Difference Between Bonds vs Debenture

To raise capital through borrowings, issuers issue bonds, which are debt instruments backed up by specific physical assets. A bond is a contract between two parties, the issuer and the issue, with a fixed maturity date. In most cases, a Bondholder benefits from a fixed interest rate periodically. On the other hand, Debentures have no assets or security to support them; rather, they are issued only by the issuer’s promise. Like bonds, a debenture is also treated as a loan instrument.

Let us study much more about Bonds and Debenture in detail:

- In practice, a firm actively uses bonds for short-term capital requirements, a cash crunch, or funding a new project, although they may actively employ them as capital. In short, the tenure of debentures is shorter compared to bonds. The Creditors lend their funds and expect the issuer to pay back once the newly funded projects generate income. However, the creditors expect a rate of interest higher than the Bonds.

- Credit Rating companies rate bonds, and the purchase of bonds is fully safe. A bondholder rarely experiences a default. Meanwhile, the faith of the issuer backs up debts, which are available through a broker. During the purchase of a Bond or a Debenture, the owner does not get any ownership like Equities.

- On the other hand, bond or Debenture holders have a higher authority to claim the company’s assets during the liquidation of the business compared to an Equity shareholder or a Preference shareholder. A Bond/ Debenture holder is a mere lender to a company that enjoys a fixed interest rate and is less bothered about the business scenario.

- However, a bond or debenture holder wants to refrain from voting rights and participation during the election of a Director or any authority across Business planning or Business strategy. When investors buy bonds, As the Business’s Creditors, they are dealt with accordingly. Generally, the tenure of the Bonds is more than one year or long-term.

- Categorizing Bonds depends on several factors, such as dividend yield, capital gains, and interest rates. Some Bonds, such as municipal bonds, infrastructure bonds, or other state-government bonds, are exempt from taxes. At the same time, any collateral does not back up some unsecured bonds, and the interest rate and a low credit rating are high.

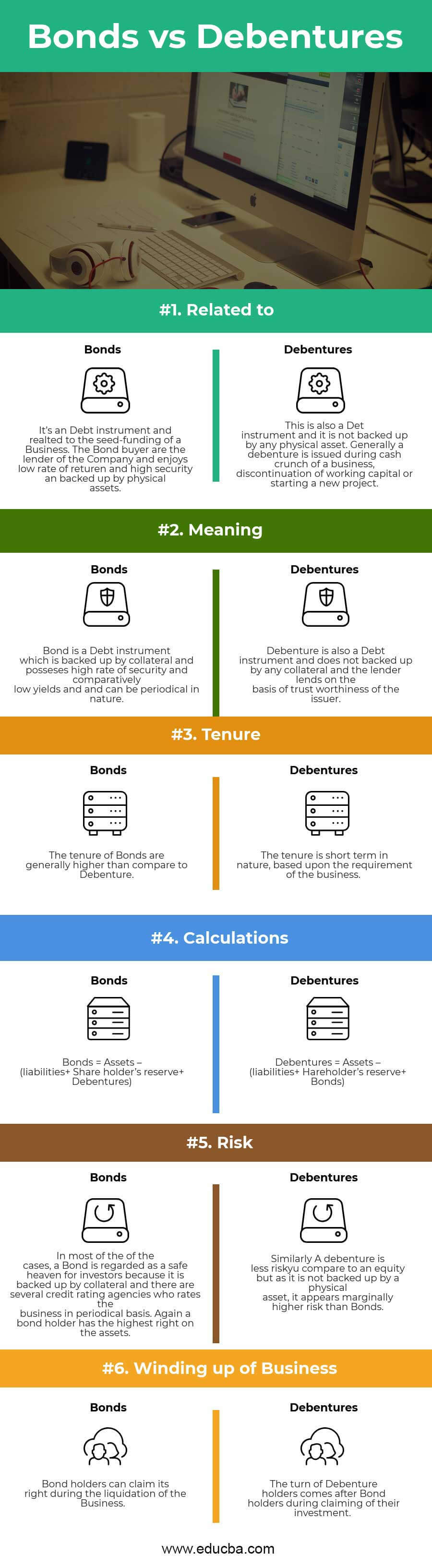

Bonds vs Debenture Infographics

Below is the top 6 difference between Bonds vs Debenture

Key Differences Bonds vs Debenture

Both Bonds vs Debenture are popular choices in the market; let us discuss some of the major differences between Bonds and Debenture:

- During the inception of a business, companies generally issue bonds, whereas the company gives debentures.

- The issuer’s promise backs up debentures, whereas collateral, security, or a physical asset backs up bonds.

- Bonds actively repay the principal amount after the maturity period, while debentures actively repay the principal amount once the revenue from the specific project is generated.

- The rate of interest is higher in Debenture in comparison to a bond.

- The Tenure is higher in the case of Bonds in comparison to Debenture.

- In comparison to debentures, bonds have a lower risk factor.

- Bond payments are periodic; for example, one can pay them in several installments. But Debenture is paid when the business requires funding.

- The bondholder has the highest authority in claiming the assets of the company during liquidation in comparison to the Debenture-holder.

Head To Head Comparison Between Bonds vs Debenture

Below is the topmost Comparison Between Bonds vs Debenture

| The Basis Of Comparison | Bonds | Debentures |

| Related to | It’s a Debt instrument related to the seed funding of a Business. The Bond buyer is the lender of the Company and enjoys a low rate of return and high security backed up by physical assets. | This is also a Det instrument, not backed up by any physical asset. Businesses generally issue debentures during a cash crunch, discontinuation of working capital, or the start of a new project. |

| Meaning | The Bond, which is periodic in nature, possesses a high-security rate as it is backed up by collateral and offers comparatively low yields. This feature makes it a debt instrument. | The issuer relies on its trustworthiness to secure a loan when issuing a debenture, which is also a debt instrument not backed by any collateral. |

| Tenure | The tenure of Bonds is generally higher in comparison to Debenture. | The tenure is short-term in nature, based on the requirements of the business. |

| Calculations | Bonds = Assets – (liabilities+ Share holder’s reserve+ Debentures) | Debentures = Assets – (Liabilities+ Shareholder’s reserve+ Bonds) |

| Risk | Most investors regard a Bond as a haven because collateral backs it, and several credit rating agencies periodically rate the business. Again, a bondholder has the highest right to the assets. | Similarly, A debenture is less risky than equity, but as physical support does not back it up, it is marginally higher risk than Bonds. |

| Winding up of Business | Bondholders can claim their rights during the liquidation of the Business. | The turn of Debenture holders comes after Bondholders during the claiming of their investment. |

Conclusion

Both Bonds and debenture holders are like lenders to the company that enjoys fixed interest on their capital and do not have any impact on the business, unlike the Shareholders. Depending on the business scenario, the holders of Bonds or Debentures convert to Equity. In the modern world, Debt-instrument remains one of the pivotal mediums of capital or fund infusion into the Business.

Recommended Articles

This has been a guide to the top difference between Bonds and Debenture. Here, we discuss the differences between bonds and debture with infographics and a comparison table. You may also have a look at the following articles –