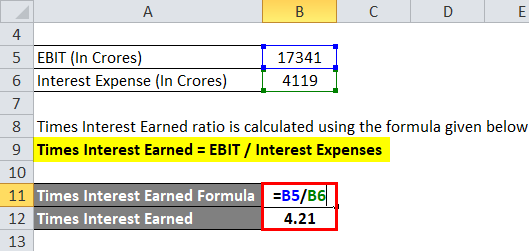

Below is the snapshot of quarterly results for reliance industries. We can see that the operating profit or EBIT for industries for a quarter is Rs 17341 crore. And the interest expense or finance cost for the period is Rs 4,119 crore. Calculate the time’s interest earned ratio for the company.

Source: Ril

Solution:

The calculation for the Times Interest Earned ratio is as below:

Times Interest Earned = EBIT / Interest Expenses

- Times Interest Earned = 17341 / 4119

- Times Interest Earned = 4.21

This signifies that the company can generate operating profit four times the total interest liability for the period.

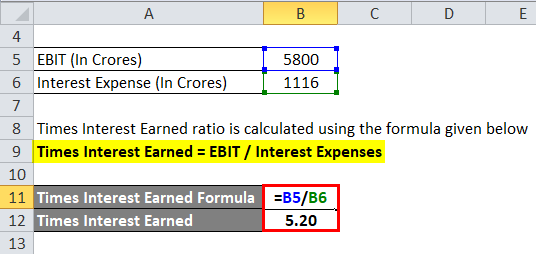

Example #3

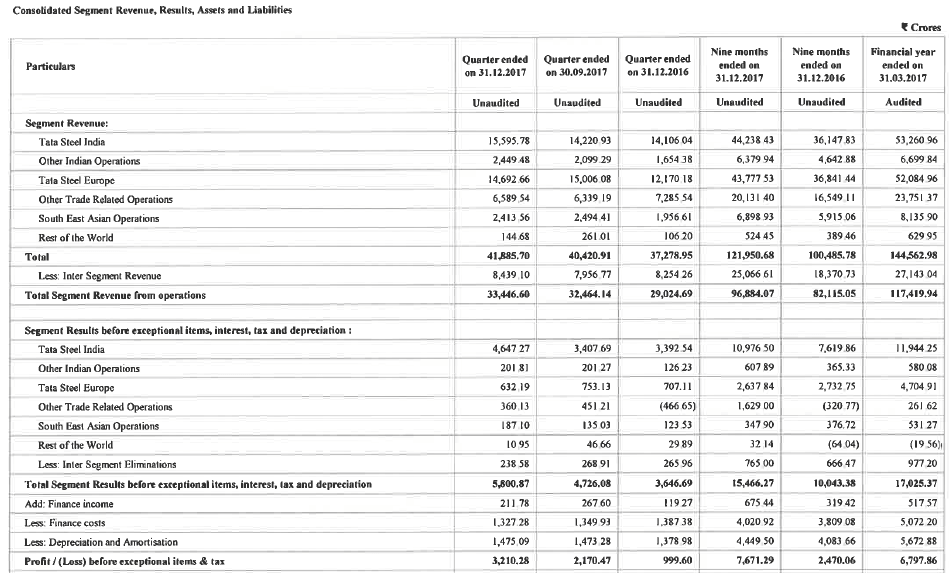

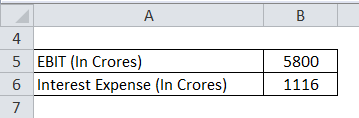

Below is the snapshot of the quarterly result for Tata Steel. We can see that the operating profit or EBIT for industries for the quarter is Rs 5800 crore. And the net interest expense or finance cost for the period is Rs 1116 crore. Calculate the times interest earned ratio for the company.

Source: Tata Steels

Solution:

The calculation for the Times Interest Earned ratio is as below:

Times Interest Earned = EBIT / Interest Expenses

- Times Interest Earned= 5800 / 1116

- Times Interest Earned = 5.20

This signifies that the company can generate operating profit five times over the total interest liability for the period.

Explanation of Times Interest Earned Formula

The times interest earned formula, or interest coverage, is a ratio used to assess how well a company’s operating profit covers its interest expenses. Interest expenses represent the company’s obligations to repay lenders who have provided funds for business expansion. These expenses primarily arise from long-term debt. This ratio is also called a solvency ratio because it indicates the company’s ability to meet its debt obligations. If a company fails to generate sufficient operating profit to cover interest payments, creditors may demand bankruptcy proceedings and the liquidation of assets to repay the debt. Creditors prefer a higher ratio, indicating the company can meet interest payments using income from regular business operations. The ratio expresses how often the operating profit covers the interest cost as an absolute number rather than a percentage.

Relevance and Uses

The Times Interest Earned formula is crucial for creditors to assess a company’s credit health. It calculates how often a company’s operating profit can cover its total interest expenses within a specific timeframe. This ratio, considered a solvency ratio, primarily focuses on the interest accrued from long-term debt. It enables lenders to evaluate whether the company can repay its debt and fulfill interest obligations using regular business operations. Reliance Industries’ Times Interest Earned ratio is 4, indicating that the company generates operating income four times higher than its interest payments to lenders. Creditors and investors use this ratio to gauge the company’s financial strength. A higher ratio is preferable from their perspective, as it signifies a stronger position.

Conversely, a lower ratio suggests liquidity challenges and, in certain cases, potential solvency issues for the company. If a company fails to earn sufficient operating income through its regular business activities, it will struggle to meet interest payments, resulting in a liquidity crunch. This may force the company to sell assets or acquire additional debt to service its existing interest obligations, eventually leading to a solvency crisis.

Times Interest Earned Formula Calculator

You can use the following Times Interest Earned Calculator.

| EBIT | |

| Interest Expenses | |

| Times Interest Earned Formula | |

| Times Interest Earned Formula | = |

|

|

Recommended Articles

This has been a guide to Times Interest Earned formula. Here we discuss How to Calculate Times Interest Earned along with practical examples. We also provide Times Interest Earned Calculator with a downloadable Excel template. You may also look at the following articles to learn more –