Updated November 17, 2023

Difference Between Stock vs Equities

Stocks vs Equities are often used interchangeably as there is a very thin line of difference between Stocks vs Equities. In the stock market context, stocks are equity shares of the company which are traded in the market. However, equity in the context of the corporate world means ownership. When equity shares of the company are listed on stock exchanges (like BSE, NSE) to enable the trade of ownership of the company, it’s then that equity is termed as stocks.

Equity

Equity means the value of a business after all the liabilities are paid off. It is also termed as the net worth of the entity. Equity can be calculated from the Balance Sheet of an entity by using either of the following formulae:

Where outside liabilities include all long-term and short-term debts

Or,

Stocks

- A stock is the capital a company raises by listing its shares on a stock exchange. Investors can buy a share of ownership in exchange for their investment, with the shares representing equity and traded on the exchange as stocks. Before listing, a company conducts a valuation exercise to determine the value of a stock, often at a premium over the face value.

- There are two types of stocks: common stock and preferred stock. In general parlance, they are called equity shares and preference shares. Both stocks provide ownership to the holder of these stocks but with a difference.

- As the name suggests, preferred stocks offer some preference to their holders. The company typically pays them a fixed dividend over and above the common stockholders, provided it has earned sufficient profits. Additionally, if the company is liquidated, preferred stockholders are given preference while returning the money. However, the preferred stockholders do not possess any voting rights and cannot participate in the company’s decision-making process.

- Common stockholders take on the highest risk, which is paid off last. They have the privilege of voting rights and can participate in the company’s decision-making process. Also, they have the right over the entire residual profits of the company.

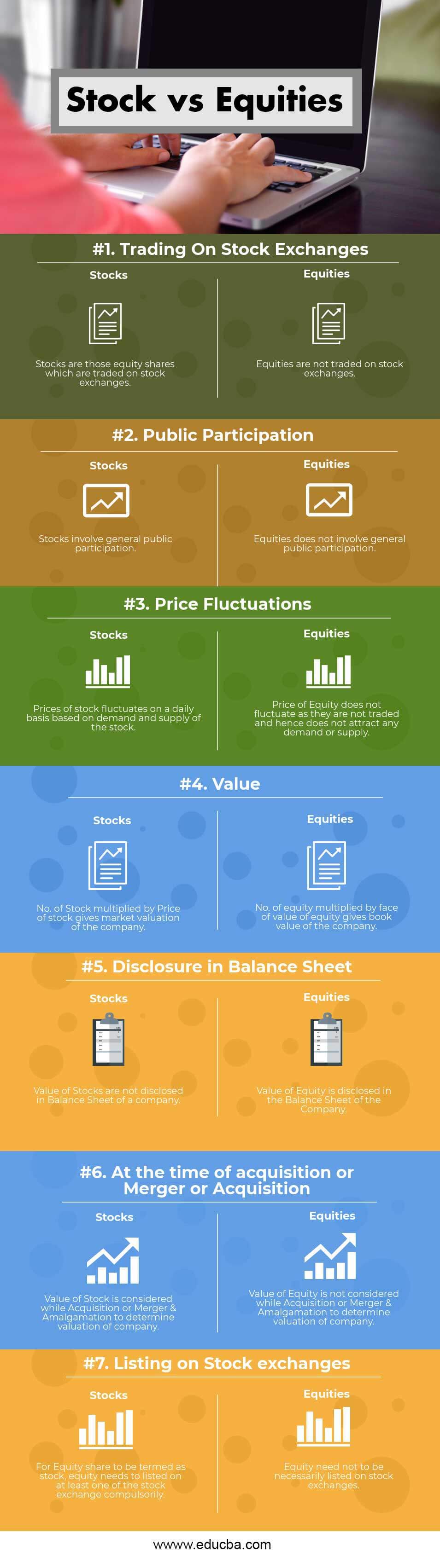

Head To Head Comparison Between Stock vs Equities (Infographics)

Below is the top 7 difference between Stock vs Equities :

Key Differences Between Stock vs Equities

Both Stocks vs Equities are popular choices in the market; let us discuss some of the major differences between Stocks vs Equities :

While there is some overlap between stocks and equities, the main difference is the listing of shares. The company offers a portion of its equity to the public to raise capital, transforming it into a stock that can be traded on stock exchanges. These transactions occur in the stock market, and buying and selling stocks can transfer company ownership.

The company promoter invests capital and holds ownership in return, constituting equity. Simultaneously, the company issues equity shares to the general public to raise capital, providing them with an ownership share.

Stock vs Equities Comparison Table

Below is the topmost Comparison between Stock vs Equities–

| The Basis Of Comparison |

Stocks |

Equities |

| Trading On Stock Exchanges | Stocks are those equity shares that trade on stock exchanges. | Equities are not traded on stock exchanges. |

| Public Participation | Stocks involve general public participation. | Equities do not involve general public participation. |

| Price Fluctuations | Stock prices fluctuate daily based on the demand and supply of the stock. | Equity prices do not fluctuate because they are not traded and do not generate demand or supply. |

| Value | No. of Stock multiplied by the stock price gives the company’s market valuation. | No. of equity multiplied by the face of the equity value gives the company’s book value. |

| Disclosure in the Balance sheet | A company’s balance sheet does not disclose the value of its stocks. | The company discloses the value of equity in its balance sheet. |

| At the time of acquisition or Merger Acquisition | Value of Stock is considered, while Acquisition Merger & Amalgamation determine a company’s valuation. | Value of Equity is not considered, while Acquisition, Merger, and amalgamation determine a company’s valuation. |

| Listing on Stock exchanges | For Equity shares to be termed as stock, equity must be listed on at least one stock exchange compulsorily. | Listing equity on stock exchanges is not a requirement. |

Conclusion

Issuing equity shares to the public through stock exchanges differentiates stocks from equities. Companies convert equities into stocks due to the limited availability of funds the promoter holds. SEBI monitors and safeguards the interests of the general public by highly regulating stocks. Hence to summarize, it can be said that all stocks are equities, but all equities are not necessarily stocks.

Recommended Articles

This has been a guide to the top difference between Stocks vs Equities. Here we also discuss the Stock vs Equities key differences with infographics and comparison tables. You may also have a look at the following articles to learn more