Updated November 6, 2023

Difference Between Option vs Warrant

“Options” are derivative products that allow the buyer a right to exercise an action (of buying or selling) for the underlying asset on or before a specified date at a specified price (also called the strike price) and an obligation to the seller to fulfill the transaction once the buyer exercises its right. “Warrants” are derivative products as well, which allow the buyer to buy or sell stocks of the company issuing warrants at a specified price on a later date before the expiration of such a warrant. They are very similar to Options, with the 2 basic types being “Callable” and “Puttable” warrants.

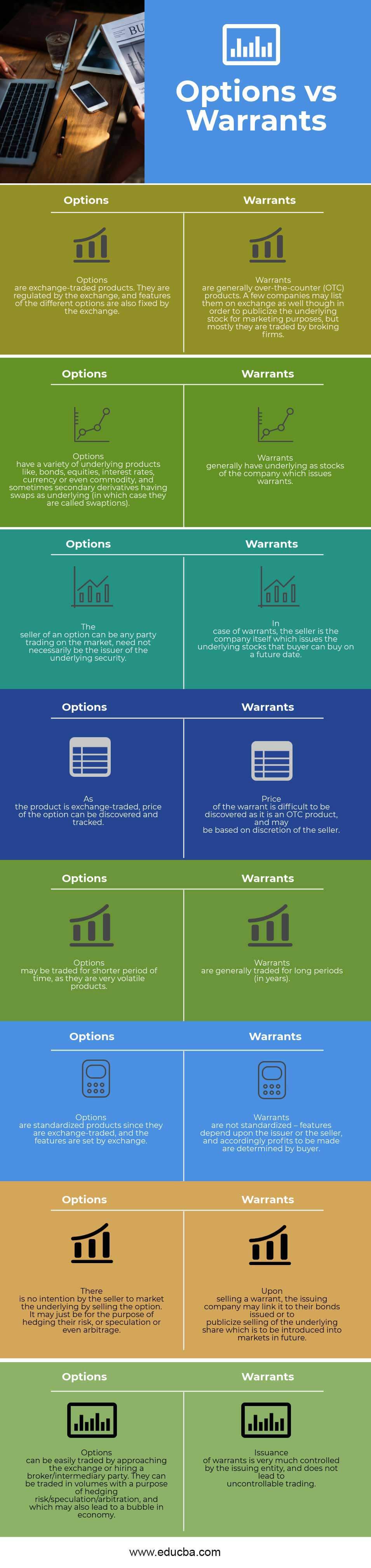

Head To Head Comparison Between Option vs Warrant Infographics

Below is the top 8 difference between Option vs Warrant

Key Differences Between Option vs Warrant

Both Option vs Warrant are popular choices in the market; let us discuss some of the major differences:

- There are 2 basic types of options – Call and Put. A “Call” option gives the buyer a right (not the obligation) to buy the underlying asset at a particular strike on a particular date. A “Put” option gives the buyer a right (not the obligation) to sell the underlying asset at a particular strike on a particular date.

- Depending upon the then-current spot price of the asset at maturity of the option, the buyer can make a decision whether to exercise the option or not to make profits (or limit the loss).

- Option vs Warrant products give the buyer the right to exercise the required action (of buying or selling the underlying) on a future date at a specified price, however, before the maturity date of the respective product.

- Both options and warrants offer buyers special rights; a premium is charged to the buyer when sold. The market determines the premium based on both the time value and intrinsic value of the underlying.

- Option and Warrant products have a fixed expiration date and a fixed strike price for the underlying, and traders follow similar procedures if they wish to exercise their rights.

- The price of the warrant, similar to the price of an option, increases with the time to maturity and decreases as the maturity nears. Moreover, if these products are not exercised by the maturity date, they expire, leaving the buyer with a loss equal to the premium paid to buy the product.

- Option vs Warrant products intend to minimize the risk of losses to the buyer, limited only to the premium they paid. If a market is favorable and the buyer exercises its rights, it can make unlimited profits.

- Option vs Warrant both come with time-to-exercise features and thus are either American style or European style. With an American style, the buyer can exercise their right at any time before maturity. In contrast, with a European style, he can exercise his right only at the maturity of such a product.

- Option and Warrant products are derivative instruments with a specific underlying asset, and market participants price them based on the underlying asset’s price. These products aim to facilitate the sale of the underlying asset and benefit the sellers.

- Both give the buyer liberty to only purchase the derivative (option or warrant) without necessarily having to buy the underlying. The buyer may or may not buy the underlying asset and be able to hedge the risk by buying a suitable option or a warrant.

Option vs Warrant Comparison Table

Below is the topmost comparison between Option vs Warrant

| Options | Warrants |

| Exchange-traded products regulate options, and the exchange fixes the features of the different options. | Broking firms mostly trade warrants as over-the-counter (OTC) products, although a few companies may also list them on an exchange to publicize the underlying stock for marketing purposes. |

| Options have various underlying products like bonds, equities, interest rates, currency, or even commodities, and sometimes secondary derivatives having swaps as underlying (in which case they are called swaptions). | Warrants generally have to underlie the stocks of the company that issues warrants. |

| The seller of an option can be any party trading on the market and need not necessarily be the underlying security issuer. | In the case of warrants, the seller is the company that issues the underlying stocks that the buyer can buy on a future date. |

| As the product is exchange-traded, the option’s price can be discovered and tracked. | Discovering the warrant’s price is difficult as it is an OTC product, and the seller may exercise discretion in determining it. |

| Options may be traded for a shorter period of time as they are very volatile products. | Traders generally trade warrants for long periods (in years). |

| Options are standardized products since they are exchange-traded, and the exchange sets the features. | The issuer or the seller determines the features of warrants, and the buyer determines the profits. |

| There is no intention by the seller to market the underlying by selling the option. It may be to hedge their risk, speculation, or even arbitrage. | The issuing company may link the sale of a warrant to their bonds or publicize the sale of the underlying share, which will be introduced into markets in the future. |

| Approaching the exchange or hiring a broker/intermediary party enables individuals to trade options. Individuals can trade options in volumes for the purpose of hedging risk, speculation, or arbitration, which can also lead to a bubble in an economy. | The issuing entity controls the issuance of warrants and does not lead to uncontrollable trading. |

Conclusion

Trading into options or warrants must be done with proper and in-depth analysis by investors. Such products move with market sentiments and hence need to be regularly tracked. Each product has merits and demerits, so they must be carefully studied and invested in.

Recommended Articles

This has been a guide to the top difference between Option vs Warrant. Here, we discuss the Option vs Warrant key differences with infographics and a comparison table. You may also have a look at the following articles –