Updated November 23, 2023

Difference Between Qualified vs Ordinary Dividends

Investors can gain on their investment by asset price appreciation and dividend income. Asset price appreciation is the increase in the asset’s price, which means the investor can sell that asset at a higher price than he brought it. Based on the investor’s investment style and comfort, investors choose assets suited for them. What is dividend income and its categories and tax implications on investors’ income, which we will see in detail in this Qualified vs Ordinary Dividends article?

What is an Ordinary Dividend?

The company gives its shareholders cash, rewards, or any other benefit from its profit, known as a dividend. The dividend can be distributed in various forms, such as stocks, cash dividends, or any other legitimate form. The organization’s board of directors decides the dividend policy and requires the shareholders’ approval for policy implementation. However, the company is not obligated to pay dividends to shareholders even if the policy is in place. The dividend is simply a portion or the entirety of the profit that the organization shares with its shareholders.

After paying creditors, a firm can use a small/large part or all of its profits to distribute its shareholders as dividends. The firm announces a dividend and sets an ex-record date, making all shareholders who hold shares as of that date eligible to receive dividend pay in proportion to their shareholding. The company usually pays shareholders within a week into the shareholders’ bank accounts.

In the United States, some big organizations do not pay dividends to shareholders and reinvest their total profit in their own businesses. Firms with high growth potential and at an early stage of their life generally don’t pay dividends as these firms prefer to re-invest all of their earnings to help the firm’s higher growth and expansion plans. In comparison, established companies offer frequent dividends to reward long-term investors.

What is the Qualified Dividend?

The most important thing to understand about qualified dividends is that they are a subcategory of ordinary dividends subject to special tax rules by the United States Government, which can save investors money on their tax returns. In other words, all qualified dividends are ordinary dividends, but not all ordinary dividends are qualified dividends.

To be a qualified dividend, the following criteria must be met –

- The dividend should be paid by a corporation operating in the United States or by a qualified foreign company;

- The shares should have been held for at least 60 days during the 121-day period, which starts 60 days before the ex-dividend date.

If the investment meets the criteria outlined by the Internal Revenue Service (IRS), then the IRS considers the earned dividend as qualified.

The ex-dividend date is when new shareholders will not be eligible to receive the declared dividend – which means investors should own the stock before the ex-dividend date to get the dividend as a qualified dividend. However, qualified dividend treatment doesn’t apply to certain types of dividend payments, such as those that resemble interest more than dividends.

Some types of dividends automatically exclude themselves from being qualified dividends, even if they meet the criteria mentioned. These include (but are not limited to) the dividends mentioned below.

- Dividends held by a corporation in an Employee Stock Ownership Plan (ESOP)

- Capital gains distributions

- Dividends paid by tax-exempt corporations

- Dividends on bank deposits

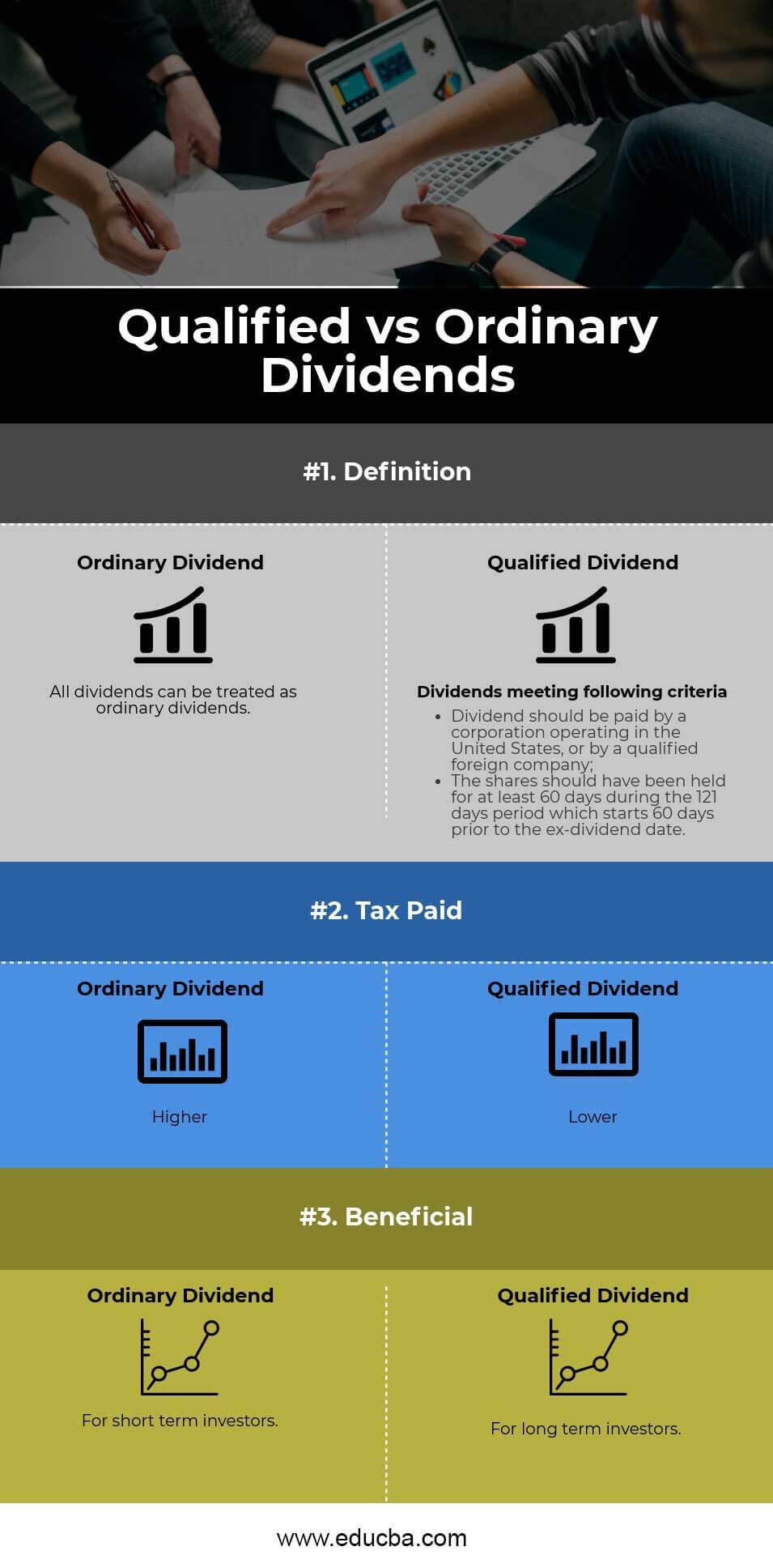

Head To Head Comparison Between Qualified vs Ordinary Dividends(Infographics)

Below is the top 3 difference between Qualified vs Ordinary Dividends

Key Differences Between Qualified vs Ordinary Dividends

Both Qualified vs Ordinary Dividends are popular choices in the market;

let us discuss some of the major differences between Qualified vs Ordinary Dividends

The difference between qualified vs ordinary dividends is quite substantial when the time comes to pay taxes. The Internal Revenue Service (IRS) taxes ordinary dividends as ordinary income, while it applies a lower tax rate to qualified dividends.

| Ordinary Income Tax Rate | Qualified Dividend Tax Rate |

| 10 % | 0 % |

| 15 % | 0 % |

| 25 % | 15 % |

| 28 % | 15 % |

| 33 % | 15 % |

| 35 % | 15 % |

| 39.6 % | 20 % |

The primary motto of this structure is to encourage long-term investment and benefit the United States citizens by giving tax benefits.

Please Note: An additional 3.8 % Net Investment Income Tax exists for investors whose modified adjusted gross income exceeds 0.2 million dollars ( 0.25 million dollars for married taxpayers filing jointly).

Qualified vs Ordinary Dividends Comparison Table

Below is the 3 topmost comparison between Qualified vs Ordinary Dividends

| The Basic comparison |

Ordinary Dividend |

Qualified Dividend |

| Definition | All dividends can be treated as ordinary dividends |

|

| Tax Paid | Higher | Lower |

| Beneficial | For short-term investors | For long-term investors |

Tax Advantages of Qualified Dividends (Calculation with Example)

Consider an example of an investor in the 33 % tax bracket who owns $ 1,000,000 worth of dividend-paying shares with a yield of 4 % per year. This investor will receive $ 40,000 in income from his dividends.

If the above-mentioned dividends were considered ordinary income, this investor would get hit with a $ 13,200 tax, reducing the dividend income to $ 26,800. However, if dividends met the “qualified dividend” definition, the tax would be reduced to $ 6,000.

For a long-term investor, a qualified dividend means that more of the dividend income stays in his portfolio to re-generate more gains in the future.

Conclusion

- A qualified dividend is an ordinary dividend; all qualified dividends are ordinary, but not all are qualified.

- The qualified dividend category benefits the long-term investor if it qualifies for the qualified dividend criteria.

- Qualified dividends and ordinary dividends have different tax brackets. Qualified dividend-eligible investors pay less tax compared to ordinary dividends.

Recommended Articles

This has guided the top difference between Qualified vs Ordinary Dividends. Here, we discuss the key differences between qualified vs ordinary dividends with infographics and a comparison table. You may also have a look at the following articles to learn more.